Which Income Tax Return Form to file?

Table of Contents

Income Tax Return

The tax return is a document that you are expected to file which includes information about your earnings as well as your tax liabilities. These tax return forms are necessary to file with the Income Tax Department. The Income Tax Act, 1961, allows the Indian citizen to send their Income tax returns at the end of each F.Y to the Income Tax Department. With every person, though, it is not compulsory. There are various ITR form forms and each form is relevant to that certain category of assesses. It is important to file these forms at a defined due date. Only certain tax returns that are filed in the required manner and within the due date will be handled by the Income-tax department.

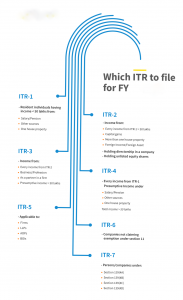

Which ITR Form to file

In fulfillment of this commitment, CBDT has now launched a simpler ITR 1 Form available only to individuals with incomes of up to Rs. 50,00,000. The finance minister has assured the individual taxpayer that he would make tax filing easier for them. But taxpayers may not apply for ITR-1 with dividend income of more than Rs. 10,00,000 or unexplained credit. The ITR-2A implemented in 2016 has now been discontinued and both the older ITR-3 and ITR-2 have been combined. Even so, all individual taxpayers will be entitled to issue only ITR-2 (except those who are entitled to use ITR-1 or that receiving business income).

As the individual taxpayer receiving income from business or profession is now expected to use ITR-3 because Old ITR-4 is now replaced by ITR-3. ITR-4S was supposed to be submitted by citizens opting for presumptive taxes, however now they are forced to submit ‘ITR-4 ‘ for presumptive incomes.

INCOME TAX RETURN- ITR-1

WHO IS ELIGIBLE FOR FILING ITR-1?

The ITR-1 form is to be used where the assesses have income around Rs. 50,00,000 and contains overall individual income;

- Income from other sources (excluding lottery winnings, racing horses, foreign asset income, capital gains, business or profession, agricultural profits that exceed Rs. 5000).

- Salary / Pension income

- Income from One House Property (excluding situations where losses from previous years are taken forward)

- Income from agriculture does not exceed Rs. 5,000.

This may only be applied in the case of clubbed Income Tax Returns, where a spouse or a minor is involved, where their income is not restricted to the above requirements.

WHO IS NOT ELIGIBLE TO FILE ITR-1?

- Is an Indian resident and normally citizen, and has-

- Any asset situated outside of India (including financial interest in any entity); or

- Signing authority for any account outside of India; or

- Revenue from any source outside India.

- Received income from capital gains or from a company or profession

- Has income from more than one real estate property

- Has losses from other sources under Head Profits

- Total earnings over Rs 50,00,000

- Has taxable dividend revenue above Rs 10,00,000 according to Section 115BBDA

- Had an unexplained credit or investment taxable under Section 115BBE at 60 percent.

- Has agricultural income in excess of Rs 5000

- Has earnings from winning lotteries or horse races

- If you are a director of an Indian company.

INCOME TAX RETURN- ITR-2

WHO IS ELIGIBLE FOR FILING ITR-2?

ITR form 2 is for individuals and HUFs who earn revenue rather than income from “Business or Profession profits and gains.” Individuals who have revenue from the following sources are also required to file Form ITR 2:

- Salary / Pension income, housing properties, other sources exceeding Rs. 50,00,000

- Housing property from one or more

- Capital Gains / Loss on investment/property sales (both short and long term)

- Additional sources (lottery, gaming, and other legal channels)

- Being a partner in the business (for this, the ITD abandoned the form and merged into ITR 2 until there was independent ITR form 3)

- Foreign Assets/incomes

- Dividend earnings greater than Rs 10,00,000 taxable u / s 115BBDA

- Unexplained taxable credit or unexplained investment at 60% u / s 68, 69, 69A, etc.

- Share of a partner’s gains from a partnership business

- Agricultural income in excess Rs 5,000

WHO IS NOT ELIGIBLE TO FILE ITR-2?

- Any person or HUF who has a business or professional income

- Individuals that apply to complete the ITR-1 Form

INCOME TAX RETURN- ITR-3

WHO IS ELIGIBLE FOR FILING ITR-3?

- A person or a HUF is a partner in business AND

- If income calculated under the head ‘Gains or profits of business or profession’ does not contain any revenue other than taxes by means of any interest, wage, incentive, reward or remuneration owed to or earned from, that activity.

In the event where the company’s partner has no income from the business by means of interest, wages, etc. and has only exempted the company’s benefit by means of a share of the business’s profits, the assesses shall use only that form, not Form ITR-2.

WHO IS NOT ELIGIBLE TO FILE ITR-3?

As the ITR-3 form is used for business returns, any person filing his / her personal income tax return, i.e. Salaried workers do not have to file ITR3 or register with ITR 1 form.

Income tax returns (ITR) are to be used for the 2021-22 assessment year for individuals receiving business revenue. The year of the assessment is the year subsequently after the financial year.

