Procedure of LLP Incorporation in India

Table of Contents

Limited Liability Partnership

A Limited Liability Partnership (LLP) is a business structure that offers the advantages of limited liability and the flexibility of a partnership business. When compared to the company form of business structure, the LLP has fewer compliance requirements. In the case of an LLP, audit is exempt up to a certain level of turnover. An LLP can be formed by at least two people. There is no limit on the number of partners. Instead of a general partnership, this is the preferred option for small businesses. We are the most reputable LLP Registration consultants.

The Minimum Requirement to Form an LLP:

- Minimum of Two People: The LLP must be registered by at least two people. The maximum partners, however, have no limit.

- No Minimum Capital: In the case of an LLP, capital is determined by the needs of the business and the partners’ contributions to the partnership. The amount of capital determines the Stamp Duty on the deed.

- Resident Person Requirement: One of the LLP’s designated partners must be from India.

- Unique Name: The LLP’s name should be unique, and it should not be the same or similar to the name of any existing company, LLP, or trademark that is registered or applied for.

Required Documents for LLP Registration:

- The most recent passport size All partners’ photographs

- All Partners’ PAN (Permanent Account Number) (Minimum 2).

- Proof of each partner’s identity (Aadhar Card, Passport, Driving License or Voter ID Card).

- Address Verification for All Partners (Bank Statement or Passbook, electricity bill, telephone bill, Aadhar card or any utility bill).

- A copy of each partner’s mobile phone bill, telephone bill, electricity bill, or bank statement with their current address.

- Proof of Registered Office Address – Electricity Bill along with Rent Agreement / Proof of Ownership of Proposed Registered Office

- Stamp paper for LLP Agreement of the State in which the LLP is to be incorporated.

- Documents must be self-certified.

