Essential Bookkeeper Skills to be Consider Manage Financial

Table of Contents

What are the essential Bookkeeper Skills to be Consider manage the financial?

Bookkeepers are responsible to effectively maintain the company’s financial records. Every business firm needs bookkeeping and accounting, so business are expected to have a broad range of skills. Check out a few necessary abilities if you’re thinking about pursuing a job as a bookkeeper or searching for professional accounting services. You might now have a query:

What Requirements Are Needed for Accounting professionals?

- There are a few fundamental abilities that professional bookkeepers are supposed to possess. bookkeeper talents are needed all combined in these like in core knowledge, soft skills, and technical skills. It would be fascinating to examine these skills in further detail as they relate to bookkeepers.

What abilities are required to be a master bookkeeper and accountant?

A better accounting system can be accomplished with a few primary skills that the accountant and bookkeeper are supposed to possess.

The list that follows consists of competencies required to become a bookkeeper or accountant.

Paying attention to details properly

A proper eye for detail is one of the most crucial abilities required for bookkeeping. Efficiency in accounting & Other financial areas of the business firm will be improved. Also, it will help to reduce errors and increase accuracy in the bookkeeping process.

A methodical or disciplined approach

A disciplined approach is a crucial bookkeeper skill that can aid in producing effective accounting records. It will prevent additional problems that might arise as a result of bad bookkeeping. A systematic approach will also aid in providing a clear picture of the business’s current financial situation. The ability to complete the work in a timely manner will help business owners in fostering the expansion of their enterprise.

Familiarity with technology

Nowadays, technology is used in many aspects of bookkeeping and accounting. So, the bookkeeper needs to be familiar with using the necessary technology. They must be proficient in using Excel, Microsoft Word, data entry, and other tools. They may be able to improve their accounting and bookkeeping accuracy as a consequence of this.

The capacity for problem solving

With bookkeeping and accounting work, issues inevitably arise that can complicate subsequent tasks. So, it is expected of the bookkeeper to have stronger problem-solving abilities in order to resolve problems swiftly and maintain a smooth workflow. The efficiency of the bookkeeping and accounting operations will increase as a result.

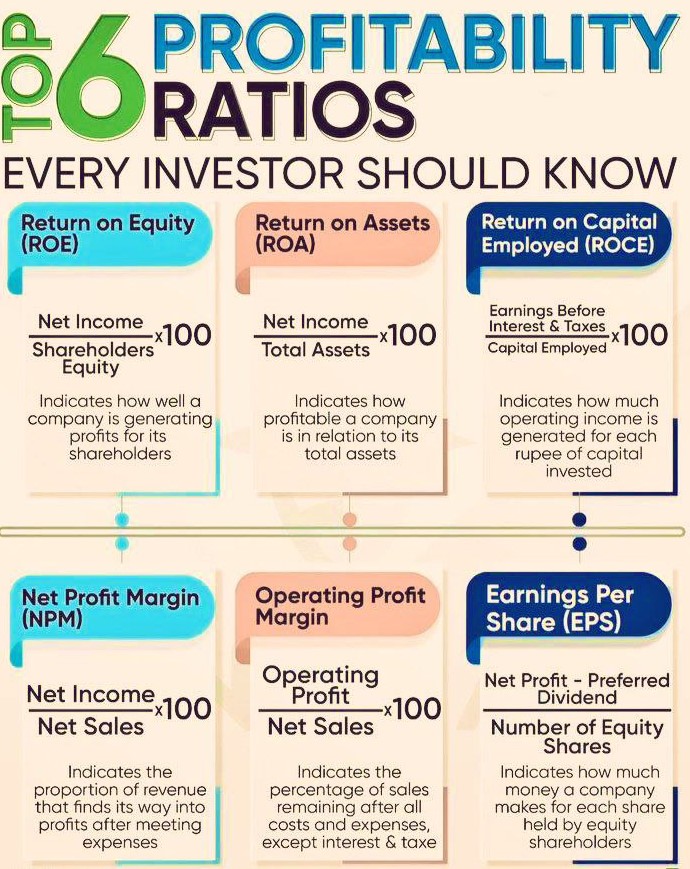

Top 6 Profitability Ratio

- Gross Profit Ratio.

- Operating Ratio.

- Operating Profit Ratio.

- Net Profit Ratio.

- Return on Investment (ROI)

- Return on Net Worth.

- Earnings per share.

- Book Value per share.

Understanding of basic bookkeeping principles

All key bookkeeping concepts must be properly understood by the bookkeeper. They need to be well-versed in the fundamentals of bookkeeping as well as how to manage various situations. They must remain informed of all the requirements established by the relevant authority in the specific location. Their job must adhere to all the rules established by the specific authorities.

To obtain high-quality bookkeeping, it is vital to consider acquiring these 5 bookkeeper skills. Your reputation will improve thanks to these abilities, and your bookkeeping work will be highly valued.

