FAQ on Applicability of Income Tax Provision to NRI’s

FAQ on Applicability of Income Tax Provision to Non-Residents

This Article defines the importance of residential status of a person for determining the taxability of the income in his hands of individual, HUF, Company or any other and how to determine the same, will a person holding Indian citizenship be treated as a resident in India for the purpose of charging Income-tax, Income deemed to be received in India, Income deemed to accrue or arise in India, When is a business connection said to be established, provisions under the Income-tax Act applicable to a Non-Resident, objective of FEMA, capital account transaction and current account transaction.

Q.: Is the residential status of a person important for computing the taxability of the income in his hands?

Ans. Yes, the residential status of a person is important for the taxability of income in his hands.

The income which is taxable in the hands of person is depending only on two things:

(1) Residential status as per Income Tax Act of the person; and

(2) Nature of income earned by him.

Hence, residential status plays a very important role in computing the taxability of the income.

Q.: What are the different classes for an individual to determine the residential status under the Income-tax Law?

Ans. An individual has to be come in any of the three following residential status for the purpose of Income-tax law:-

(1) Resident and ordinarily resident in India (which is also known as resident), [ROR]

(2) Resident but not ordinarily resident in India, [RNOR]

(3) Non-resident, [NR]

The residential status of the assesse is to be determined by the help of provisions of the Income-tax Law and hence, it may so happen that in one year the individual would be a resident and ordinarily resident and in the next year he may become non-resident or resident but not ordinarily resident and again in the next year his status may change or may remain same.

Q.: If any person holding the citizenship of India, will be treated as resident in India for the purpose of Income Tax?

Ans. A new section in relation to the 6(1A) to the Income Tax Act, 1961 has been introduced by the Finance Act, 2020. It provides that an Indian citizen shall be deemed to be resident in India only if his total income (excluding the income from foreign sources) exceeds Rs.15 lakhs during the previous year. Income from foreign sources means that the income which accrues or arises outside India (except the income derived from a business controlled in or a profession set up in India).

However, only such individual shall be deemed to be resident in India when he is not liable to tax in any country or jurisdiction by reason of his domicile or residence or any other criteria of similar nature.

From the AY 2021-22, an Indian Citizen earning his total income from India in excess of Rs.15 lakhs (other than foreign income) shall be deemed to be Indian resident only when he is not liable to pay tax liability in any country.

Q.: What are the different classes for a HUF to determine the residential status under the Income-tax Law?

Ans. A HUF has to be come in any of the three following residential status for the purpose of Income-tax law:-

(1) Resident and ordinarily resident in India [ROR]

(2) Resident but not ordinarily resident in India [RNOR]

(3) Non-resident [NR]

The residential status of the assesse is to be determined by the help of provisions of the Income-tax Law and hence, it may so happen that in one year a HUF may become a resident and ordinarily resident and in the next year he may become non-resident or resident but not ordinarily resident and again in the next year his status may change or may remain same.

Q.: What are the different classes for other than Individual or HUF to determine the residential status under the Income-tax Law?

Ans. A Person other than Individual or HUF i.e., company, partnership firm, etc., can have any one of the following residential status:

For the purpose of Income-tax Law, a person other than an individual or a HUF, i.e., company, partnership firm, etc., can have any one of the following residential status:

(1) Resident

(2) Non-resident

The residential status of the taxpayer is to be determined by the help of provisions of the Income-tax Law and hence, it may so happen that in one year company, partnership firm would be a resident and in the next year it may become non-resident and again in the next year the status may change or may remain same.

