Outsourcing Your Bookkeeping Services Will Save Your Cost

Table of Contents

Why outsourcing your Bookkeeping Services will Save your cost?

Although though bookkeeping is a crucial component of every organisation, many MSME companies find it difficult to operate efficiently. Despite the numerous issues that businesses have with bookkeeping, one of the main problems is the cost involved.

This has an impact on the company’ overall accounting and operational processes. So, you can save a lot of money by outsourcing your bookkeeping to a professional company. Several businesses who were previously hesitant to delegate the bookkeeping duty to another party are now showing interest in doing so. They now comprehend the advantages of outsourcing bookkeeping for their company. Also, they can now outsource the bookkeeping because they saved a lot of money.

You can Save Money via Outsourcing Your Bookkeeping

We can making appropriate Saving of money is one of the basic benefit of bookkeeping outsourcing task. Now in this post are few ways via which you can save cost by bookkeeping outsourcing:

Relieve a saving lot of time

You save a lot of time when you outsource bookkeeping, which is one of its main advantages. You don’t have to sit down and complete the bookkeeping activity in this situation, nor do you have to use up other resources or time. You can use this time to complete other useful tasks.

Flexibility Increase in bookkeeping and other related task

You cannot have a dedicated person or team who will exclusively work on bookkeeping unless you are a major company. They typically have bookkeeping and other accounting-related chores to complete. This is considered to be a little distraction from maintaining the delicate balance between bookkeeping and accounting, though. So, you can increase job freedom via outsourcing.

Decrease the payroll expense.

Lot of teams and other resources are required for a corporation if there are many employees working there. This raises the business’s overall payroll-related costs. You can attain accuracy in your firm and reduce payroll-related costs by outsourcing.

Provide better guidance

By hiring experts with good expertise working on various organisations, you can get bookkeeping services for your company. Therefore they can easily keep track of all the unneeded expenses incurred by the company and find strategies to reduce them. They can also offer recommendations for ways to enhance the company’s overall cash flow.

Decrease overall cost

When you have an in-house bookkeeping or accounting team, there are significant costs involved. The majority of these expenses go into hiring, training, and allocating the required resources. The cost of outsourcing bookkeeping is unquestionably less than hiring an internal workforce to handle it. The overall cost of bookkeeping for the corporate organisation is decreased as a result.

These are a few methods by which your company can significantly reduce costs by outsourcing bookkeeping. In addition to that, outsourcing has a lot of other benefits for businesses.

