Deductions U/S 80C under Schedule VI of Income Tax

Table of Contents

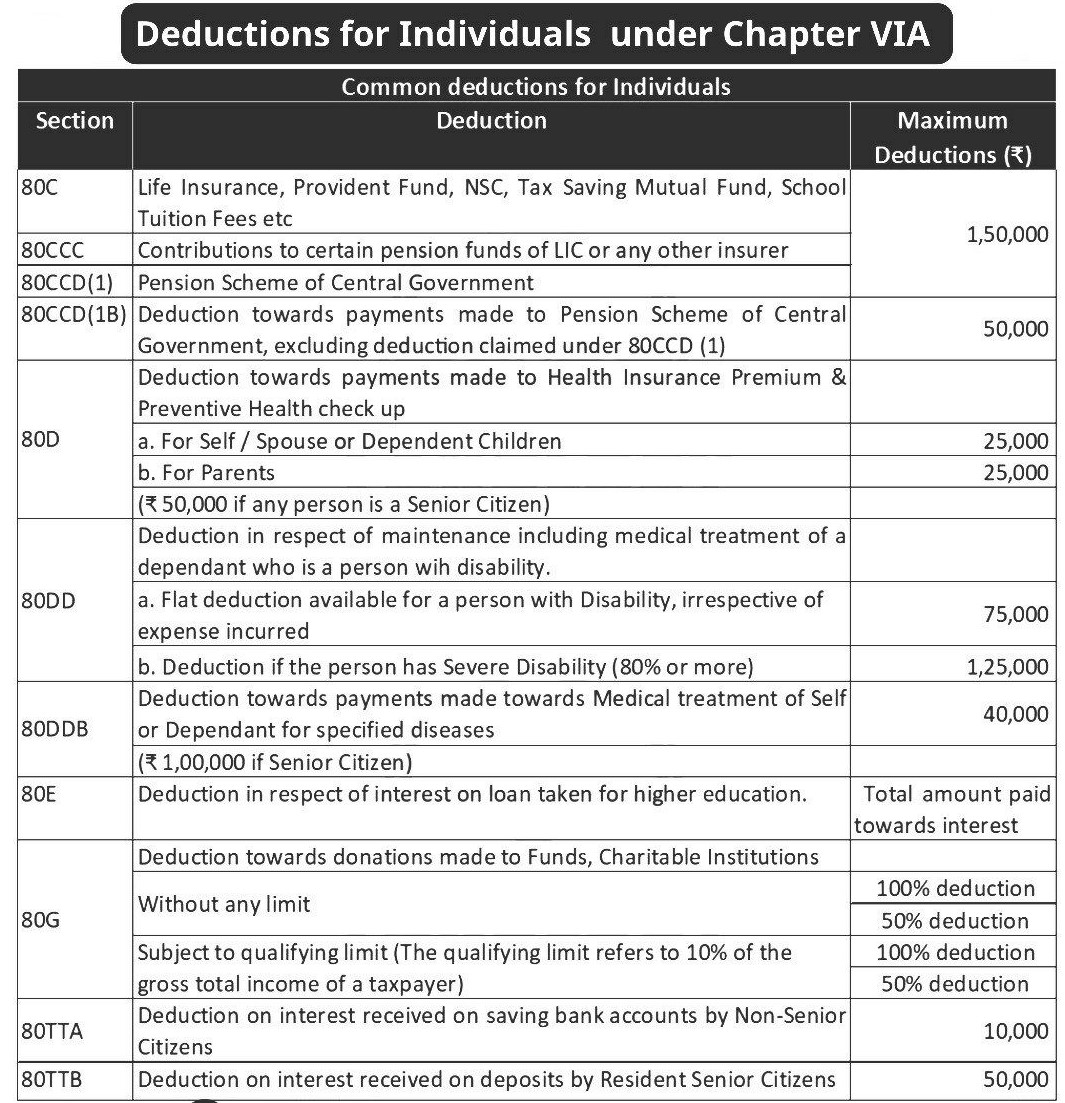

DEDUCTIONS UNDER SECTION 80C:

Under section 80C, every individual and HUF, is provided with a deduction of amount up to Rs.1,50,000. To avail such deductions, the prescribed taxpayers, need to invest in any of the following options –

- Life insurance premium payment

- Annuity plan of LIC or any other notified insurers.