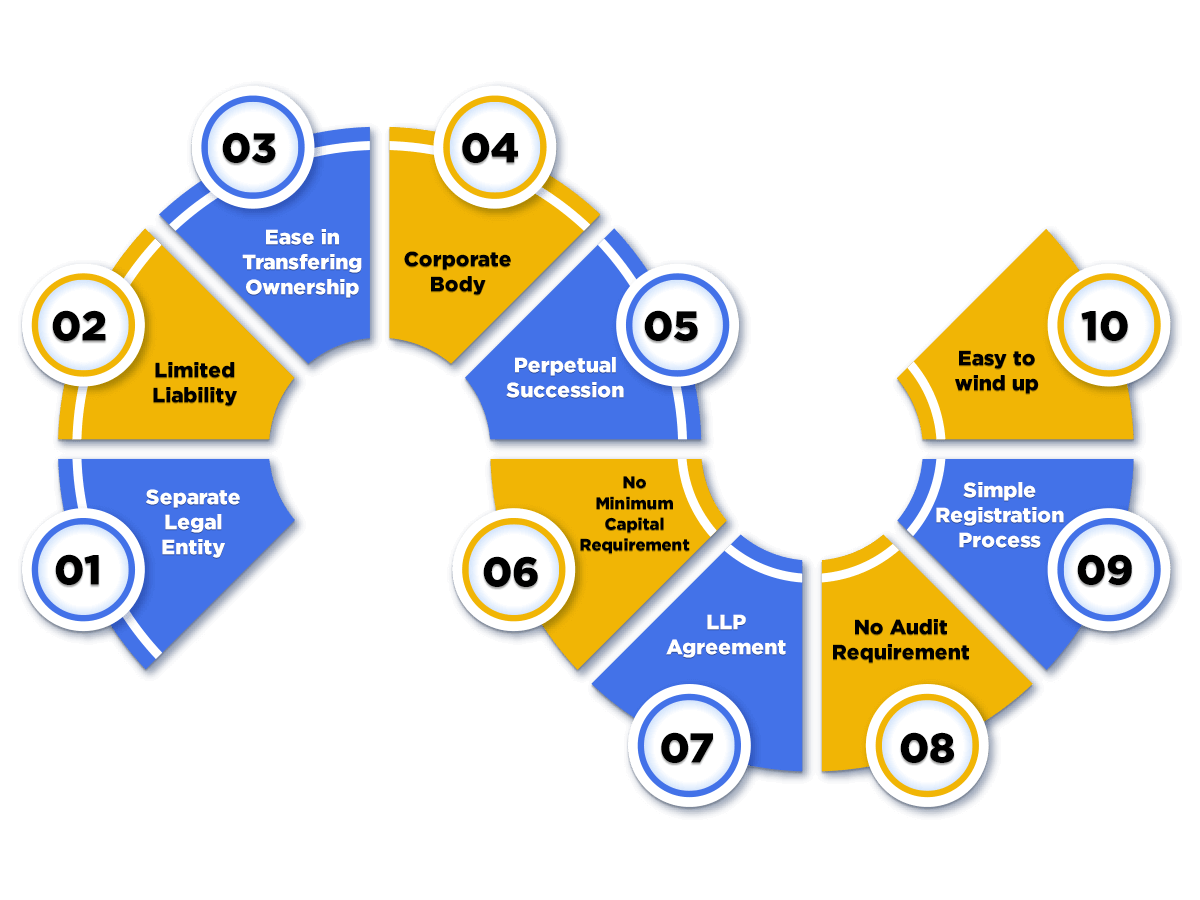

Advantages of LLP:

- Limited responsibility protects personal assets of the member from the company’s liabilities. LLPs are legal entities distinct from their members.

- The operation of a partnership is determined by written agreement between the members and their distribution of profits. This can make the management of the company more flexible. The LLP is considered a lawyer. It can be bought, rented, leased, owned, employed, concluded contracts and held accountable if needed.

- Corporate control. LLPs can have up to two companies as members. At least one director in an LTD company must be a real person.

- Members who have been designated and those who have not been designated. You can run the LLP with various levels of membership.

- Protecting the name of the partnership. By registering the LLP with Companies House, you are preventing another partnership or company from using the same name.

This is not an exhaustive list, but it does cover some of the most important advantages of an LLP.

Disadvantages of LLP:

As with any business format, there will be advantages and disadvantages. In some cases, the following may be considered disadvantageous.

- The main disadvantage of an LLP is public disclosure. Financial statements must be filed with Companies House and made public. The accounts may include income from members that they do not want made public.

- Income was also classified as personal income and is taxed accordingly. There may be tax advantages to forming a corporation, but this will depend on your individual circumstances.

- Profits cannot be retained in the same way that profits can in a company limited by shares. This means that all earned profit is effectively distributed, with no option to carry it forward to a future tax year.

- A limited liability partnership (LLP) must have at least two members. If one of the partners decides to leave the partnership, the LLP may be forced to dissolve.

- Although any address previously provided to Companies House is no longer part of the public record unless you pay to have the records suppressed, any address previously supplied to Companies House remains part of the public record unless you pay to have the records suppressed. This is not a problem for many businesses. In other cases, however, this may not be desirable. Consider the fact that if their job includes sensitive matters, solicitors and partners in law firms may not want their home location to be made public.

This is not a full list, but it does address some of the major difficulties that some may consider to be detrimental to a limited liability partnership.

LLP’s Fundamental Characteristics:

A Limited Liability Partnership has the following characteristics.

- The key feature of an LLP is that it is a separate legal entity, so its existence is distinct from that of the Members.

- Through an LLP agreement, members take advantage of the organisational flexibility of a partnership.

- Please keep in mind that the LLP agreement is a private document that must be kept confidential by the members.

- In order to form an LLP, at least two “designated” members must be present.

- An LLP’s “trading disclosure” is similar to that of a corporation.

- LLPs are also subject to the same accounting and filing requirements as corporations.

- Each member of an LLP is taxed on their share of the income and gains.

- An LLP may issue liabilities for fixed fees or floating fees similar to the debentures of a business.

- The Companies House must be registered with a Limited Liability Partnership.

- Finally, limited liability is granted to LLP members

LLP Registration benefits through private registration of limited companies:

If your choice to choose LLP or private limited company registration is a dilemma, consider the benefits of LLP.

The maximum number of partners is not limited. The establishment of the LLP requires at least 2 partners, and there is no maximum partners limit. A Private Limited Company, on the other hand, is limited to having no more than 200 members.

