Penal Consequences for the non-Issuance of IRN or E-Invoice

Table of Contents

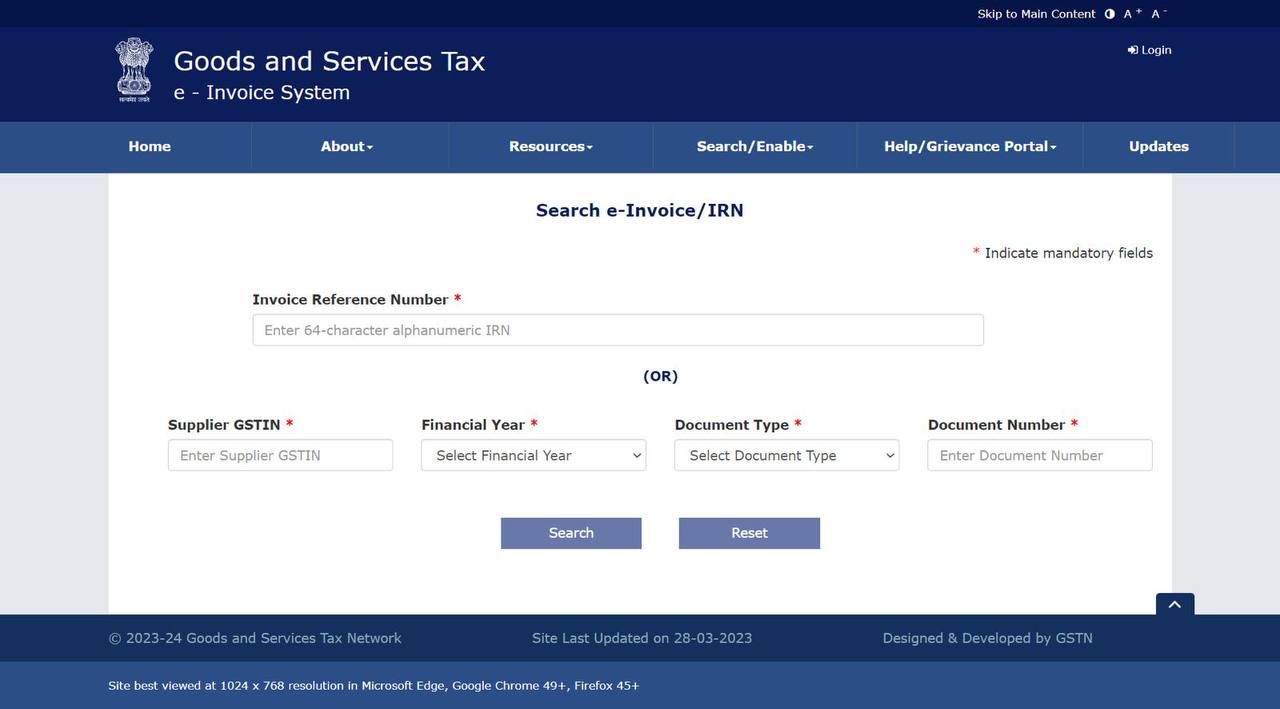

GSTN has enabled the functionality to validate IRN or search IRN from the document number.

https://einvoice.gst.gov.in/einvoice/search-irn

You may useful above link to verify the genuineness of E-invoice bcoz otherwise ITC can be rejected.

Penal Consequences for the non-Issuance of IRN or E-Invoice.

- Every registered Taxpayer under GST whose overall turnover for the financial year or threshold limit more than Rs 500 crores had to mandatory to implement E-Invoicing from 1st of October 2020.

- However, from 1st January 2021 the threshold limit changes to 100 crores it means from 1st Jan 2021 the turnover of the company exceeds 100 crores are liable to generate to E-invoice. As time passes the threshold limit changes to Rs 50 crores for the taxpayers whose applicability are from 1st April 2021. Later on again the government changes the threshold limit to Rs 20 crores which came to effect from 1st April 2022.

- The turnover for the GST registered taxpayer for E-Invoicing applicability, which is begins and considered from the fiscal year 2017-18.

E-Invoices will become mandatory for B2B transactions

- With effect From 1st August 2023, e-Invoices will become mandatory for B2B transactions of all GST-registered businesses with a turnover of 5 crore or more.

- We can say that, if the aggregate sale of any GST taxpayer in any of the FY from 2017-18 to 2022-23 has exceeded INR 5 Cr, then it is mandated to issue E-invoice w.e.f. 1st August 2023. Applicable date is 1st August 2023.

Consequences you have bear for the non-Issuance of E-Invoice ?

- The e-invoice necessity is provided in GST rules under sub-rules (4), (5), and (6) of rule 48. Provisions of rule 48 applicable to individual GST taxpayers only. Other remaining GST taxpayers must accept the general invoicing Provision requirements.

- E-invoice system mandates that all Business-to-Business service (B2B) supply transactions be reported to the government by way of invoice uploads to the Invoice Registration Portal. Taxpayer can generate on his accounting software or Enterprise resource planning(ERP), an invoice or a debit or credit notes

- Subsequently, the invoice must be uploaded to the IRP. After the issuance of each invoice it will receive a special Invoice Reference Number (IRN) after being uploaded. The Govt won’t get any intimation of supply transactions if no electronic invoices are generated.

- In case if there is any possibility of the issuance of any invoice by the registered taxpayer without the IRN is considered an as an Invalid Invoice as per the GST law. Further it was treated as there is no issuance of invoice and also draws several penalties as stated in the below section.

What happens you isn’t generated IRN correctly?

- Non-fulfilment to issue E-Invoice due to failure in generating IRN. As per the Rule 48 sub-rule (5) under the CGST Rules. Penalties under Different sections of GST law will be levied as listed mentioned below.

What are the Penalties for the Incorrect issuance of the E- Invoice?

- Non-generations of the E-invoice is a violation of the provisions of GST law, which attracts some Below penalties provisions. The following are some of the consequences for failing to issue an invoice or issuing an incorrect invoice:

- If an invoice is not issued, the penalty is 100% of the tax owed or Rs. 10,000, whichever is attracts the higher penalty.

Fine of INR 25,000, for Incorrect E-invoicing.

- As per the provision of the Rule 48, an e-invoice that a firm is required to prepare but somehow fails to do so shall be deemed invalid.

- According to the provision of the Section 122, a manufacturer who supplies goods without a tax invoice is subject to pay fine of Rs 20,000 or the taxable value on the tax invoice, whichever is larger.

It is apparent that any violation of the e-invoice mandate will subject taxpayers to substantial penalties. Consequently, if they haven’t already, taxpayers should start upgrading to electronic invoicing as soon as possible.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.