EBITDA & EBIT both measures of profitability of business

Table of Contents

EBITDA & EBIT are both measures of profitability of business

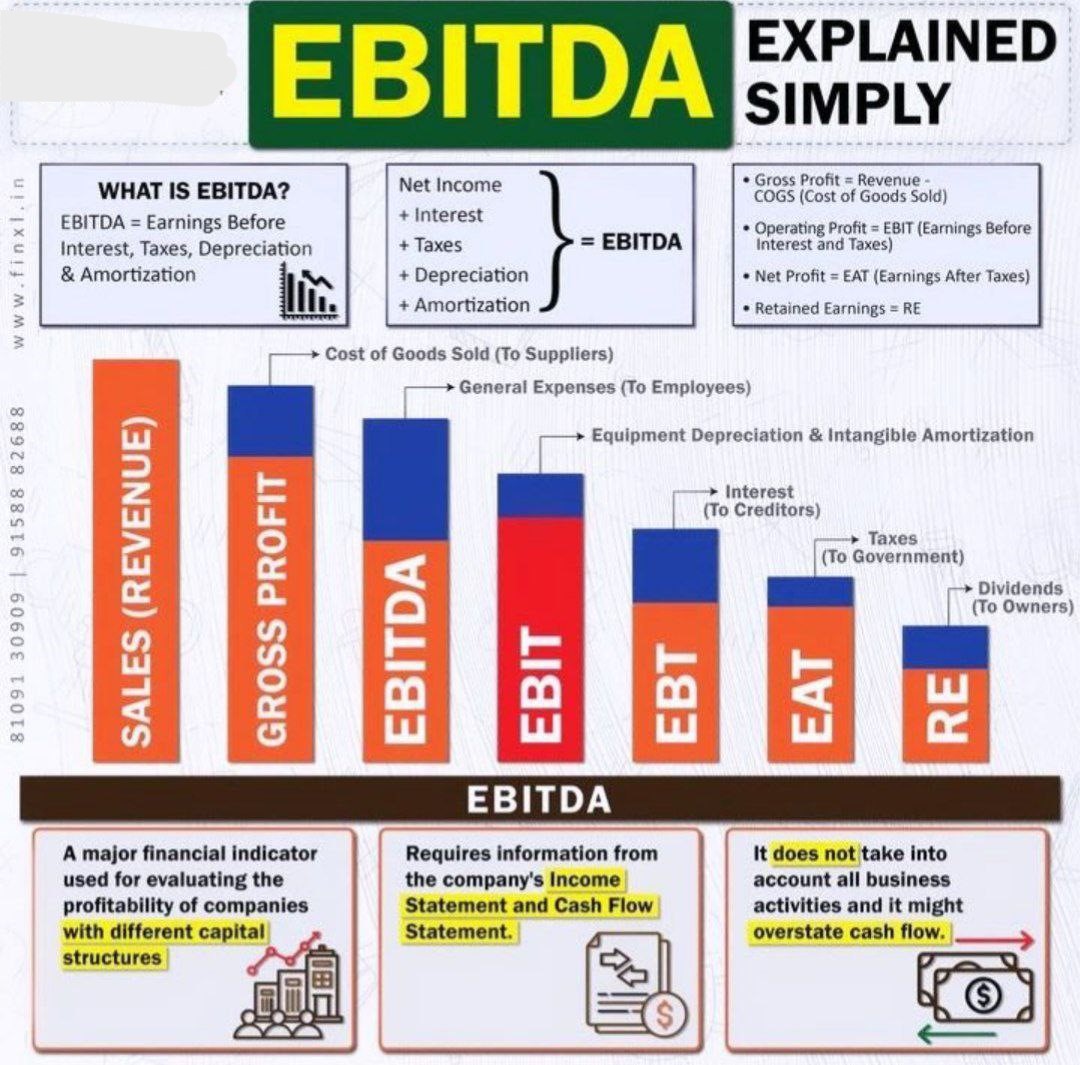

Both EBITDA & EBIT are indicators of a company’s profitability. Net income before interest and taxes is known as EBIT. Additionally, amortisation and depreciation are not included in EBITDA. Operating profit is commonly measured by EBIT, which is sometimes equivalent to operating income as measured by GAAP.

