ANNUAL FILING (UNDER COMPANIES ACT, 2013)

What are the Annual Filling Under Company Act

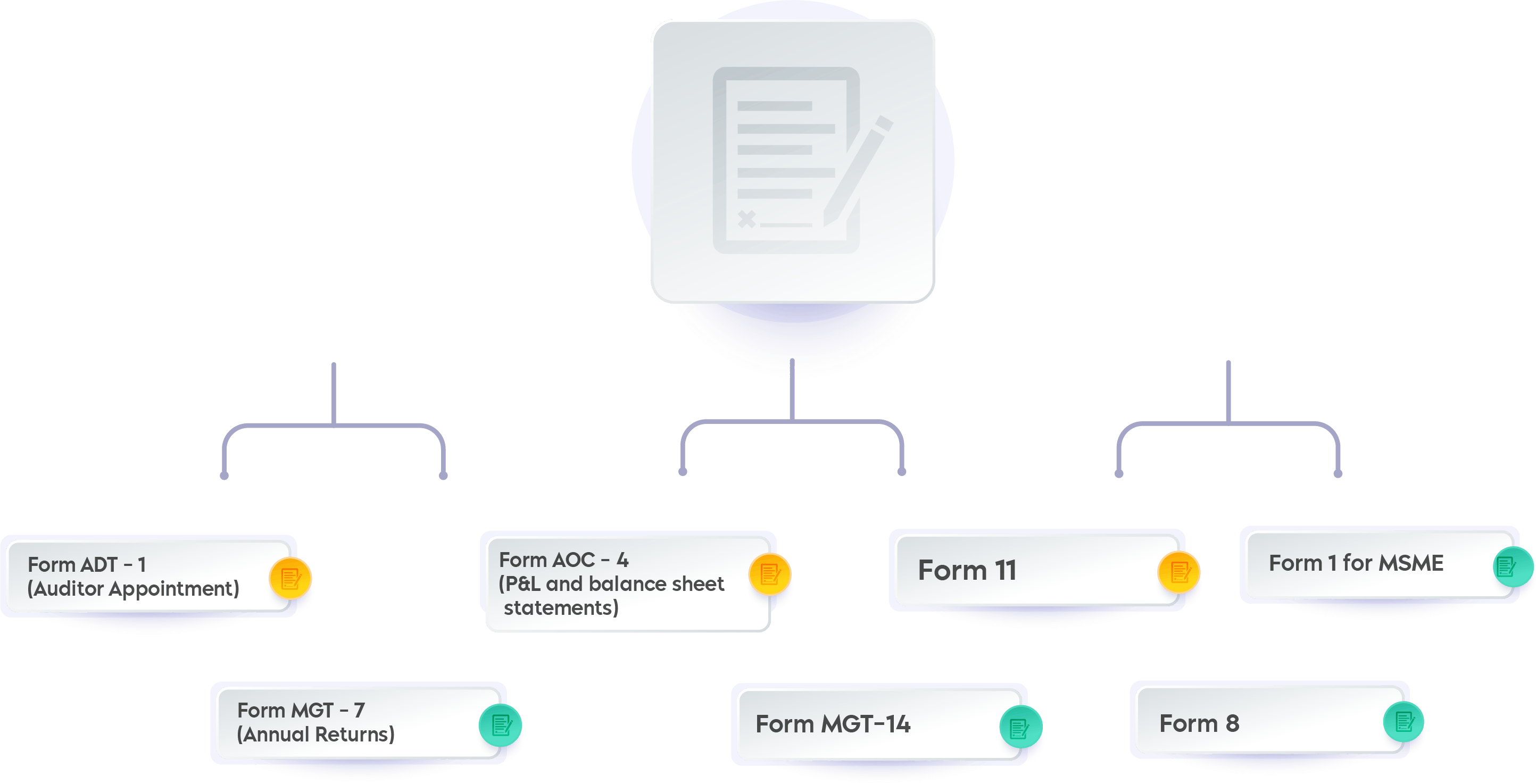

Following forms to be filed with ROC:

- MGT-14 (For approval of financial Accounts and Board’s Report)

- AD T -1 (For appointment of Auditor)

- AOC-4 or AOC- 4 XBRL (For filing of Notice, Directors’ Report and Financial Statement)

- MGT-7 (For Annual Return)

1. Form MGT-14: (Need to file within 30 days from passing the Board Resolution)

According to section 117(3)(g) of the Companies Act, 2013 read with section 179(3)(g) of the Companies Act, 2013 every Company shall have to file e-form MGT-14 for approval of financial statement and the Board’s report.

