What Investors Should Do When a Company Get Delisted

Table of Contents

What Investors Should Do When a Company Gets Delisted?

Delisting occurs when the shares of a publicly traded company are removed from a stock exchange, making them no longer available for trading. This event can profoundly impact investors as it affects the liquidity and potentially the value of the shares they hold. Delisting can happen for several reasons, including failure to meet the financial or regulatory requirements set by the exchange, a merger or acquisition, or even voluntary withdrawal by the company. Understanding the nuances of delisting can help investors make informed decisions on how to invest in mutual funds and how to manage their investments in such scenarios.

Voluntary Delisting and Involuntary Delisting

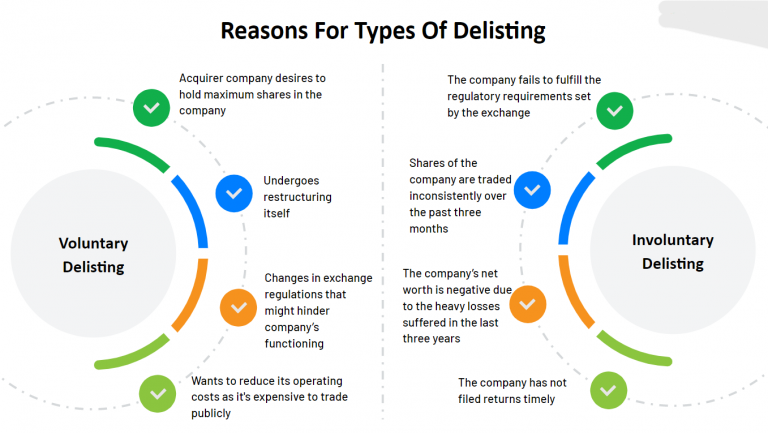

Delisting can be categorized into two main types: voluntary and involuntary.

Voluntary Delisting:

This occurs when a company chooses to remove its shares from the stock exchange. Reasons for this might include plans to go private, cost reduction strategies (e.g., eliminating listing fees and the cost of regulatory compliance), or a shift in business strategy. In such cases, the company often offers to buy back shares from existing shareholders at a premium to the current market price to compensate them for potential losses and liquidity issues.

If you are a shareholder of a company that opts for voluntary delisting, SEBI guidelines mandate that the company provide you with two options:

-

Offload Your Shares in Reverse Book Building

The company initiates a reverse book building process where the promoters or acquirers offer to buy back shares. They must make a public announcement, send out a letter of offer to eligible shareholders, and provide a bidding form. You can choose to tender your shares during this process. The buyback price is determined based on the price at which the maximum number of shares is tendered. Delisting is deemed successful if the shares tendered meet the specified threshold. If the threshold is not met, the company remains listed.

-

Hold Your Shares Until You Find a Buyer

If you choose not to sell your shares during the reverse book building or within the exit window, you can retain your shares and attempt to sell them on the over-the-counter market. This process can be challenging and time-consuming, as finding buyers for delisted shares is often difficult. Patience is crucial when trying to sell at your desired price.

For instance, if a company opts for delisting due to expansion plans, it might offer to buy back shares at a premium. This can lead to significant gains for investors, though such opportunities are usually short-lived. Once the buyback window closes, the stock’s value may decrease.

Involuntary Delisting:

Involuntary delisting occurs when a company is forced to remove its shares from the stock exchange due to non-compliance with listing standards, such as failing to file timely financial reports or maintaining a minimum share price. In these cases, promoters are required to buy back the shares at a fair value determined by an independent evaluator. While delisting does not strip you of share ownership, the shares may essentially become valueless. If your shares are in a company facing involuntary delisting, it is generally advisable to sell them either through the market or back to the company during any buyback initiative.

Can a Delisted Stock Come Back?

A delisted stock can potentially re-list on an exchange but the feasibility and likelihood depend on the reasons for delisting and the company’s subsequent actions. If the delisting was voluntary and the company’s financial health improved, or if it was part of a strategic restructuring, the company might seek to relist its shares. For involuntary delisting, the company would need to rectify the compliance or financial issues that led to its removal from the stock exchange and then apply for relisting. However, investors should be cautious as the process can be lengthy and uncertain.

Conclusion

When a company gets delisted, it can leave investors facing uncertainty and potential financial loss. The key is to understand the type of delisting and the underlying reasons. Whether to hold onto the shares or sell them depends on the prospects of the company and the nature of the delisting. Regularly engaging with mutual fund update time and learning how to invest in mutual funds can also offer strategies to manage such risks effectively. Consulting with a financial advisor can provide personalized advice, helping you navigate the complexities of delisting and make decisions that align with your long-term financial goals.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.