Overview on New Section 206AB & Section 206CCA

Table of Contents

TDS /TCS CHANGES W.E.F. 1ST JULY 2021

Finance Act 2021, which takes effect on July 1, 2012, makes several amendments to TDS/TCS provisions. In brief, the following changes have occurred:

- TDS is to be deducted by persons whose total sales, gross receipts, or turnover exceed Rs.10 Crore during the financial year immediately preceding the financial year at 0.1 percent from the payment made to seller on purchase consideration paid or credited to him on the amount exceeding Rs 50 lacs in the financial year, according to Section 194Q. If the seller does not provide the buyer with a Permanent Account Number (PAN) or Aadhar Number, TDS will be deducted at a rate of 5% rather than 0.1%.

- If the buyer claims a tax deduction under Section 194Q of the Act, the seller is not required to collect TCS under Section 206C. (1H).

- New sections 206AB and 206CCA have been introduced, which require every person liable to deduct / collect tax at source to collect information from the deductee to determine whether he has filed returns of income for the previous two assessment years if the amount of TDS / TCS in his case has been Rs.50,000/- or more. If he has not filed returns for both assessment years, the rate of TDS / TCS will be the higher of the following rates:

- The tax rate will twice, as provided by the law.

- Twice the rate or rates in force.

- 5% interest rate.

The provisions of the preceding sections are not applicable unless tax is deductible under sections 192 (Salaries), 192A (Payment of accumulated balance from PF), 194B (Winning from lottery or crossword puzzle), 194BB (Winning from horse race), 194LBC (Income from investment in Securitization Trust), and 194N (Income from investment in Securitization Trust) (tax on cash withdrawals from banks).

In view of the above mention, assessors must collect information / obtain declarations from each vendor / supplier / seller / buyer and persons from whom income tax is required to be deducted in order to properly modify accounting software in order to deduct / collect tax in accordance with the applicable provisions of Section 194Q or 206C(1H) of the Act. In addition, data on PAN and return filing for the previous two assessment years, 2019-20 and 2020-21, must be collected. Likewise, assessment should be made available to all persons responsible for deducting/recovering tax from income/payments that have to be made to an assessment person during the present financial year for the PAN and filing of returns for the 2019-20 and 2020-21 assessment years.

Each assessee’s suggested draft of letters / declarations to be issued or furnished has been developed and is attached herewith as per the details stated below.

- Draft letter to be sent to buyers inquiring whether their turnover in FY 2020-21 was more than Rs.10 Crores and whether tax is deductible by them under section 194Q of the Act on payments of purchase consideration in excess of Rs. 50 lacs, so that levy is not obtained under section 206C(1H) of the Act. A draft of the declaration that buyers must provide is also provided. (Annexure-A).

- Letter to be sent to vendors, suppliers, and sellers for the purpose of determining the applicability of Sections 194Q and saying that tax would be deducted under the above mention section and that, if applicable, no action should be taken by them under Section 206C(1H) of the Act. The declaration is also draft for the vendors/suppliers/sellers. (Annexure-B).

- Each individual deductor must issue a letter to all persons whose income tax is deducted/recognized and requires them to provide PAN information and returns for AYRs 2019-20 and 2020-2021, for each of these persons. The draught declaration to be issued by the persons concerned is also presented. (C- and D-Annexes).

- Declaration to be provided by each assessee to all individuals who are liable to deduct / collect tax at source from the assessee’s payments / income, providing information regarding PAN and filing of income returns by your company for the financial years 2019-20 and 2020-2021. (Annexure-D).

Since the new provisions will take effect on July 1, 2021, each assessee must take prompt measures to ensure that he is in a position to comply with the same. If the proposed draughts are appropriate for the situation, they can be employed. Alternatively, the same can be amended according to the facts and the provisions that apply to the specific case.

New Section 206AB is added.

THE FINANCE ACT, 2021 NO. 13 OF 2021, added a new section 206AB. The date is March 28th, 2021. The section will be implemented on July 1, 2021.

The Finance Minister included a special provision for TDS in the Income Tax Act 1961 in Budget 2021. A new section has been added that will take effect on July 1, 2021. The main goal of including Section 206 AB is to ensure that taxpayers file their income tax returns on time. In this article, we will look at the newly added Section 206AB of the Income Tax Act of 1961.

An Overview of Income Tax Act Section 206AB:

As a result, Section 206AB allows the individual to deduct the tax at a greater rate in order to punish the specified individuals. As a result, the deductor must take into account the provisions of this section while deducting TDS.

Higher TDS rates are applicable under Section 206AB.

Deductees will be subject to higher TDS rates:

- Who has not filed an income tax return for both of the two assessment years preceding the previous year where the tax is to be deducted.