ITR 4, or generally known as Sugam, is to be filed under Sections 44AD, 44ADA, and 44AE of the Income-Tax Act, 1961, by individuals and Hindu Undivided Families (HUFs) who have opted for the presumptive exemption scheme for income received from business and occupation during the F.Y. 2020-21.

The form has been updated for the assessment year 2021-22 to contain GST data along with comprehensive financial information. ITR-4 has been called the old ITR-4S tax form.

For those taxpayers who have opted for the presumptive revenue system as per se, the ITR-4 Form is the Income Tax Return Form for Section 44AD, Section 44ADA, and Section 44AE of the Income Tax Act. However, if the turnover of the undertaking referred to above reaches Rs 2,00,00,000, ITR-3 would have to be submitted by the taxpayer.

INCOME TAX RETURN- ITR-4

WHO IS ELIGIBLE FOR FILING ITR-4?

This Return Form is to be used by an individual / HUF / Partnership Business whose overall income for the 2020-21A.Y includes:

- Business income if such income is measured in compliance with the special provisions referred to in sections 44AD and 44AE of the Act, for Company Income calculation.

- Professional income where that income is calculated in compliance with the special requirements referred to in sections 44ADA; or

- Salary / Pension; or

- Income from One House Property (excluding situations where losses are carried forward or brought forward); or

- Income from other sources (with the exception of lottery winning and racehorse income).

WHO IS NOT ELIGIBLE TO FILE ITR-4?

- In the following situations, SUGAM cannot be used:-

- Income from more than one house property or where loss or damage to be taken forward under this head is taken forth.

- Income from lottery winnings or racing horses

- “Under the heading” Capital Gains “, – for example Short-term capital gains or long-term capital gains from the selling of houses, land, stocks, etc.

- Taxable on income under section 115BBDAA

- Income of the sort mentioned in section 115BBEBE

- Agricultural earnings in excess of ~5,000

- Speculative Business Income and other special incomes; or

- Income throughout the form of commission or brokerage by an agent business or income

- A person seeking international tax relief paid pursuant to Section 90, 90A or 91;

- Any citizen with any asset located outside India (including financial interest in any entity) or a signing authority on any account located outside India

- Any resident with income from outside India

INCOME TAX RETURN- ITR-5

WHO IS ELIGIBLE FOR FILING ITR-5?

- firm

- LLP- Limited Liability Partnership

- AOP-Association of Persons

- BOI- Body of Individuals

- Artificial juridical person under section-2(21)(vi))

- Cooperative / registered society

- Local Authority

- persons referred to in section 160(1)(iii)(iv)

INCOME TAX RETURN- ITR-6

WHO IS ELIGIBLE FOR FILING ITR-6?

- Companies can use ITR-6 for tax filing (other than a corporation claiming exemption under section 11).

- Companies seeking exemption u / s 11 are those keeping their income for religious or social benefits arising from any property.

WHO IS NOT ELIGIBLE TO FILE ITR-6?

- Individual,

- HUF( Hindu undivided family),

- The firm, Association of Person (AOP),

- Body of Individuals’ (BOI),

- Local Authority and Artificial Judiciary person

- Companies seeking exemptions under section 11 (property income kept for charitable or religious purposes)

INCOME TAX RETURN- ITR-7

WHO IS ELIGIBLE FOR FILING ITR-7?

- Return in compliance with section 139 (4A), filing. Any person receiving income arising from property held in trust or other legal duty completely for, or in part solely for, charitable or religious purposes, or earning income in the form of voluntary donations where the gross income for which he is taxed as a qualified assesses reaches the permissible amount which is not subject to income tax.

- Return under section 139(4B), in the event of revenue exceeding the maximum amount not taxable, the political party is expected to fill out the form.

- Returns pursuant to section 139 (4C) are performed by such organizations, such as:

- Association for Scientific Research;

- Hospitals, funds, any Institution or university of education;

- Association or institution referred to in section 10(23A).

- New agency

- Institution referred to in section 10 (23B);

- Returns under section 139(4D) to any college or university that is not required to have income or loss returns

- Return under section 139(4D), any college or university that is unable to provide the return of income or loss under any other clause of this section is needed to fill out and is unable to supply

- Return pursuant to section 139(4E), Any business trust which is not needed to filled income return or loss under any other law of this section shall return its income in lieu of its income or loss in the previous year, and all the provisions of this Act shall apply, to the degree that this may be the case, * if the return is necessary to be furnished In compliance with sub-section.

- Return under section 139(4F) Any investment fund referred to in section 115UB which is not necessary to provide a return on its income or loss under any other clause of this section shall provide a return on its income or loss in any previous year and all the provisions of this Act shall, to the degree that they may be, apply as though it were a return needed to be supplied in compliance with sub-sub-paragraphs.

WHO IS NOT ELIGIBLE TO FILE ITR-7?

- A person who does not claim an exception pursuant to Section 139(4A), Section 139(4B), Section 139(4C) or Section 139(4D) or 139(4E) or 139(4F) or 139(4F)

Regards

India Financial Consultancy Corporation Private Limited

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.