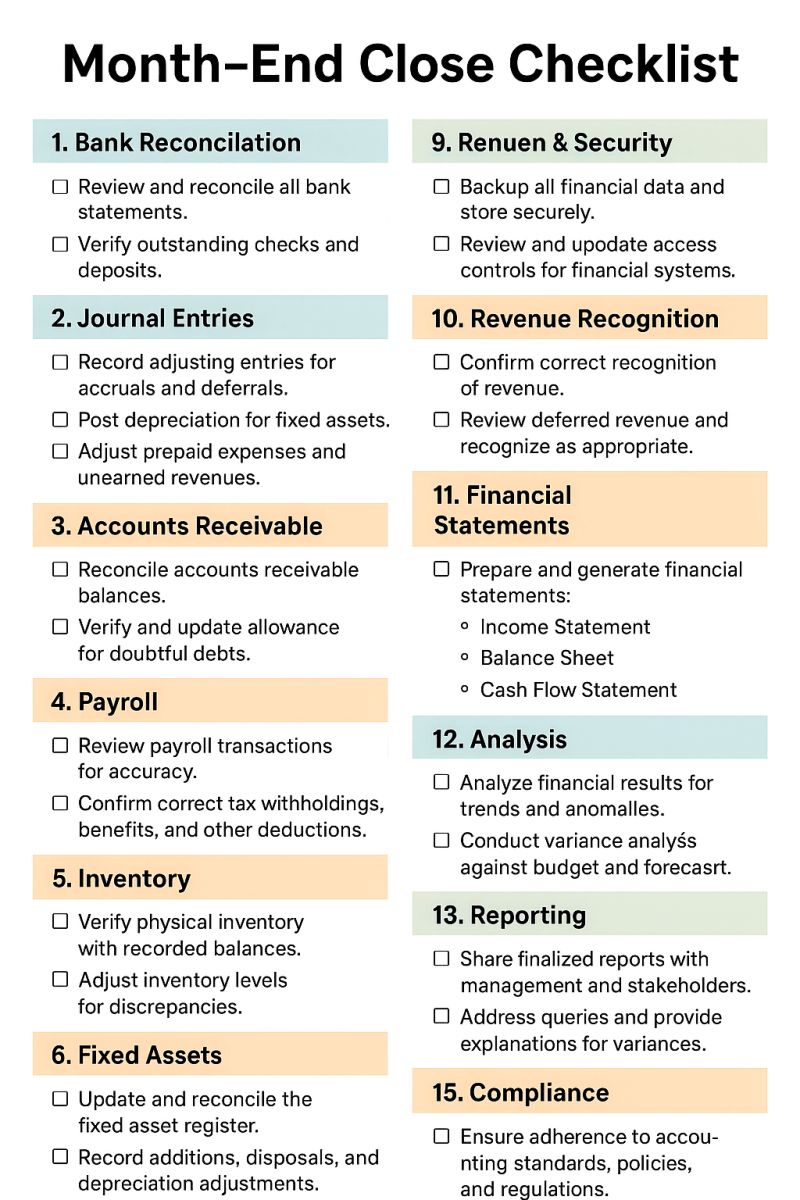

Month-End Close Checklist | Accounting & Finance Essentials

Efficient month-end closing ensures accurate financial reporting, compliance, and strategic decision-making. Use this checklist to streamline your close process and maintain control across all key accounting areas.

1. Bank Reconciliation & Journal Entries

-

Reconcile all bank accounts, credit cards, and petty cash balances.

-

Verify outstanding cheques, deposits in transit, and service charges.

-

Post all standard, recurring, and adjusting journal entries.

-

Review suspense accounts and clear temporary balances.

2. Accounts Payable (AP) Review

-

Match vendor invoices with POs and GRNs (three-way match).

-

Accrue unpaid expenses and verify cut-off for the month.

-

Review and approve payment runs.

-

Ensure proper classification of prepaid expenses and advances.

3. Accounts Receivable (AR) Review

-

Post all sales invoices and receipts.

-

Review ageing reports for overdue accounts and bad debt provisions.

-

Reconcile customer advances and unearned revenue.

-

Confirm inter-company receivables/payables, if applicable.

4. Payroll & Employee Expenses

-

Verify salary calculations, deductions, and statutory contributions (PF, ESI, TDS).

-

Accrue unpaid wages, bonuses, and leave encashments.

-

Reconcile payroll control accounts.

-

Review employee reimbursements and travel expenses.

5. Inventory & Fixed Assets

-

Verify physical inventory counts and reconcile with book balances.

-

Post necessary adjustments for shrinkage, obsolescence, or valuation.

-

Capitalize new assets and record disposals or retirements.

-

Post depreciation and reconcile asset registers.

6. Revenue Recognition & Financial Statements

-

Verify revenue cut-off and ensure proper recognition under applicable accounting standards (Ind AS/IFRS/GAAP).

-

Review deferred revenue, discounts, and rebates.

-

Prepare and review Trial Balance, P&L, and Balance Sheet.

-

Perform cross-checks for internal consistency across statements.

7. Variance Analysis & Final Review

-

Analyze actuals vs. budget and prior periods.

-

Investigate major variances and document explanations.

-

Review financial ratios and performance metrics.

-

Conduct internal review and sign-off by department heads/CFO.

8. Reporting & Compliance Controls

-

Prepare management reports and dashboards.

-

File applicable tax returns (GST, TDS, PF/ESI) and statutory submissions.

-

Ensure adherence to internal controls and accounting policies.

-

Back up financial data and archive documentation securely.

Final Step: Month-End Close Confirmation

-

Obtain close sign-off from Finance Controller/CFO.

-

Communicate finalized results to management.

-

Roll forward closing balances for next month.

If you’re looking for a professional company to outsource the bookkeeping process to, you might want to think about India Financial Consultancy Corporation Pvt LTD. IFCCL employs professional bookkeepers with excellent bookkeeping abilities. You can increase your bookkeeping efficiency with the aid of their experience. IFCCL is a reputable organisation that offers accounting services all around the world.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.