File your Income Tax Return-ITR

Table of Contents

File your Income Tax Return(ITR)

- Government of India is enforcing the Income tax on the income of a person. Every person is responsible for Income tax filing whose income is above the maximum exemption limit specified by income tax act 1961.

- The Income tax dept make the assessment of theses these income return, and if any income tax amount has been paid in short or error, the excess paid income tax is refunded by the tax department to the assessee’s officially declared bank A/c .

- Assesses who is willing to avoid penalties, all the person must have to file Online Income tax return on time. The official tax filing return is a different kind of form-based compliance required to file with income tax department that contains details about an assesses income & loss exemptions along with and taxes paid on it income earing.

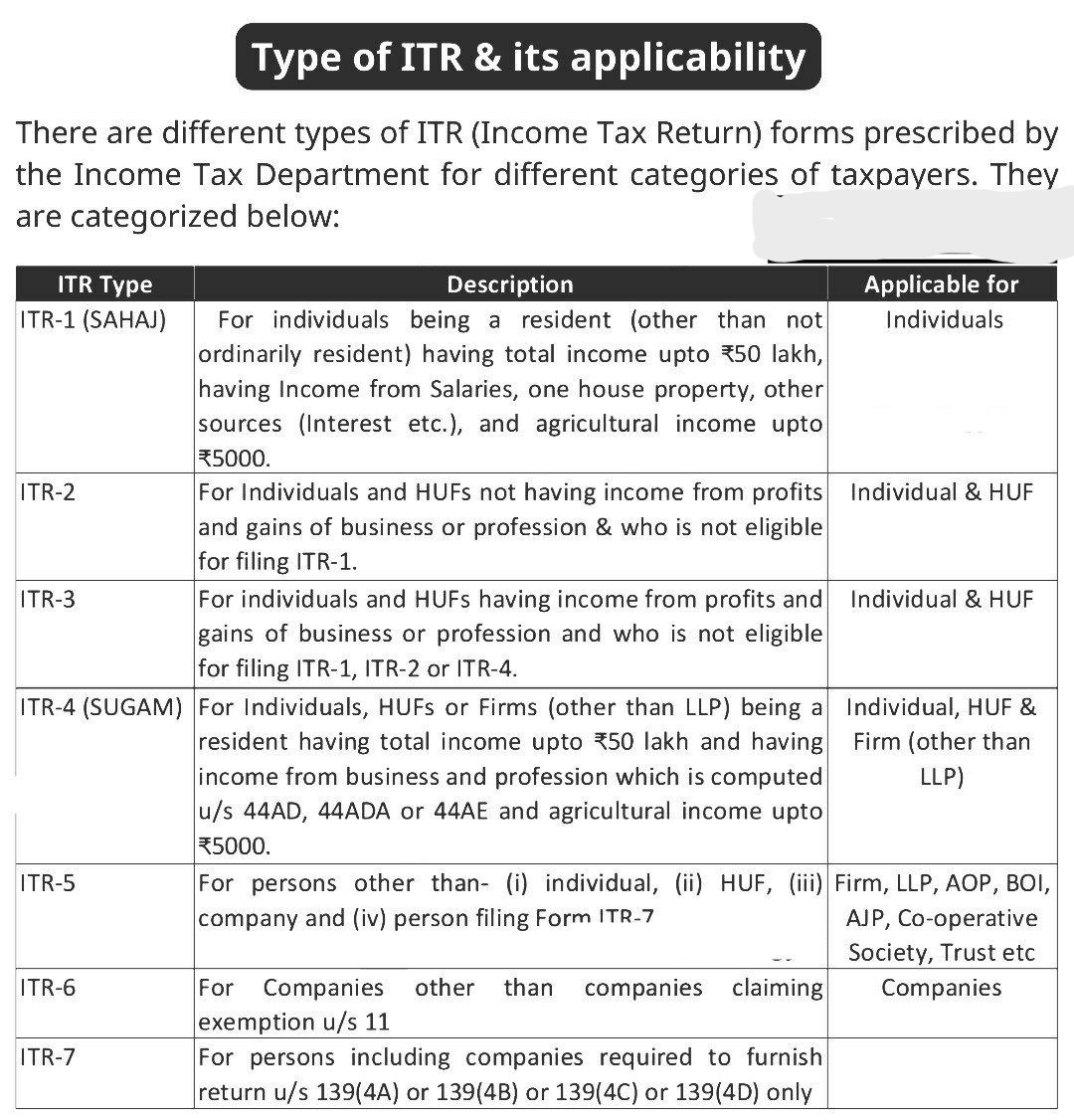

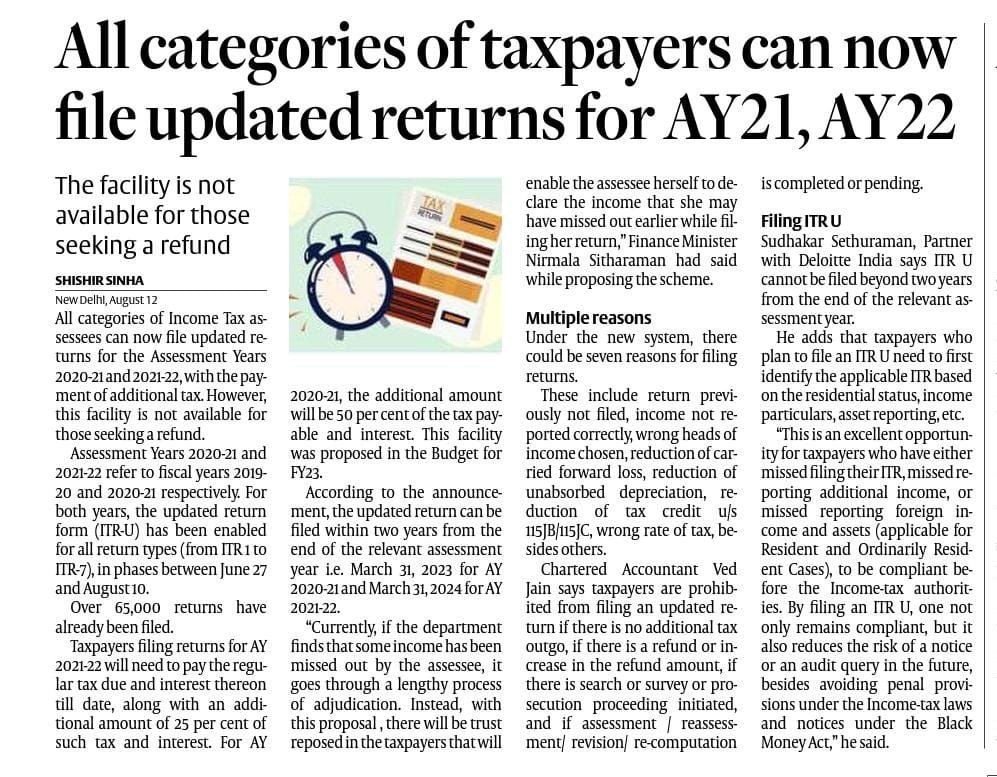

- Income tax return type i.e. ITR 1, ITR 2, ITR 3, ITR 4S, ITR 5, ITR 6, & ITR 7 are all are e-filling ITR Filing forms to be used by the Income Tax Dept as per specified manner.

System of Income tax Refund:

what is meaning, income tax refund process, & How to claim an Income tax refund?

- Every person who should be familiar with the compliance under “Income tax refund.” In case person have properly completed his taxes filing in the past years, He will surly have gotten a income tax refund based on his financial statement and relevant required reports.

- According to provisions relating to income tax refunds are specified in under sections 237 to 245 of the Income Tax Act. 1961.

- When a Assesses has paid excess in income tax than his/her actual income tax burden, they may be eligible to get an Income tax refund. Advance tax, self-assessment tax, TDS, TCS, & even foreign income tax credit are all possibilities.

Income tax refunds are usually get in these two way to maintain tax filling transparency:

- Via Cheques: Instead, a income tax refund bank account cheque may be send via speed post to the Assesses’s home address. It is essential to provide the correct home address again. Income tax refund cheque will be returned till the right home address is not provide correctly.

