Read All About Royalty Taxatio Under Income Tax Act

Table of Contents

READ ALL ABOUT ROYALTY TAXATION UNDER INCOME TAX ACT, 1961

BRIEF INTRODUCTION

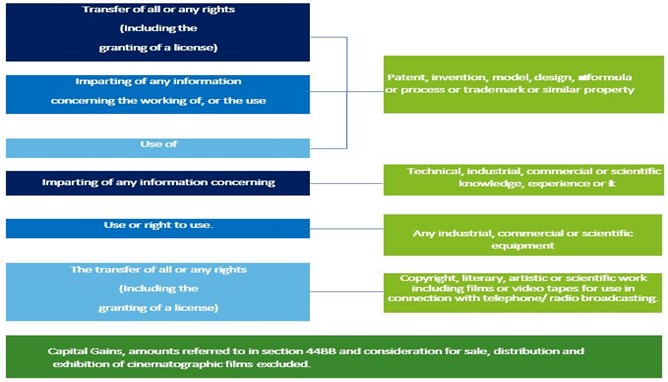

Royalty refers to the payment made in any kind and the same is received as consideration for the utilization of any intangible property like patent, copyright, design or model, secret formula or process, trademark, name or for information concerning industrial, commercial or scientific experience.

Royalty ensures that its owner of possess the domain knowledge of the intangible asset and thus, only permits for the utilization of the said intangible property.

Ownership of intangible assets are legally secured. Where intangible property is legally secured, there are certain test which needs to be applied, in case of transfer of rights in property. But where the owner of intangible asset is also the economic owner, the character of rights enjoyed would be dependent on the provisions provided in the domestic law.

Although the concept of economic ownership is not recognized in reality in India, royalty contracts are generally made under licensing agreements. The consideration of for such agreements are determined as a percentage of gross or income to be derived by utilizing the said asset.

Transfer pricing regulations have been introduced in order to provide for arm’s length pricing of international transactions. These transactions also involve payment in respect of royalties and the same shall be determined by comparing the results or conditions of controlled transactions to the results available under comparable uncontrolled transactions.

OBJECTIVE

- Simplification and rationalization of non-resident taxation

- Reduce administrative difficulties and uncertainties.

- Ensuring gross income of basis of tax for NRI, instead of net profit basis of tax.

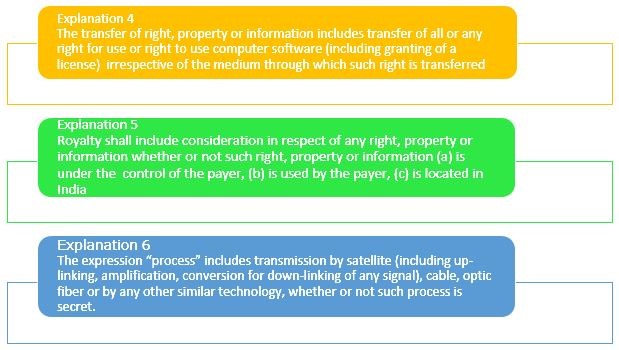

EXPLANATION UNDER FINANCE ACT 2014

EXEMPTED ROYALTY

Royalty payment made in respect of computer software shall be exempt provided –

- Lump consideration is made by a resident.

- For transfer of all or any rights regarding computer software supplied together with a computer or computer-based equipment

- By a non-resident manufacturer

- The same has been transferred under any approved scheme of Policy on Computer Software Export, Software Development and Training, 1986 of the govt. of Indi

ROYALTY – INTERPRETATION ISSUES UNDER ITA

| ISSUE IN INTERPRETATION | CLARIFICATION | REFERENCE TO RULING PROVIDED |

| MEANING OF ‘IMPARTING OF INFORMATION CONCERNING TECHNICAL, INDUSTRIAL, COMMERCIAL OR SCIENTIFIC KNOWLEDGE, EXPERIENCE OR SKILL’ (‘KNOW-HOW’) | EVERY INFORMATION CONCERNING THE INDUSTRIES OR COMMERCIAL VENTURES DOES NOT QUALIFY AS ROYALTY. EXPERTISE AND SKILL REQUIRED TO SOME EXTENT. CONFIDENTIALITY/ SECRECY & EXCLUSIVITY IS REQUIRED TO SOME EXTENT. THE SAME NOT BE SOMETHING READILY AVAILABLE IN THE MARKET. | (CIT VS. HEG LTD. (263 ITR 230) (MP) |

| ALLOWING ACCESS AND DOWNLOADING BUSINESS INFORMATION REPORTS, WHICH IS A COMPILATION OF PUBLICLY AVAILABLE COMMERCIAL INFORMATION IS NOT ROYALTY. | (DUN & BRADSTREET ESPANA SA (272 ITR 99) (AAR) | |

| DEFINITION OF USE | THE APPLICATION OR EMPLOYMENT OF SOMETHING; A LONG-CONTINUED POSSESSION AND EMPLOYMENT OF A THING FOR THE PURPOSE FOR WHICH IT IS ADAPTED (BLACK LAW DICTIONARY) CRITERIA FOR DETERMINATION OF RIGHT TO USE OR USE OF EQUIPMENT (OECD TAG REPORT)

|

(TOURAPARK PTY LTD V FCT [12 ATR 842]) |

| THE WORD ‘USE’ (OF COPYRIGHT) SHALL NOT BE INTERPRETED IN GENERIC SENSE. THE EMPHASIS HAS BEEN MADE ON ‘USE OF COPYRIGHT OR THE RIGHT TO USE IT’. THUS, WHERE THE EXCLUSIVE RIGHTS, WHICH THE OWNER OF COPYRIGHT HOLDS, IS PRIVIDED TO THE CUSTOMER, EITHER PERMANENTLY OR FOR A FIXED DURATION OF TIME AND THE PERSON MAKE A BUSINESS OUT OF IT, THE SAME SHALL BE EXCLUDED WITHIN THE AMBIT OF USE OR RIGHT TO USE THE COPYRIGHT. | (FACTSET RESEARCH SYSTEMS INC [182 TAXMAN 268]) |

EXCEPTION OF CAPITAL GAIN

The definition of royalty excludes any consideration which might be income of the recipient chargeable under the pinnacle ‘Capital gains.