- Where the deadline for filing a tax return under Section 139(1) of the Act has passed for both assessment years.

- Where the TDS amount is more than 50000 rupees in each of the two assessment years.

It should be noted that all of these conditions must be met in order to deduct TDS at higher rates.

TDS levels are higher under Section 206AB.

The following TDS rates will be higher:

- Twice the rate specified in the relevant Act provision.

- Twice the rate or rates in force.

- A 5% rate.

Rates in force mean rates which are currently applicable.

For example, a deductee has not filed his or her income tax return for the fiscal year 2020-21. The higher of the TDS deducted under Section 194J.

- The rate is 20%, which is double the rate specified in the applicable Act section.

- Twice the current rates- 20%.

- 5%.

TDS will eventually be deducted at a rate of 20%.

Section 206AB of the Income Tax Act of 1961 exempts certain items from taxation.

TDS will not be deducted at a higher rate on the following items.

- TDS on wages, Section 192

- TDS on early EPF withdrawal under Section 194A.

- TDS on lottery winnings is covered by Section 194B of the Income Tax Act.

- TDS on a horse race win, Section 194BB.

- TDS through securitization trust under section 194LBC.

- Section 194N- TDS on cash withdrawal.

- Non-residents who do not have a permanent address in India.

In the event that the deductee fails to provide his or her PAN.

TDS will be deducted at the higher of:

- Rates based on this section or

- Rates determined in accordance with Section 206AA of the Income Tax Act of 1961.

The Newly Inserted Section’s Difficulties (Section 206AB of Income Tax Act)

This section reveals three significant challenges. The difficulties arise from the deductor’s inability to determine this.

- Whether or not the deductee filed an income tax return in the previous two years.

- Whether the total TDS collected in the previous two years exceeds 50000 rupees.

- Whether the deductee is mandated to file an income tax return.

In situations where the return has not expired on the due date, there would be another challenge. In these cases, what would a deductor do?

It is also possible that the deductee will not provide the deductors with the details of their income tax return. As a result, the burden of gathering information from the deductee can impede deductors’ ability to function effectively and impose an additional burden.

However, in order to avoid higher-rate deductions, the deductee would be mandated to provide proof of having filed an income tax return for the previous two years, which could increase the overall compliance burden.

Section 206AB: Special provision for allowed to deduct tax at source for non-filers of income-tax returns.”

- This section applies:

- In which a person requires tax deduction from the source, in accordance with any provisions of Chapter XVIib.

- The transaction is carried out with a specific individual. (A “specified person” is someone who has not filed his or her income tax return for the previous two years and whose due deadline has passed under section 139(1).

For example, if tax is required to be deducted in July 2021, the relevant immediately preceding previous years for which ITR filing is required to be checked are 2018-19 and 2019-20. (AY 2019-20 and 2020-21 respectively). Because the time limit for the preceding previous year 2020-21 has not passed.

- In his case, the aggregate of tax deducted at source and tax collected at source is fifty thousand rupees or more in each of the two previous years.

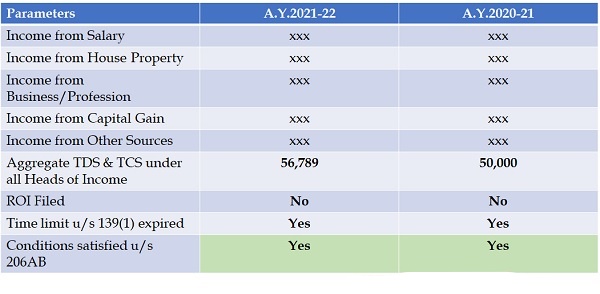

Let us analyses the section’s applicability using this table:

|

Particular |

Tax Deduction/ Collection in

Previous Year |

ITR filing status

|

Is section 206AB/ 206CCA Applicable? |

|

| 2019-20

Rs. 50000 Or More |

2020-21

Rs. 50000 Or More |

|||

| Case A | No | Yes | Not filed for both year | No |

| Case B | Yes | No | Not filed for both year | No |

| Case C | Yes | Yes | Filed for both year | No |

| Case D | Yes | Yes | Not filed for both year | Yes |

| Case E | Yes | Yes | filed only for One relevant PY | No |

- If the Specified Person is a Non-Resident without a permanent establishment in India.

- The section has precedence over all provisions of Chapter XVIIB of the Income Tax Act of 1961 Except as specified below:

| S.No. | Section | Details |

| 1. | 192 | TDS on Salary |

| 2. | 192A | TDS on Premature withdrawal from EPF |

| 3. | 194B | TDS on Lottery |

| 4. | 194BB | TDS on Horse Riding |

| 5. | 194LBC | TDS on Income in respect of investment in securitization trust |

| 6. | 194N | TDS on cash withdrawal in excess of Rs. 1 crore |

- The applicable tax rate.