- Unit Linked Insurance Plan (ULIP) of UTI or ULIP of LIC mutual fund u/s 10(23D) contribution

- PPF (Public Provident Fund) contribution

- Non-commuted deferred annuity plan payment

- Amount deducted from government employee salary for the purpose of securing him of deferred annuity

- SRF/RPF contribution

- Tuition fees payment

- Repayment of housing loan

- Superannuation Fund contribution

- Senior Citizen Scheme investment

- PPF investment

- 5-year FD investment

- Sukanya Samridhi Yojana investment

- Mutual Funds (Equity Linked Saving Scheme) investment

- Subscription to any deposit scheme/pension fund of National Housing Bank (NHB)

- Subscription to bonds issued under the scheme of National Bank for Agriculture and Rural Development (NABARD)

- Subscription to notified deposit scheme of Public Sector Housing Finance Company and Housing Development Authority of cities, towns and villages

- Subscription to equity shares or debentures of a Company or any Public financial institution, where the proceeds are utilized for infrastructure purpose.

- Stamp duty, registration fee incurred for the purpose of transfer of such house property to the assessee.

DEDUCTIONS UNDER SCHEDULE VI

| SECTIONS | PARTICULARS | ELIGIBLE PERSONS | PRESCRIBED LIMIT OF DEDUCTION |

| SECTION 80C | INVESTMENT IN LIC, PPF, SUKANYA SAMRIDDHI ACCOUNT, MUTUAL FUNDS, FD ETC | INDIVIDUAL AND HUF |

UPTO RS 1,50,000 |

| SECTION 80CCC | INVESTMENT IN PENSION FUNDS | INDIVIDUALS | |

| SECTION 80CCD (1) | ATAL PENSION YOJANA AND NATIONAL PENSION SCHEME CONTRIBUTION | INDIVIDUALS | |

| SECTION 80CCD (IB) | ATAL PENSION YOJANA AND NATIONAL PENSION SCHEMECONTRIBUTION | INDIVIDUALS | UPTO RS 50,000 |

| SECTION 80CCD (2) | NATIONAL PENSION SCHEME, UNDERTAKEN BY THE EMPLOYER | INDIVIDUALS | LOWER OF –

· AMOUNT CONTRIBUTED · 14% OF BASIC SALARY + DEARNESS ALLOWANCE, IN CASE OF GOVERNMENT EMPLOYEE. · 10% OF BASIC SALARY+ DEARNESS ALLOWANCE, IN CASE OF OTHER EMPLOYEES |

