ANNUAL COMPLIANCE- Annual ROC Filing AOC-4 & MGT-7

Table of Contents

UPCOMING ANNUAL COMPLIANCE(Annual ROC Filing_AOC-4 and MGT-7) OF COMPANIES ACT 2013

This Blog will elaborate on upcoming annual compliance to adhere to, by all the companies as well as “How our Firm can help you to ease the filing work at a minimum cost possible”.

Annual Filing

-

Annual Return:

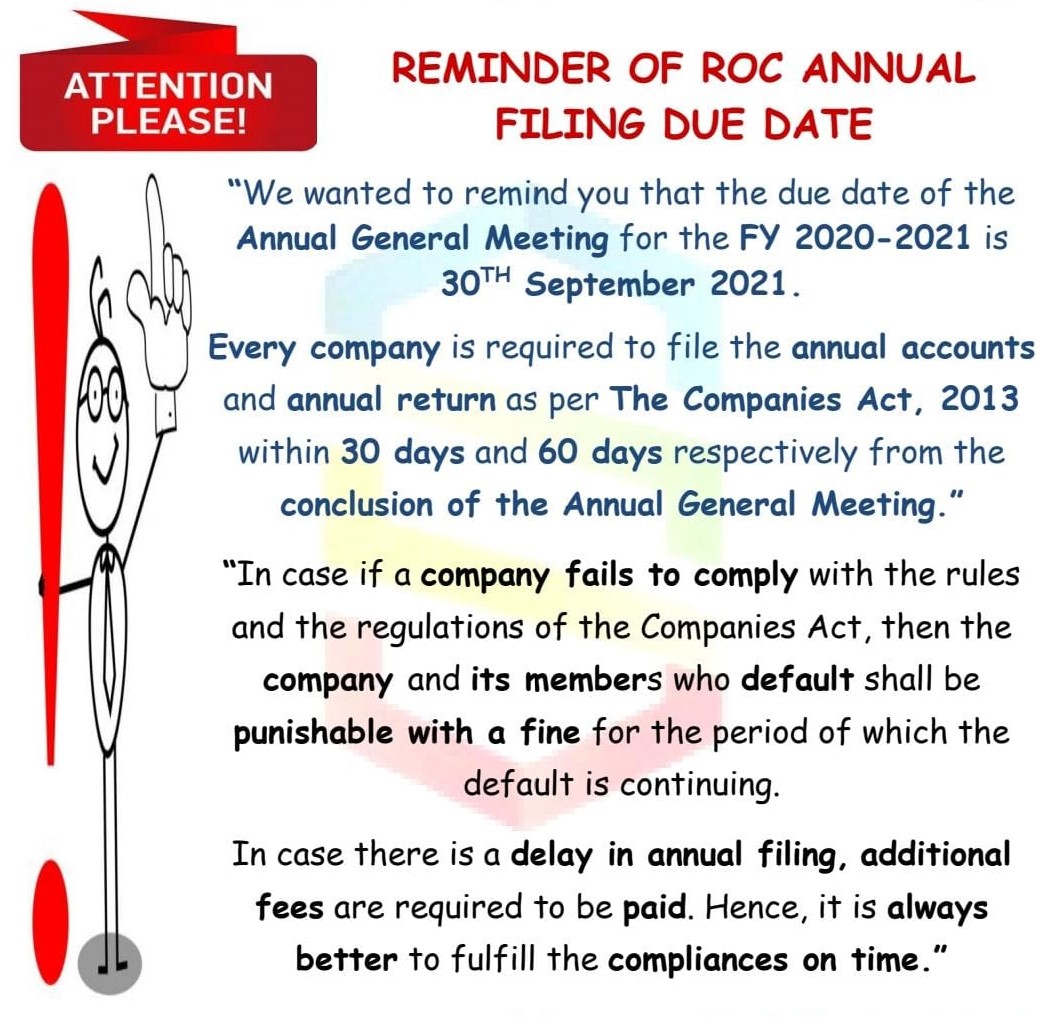

Section 92 of Companies Act 2013 makes it mandatory to file “Annual Return” to the concerned ROC within 60 days of Annual General Meeting (AGM) in form MGT-7 or FC-4.

-

Financial Statements:

Section 129 and 137 of Companies Act 2013 require filing the “Financials statement” to the concerned ROC within 30 days of an AGM in form AOC-4.

MGT-8 Certificate

Companies belonging to such class (see below) are required to obtain MGT-8 from Practicing Company Secretaries (PCS):

- Listed companies;

- Paid up capital of INR 10 crores or more;

- Turnover of INR 50 crores or more.

XBRL

Who are required to file their financials in XBRL format i.e. eform AOC-4XBRL:

- Listed Companies;

- All Companies having paid up of 5 crore or more;

- All companies with turnover of 100 crore or more;

- All companies who were covered under XBRL rules, 2011.

How can we help your company?

We IFCCL are having team of experts working in the field of Compliance(s) for many years. Our firm possesses rich experience in compliance related to all the compliance.

We can do the following tasks with the required expertise:

- Drafting of various documents such as Directors Report, MGT-9 etc.

- Filing of various eforms suc as AOC-4/XBRL, MGT-7 and MGT-14 etc. at MCA Portal.

- Conversion of financials into XBRL;

- Co-ordination with CDSL/NSDL/RTA to conduct the e-voting and drafting of necessary documents in this regard.

- All other ancillary tasks, as may be necessary as per Companies Act read with rules.

Should you require further clarifications or need to discuss any legal point or cost of filing,

We look forward for your valuable comments. www.caindelhiindia.com

FOR FURTHER QUERIES CONTACT US:

W: www.caindelhiindia.com E: info@caindelhiindia.com T: 9-555-555-480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.