Process of Conversion of Loan into Equity Share are possible

Table of Contents

Process of Conversion of Loan into Equity Share are possible under Companies Act.

A company are allowed to go under conversion of the loan into equity in accordance to the loan agreement, where in the section of paying the process of the debt it was mentioned.

Benefits of the conversion of the loan into Equity Shares:

- You are not required to exchange cash while the conversion debt to equity.

- The conversion also helps in reducing debt and also increase the funding of shareholders which improves the balance sheet.

- In this process money lender convert the amount (reflects outstanding) into equity. Without any transfer of actual cash but equity is kind of money which is invested by the shareholders in the company.

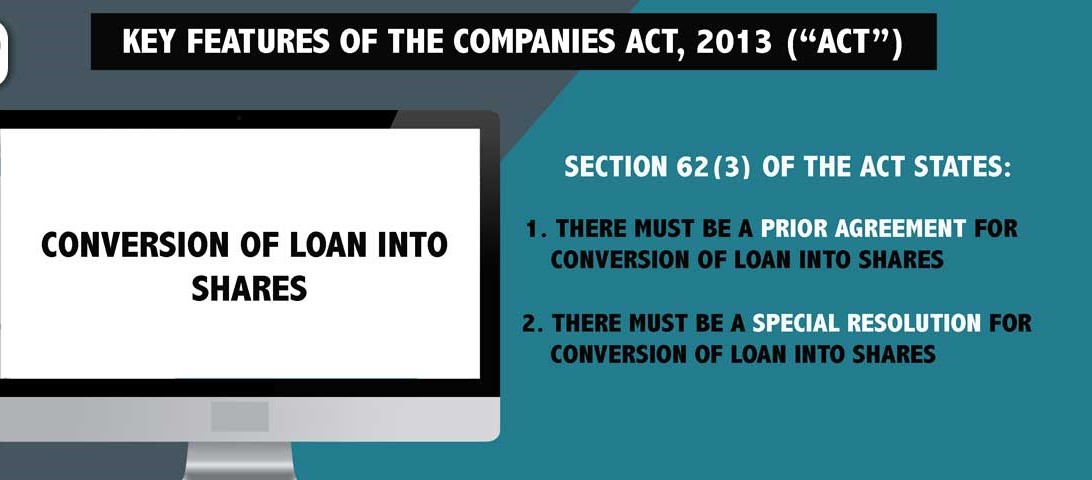

RELEVANT UNDER SECTION- 62 (3) OF THE COMPANIES ACT, 2013

- For the increment of the subscribed capital of any company there is nothing mentioned in this section but caused the loan borrowed by the company which is converted into equity share of the company.

- Assuming that a special resolution adopted by the company’s general meeting approved the terms of the issuing of such debentures or the loan raising before the issuance of such debentures or the raising of loan.

- As a result, it is important to remember that the loan was accepted by the company with the understanding that it would eventually be converted into equity.

- There should be special resolution which must be passed for this type of loan under which conversion is possible.

PROCEDURE FOR CONVERSION OF LOAN INTO EQUITY

Follow steps for the conversion of the Loan into Equity shares.

- Hold a board meeting— A company have to conduct a board meeting by giving notice for the meeting before 1 week for this particular agenda.

- Resolution for loan acceptance

- The Resolution for loan conversion to equity

- Publication of a notice convening an Extraordinary General Meeting.

Hold Extra Ordinary General Meeting

It can be conducted after issuance of the notice before 21 days or even shorter if necessary, conveying the Extraordinary General Meeting to approve the conversion of loan into Equity.

- Submitting e-Form MGT-14 within 30 days after the special resolutions passed.

- The company must enter into a loan agreement with the lender that specifies the terms and conditions for converting the loan into equity.

- Hold a second board meeting in between 7 days’ after notice passes a resolution for allotment on loan conversion into equity.

- Completing Filling e-Form PAS-3 within 30 days after the resolutions get passed.

Don’t Forget to Attach the below mentioned attachment into Forms:

MGT-14:

- Notice of the Extra General Meeting Conducted with statement of explanation.

- A copy of certification of the resolution passed through an Extra ordinary general meeting.

- Loan agreement (Optional)

PAS-3:

- Board resolution for allotment of equity for conversion of loan into equity.

- List Allotees.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.