Company Registration of online Sellers

Table of Contents

E- Commerce Business Company Registration

Brief Introduction

Online shopping has become the new way of shopping for things with just a click. With the increase in the usage of internet, the e-commerce industry is witnessing higher growth prospects and increasing demand. Starting a web retail business is one among the most effective options during this tech-savvy world. More and more people are choosing online shopping in this era of coronavirus pandemic instead of venturing out. Putting in place a business online is simple, and online business means the business reach is high. during this article, we are going to look into the procedure of company registration for online sellers in India, and also the legal requirements.

Regulatory authority for Company Registration for E-Commerce Business

The Companies Act, 2013 defines a corporation as a corporation that’s incorporate entityd under the companies Act. For registration of the corporate entity, the individual must incorporate entity the company, register the office address, notice for the appointment of directors is required, and a statement of employee’s salary structure is additionally needed. If someone is aiming to venture into the e-commerce business and become an online seller, he can do so under sole proprietorship.

Joining of E-Commerce Business

If someone is about to join an e-commerce business, joining a longtime marketplace as a web seller is that the easiest method. Such a business structure only requires opening of a bank account and obtaining of GST registration for the business. Joining these big e-commerce platforms makes the method of getting our own business a bit less burdensome. this is often because, these e-commerce giants make sure of technological developments, payment gateways, and logistics. Moreover, online sellers have the freedom to hitch multiple e-commerce platforms for better reach without facing any technical difficulty.

Importance of Company Registration- Online Sellers.

If you’re establishing any kind of business, the primary and foremost thing to do is to obtain a company registration. If you’re going to venture into the e-commerce industry, you have got to determine the sort of company you wish to begin with. One can favor to start a corporation, firm, sole proprietorship, LLP, or partnership. If the company is a start-up, then sole proprietorship is the easiest to begin with. This business model is go past a sole person and is straightforward to handle.

The owner has direct control over the entire business. You don’t need a special registration for this sort of business. it’s always advisable that the corporate entity gets registered, because it helps the corporate entity to achieve more trust among the shoppers. Moreover, while doing business, the corporate entity needs to maintain a current account within the name of the business. For this one should make sure that the corporate entity could be a separate legal entity. For this, it has to be registered and have an establishment license also.

If an online seller wishes to determine a web store, they have to register themselves as a business to enable online payment. Getting company registration will bring more trust and also the person will avoid any legal difficulty.

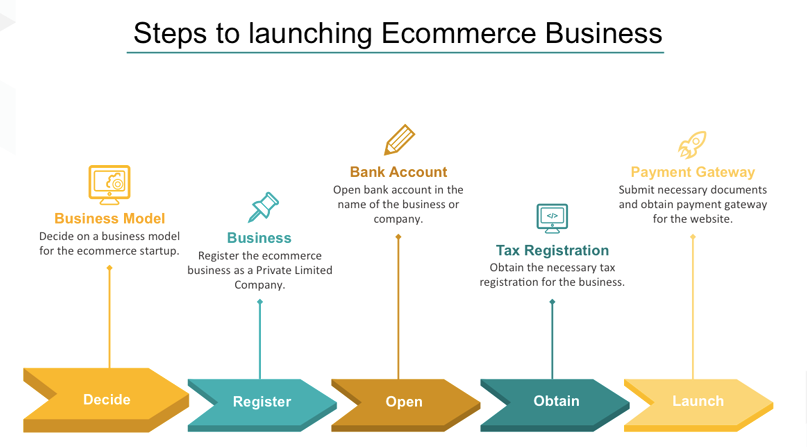

Process of Registration E-commerce Business

- Step 1: Registration are often done by online and offline mode.

- Step 2: After obtaining all the documents, the desired forms need to be submitted with MCA by paying a requisite fee and tax.

- Step 3: Once the form, along with the documents, are approved by the MCA, the same shall issue the Certificate of Registration in the name of the said company. Additionally, the records of the corporate entity will be updated.

- Step 4: Once the person receives the incorporation certificate, he can open a current account within the bank. it’s mandatory to own a current account within the name of the corporate entity.