But as per notification of Ministry of Corporate Affairs on 05th day of June, 2015 all private Companies are exempted to file resolutions given under clause (g) of sub section (3) of section 117. So, there is no need to file e-form MGT-14 by the Private Limited Companies for the above said purpose. But in case of Public Limited Companies, this e-form shall have been filed as per section 117(3)(g) of the Companies Act, 2013 read with section 179(3)(g) of the Companies Act, 2013.

According to section 117(3)(g) of the Companies Act, 2013 read with 179(3)(k) also read with clause 9 of rule 8 of the Companies (Meetings of Board and its Powers) Rules, 2014 of the Companies Act, 2013. Every Company shall have to file e-form MGT-14 to approve quarterly, half yearly and annual financial statements or financial results as the case may be.

But as per notification of Ministry of Corporate Affairs on 18th day of March, 2015 Every Company are exempt to file e-form MGT-14 for the above said purpose.

Required documents/Information for filing this e-form:

- Signed copy of Board Resolution for approval of Financial Statements.

- Signed copy of Board Resolution for approval of Board’s Report or Directors’ Report.

- Notice of Board Meeting or Date of Dispatch Notice of Board Meeting.

2. FORM ADT-1: (Need to file within 15 days from the date of meeting in which the auditor is appointed)

According to section 139 of the Companies Act, 2013 every company shall appoint an individual or a firm as an auditor who shall hold office from the conclusion of that meeting till the conclusion of its sixth annual general meeting and thereafter till the conclusion of every sixth meeting.

Board shall consider and recommend an individual or a firm as auditor to the members in the annual general meeting for appointment, if company is not required to constitute the Audit Committee.

Such appointment shall be subject to ratification in every annual general meeting till the sixth such meeting by way of passing of an ordinary resolution.

Before such appointment is made, the written consent of the auditor to such appointment and a certificate shall be obtained from the auditor.

An auditor (individual) and an audit firm shall be appointed/re-appointed for a maximum period of five (5) consecutive years and ten (10) consecutive years respectively in the following companies (except OPC and small companies):

- Listed company,

- All unlisted public companies having paid up share capital of rupees 10 (Ten) Crore or more and

- All private limited companies having paid up share capital of rupees 20 (Twenty) Crore or more all companies having public borrowings from financial institutions, banks or public deposits of rupees 50 Crore or more.

Cooling Period for reappointment of existing Auditor or Auditor’s Firm: 3 Years and 8 Years respectively

After completion of term of five (5) years or ten (10) years as the case may be, there shall be minimum gap of 5 years for re-appointment of the same auditor in the same company.

Every Company shall inform the auditor concerned of his or its appointment, and also file a notice of such appointment with the Registrar within fifteen days of the meeting in which the auditor is appointed in form

ADT-1: If Company has already filed e-form ADT-1 for appointment of Auditor with tenure of 5 Years then no need to file e-form ADT-1 again with the Registrar of Companies, only ratification by the members shall have been made by passing the ordinary resolution in the AGM.

Required documents/Information for filing this e-form:

- PAN of Auditor or Auditor’s firm

- Name of Auditor’s firm

- Membership No. or FRN

- Address of Auditor

- E-mail Id of Auditor

- Tenure of previous appointment

- Partner or Proprietor

- Period for which auditor is being appointed

- AGM Resolution

- Consent and confirmation from auditor

- Intimation letter sent by company to auditor.