EBIT (Earnings Before Interest and Taxes) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) are both widely used metrics to assess a company’s profitability and operating performance.

EBIT shows how much profit a company generated from its operations before considering interest expenses and taxes. It gives a clear picture of the company’s ability to generate profit from its core operations.

EBITDA, on the other hand, goes a step further by excluding not only interest and taxes but also depreciation and amortization. Depreciation and amortization are non-cash expenses related to the wear and tear of assets and the gradual expensing of intangible assets, respectively. By excluding these expenses, EBITDA provides a clearer view of the company’s cash flow from operations and its operating profitability, without the impact of non-operational factors.

Both metrics are useful for different purposes. EBIT is often used as a measure of operating profit and is sometimes equivalent to the GAAP metric of operating income. EBITDA, on the other hand, is commonly used in industries with high capital expenditures or where asset values are significant, as it provides a better indication of cash flow available for debt repayment, investments, and other purposes. However, it’s essential to consider each metric’s limitations and the specific context in which they are used.

How to Calculate EBIT

There is two method, Both methods you’ve mentioned are correct ways to calculate EBIT.

Starting with Net Income and Adjusting:

- This method begins with the company’s net income, which is the bottom line of the income statement, after all expenses, including interest and taxes, have been deducted.

- To arrive at EBIT using this method, you add back the interest expenses and taxes to the net income. This is because EBIT is calculated before considering interest expenses and taxes.

- The formula is:

𝐸𝐵𝐼𝑇=Net Income+ Interest Expenses + Taxes

Starting with Revenue and Deducting Costs:

- This method starts with the company’s total sales revenue and then subtracts the cost of goods sold (COGS) and operating expenses.

- The formula is:

𝐸𝐵𝐼𝑇=Sales Revenue−COGS−Operating Expenses

Both methods should yield the same result because they represent different ways of looking at the company’s profitability. The first method focuses on starting from the bottom line and adjusting for interest and taxes, while the second method focuses on starting from the top line and deducting costs to arrive at operating profit

What is EBITDA?

Method 1: Starting with Net Income and Adjusting:

This method begins with the company’s net income, similar to the calculation of EBIT.

To calculate EBITDA using this method, you add back interest expenses, taxes, depreciation, and amortization to the net income.

The formula is:

𝐸𝐵𝐼𝑇𝐷𝐴=Net Income+ Interest Expenses +Taxes +Depreciation +Amortization

Finding the Components:

Net income, interest expenses, and taxes are typically found on the income statement.

- Depreciation and amortization can be listed separately as line items on the income statement or the cash flow statement.

- Alternatively, depreciation and amortization might be included within operating expenses. In such cases, you might need to refer to footnotes or supplementary notes accompanying the financial statements to find the breakdown.

Using this method provides a comprehensive view of the company’s earnings potential before considering the impact of interest, taxes, and non-cash expenses like depreciation and amortization. It’s a valuable metric for assessing operating performance and cash flow generation capabilities.

Method 2: Starting with EBIT and Adjusting:

This method begins with calculating EBIT using one of the methods described earlier.

Once you have EBIT, you add back depreciation and amortization to calculate EBITDA.

The formula is:

EBITDA= EBIT +Depreciation +Amortization

This method focuses on starting from the operating profit (EBIT) and then adding back depreciation and amortization, which are non-cash expenses. These expenses are added back because they reduce net income but do not affect cash flow, so by adding them back, we get a clearer picture of the company’s cash flow generation potential.

Depreciation and amortization are usually straightforward to find, but like in the first method, if they are bundled within operating expenses, you might need to refer to the accompanying notes in the financial statements for a detailed breakdown.

Both methods are valid ways to calculate EBITDA, providing insights into a company’s operational performance and cash flow generation capabilities by adjusting for non-operating expenses and non-cash items.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.