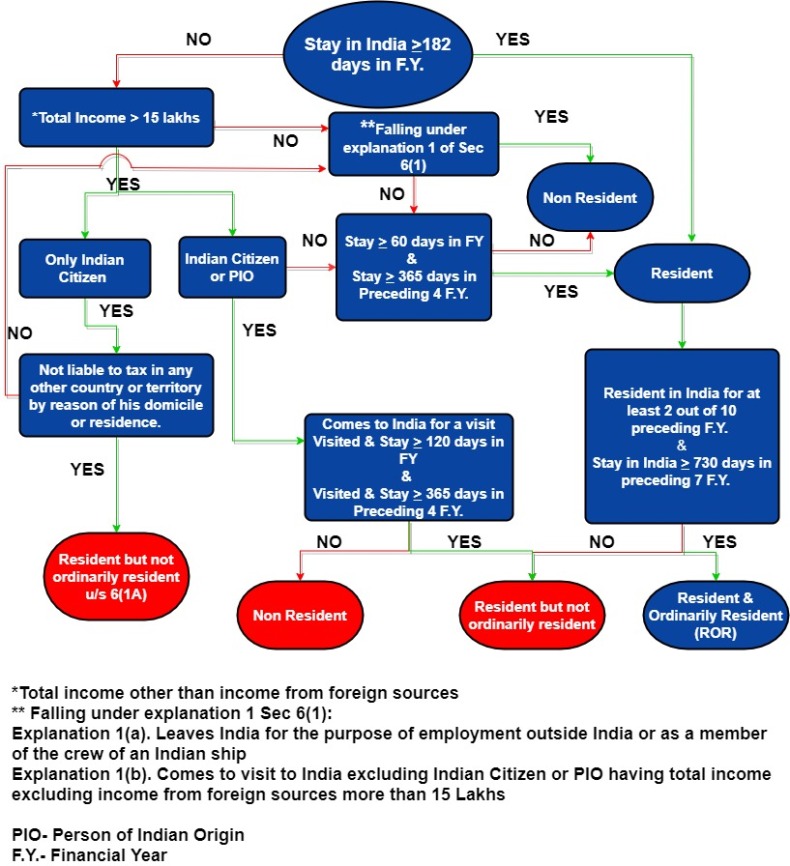

Q.: How to determine the individual residential status?

Ans. To determine the individual residential status, the first step is to ascertain whether he is resident or non-resident. If he became a resident, then the next step is to ascertain whether he is resident and ordinarily resident or is a resident but not ordinarily resident.

Step 1 Whether the individual is resident or non-resident and step 2 will guide whether he is ordinarily resident or not ordinarily resident. Step 2 is to be performed only if the individual became to be a resident individual.

Step 1: Determining whether individual is a resident or non-resident

In the Income-tax Law, an individual will be treated as a resident in India for the previous year if he satisfies any of the following conditions:

(1) If he residence in India for a period of 182 days or more in that previous year; or

(2) If he residence in India for a period of 60 days or more in the that previous year and for a period of 365 days or more in 4 years immediately preceding the relevant previous year.

However, in relation to an Indian citizen and a person of Indian origin who visits India during the year, the period of 60 days as mentioned in (2) above shall be substituted with 182 days. The same concession is given to the Indian citizen who leaves India in any previous year as a crew member or for the purpose of employment outside India.

From the AY 2021-22 has amended the above exception to provide that the period of 60 days as mentioned in (2) above shall be substituted with 120 days, as per the Finance Act, 2020, if an Indian citizen or a person of Indian origin whose total income (excludes the income from foreign sources), exceeds Rs.15 lakhs during the previous year. Income from foreign means that the income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India).

Note: A new section 6(1A) to the Income-tax Act, 1961 has been introduced by the Finance Act, 2020. The new provision provides that an Indian citizen shall be deemed to be resident in India only if his total income, (excludes the income from foreign sources), exceeds Rs. 15 lakhs during the previous year. Income from foreign sources means that income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India) as per this provision,.

However, the individual shall be deemed to be resident in India only when he is not liable to tax in any other country or jurisdiction by reason of his domicile or residence or any other criteria of similar nature.

Therefore, from the AY 2021-22, an Indian Citizen earning total income in excess of Rs. 15 lakhs (excludes the income from foreign sources) shall be deemed to be resident in India only when he is not liable to pay tax in any country.