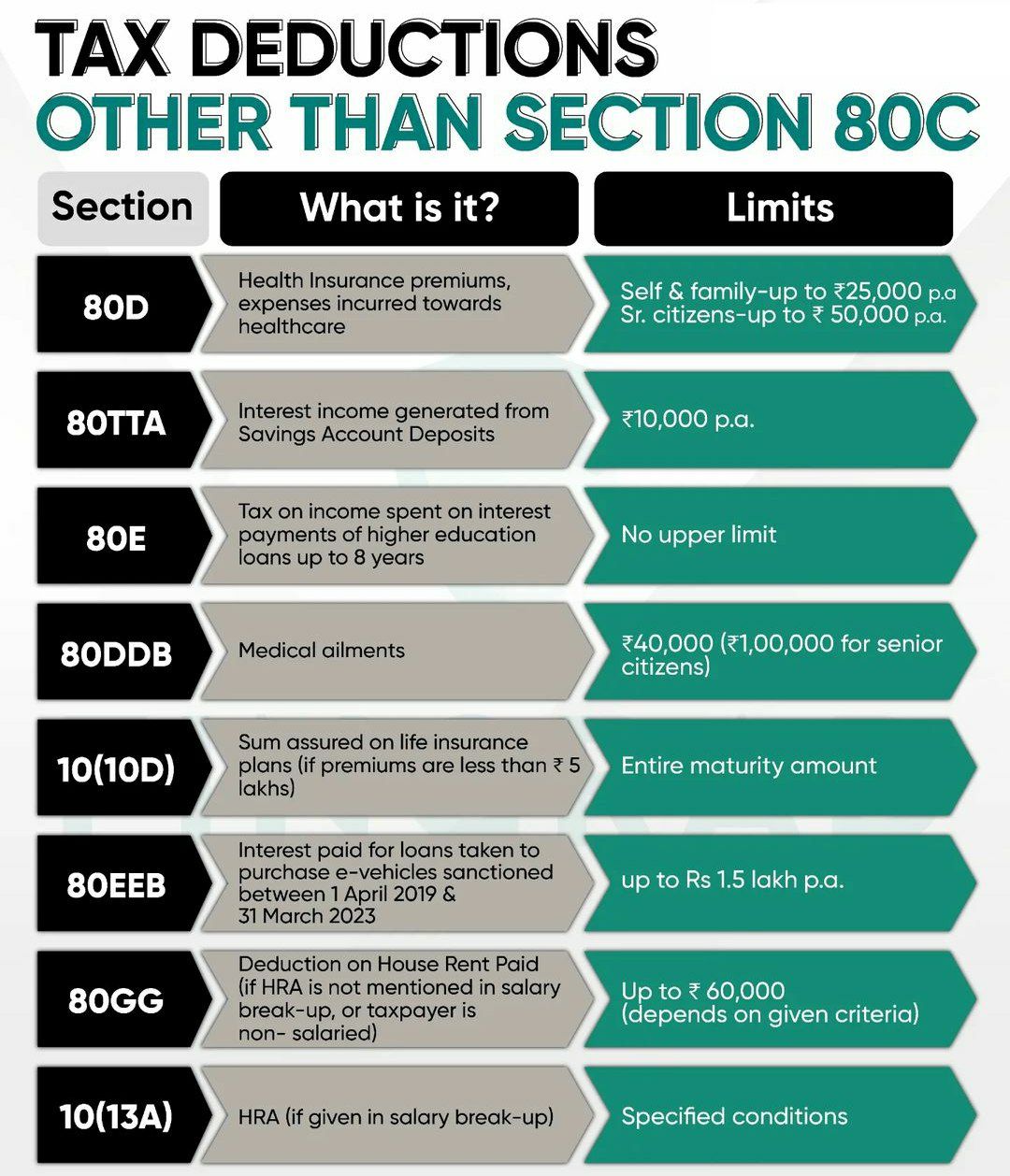

| SECTION 80D | MEDICAL INSURANCE PREMIUM AND MEDICAL EXPENDITURE | INDIVIDUAL OR HUF |

UPTO RS 25,000 FOR SELF AND FAMILY. MAXIMUM UP TO RS 1,00,000 INCLUDING PARENTS |

| SECTION 80DD | MEDICAL TREATMENT OF A DEPENDENT WITH DISABILITY | INDIVIDUAL OR HUF |

NORMAL DISABILITY: RS 75000/- SEVERE DISABILITY: RS 125000/- |

| SECTION 80DDB | SPECIFIED DISEASES | INDIVIDUAL OR HUF |

SENIOR CITIZENS: UPTO RS 1,00,000 OTHERS: UPTO RS 40,000 |

| SECTION 80E | INTEREST PAID ON LOAN TAKEN FOR HIGHER EDUCATION | INDIVIDUAL | 100% OF THE INTEREST PAID, ALLOWED UPTO 8 ASSESSMENT YEARS |

| SECTION 80EE | INTEREST PAID ON HOUSING LOAN | INDIVIDUAL | UPTO RS 50,000 SUBJECT TO SOME CONDITIONS |

| SECTION 80EEA | IINTEREST PAID ON HOUSING LOAN | INDIVIDUAL | UPTO RS 1,50,000/- EXTENDED FOR AY 2021-22 |

| SECTION 80EEB | INTEREST PAID ON ELECTRIC VEHICLE LOAN | INDIVIDUAL | UPTO RS 1,50,000 SUBJECT TO SOME CONDITIONS |

| SECTION 80G | DONATION TO CHARITABLE INSTITUTIONS | ALL ASSESSEE (INDIVIDUAL, HUF, COMPANY ETC) | 100% OR 50% OF THE DONATED AMOUNT OR QUALIFYING LIMIT, ALLOWED IN CASH UPTO RS.2000. |

| SECTION 80GG | INCOME TAX DEDUCTION FOR HOUSE RENT PAID | INDIVIDUAL | LOWER OF –

· RS.60,000 · 25% OF TOTAL INCOME · RENT PAID – 10% OF TOTAL INCOME |

| SECTION 80GGA | DONATION TO SCIENTIFIC RESEARCH & RURAL DEVELOPMENT | ALL ASSESSEES EXCEPT THOSE WHO HAVE AN INCOME (OR LOSS) FROM A BUSINESS AND/OR A PROFESSION | 100% OF THE DONATION, ALLOWED IN CASH UPTO RS.10,000. |

| SECTION 80GGB | CONTRIBUTION TO POLITICAL PARTIES | COMPANIES | 100% OF THE DONATIO, HOWEVER, DONATION IN CASH IS NOT ALLOWED |

| SECTION 80GGC | INDIVIDUALS CONTRIBUTION TO POLITICAL PARTIES | INDIVIDUAL HUF AOP BOI FIRM |

100% OF THE DONATIO, HOWEVER, DONATION IN CASH IS NOT ALLOWED |

| SECTION 80IA | PROFITS AND GAINS FROM INDUSTRIAL UNDERTAKINGS ENGAGED IN INFRASTRUCTURE DEVELOPMENT, ETC. | INDUSTRIAL UNDERTAKINGS ENGAGED IN SPECIFIED BUSINESSES | 100% OF THE PROFIT FOR 10 CONSECUTIVE YEARS OUT OF 15 YEARS FROM COMMENCEMENT |

| SECTION 80IAB | PROFITS AND GAINS TO SEZ DEVELOPERS | SEZ DEVELOPERS | 100% OF THE PROFIT FOR 10 CONSECUTIVE YEARS OUT OF 15 YEARS FROM COMMENCEMENT |

