Get INR 20,00,000/- By Investing INR 100: Post Office Scheme

Table of Contents

Get INR 20,00,000/- By Investing INR 100: Post Office Scheme

The Post Office offers a variety of useful schemes that will help you keep your money safe and provide you with more rewards than you would get from any other source.

Post office schemes are the solution to go if you’re looking for a safe and secure investment option.

They’ve been around for quite a long time and are, in some ways, risk-free investing options. The Post Office offers a variety of useful schemes that will help you keep your money safe and provide you with more rewards than you would get from any other source.

Small monthly deposits of Rs 100 can turn you into a millionaire in a few years.

National Savings Certificate

India Post offers this tried-and-true plan. In this system, you can make a lot of money in a short period of time.

In the post office, your money will be completely safe. So we can say that We may invest our fund in NSC without any risk & make our and our family’s future safe.

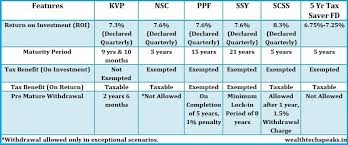

What are the Benefits of National Saving Certificate Scheme ?

The NSC system has a 5-year maturity term. You can, however, remove funds from your account after one year if certain requirements are met.

The government sets interest rates at the start of each quarter (3 months) of the financial year.

What is the interest rate?

The plan is currently earning 6.8% per year in interest. Under Section 80C of the Income Tax Act, you can claim a tax exemption of 1.5 lakh rupees every year.

How much should you invest?

With as little as Rs 100 per month, you can begin investing in this scheme.

If you want Rs 20.85 lakh after 5 years at a 6.8% interest rate, you’ll need to invest Rs 15 lakh over 5 years and earn roughly Rs 6 lakh in return.

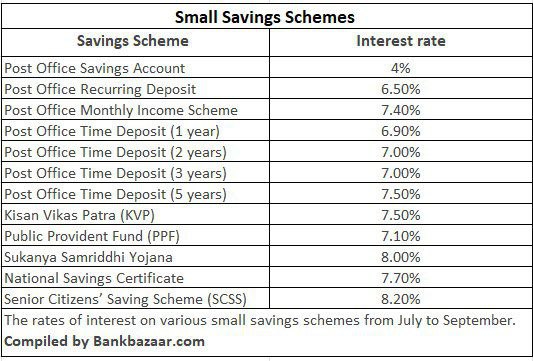

Small saving schemes: Highest interest rate is 8.2 %

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.