In & out of E-TDS Challan 26QB – Income Tax Dept.

Table of Contents

CHALLAN 26QB: FOR TDS ON PROPERTY SALES

In compliance with the provisions laid down in section 194-IA, where a buyer purchases an immovable property such as a house or part of a building other than agricultural land, it is required to deduct TDS on such property at 1% at the time of payment to the seller in case cost greater than Rs.50 Lakh. Corporate and non-corporate deductors may use the method.

List of Particular of the Information/ details to be required In Challan 26QBB

- Deductor and deductee PAN category, whether it is corporate or non-corporate

- Deductor and deductee Full name

- Deductor and deductee address

- Choice of more than one deductor or deductee

- Information of the transferred property and full address of such property

- Date of arrangement or reservation, consideration for sale, and payment type (lump sum or installment)

- The amount that is paid or attributed

- TDS number and other statistics, such as TDS rate, interest, charges, etc.

- Mode of payment (net banking or e-payment by a bank branch visit)

- Payment/credit date and tax deduction date

Protective measures while making the payment of Challan 26QB i.e TDS on property

- One percent TDS on the gross sales consideration required to be deducted and paid to the income tax department, the buyer is allowed to deduct TDS. Only the buyer can deduct TDS, not the seller.

- If sales consideration is less than Rs. 50 Lakh, No TDS will be deducted. If installments are charged, TDS will be deducted on each installment.

- On the whole sales amount, tax is to be paid.

- The buyer is not entitled to accept a TAN number (Tax Deductible Account Number).

- The seller must have his PAN number, otherwise, 20 percent of the TDS would be deducted. The PAN number also requires to be provided by the buyer.

- TDS shall be withheld at the point of payment or at the point of the seller’s credit, whichever is earlier.

- Within 7 days after the end of the month in which TDS is deducted, TDS is to be deposited along with Form 26QB.

- The buyer must give the TDS certificate to the seller after payment of the TDS to the government.

What is the Procedure to pay tax under property TDS via Challan 26QB?

- Visit the website https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp to pay for TDS by using Challan 26QB

- After that, click on Challan 26QB and choose the taxpayer type:

- Taxpayer for corporations: 0020

- Non-firm taxpayer: 0021

- Full information such as the Financial Year and Assessment Year, the name of the deductor and deductor, the address of the deductor and deductor, property descriptions, and the sum of tax deducted.

- Pick the payment mode. Select e-tax payment for online payment directly, and e-payment for offline payment on corresponding days.

- If you vote for online payment via net banking, By using the correct username and password, log in to your net banking account.

- Thereafter The system will create printable acknowledgment after the correct payment, which consists of details such as TDS payment and banking details.

- Take the print out of your acknowledgment slip if you want to pay offline. The slip of acknowledgment will be valid for Ten days after completion. By visiting the designated bank branch, you can pay tax via cheque or Demand Draft. You will get a copy of your Challan 26QB from the bank after making a successful payment.

STEPS TO BE FOLLOW FOR MAKING INCOME TAX PAYMENT THROUGH CHALLAN:

- Press on the e-pay tab or pay taxes online on the TIN NSDL website and choose the respective Challan. If you open the screen with the form, enter the following details:

- Permanent Account number

- Your Residential address

- year of Assessment for which the tax is to be paid

- Minor Head code

- Applicable Tax (income tax on salaried workers)

- Type of payment: You must pick 100 in the case of advance tax, 300 in the case of self-assessment tax and 400 in the case of daily assessment tax to make any payment only if the income tax department has increased the query.

- Choose a bank name from the drop-down list of banks

- Click the Proceed button after filling in all the required details. The TIN system will display all the information entered by you along with your name in the income tax department database for the Permanent Account Number entered by you.

Note: Permanent Account Number is Compulsory for the payment of income tax. Paying of tax would not continue without a correct Permanent Account Number (PAN) number.

- You will get an opportunity to check the information you entered. If you notice any errors, click on the Edit button to correct the details. If all the filled-in details are correct, tap submission. You will be directed to its net-banking site via the TIN system.

- Log in with a user ID and password to your net banking account and enter the payment details. Your pay has to be split into separate elements such as income tax and education cess, etc.

