Section 8 Online Registration of Company

Table of Contents

Section 8 Online Registration of Company

We can start an NGO under Section 8 Company Registration Online, We can help you register Section 8 Company in India in just Rs.12899 in about 20 days.

OVERVIEW

According to the companies act, 2013 section 8 companies are one whose objective is to promote the field of art, commerce, science, research, charitable, social welfare. Section 8 Company is an entity licensed for charitable purposes; it can also be applied to as a Non-Profit Entity (NPO) or NGO. It is an association dedicated to the promotion of the arts, literature, trade, charity, education, environmental protection, science, social welfare, religion, study, sport, and seeks to make use of its revenues, if any, or any other benefit, in the promotion of its objects. Section 8 Companies act precisely as a limited liability company, in particular with regard to all rights and duties that come with limited liability companies.

While it differs from a limited liability company in one quite important element, it does not use the words “Limited” or “Section 8” in its name. The revenue of the Company shall be used exclusively for charitable causes, and the Company shall not be able to pay any benefit to its shareholders. The government shall grant a certificate of incorporation to all such corporations and shall also enforce certain conditions and restrictions. In the event that they do not meet them, the government will order them to close the Company. In the event that charges of wrongdoing are proven, legal action may be taken against all members of the Organization. Pursuant to Rule 8(7) of the Companies (Incorporation) Law, 2014, These come do not distribute the dividend to their members. The company also apply their profit in their objective promotion. Examples of section 8 company FICCI i.e federation of the Indian chamber of commerce include the terms Academy, Association, Chambers, Confederation, Council, Charities, Growth, Electoral Trust, Foundation, Federation, Platform, Organization, Society, and the like.

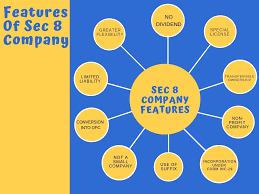

Features of incorporation of Section-8 company

These companies are incorporated for charitable purposes, not to motivate for earning profit and distribute it.

- These companies do not require any minimum paid-up share capital requirement.

- The liability of the members of the section 8 company is limited.

- Section 8 company only can work after obtaining a license from the government.

Process & Documents required for incorporation

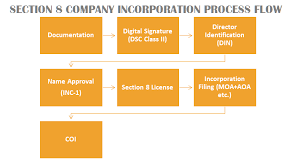

INCORPORATION PROCESS OF U/S 8 COMPANY

Documents required for incorporation of Section 8 Company.

- Documents required to file for incorporation of Company under section 8 of Company act–

- Pan card of all the directors and shareholders.

- Id proof of all the directors and shareholders.

- Address proof to all the directors and shareholders.

- Photo ids of the same personnel

- Declaration of deposits

- Proof of registered place to serve as an office of section 8 company.

- Form DIR-2 with its attachments, i.e. PAN Card and address proof of the directors

- Consent letter of all the directors

- NOC in case the premises are rented or leased

- Interest in other entities of the directors

- An affidavit of all the director(s) cum subscriber(s) – INC-9

- With the help of filing of the above documents obtain DSC

Phase 1: Obtain your name approval in the RUN form

Applications to receive the name of the company and the DSC for the Directors must be submitted with the ROC. Once DSC has obtained to continue with the registration of a company as it has done with a private limited liability company Registration

3.File RUN application to get the name of your NGO (sec.8) approved.

Basic Documents required to be attached along with INC-12:

- Draft MOA as per INC-13 type

- Draft of the AOA

- Declaration as per Form INC-14 (Declaration from Practicing Chartered Accountants)

- Declaration as per Form INC-15 (Declaration from each person making the request)

- Estimated revenue & expenditure for the next 3 years.

Each subscriber shall, in the presence of at least one witness, sign and add his name, address, and occupation to the subscription pages of the Memorandum and Articles of Association of the Company, together with a declaration of his name, address, and occupation. SPICE Type 32 with the ROC for incorporation, along with the following papers, for section 8 of the company registration Ministry of Corporate Affairs

- A draft memorandum of association and articles of association of your company along with other documents.

Phase 2: Submit to License & COI

Upload Form INC-12 with ROC after name approval to apply for a license for Section 8 Business has now been combined with SPICE 32 FORM.

- File an online application for registration which is in SPICE+ form.

- Then wait for application processing.

- Once your application is processed, you got the certificate of incorporation which indicates that your company is incorporated.

Advantages of section-8 company incorporation

- No minimum paid-up share capital: The is no minimum paid-up share capital required for section 8 companies.

- Several Tax Exemptions: Under Section 8 is non-profit, the Company benefits from an exemption from income tax under Section 80 G of the Income Tax Act as well as numerous other tax deductions and advantages.

- Zero Stamp Duty: Section 8 corporations do not require to pay stamp duty on the MoA and AoA, unlike a private or public limited company.

- Minimal share capital: More creditability than any NGO, trust unlike other limited companies, such as private, public, or one person, a company under Section 8 does not need a large amount of share capital to form an entity. Members may use the funds from their gifts or subscriptions instantly.

- Separate legal entity: Section 8 companies get a separate legal status. Section 8 of the Company shall have perpetual succession and a legal person which implies the survival of the company shall be different from its members.

- No Stamp duty: At the time of registration of section 8 company, there is no need to pay stamp duty and high fees.

Disadvantages of Section-8 company incorporation

Below are the shortcomings of Section 8 of the Company:

- No distribution of profits: the members of Section 8 can not share the profits among themselves. Earnings used solely for the advancement of the company’s aspiration.

- Change in MOA and AOA: If section 8 company wants to make any amendment in their memorandum and articles then this can only be done by central government approval.

- Zero benefits: The officers and directors and any other employees of section 8 company do not get any benefit and They are only allowed to cover their out-of-pocket expenses.

- Limited objective: The profit earned by the section 8 companies only uses in the furtherance of their objective or charity purposes. The main objective of Section 8 companies is to use the revenues and revenue of the Company for the purposes of supporting those fields only and not for other purposes.

Cancellation of the license of Incorporation Section-8 company

Section 8 company license can be canceled by the central government on any of the following grounds-

- When a company violates the terms of the license.

- Company act in a fraudulent manner.

- When a company contravenes any provisions of section 8

FAQ- Frequently Ask Question

Q.1- can members of section 8 company get a share in the surplus profit?

Ans. – NO, section 8 company only use the profit for their objective.

Q.2- Can the central government cancel the license of section 8 company?

Ans.- yes, the license of section 8 company can be canceled by the central government on violations of the terms.

Q 3. What is the exemption of tax for section 8 company Incorporation?

Ans. There is a popular misconception that a company under Section 8 does not have to pay taxes because they operate for the benefit of society. The corporation of Section 8, like all legal entities, is responsible for paying taxes. In order to assert an exemption from taxes, a business under Section 8 must be authorized, in specific sections 12 A, 80 G, etc., by the IT authorities.

Q 4. What is the Compliance of Section 8 Companies Registration as per Company act 2013?

Ans. Like all other kinds of companies incorporated under the companies act 2013, Section 8 Company is obliged to file compliance with the provisions of the Act.

- Like all businesses, the business of Section 8 should comply with the annual enforcement criteria.

- In the case of non – compliance, the Company will be run as a dormant company and will strike via the Register.

- Section 8 also obliges the organization to comply with the CSR and to carry out its operations.

- Section 8 Corporation is licensed for the promotion of sports, art, science, faith, charitable works, etc. These businesses are obliged to comply with the registrar of companies on a yearly and event-based (one-time) basis.

Regards

India Financial Consultancy Corporation Pvt Ltd.(IFCCL)

www.caindelhiindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.