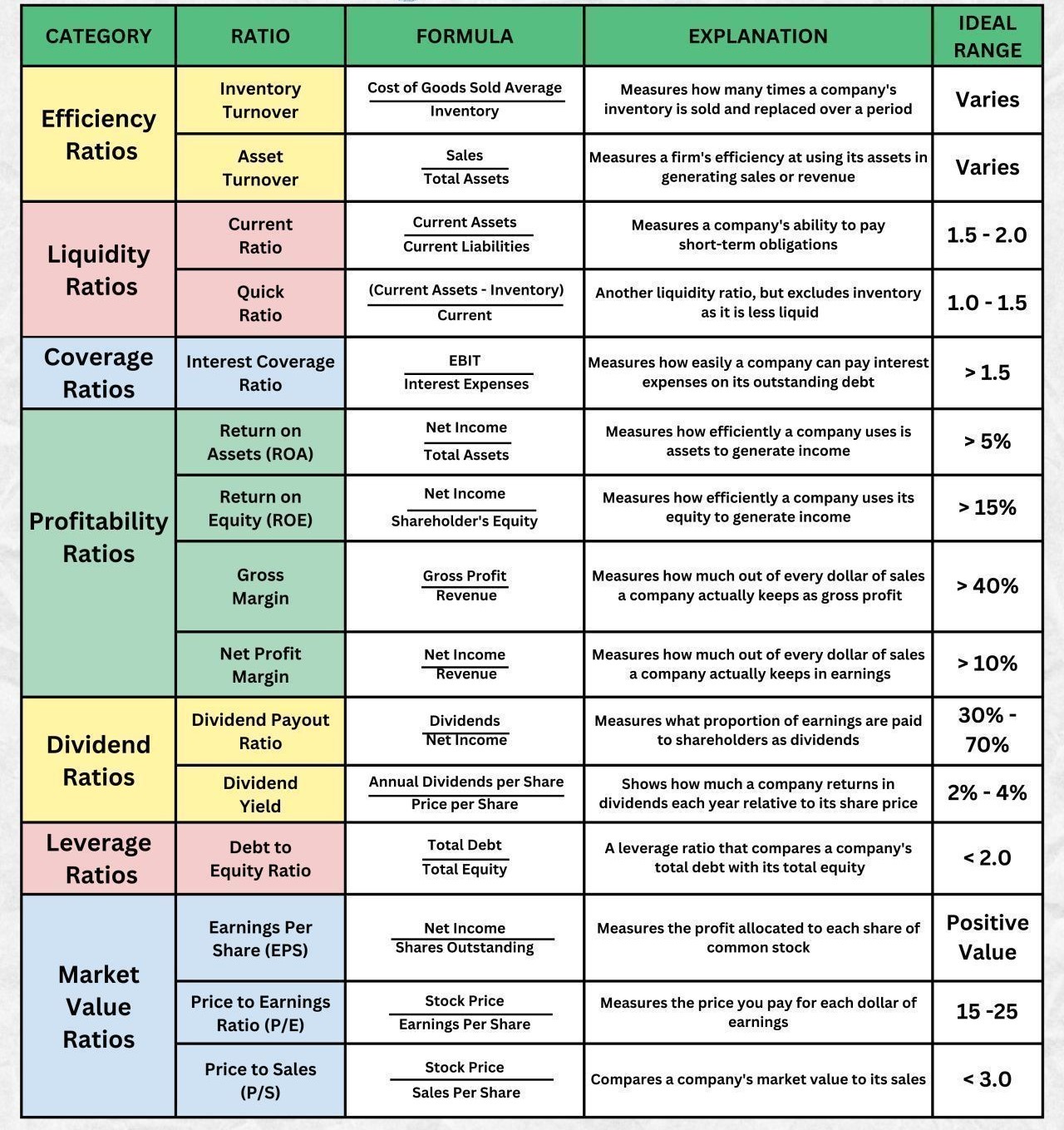

How to analyze a company in less than 5 minutes: Study these ratios:

💡Efficiency Ratios

• Inventory Turnover:

Cost of Goods Sold ÷ Inventory

Measures how many times a company’s inventory is sold and replaced over a period.

• Asset Turnover:

Sales ÷ Total Assets

Measures a firm’s efficiency at using its assets in generating sales or revenue.

🚰 Liquidity Ratios

• Current Ratio:

Current Assets ÷ Current Liabilities

Measures a company’s ability to pay short-term obligations.

• Quick Ratio:

(Current Assets – Inventory) ÷ Current

Another liquidity ratio, but excludes inventory as it is less liquid.

☔ Coverage Ratios

• Interest Coverage Ratio:

EBIT ÷ Interest Expenses

Measures how easily a company can pay interest expenses on outstanding debt.

💰Profitability Ratios

• Return on Assets (ROA):

Net Income ÷ Total Assets

Measures how efficiently a company uses its assets to generate income.

• Return on Equity (ROE):

Net Income ÷ Shareholder’s Equity

Measures how efficiently a company uses its equity to generate income.

• Gross Margin:

Gross Profit ÷ Revenue

Measures how much out of every dollar of sales a company keeps as gross profit.

• Net Profit Margin:

Net Income ÷ Revenue

Measures how much out of every dollar of sales a company keeps as earnings.

💸 Dividend Policy Ratios

• Dividend Payout Ratio:

Dividends ÷ Net Income

Measures what proportion of earnings are paid to shareholders as dividends.

• Dividend Yield:

Annual Dividends per Share ÷ Price per Share

Shows how much a company returns in dividends each year relative to its share price.

🛠️ Leverage Ratios

• Debt to Equity Ratio:

Total Debt ÷ Total Equity

A leverage ratio that compares a company’s total debt with its total equity.

📈 Market Value Ratios

• Earnings Per Share (EPS):

Net Income ÷ Shares Outstanding

Measures the profit allocated to each share of common stock.

• Price to Earnings Ratio (P/E):

Share Price ÷ Earnings per Share

Measures the price you pay for each dollar of earnings.

• Price to Sales (P/S):

Share Price ÷ Sales Per Share

Compares a company’s market value to its sales.

We specialize in providing high-quality accounting services tailored to the requirements of small, medium, and large enterprises. Our cost-effective services include:

1. Bookkeeping & Accounting

2. Professional Tax Preparation

3. Financial Statements

4. End-to-End Payroll Solutions

5. Data Entry & Administration

One of the first companies to offer outsourced bookkeeping services was IFCCL. They are professionals with extensive experience in bookkeeping who have worked for many kinds of companies. They offer all the required accounting tools, making it simple to complete bookkeeping operations. India Financial Consultancy Corporation Pvt LTD is a known Booking services providing firm in Delhi India.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.