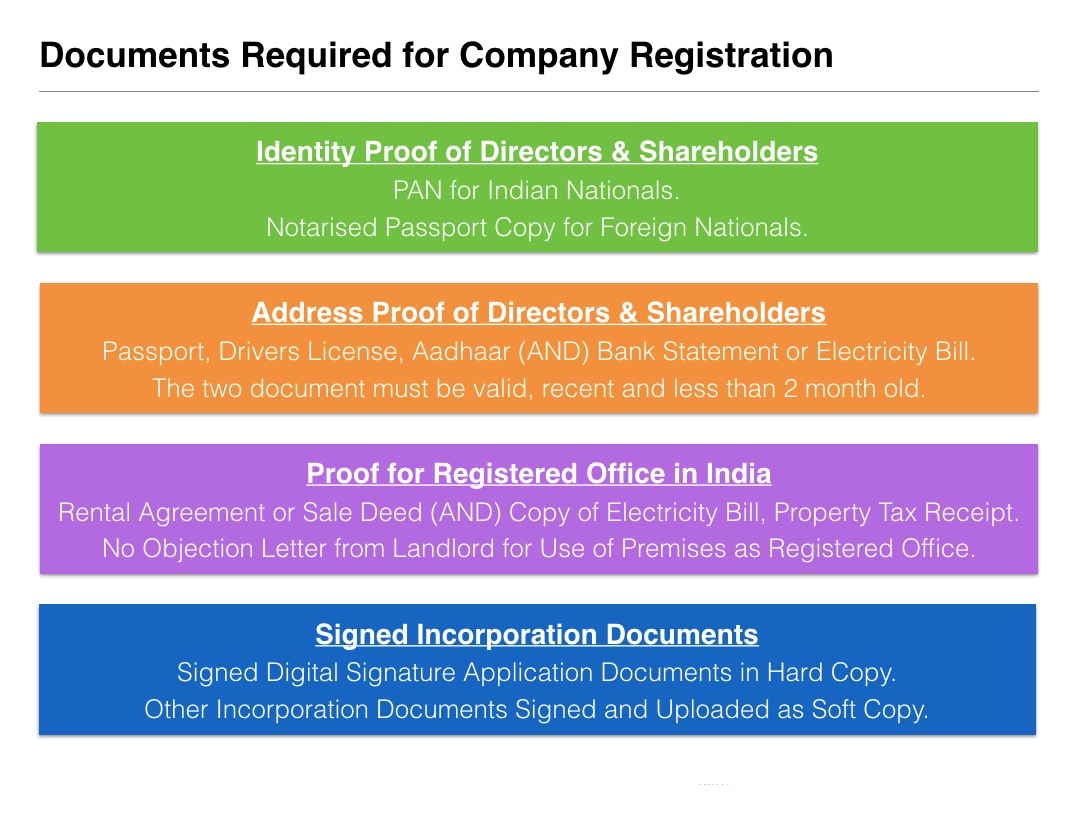

Documents Required Online Sellers

Following is that the list of documents required for company registration for online sellers as per the companies Act, 2013-

- PAN card in the name of company, along with an address proof like sale deed or rent agreement, or the Aadhar, voter id, passport, etc. in case of proprietors.

• Bank statement.

• Copy of utility bill in the name of the company, that can the electricity, landline, and water bill.

• A NOC of the proprietor.

• A rental agreement just in case the premises is rented.

• A declaration of compliance.

Legal requirements E-Commerce Business

- GST Registration: If the corporate entity has an annual turnover of Rs. 20 Lakhs or Rs. 10 Lakhs within the case of north-eastern states, then they need to obtain GST registration. Earlier, the businesses had to induce various tax registrations, like VAT, excise or service tax, etc. now after the goods and service Tax regime were introduced, online sellers need to get GST registration only.

- Trademark Registration: When someone is starting an online business, keeping it different from the masses is crucial for business growth. If the web sellers get trademark registration, it can help their business enormously. Trademark registration helps to safeguard the legal rights by safeguarding the brand and value.

- Vendor Agreement: this is often the foremost important agreement when establishing an e-commerce business. Online sellers have to have an agreement with vendors listed on their online portal. Such an agreement provides forth the expectation of the parties to the agreement and hence safeguards their legal rights. This agreement includes the responsibilities of both parties and therefore the consequence of non-payment if any.

- Business License: the entire process of company registration depends on the kind of business and also the home state of the business. One must visit the official website of the respective state to determine the corporate entity registration requirements and process.

- Resale Certificate: If the individual deals with purchase, and reselling, they have a resale license/certificate. All the states don’t require this. This license allows stores to gather GST from the purchasers. Most vendors will ask for the resale certificate before doing business with the corporate entity.

- Business Name Registration: Individuals must get a business name registration for starting a business.

- Professional Licenses: Certain specified retailers are required to obtain a separate professional license. One has to check the industry-specific guideline for a professional license.

- Certificate of Occupancy: Some of the online sellers are also required to obtain a certificate of occupancy in respect of certain areas. After applying for the certificate of occupancy, the property is inspected by the govt. authorities.

CONCLUSION

Every business structure has its own benefits. For the online sellers, its their place of business. Online sellers are provided with the benefit, that they can start their business from anywhere around the world. It’s the best and easiest to make and one among the most effective choices for entrepreneurs. Now, you’re attentive to all about company registration for online sellers. move and begin your online business.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.