ROC Impose Penalty of 20,00,000/- for Non-Appointment of CS

Registrar of Companies Impose Penalty of INR 20,00,000/- for Non-Appointment of CS.

- Under Section 203 of the Company Act of 2013, as amended by Roc Rule 8 Companies (Appointment and Remuneration of Managerial Personnel) Rule of 2014, requires certain types of companies to appoint key personnel like a Managing Director, Chief Executive Officer or Manager, a full-time director in their absence, Company Secretary and Chief Financial Officer. But, a large number of companies registered with the Ministry of Corporate Affairs have failed to comply with these requirements, raising worries about corporate governance standards.

- Every publicly listed corporation and any company with a paid-up share capital of ten crore rupees or more is required to have a full-time company Secretary.

- The Hon’ble ROC Kolkata has taken commendable action against such noncompliance, as indicated by adjudication orders issued to Kolkata-based enterprises. Ambica Shipping & Industries Limited is the subject of one such order, which will be addressed in depth in this publication.

- M/s Ambica Shipping & Industries LTD is a registered company with it office that was incorporated on 23.04.1973 under the provision of the Co. Act, 1956 & its registered office at address 31, Lala Lajpat Rai Sarani, 5th Floor Kolkata WB 700020 India according to the MCA21 Registry.

Registrar of Companies Order:

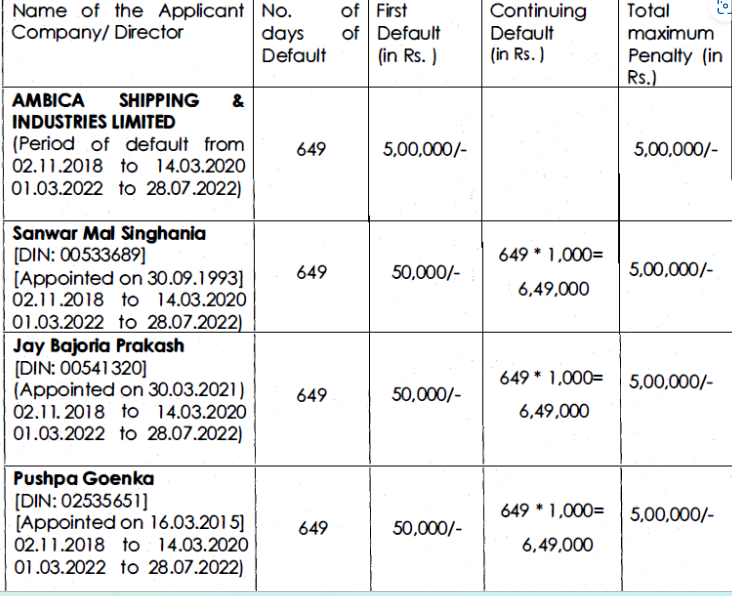

- M/s Ambica Shipping & Industries LTD and its officers, who have defaulted u/s 203(1) & 203(5) of the Co. Act, 2013 for non-appointment of Whole- Time Company Secretary are liable for penalties u/s 203(5) of the Co. Act, 2013.

- In exercise of the powers provided by the Companies (Amendment) Ordinance, 2019, the undersigned is entrusted with adjudicating fines under Section 203 of the Companies Act, 2013, with effect from 02.11.2018, and after taking into account all factors listed above.

- I hereby impose a penalty of Rs. 20,00,000/-, i.e., Rs. 5,00,000/- on the Company and Rs. 5,00,000/- on each of its officers-in-default, in accordance with Rule 3(12) of Companies (Adjudication Of Penalties) Rules, 2014 and the proviso of the said Rule and Rule 3(13) of Companies (Adjudication Of Penalties) Rules, 2014.

- As the above ROC notice order shall pay the previously mentioned penalty amount for the company and its directors personally (from his or her own pocket) via e-payment [accessible on the Ministry Website].

For more details on other relating topics to the Ministry of Corporate Affairs & Accounting field, please contact India Financial Consultancy Corporation Pvt Ltd, a team of expert & professionals CA CS in Delhi.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.