- Via RTGS/NEFT: income tax authorities will credit your bank account directly with the eligible income tax refund. To the specified Indian bank A/c, Assesses have to required provide the below following details. i.e Ten digit bank’s account No, the bank’s MICR code, & communication address along with the name.

When submitting taxes online, people can choose the payment method that is most convenient for them.

- Discrepancies in the communication address, bank account, or refund calculation, on the other hand, can result in delays or even cancelation.

- Taxpayers can track the status of their return by entering their PAN and evaluation year on the official site 10 days after the assessing officer submits it to the refund banker.

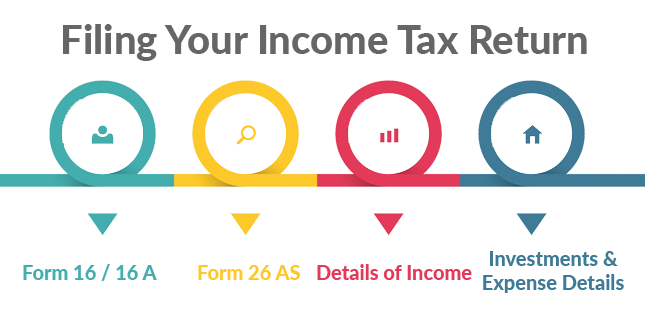

- Filing an ITR is a simplistic approach to get an income tax refund. It must be physically confirmed by sending signed ITR-V (acknowledgment) within 120 days after submitting returns using an Aadhar number OTP and an EVC issued via a bank account, or it must be validated using an Aadhar number OTP and an EVC issued via a bank account.

Also read : Implication of cash transaction under income tax Act

Important things to be keep in mind before Online Income tax return filing

- Key thing on income tax return is to make sure that all of your Income details is completely disclosed over there.

- Moreover, salaried persons can file to do e filling ITR only on the basis of his Form 16. In case they overlook details like as stock market transactions, interest income & other important details that required to be declared when filling income tax return.

- Normally Salaried taxpayers usually use the ITR 1 or ITR 2 forms to file his income tax returns. Incom e tax return – ITR 1 is for whose have a 1house property & income up to INR 50,00,000/-.

- In case person have more than 1 house or house is co-owned, they have to file the income tax return Form ITR 2. Even if income amount are accurate, Assesses should pick the exact form that applies to them, as the income tax dept. will deemed erroneous income tax form filed and can be considered as invalid return.

- To complete online Income tax filing we have to take the assistance of legal & Taxation compliance firm like online ca services. www.caindelhiindia.com is a leading firm in Delhi/NCR that can help us to get Online ITR Filing compliance & getting your Income tax refunds.

Also Read :

Implication of cash transaction under income tax Act

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.