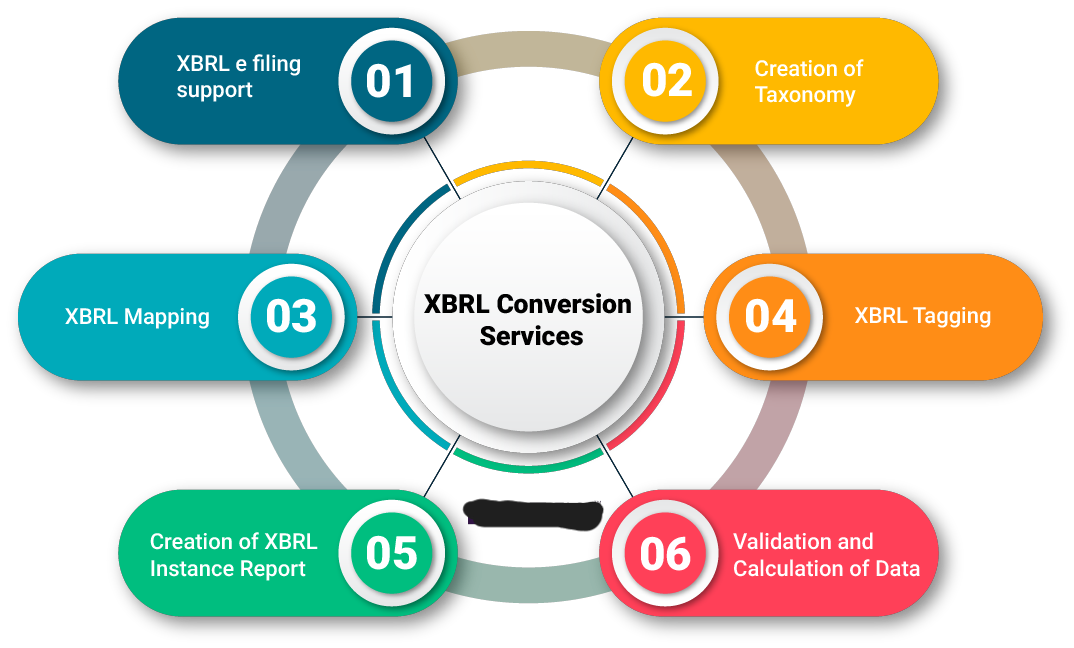

3. FORM AOC-4 or FORM AOC-4 XBRL: (Need to file within 30 days from of the Annual General Meeting)

A. For filing of this form we need to prepare the following documents:

- Notice of the Annual General Meeting,

- Directors’ Report or Board’s Report,

- Auditor’s Report,

- CARO Report, if any,

- Financial Statement,

- consolidated financial statement, if any,

- Cash Flow Statement, if any.

B. Notice of the Annual General Meeting:

A general meeting of a company may be called by giving not less than Clear Twenty-One Days.

A general meeting may be called after giving a shorter notice if consent is given in writing or by electronic mode by not less than ninety-five per cent of the members entitled to vote at such meeting.

The notice of every meeting of the company shall be given to every member of the company, the auditor or auditors of the company, every director of the company. As per section 146 of the Companies Act, 2013 unless otherwise exempted by the company. Auditor shall attend the General Meeting either by himself or through his authorized representative, who shall also be qualified to be an auditor.

According to section 102 of the Companies Act, 2013 a statement on material facts concerning each item of special business to be transacted at a general meeting, shall be annexed to the notice calling such meeting.

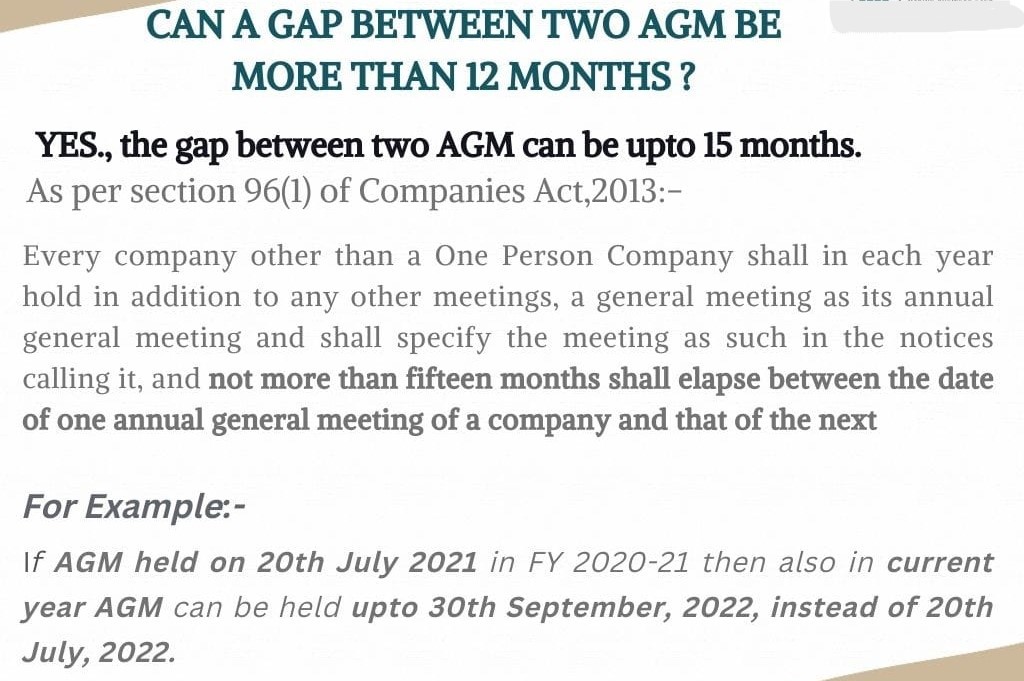

Analysis on Gap between two Annual General Meeting

Any member of a company entitled to attend and vote at a meeting of the company shall be entitled to appoint another person as a proxy to attend and vote at the meeting on his behalf.