Low cost of formation: The cost of forming an LLP is comparable to that of forming a Public Limited company. The cost of an LLP ranges between Rs. 1500/- and Rs. 7000/-, whereas the minimum statutory fee for a private company is Rs. 6000/-.

Least capital requirement: The most significant advantage of an LLP over a private limited company is that it requires the least capital to establish the business. Furthermore, a partner’s contribution may be tangible or intangible, movable or immovable property.

No compulsion for auditing: any company, whether private or public, must get their accounts audited. There is no requirement for auditing: any company, private or public, must have their accounts audited. Nonetheless, there is no such compulsion in the case of LLP. According to the provisions of the Limited Liability Partnership Act, 2008, LLPs are required to audit their accounts on an annual basis, with the exception of those with a turnover of less than Rs. 40 lacs or a contribution of less than Rs. 25 lacs in any financial year.

Less Compliance Burden: compliance burden: LLPs face less compliance burden than private companies. Unlike private companies, which must meet at least 8 to 10 regulatory formalities and compliance, an LLP only needs to file two statements: the Annual Return & Statement of Accounts and Solvency.

Eligibility Criteria for Completing the LLP Registration Procedure:

An LLP applicant must meet the following LLP registration requirements:

- Ensure that you have a minimum of two designated partners, one of whom must be a resident of India.

- All designated partners must have a DPIN (Designated Partners Identification Number).

- Every designated partner must have a DSC (Digital Signature Certificate).

- The applicant must provide proof of the proposed registered office’s address.

LLP names:

- An LLP can be registered under any name chosen by its members, as long as it is available at Companies House. It is common to see the names of the members included in the LLP name, but this is not required. An LLP, for example, may be registered as SMITH, JONES & DAVIES LLP, or it may use a descriptive name such as LEGAL ADVISORS LLP or something freestanding such as INDIVIEW SERVICES LLP. (These are fictitious names with no connection to any company currently or in the future registered with Companies House.)

- When registering the LLP, the members must choose whether they want the name to be listed at Companies House using the full phrase “Limited Liability Partnership” or the abbreviation “LLP.” Following registration, the LLP may continue to use either version.

Procedure of LLP Incorporation in India:

The most difficult challenge in a business partnership is that the inefficiency of one partner affects the progress of the others. However, any of these risks are annulled by the Limited Liability Partnership or LLP. It encourages businesses to start collaborative partnerships with the least amount of risk. Furthermore, it is the most secure way for startups or small businesses to conduct business. The Limited Liability Partnership Act of 2008 governs and ensures the smooth operation of corporate partnership bodies. If you choose LLP, you should be familiar with the LLP registration process. Without a doubt, this blog will assist you in dispelling any doubts you may have about Online LLP registration.