Step 2: Determining whether the individual is resident and ordinarily resident or resident but not ordinarily resident

A resident individual will be treated as resident and ordinarily resident in India during the year if he satisfies the following two conditions:

(1) If he is resident in India for at least 2 years out of 10 years immediately preceding the relevant year.

(2) If his stay in India is for 730 days or more during 7 years immediately preceding the relevant year.

However, w.e.f., AY 2021-22, there are two more situations added by the Finance Act, 2020, wherein a resident person is deemed to be ‘Not Ordinarily Resident’ in India:

- a) An Indian Citizen or a person of Indian origin whose total income (exclude the income from foreign sources) exceeds Rs.15 lakhs during the previous year and who has been residence in India for a period of 120 days or more but less than 182 days;

- b) If an Indian Citizen who is deemed to be resident in India as per the new section 6(1A).

A resident individual who does not fulill any of the aforesaid conditions or satisfies only one of the aforesaid conditions will be treated as resident but not ordinarily resident.

In brief, the following test will performed to determine the residential status of an individual:

- If the individual satisfy any one or both the conditions specified at step 1 and satisfies any of the conditions specified at step 2, then he will become resident and ordinarily resident in India.

- If the individual satisfy any one or both the conditions specified at step 1 and satisfy neither one nor any condition specified at step 2, then he will become resident but not ordinarily resident in India.

- If the individual satisfy not any conditions satisfied at step one, then he will become non-resident.

Q.: How to determine HUF residential status for the purpose of the Income-tax Law?

To determine the HUF residential status, the first step is to find out whether the HUF is resident or a non-resident. If the HUF became a resident, then the next step is to find out whether it is resident and ordinarily resident or is resident but not ordinarily resident.

Step 1 Whether the HUF is resident or non-resident and step 2 will ascertain whether the HUF is ordinarily resident or not ordinarily resident. Step 2 is to be applicable only if the HUF turns to be a resident.

Step 1: Determining HUF is whether resident or non-resident

A HUF will be deemed as resident in India, if the control and management activities is located (partly or wholly) in India for the purpose of Income-tax Law.

Step 2: Determining HUF is whether resident and ordinarily resident or resident but not ordinarily resident

A resident HUF will be deemed as resident and ordinarily resident in India during the year if its manager (i.e. karta or manager) satisfies both the below following conditions:

(1) If he is resident in India for at least 2 years out of 10 years immediately preceding the relevant year.

(2) If his stay in India is for 730 days or more during 7 years immediately preceding the relevant year.

A resident HUF whose manager (i.e. karta) does not satisfy any of the following conditions or satisfies only one of the aforesaid conditions will be treated as resident but not ordinarily resident.

In brief, following test will performed to determine the residential status of a HUF:

- If the control and management activities of the HUF is located (partly or wholly) in India and the manager (i.e. karta) satisfies both the conditions specified at step 2, then the HUF will become resident and ordinarily resident in India.

- If the control and management activities of the HUF is located (partly or wholly) in India and the manager (i.e. karta) satisfies none or only one condition specified at step 2, then the HUF will become resident but not ordinarily resident in India.

- If the control and management of the affairs of the HUF is located wholly outside India, then the HUF will become non-resident.

Q.: How to determine company residential status?

Ans. From AY 2017-18, a company is said to be resident in India in any previous year:

(i) if it is an Indian company; or

(ii) its place of effective management, at any time in that year, is in India.

For this purpose, the “place of effective management” means that a place where key management and commercial decisions that are necessary for the running the business of an entity as a whole are, in substance made.

The concept of POEM is effective from AY 2017-18. The CBDT has released the final guidelines for determination of POEM of a foreign company.

The final guidelines on POEM will contain some special features. One of the unique features is to test of Active Business Outside India (ABOI). The guidelines prescribe that a company shall be said to engaged in ‘active business outside India’ if passive income is not more than 50% of its total income.