- Through debiting your account and on a satisfactory deposit, your bank will process the transaction online; a printable certification representing CIN (Challan Identification Number) will be created by the machine. The CIN number, payment information, and name of the bank from which the payment was made would be included in the Challan acknowledgment. Challan recognition is the evidence of payment being made. After a week of making payment, you can check the Challan status online in the Challan Status Enquiry section on the NSDL-TIN website using your CIN.

How to pay income tax using the offline Challan?

By visiting your particular bank branch, you can also pay income tax by using respective Challan offline. You may make payment by cheque or Demand Draft. A counterfoil containing the Corporate Identification Number (CIN) number and payment information will be provided by the bank during deposit. After a week of payment, you can check your Challan on the Tax Information Network (TIN) NSDL website.

Challan 287:

Under Pradhan Mantri Garib Kalyan Yojana Scheme or PMGKY scheme, 2016 while making an income tax payment

Normally Challan 287 are using Under the Pradhan Mantri Garib Kalyan Yojana (PMGKY) Scheme, 2016, for making tax payments by taxpayers preparing to planning to disclose income during the period From 17 December 2016 until 31 March 2017 under the PMGKY Scheme.

Pradhan Mantri Garib Kalyan Yojana Scheme or PMGKY, 2016

You could report all of declaring any of your disclosed income (either in the form of cash or deposit) to pay tax, cess, or penalty under the taxation and investment regime of PMGKY, 2016. under the Pradhan Mantri Garib Kalyan Yojana Scheme, 2016, the tax on such declare any of your disclosed earnings is to be deposited in government accounts with the help of Challan 287 under the income tax.

How to make payment of tax under PMGKY?

Under Pradhan Mantri Garib Kalyan Yojana, 2016, you can pay tax on your disclosed income by following the steps below:

- Declare income such as deposits and cash: under government PMGKY, 2016, you are expected to report your unaccounted deposits and cash.

- Pay tax and make the deposit: As recommended by the Income Tax Department, you are expected to pay tax at a 50 percent rate on reported income. Afterward, in Pradhan Mantri Garib Kalyan Yojana, 2016, you are expected to pay 25 percent of the total declared amount. The money therefore charged will be blocked for four years by the state, and will be charged to you without interest.

- Payment of income tax using Challan 287 and proof of payment: You are expected to pay tax using Challan 287 after completing the above steps and to receive a counterfoil in respect of the payment made. The counterfoil is seen as evidence of the payment you have made.

Protective measures while filing income tax challan

- For filing taxes by using Challan 287, the PAN number is compulsory. If you do not have a PAN number, apply for the Permanent Account Number (PAN)number and the application date of the quotation, and the number of the certificate.

- Make sure the bank counterfoil contains the following details:

- Seven Digit BSR code of the branch of the bank via which the payment was made

- Date of Challan’s deposit

- Serial Number of Challan

- CIN Number

Challan 286:

For making the payment of Undisclosed income under the Income Tax Declaration Scheme 2016

The Finance Act, 2016 consists of the requirement under the Government’s Income Tax Declaration Scheme 2016, to pay taxes on undisclosed income received during the previous year. Challan 286 may be used to pay income tax on certain income to the state. As specified by the Income Tax Department, income tax on such undisclosed income is payable at a Forty-five percent rate. This Income Tax Declaration Scheme 2016 is effective as of June 1st, 2016.

Online Check the status of TDS Challan with the Tax Dept.

Check the status of your tax challan deposited in banks online. Taxpayers can verify the status of their verity either through the CIN or the TAN. Banks can verify the online status of the tax deposited in their banks by choosing either a bank branch or a nodal bank branch.

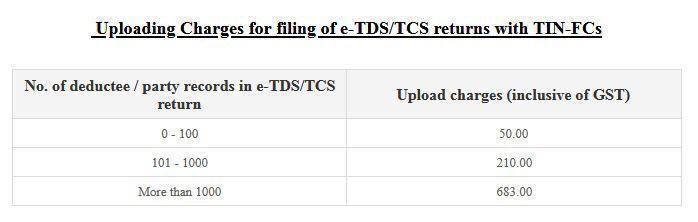

TIN Facilitation used to charge the Fee for TDS & TDS return Filling:

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.