The appointment of proxy shall be in the Form No. MGT-11.

C. Directors’ Report or Board’s Report.

The Board’s report and any annexure thereto under sub-section (3) shall be signed by its chairperson of the company if he is authorized by the Board and where he is not so authorized, shall be signed by at least two directors, one of whom shall be a managing director, or by the director where there is one director.

Following are the Contents and Annexure of Directors’ Report under Companies Act, 2013:

- Balance sheet along with the auditor’s report.

- Number of meetings of the Board

- Statement on declaration given by independent directors under sub-section (6) of section 149, if any

- Criteria for determining qualifications, positive attributes, independence of a director and other matters by the Nomination and Remuneration Committee, if any

- AOC-2 (particulars of contracts or arrangements with related parties)

- Particulars of loans, guarantees or investments

- The amount, if any, which it recommends should be paid by way of dividend the amounts which it proposes to carry to any reserves, if any.

- Material changes and commitments, if any, affecting the financial position of the company

- A statement indicating development and implementation of a risk management policy, if any

- The details about the policy developed and implemented by the company On Corporate Social

Responsibility (CSR):

- Average Net Profit of the Company for the Last 3 Financial Years(F.Y.),

- Total amount spent on CSR for the financial year,

- Amount spent in local area,

- Manner in which the amount spent during the F.Y. on CSR,

- A statement indicating the manner in which formal annual evaluation has been made by the Board of its own performance and that of its committees and individual directors, if a listed company and every other public company having a paid up share capital of twenty five crore rupees or more,

- The change in the nature of business, if any,

- The details of directors or key managerial personnel who were appointed or have resigned during the year,

- The names of companies which have become or ceased to be its Subsidiaries, joint ventures or associate companies during the year

- The details of significant and material orders passed by the regulators or courts or tribunals impacting the going concern status and company’s operations in future

- The details in respect of adequacy of internal financial controls with reference to the Financial Statements,

- Secretarial Audit Report, if any

Note: According to section 131 of the Companies Act, 2013 If it appears to the directors of a company that the report of the Board do not comply with the provisions of section 134 they may prepare REVISED REPORT in respect of any of the three preceding financial years after obtaining approval of the Tribunal on an application made by the company. But no form has been notified by the Central Govt. till now.

Auditor’s Report

According to section 145 of the Companies Act, 2013 “The person appointed as an auditor of the company shall sign the auditor’s report or sign or certify any other document of the company in accordance with the provisions of sub-section (2) of section 141, and the qualifications, observations or comments on financial transactions or matters, which have any adverse effect on the functioning of the company mentioned in the auditor’s report shall be read before the company in general meeting and shall be open to inspection by any member of the company”.

If an auditor of a company contravenes any of the provisions of section 139, section 143, section 144 or section 145, the auditor shall be punishable with fine which shall not be less than twenty- five thousand rupees but which may extend to five lakh rupees.

If an auditor has contravened such provisions knowingly or willfully with the intention to deceive the company or its shareholders or creditors or tax authorities, he shall be punishable with imprisonment for a term which may extend to one year and with fine which shall not be less than one lakh rupees but which may extend to twenty-five lakh rupees.

The auditors’ report shall be attached to every financial statement.

CARO Report

According to the order passed by the Ministry of Corporate Affairs on 10th day of April, 2015 “the Companies (Auditor’s Report) Order, 2015” shall apply to every company including a foreign company as defined in clause (42) of section 2 of the Companies Act, 2013 except:

- A banking company,

- An insurance company,

- A company licensed to operate under section 8 of the Companies Act, 2013,

- A One Person Company and a small company and

- A private limited company with a paid up capital and reserves not more than rupees fifty lakh and which does not have loan outstanding exceeding rupees twenty five lakh from any bank or financial institution and does not have a turnover exceeding rupees five crore at any point of time during the financial year.

As per section 403 of the Companies Act, 2013: Any document, required to be submitted, filed, registered or recorded, or any fact or information required or authorized to be registered under this Act, shall be submitted, filed, registered or recorded within the time specified in the relevant provision, afterwards the relevant time document have to be registered within 270 days otherwise it will be liable for the penalty or punishment provided under this Act.

For query or help, contact: info@caindelhiindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.