Tax will be deducted at the highest of the following rates.

- at twice the rate specified in the relevant Act provision;

- at twice the rate or rates currently in effect.

- at a 5% rate.

If Section 206AA applies to the Specified person, tax shall be deducted at the higher of:

- Tax rate as specified in this Section.

- Tax rate in accordance with Section 206AA.

The introduction of a new section 206CCA:

THE FINANCE ACT, 2021 NO. 13 OF 2021 inserted this section as well. Dated March 28th, 2021. The section will go into effect on July 1, 2021.

Section 206CCA: Special provision for collection of tax at source from non-filers of income-tax returns.”

When Does This Section Apply?

- If a person is required to deduct tax under any of the provisions of Chapter XVII-BB Collection at source, he or she must do so.

- The transaction is completed with a specific person. (A specified person is one who has not filed his income tax return for the immediately preceding two years, for which the due date under Section 139(1) has passed).

For example: if tax is required to be deducted in July 2021, the relevant immediately preceding previous years for which ITR filing is required to be checked are 2018-19 and 2019-20. (AY 2019-20 and 2020-21 respectively). Because the deadline for filing the Previous Year 2020-21 has not passed.

- In his case, the aggregate of tax deducted at source and tax collected at source is fifty thousand rupees or more in each of the two previous years.

Note: For a better understanding of applicability, please see the table above.

Section is Inapplicable:

- If the specified person is a non-resident without a permanent establishment in India.

Applicable Tax Rate: Tax is deducted at the higher of the following rates.

at twice the rate required by the relevant Act provision.

or

at a five percent rate.

If Section 206CC applies to the Specified person, tax will be deducted at the higher of the two rates.

The tax rate specified in this Section.

or

Tax rate in accordance with Section 206CC.

How to ensure that the conditions for section applicability are met

There is no mechanism or procedure in place to determine the applicability of the sections. It will be difficult for the Deductor/Collector to determine whether or not the person from whom TDS is required to be deducted or TCS is required to be collected meets the requirements of the sections.

It is possible that a verification link to check the status will be provided on the Income Tax Portal, similar to how a verification link to check the applicable rate of tax under Section 194N is provided.

As an alternative, the Deductor/Collector of Taxes can obtain a Declaration from the Specified Persons or obtain an ITR acknowledgment to confirm that the ITR has been filed. And deduct/collect tax as necessary.

Changes to Rule 31A of the Income Tax Rules, as well as tax and TDS forms

- Replaced clause (x) of Rule 31A ibid with the following. (x) furnish relevant information of the amount paid or credited on which tax was not deducted or was deducted at a lower rate as a result of the Notification issued under sub-section (5) of section 194A or as a result of the exemption provided under clause (x) of sub-section (3) of section 194A.

- After clause (xiii) of Rule 31A, the following clauses were added. (xiv) provide details of the amount paid or credited on which tax was not deducted in accordance with clause (d) of the second proviso to section 194 or the notification issued in accordance with clause (e) of the second proviso to section 194.

(xv) specify the amount paid or credited on which tax was not deducted due to the proviso to sub-section (1A) or section 196D’s sub-section (2).

(xvi) with effect from July 1, 2021, give particulars of amounts paid or credited on which tax was not deducted in accordance with sub-section (5) of section 194Q.

- An amendment to Form 26Q is required. To bring Form 26Q up to date with the new provisions, a new reason code has been added for indicating Reason for Non-Deduction/Lower Deduction/Higher Deduction/Threshold/Transporter, and so on.

- Changes in Form 27Q. A new reason code has been added to indicate the reason for non-deduction/lower deduction/grossing up/higher deduction. Form 27Q should be updated to reflect the new provisions.

- Changes in Form 27EQ. A new reason code has been added to indicate the reason for non-collection/lower collection/or collection at a higher rate. Form 27Q should be updated to reflect the new provisions.

Conclusion:

In order to apply this section, the deductee must declare that he has filed a return of income for the preceding two assessment years, unless the period under section 139(1) has expired or the TDS amount is not equivalent to or more than 50000 rupees in the case of non-filing of return. From July 1, 2021, forward, income tax returns and TDS amounts from the AY 2020-21 and AY 2019-20 will be included when determining the TDS deduction rate in the FY 2021-22. However, greater explanation from the government is needed to fully comprehend Section 206AB of the Income Tax Act.

IFCCL will understand your business requirements and help you in TDS/TCS related issues.

For Contact:

Website- Click here

Email id- info@caindelhiindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.