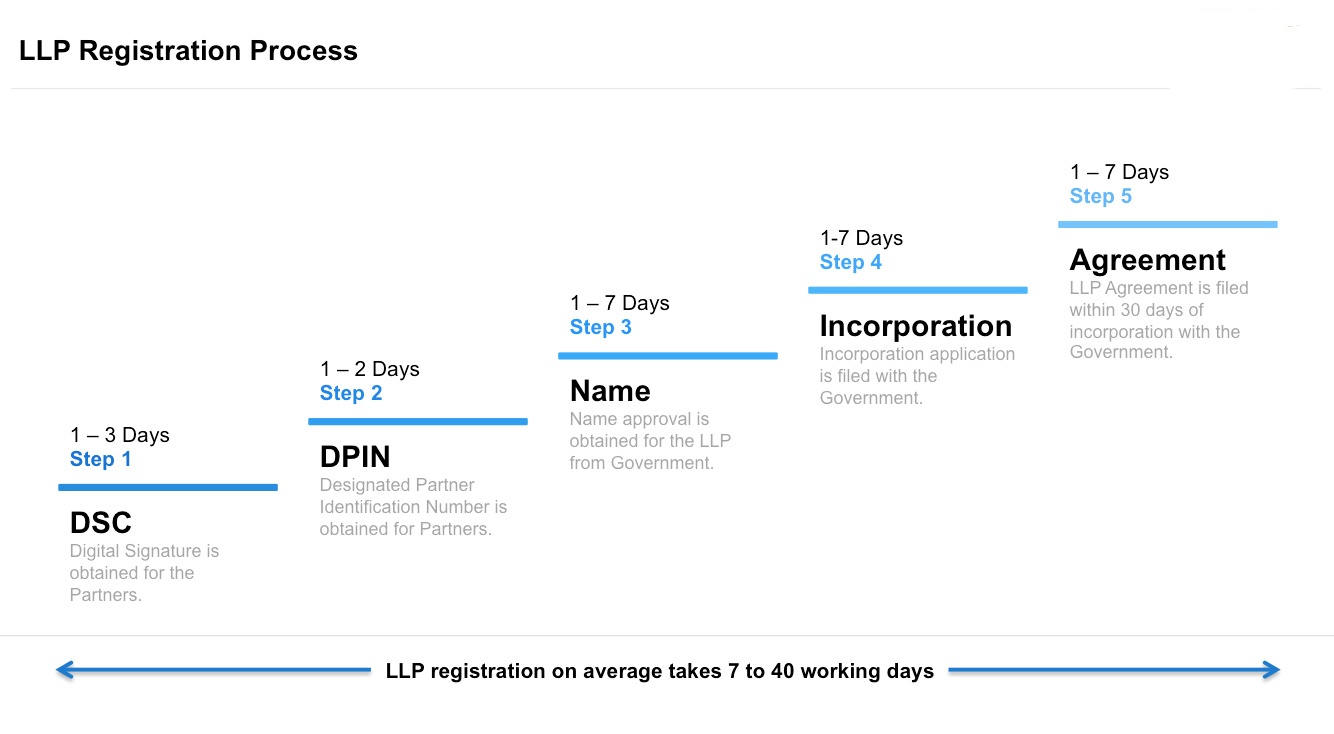

Once you’ve met the eligibility requirements, you’ll need to complete the following steps to register as an LLP:

Step 1: Obtain a Digital Signature Certificate (DSC):

The first and most important stage is to collect DSC for all of the designated partners that are being considered. ROC (Registrar of Companies) compliance forms, LLP registration, and tax returns can all be filed using the same DSC.

Step 2: Submit an application for a DPIN:

The next step is to submit an e-form DIR 3 application for a Designated Partners Identification Number (DPIN).

Step 3: Obtain approval for the company’s name:

It is an important step in the formation of an LLP. An LLP should have a distinct name; otherwise, the application may be rejected. So, once you’ve obtained your DSC and DPIN, you should apply for company name approval. To do so, go to the MCA’s official RUN-LLP to ROC webpage (Registrar of Companies).

Note that through RUN, the LLP applicant can propose a maximum of two names.

Step 4: Fill out the e-form FiLLiP Incorporation Application:

You must file an incorporation application in the e-form FiLLiP when the ROC (Registrar of Companies) confirms the company’s name. All information regarding the potential designated partners is included in the FiLLiP form. Attach all of the necessary documents to the form. The form must be filed with the ROC of the state or area in where the registered LLP office is located.

Step 5: Submit Form 3 of the LLP Agreement:

Finally, submit the online LLP agreement to the MCA portal within 30 days of incorporation. The LLP agreement is a confidential document that defines the partners’ rights and responsibilities. It must also be duly signed on a stamp of Rs. 10/-, though the value of stamp paper varies by state.

Include the following provisions in your LLP agreement:

- The name, objects, and address of your LLP company.

- Assessment of non-monetary contributions.

- The net profit or loss sharing ratios.

- Details about the designated partners.

- Interest on the capital loan is due.

- Bank account operation mode.

- All partners’ rights and responsibilities

- The procedure for appointing an auditor.

- The initial contribution made by the partner to the LLP.

- An arbitrator will be appointed.

- Additionally, draught an indemnity clause and a goodwill clause.

- The addition of a new partner.

- The termination of existing partners.

- The process of dissolving the Limited Liability Partnership.

- Also, specify the extent of liability of LLP partners.

- Remuneration due to working partners.

- Limited Liability Partnership Amendments

- And, if applicable, information about other businesses.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.