- Clause (i) and (iv) of the definition of royalty provides that transfer of all or any rights in respect of patent, invention, model, design, secret formula or process or trade mark, copyright, literary, artistic or scientific work, etc. would constitute royalty.

- Definition of ‘transfer’ includes extinguishment of any rights within the asset as per section 2(47) of the Act.

- Whether the transfer of all or any rights in patent, copyright, etc. may be treated as extinguishment of any right within the asset thereby chargeable under the top ‘Capital Gains’.

- Tests to work out whether transfer of all or any rights in asset would constitute royalty.

- Ownership of the patent, copyright, etc. isn’t transferred [HCL Limited (ITA nos. 93/2002 & 120/2008), Delhi Trib.]

- The asset is appearing within the books of transferor.

- The income received by the transferor is treated as revenue receipt [Koyo Seiko Co. Ltd 233 ITR 421 (Andhra Pradesh HC)]

- The transferor doesn’t forego his right to use the patent, copyright, etc. even after the rights are granted/ transferred to the transferee. [Dr. K.P. Karanth 139 ITR 479 (AP High Court)]

- The transferee doesn’t get enduring benefit out of the rights transferred.

- The transferee treats the payment made for rights as revenue expenditure.

DEEMING RULES UNDER THE ITA

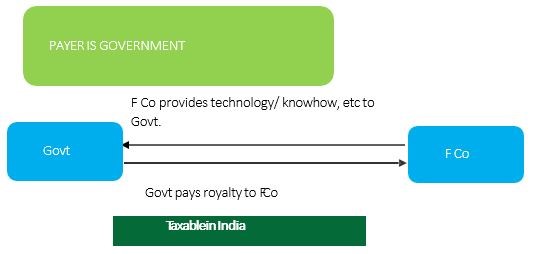

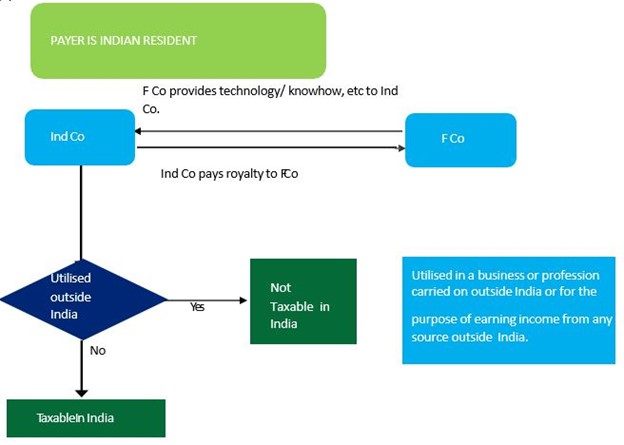

Income by way of royalty payable by—

- the Government; or

- the individual shall be an Indian resident, except for the cases, where the royalty has been paid in respect of any right, property or information used or services, being utilized for the purpose of any business or profession carried on by such person and the same is carried out outside India or is used for earning any income from any source outside India; or

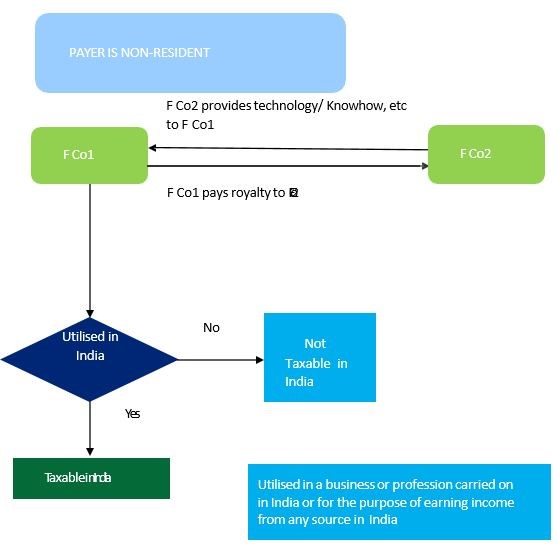

- the individual, being a non-resident, and the royalty has been paid in respect of any right, property or information used or services utilized for the purpose of running a business or profession in India or for the needs of constructing or earning any sough of income from any source in India:

A.:

B. :

C.:

Deduction for any income received as a result of a patent royalty- Deduction of Patent Royalty (Under Section 80RRB):

Under Section 80RRB any royalty income received on or after April 1, 2003, under the Patents Act 1970, is eligible for a deduction of up to Rs.3 lakh or the income received, whichever is less. The taxpayer must be a single patentee who is also an Indian resident. A certificate in the required form, duly signed by the prescribed authority, must be provided by the taxpayer.

| 80RRB | Deductions on Income by way of Royalty of a Patent | Lower of INR 3 lakhs or income received |

SUMMARY

| PAYER OF ROYALTY | UTILIZATION* | TAXABLE IN INDIA |

| GOVERNMENT | – | YES |

| INDIAN RESIDENT | IN INDIA | YES |

| OUTSIDE INDIA | NO | |

| NON-RESIDENT | IN INDIA | YES |

| OUTSIDE INDIA | NO |

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.