The place of effective management in case of a company engaged in active business outside India shall be deemed to be outside India if the majority meetings of the board of directors of the company are held outside the India.

In cases of the companies other than those which are engaged in active business outside India, the determination of POEM would be a two stage process, namely:—

- The first stage would be identification or ascertaining the person or persons who actually make the key management and commercial decision for conduct of the company’s business as a whole.

- The second stage would be determination of place where these decisions are in fact being made.

However, it has been provided that the POEM guidelines shall not apply to a company having turnover or gross receipts of INR 50 crores or less in a financial year vide CIRCULAR NO.8, DATED 23-2-2017.

Q.: How to determine other than an individual, HUF and company residential status?

Ans. Every person other than an individual, HUF and company is became resident in India during the previous year, if the control and management activities for that year is located wholly or partly in India.

Q.: Which incomes in the hands of taxpayer are become taxable?

Ans. The following chart highlights the tax applicability in case of different persons:

| Nature of income | Residential status

|

||

| | ROR (*) | RNOR (*) | NR (*) |

| Income which accrues or arises in India | Taxed | Taxed | Taxed |

| Income which is deemed to accrue or arise in India | Taxed | Taxed | Taxed |

| Income which is received in India | Taxed | Taxed | Taxed |

| Income which is deemed to be received in India | Taxed | Taxed | Taxed |

| Income accruing outside India from a business controlled from India or from a profession set up in India | Taxed | Taxed | Not taxed |

| Income other than above (i.e., income which has no relation with India) | Taxed | Not taxed | Not taxed |

Note: ROR means resident and ordinarily resident.

RNOR means resident but not ordinarily resident.

NR means non-resident.

Q.: What are the incomes deemed to be accrue or arise in India?

Ans. Following incomes are deemed to be accrued or arisen in India:

- Capital gain arising in case of transfer of property situated in India.

- Income from the business connection in India.

- Income from salary in relation to services provided in India.

- Salary Income is received by an Indian resident from Government of India in respect of service provided outside India. However, allowances and perquisites are exempt in this case.

- Income from any property, asset or other source of income located in India.

- Dividend income is paid by an Indian company.

- Interest received from Government of India.

- Interest received from a resident is treated as income deemed to have accrued or arisen in India in all cases, except in the case where such interest is earned in relation to funds borrowed by the resident and used by resident for carrying on business/profession outside India or is in respect of funds borrowed by the resident and is used for earning income from any source outside India.

- Interest income is received from a non-resident is treated as income deemed to accrue or arise in India if such interest is in respect of funds borrowed by the non-resident for carrying on any business/profession in India.

- Income received from Government of India in relation to Royalty/fees for technical services.

- Income received from resident of India in relation to Royalty/fees for technical services is treated as income deemed to be have accrued or arisen in India in every cases, except where such royalty/fees relates to business/profession/other source of income carried on by the payer outside India.

- Income received from Non-resident in relation to Royalty/fees for technical services as income deemed to have accrued or arisen in India if such royalty/fees is for business/profession/other source of income carried by the payer in India.

Q.: When is it said that a business relationship has been established?

Ans. A business connection is defined as any activity carried out on behalf of a non-resident who does one or more of the following:

- If such person has authority in India to conclude contracts on behalf of the non-resident (this does not include cases where authority is limited to contracts for the purchase of goods or merchandise on behalf of such non-resident); or

- If such a person keeps a stock of goods or merchandise in India from which he routinely supplies goods or merchandise on behalf of a non-resident;

- If the non-resident or another non-resident under the same management routinely secures orders in India, mostly or entirely for the non-resident. If the business is conducted through an independent broker, general commission agent, or other agent (e.g., a broker or commission agent who is not working primarily or exclusively for such non-resident or another non-resident under the same management), no business connection is deemed to have been established, as long as the person is acting in his or her ordinary course of business.

- Only that portion of the non-income resident’s that accrues or arises as a result of the business link is judged to be income accruing or arising from India.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.