Essential Bookkeeper Skills to be Consider Manage Financial

Table of Contents

What are the essential Bookkeeper Skills to be Consider manage the financial?

Bookkeepers are responsible to effectively maintain the company’s financial records. Every business firm needs bookkeeping and accounting, so business are expected to have a broad range of skills. Check out a few necessary abilities if you’re thinking about pursuing a job as a bookkeeper or searching for professional accounting services. You might now have a query:

What Requirements Are Needed for Accounting professionals?

- There are a few fundamental abilities that professional bookkeepers are supposed to possess. bookkeeper talents are needed all combined in these like in core knowledge, soft skills, and technical skills. It would be fascinating to examine these skills in further detail as they relate to bookkeepers.

What abilities are required to be a master bookkeeper and accountant?

A better accounting system can be accomplished with a few primary skills that the accountant and bookkeeper are supposed to possess.

The list that follows consists of competencies required to become a bookkeeper or accountant.

Paying attention to details properly

A proper eye for detail is one of the most crucial abilities required for bookkeeping. Efficiency in accounting & Other financial areas of the business firm will be improved. Also, it will help to reduce errors and increase accuracy in the bookkeeping process.

A methodical or disciplined approach

A disciplined approach is a crucial bookkeeper skill that can aid in producing effective accounting records. It will prevent additional problems that might arise as a result of bad bookkeeping. A systematic approach will also aid in providing a clear picture of the business’s current financial situation. The ability to complete the work in a timely manner will help business owners in fostering the expansion of their enterprise.

Familiarity with technology

Nowadays, technology is used in many aspects of bookkeeping and accounting. So, the bookkeeper needs to be familiar with using the necessary technology. They must be proficient in using Excel, Microsoft Word, data entry, and other tools. They may be able to improve their accounting and bookkeeping accuracy as a consequence of this.

The capacity for problem solving

With bookkeeping and accounting work, issues inevitably arise that can complicate subsequent tasks. So, it is expected of the bookkeeper to have stronger problem-solving abilities in order to resolve problems swiftly and maintain a smooth workflow. The efficiency of the bookkeeping and accounting operations will increase as a result.

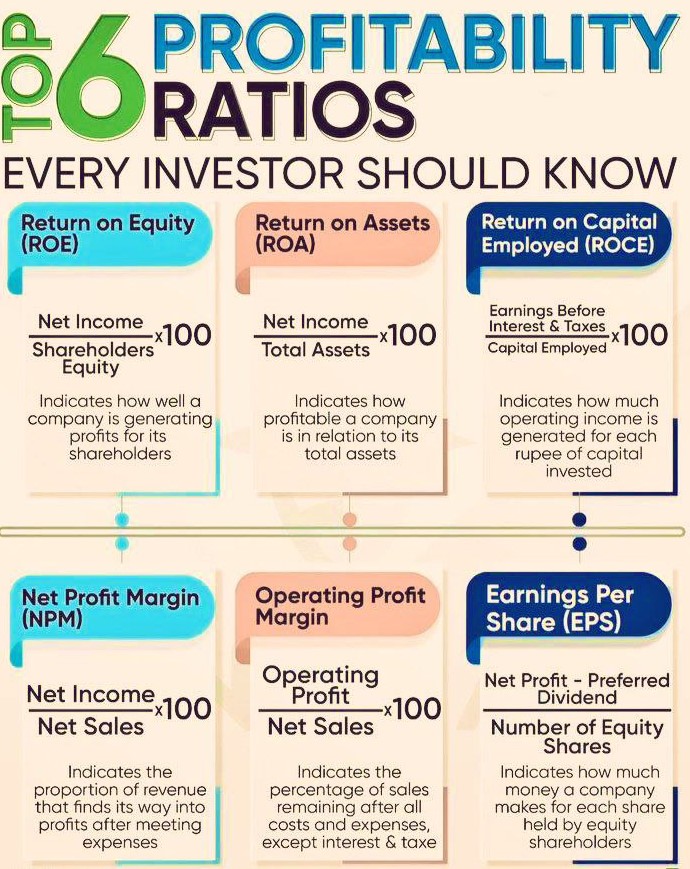

Top 6 Profitability Ratio

- Gross Profit Ratio.

- Operating Ratio.

- Operating Profit Ratio.

- Net Profit Ratio.

- Return on Investment (ROI)

- Return on Net Worth.

- Earnings per share.

- Book Value per share.

Understanding of basic bookkeeping principles

All key bookkeeping concepts must be properly understood by the bookkeeper. They need to be well-versed in the fundamentals of bookkeeping as well as how to manage various situations. They must remain informed of all the requirements established by the relevant authority in the specific location. Their job must adhere to all the rules established by the specific authorities.

To obtain high-quality bookkeeping, it is vital to consider acquiring these 5 bookkeeper skills. Your reputation will improve thanks to these abilities, and your bookkeeping work will be highly valued.

If you’re looking for a professional company to outsource the bookkeeping process to, you might want to think about India Financial Consultancy Corporation Pvt LTD. IFCCL employs professional bookkeepers with excellent bookkeeping abilities. You can increase your bookkeeping efficiency with the aid of their experience. IFCCL is a reputable organisation that offers accounting services all around the world.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.