| SECTION 80IAC | ELIGIBLE STARTUPS | COMPANY OR LLP ENGAGED IN ELIGIBLE BUSINESS SUBJECT TO SOME CONDITIONS | 100% OF THE PROFIT FOR 3 CONSECUTIVE YEARS OUT OF 7 YEARS FROM COMMENCEMENT. |

| SECTION 80IB | PROFITS AND GAINS FROM CERTAIN INDUSTRIAL UNDERTAKINGS OTHER THAN INFRASTRUCTURE DEVELOPMENT UNDERTAKINGS | SPECIFIED INDUSTRIAL UNDERTAKINGS | 25%, 30% OR 100% OF THE PROFIT DEPENDING ON THE PERIOD. |

| SECTION 80IBA | PROFITS FROM HOUSING PROJECTS | INDIVIDUAL HUF AOP BOI COMPANY FIRM ANY OTHER PERSON ENGAGED IN THE BUSINESS OF HOUSING PROJECTS AS MAY BE SPECIFIED |

100% OF THE PROFIT |

| SECTION 80IC | CERTAIN UNDERTAKINGS IN SPECIAL CATEGORY STATES | CERTAIN INDUSTRIAL UNDERTAKINGS | FOR SIKKIM – 100% OF PROFIT FOR 10 YEARS.

FOR HIMACHAL PRADESH/ UTTARANCHAL FOR NORTHEASTERN STATES – 100% OF THE PROFIT FOR 10 YEARS |

| SECTION 80ID | PROFITS AND GAINS OF HOTELS/CONVENTION CENTRES IN SPECIFIED AREA | HOTEL OR CONVENTION CENTRE | 100% OF THE PROFIT FOR 5 CONSECUTIVE YEARS FROM THE COMMENCEMENT. |

| SECTION 80IE | CERTAIN UNDERTAKINGS IN NORTH EASTERN STATES | UNDERTAKINGS ENGAGED IN MANUFACTURE/ PROVISION OF SPECIFIED GOODS/ SERVICES OR UNDERTAKE SUBSTANTIAL EXPANSION, IN NORTH EASTERN STATES | 100% OF THE PROFIT FOR 10 CONSECUTIVE YEARS FROM THE COMMENCEMENT. |

| SECTION 80JJA | PROFITS AND GAINS OF SPECIFIED BUSINESS | SPECIFIED BUSINESS | 100% OF THE PROFIT FOR 5 CONSECUTIVES FROM THE COMMENCEMENT |

| SECTION 80JJAA | EMPLOYMENT OF NEW EMPLOYEES | EMPLOYER WHO WAS SUBJECT TO TAX AUDIT U/S 44AB | 30% OF ADDITIONAL EMPLOYEE COST FOR 3 YEARS STARTING FROM THE DATE OF EMPLOYMENT. |

| SECTION 80LA | CERTAIN INCOME OF OFFSHORE BANKING UNITS IN SEZ AND IFSC | OFFSHORE BANKING UNITS IN SEZ OR UNIT OF IFSC | FOR OFFSHORE BANKING UNIT – 100% OF THE INCOME FOR FIRST 5 YEARS AND 50% FORTHE NEXT 5 YEARS.FOR IFSC – 100% OF THE INCOME FOR 10 CONSECUTIVE YEARS OUT OF 15 YEARS FROM THE COMMENCEMENT. |

| SECTION 80PA | CERTAIN INCOME OF PRODUCER COMPANIES | PRODUCER COMPANIES ENGAGED IN ELIGIBLE BUSINESS | 100% OF THE PROFIT |

| SECTION 80RRB | ROYALTY ON PATENTS | INDIVIDUALS (INDIAN CITIZEN OR FOREIGN CITIZEN BEING RESIDENT IN INDIA) | LOWER OF –

· RS.3,00,000 · INCOME SPECIFIED |

| SECTION 80QQB | ROYALTY INCOME OF AUTHORS | INDIVIDUALS (INDIAN CITIZEN OR FOREIGN CITIZEN BEING RESIDENT IN INDIA) | LOWER OF –

· RS.3,00,000 · INCOME SPECIFIED |

| SECTION 80TTA | INTEREST EARNED ON SAVINGS ACCOUNTS | INDIVIDUAL BELOWTHE AGE OF 60 YEARS OR HUF |

UPTO RS 10,000 |

| SECTION 80TTB | INTEREST INCOME EARNED ON DEPOSITS (SAVINGS/ FDS) | INDIVIDUAL OF 60 YEARS AND ABOVE OF AGE | UPTO RS 50,000 |

| SECTION 80U | DISABLED INDIVIDUALS | INDIVIDUALS | NORMAL DISABILITY: RS. 75,000/- SEVERE DISABILITY: RS. 1,25,000/- |

DEDUCTIONS UNDER SCHEDULE VI- OTHER THAN SECTION 80C

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.