Exemption of Capital Gain [Section 54 to 54F]

Table of Contents

Exemption of Capital Gain [Section 54 to 54F]

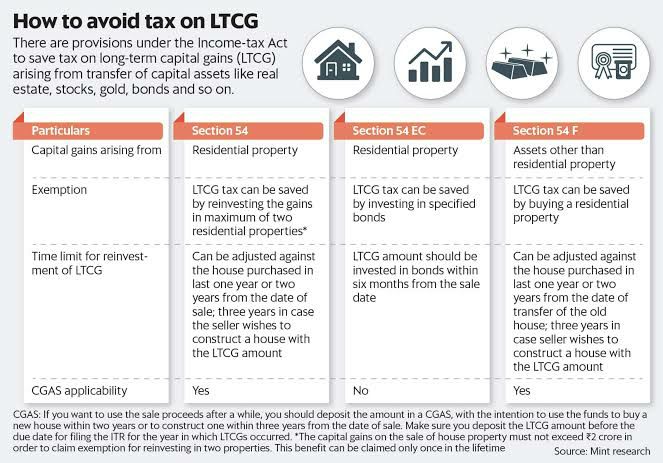

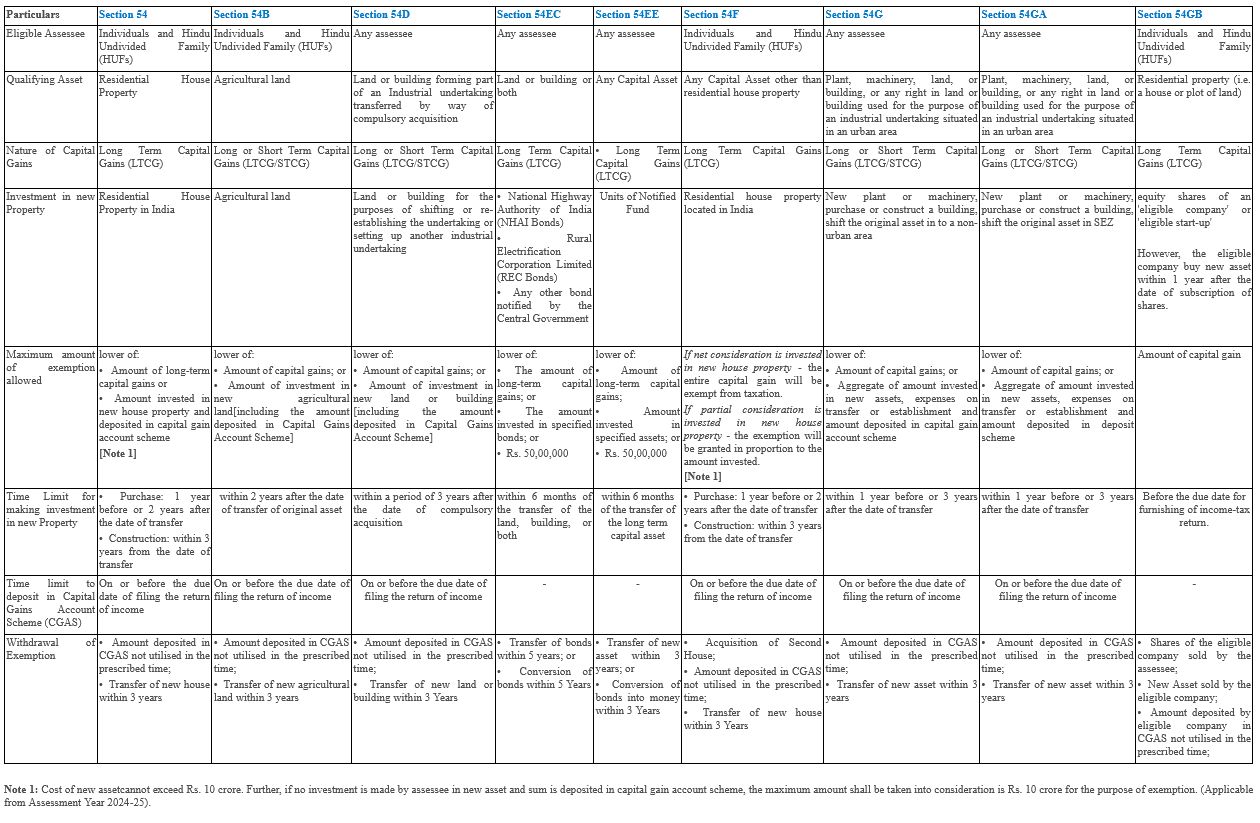

| S.No | Particulars | Section 54 | Section 54B | Section 54D | Section 54EC | Section 54F |

| 1. | Eligible Assessee | Individual/ HUF | Individual/ HUF | Any assessee | Any assessee | Individual/ HUF |

| 2. | Asset transferred | Residential House | Urban agricultural Land | L&B forming part of as industrial undertaking | Land or Building Or Both (LTCA) | Any LTCA other than residential House |

| 3. | Qualifying Asset in which CG has to be invested | One/ Two Residential House in India, at the option of asssessee, where CG does not exceed ₹2 Crore | Land for being used for Agricultural purposes (Urban/ Rural) | Land and Building | Bonds of NHAI or RECL or any other bond notified by CG (Redeemable

after 5 years) |

One Residential House situated in india. |

| 4. | Time Limit For purchase | Purchase before 1 year or 2 year after the date of transfer or construct within 3 years | Purchase within a period of 2 years after the date of transfer. | Purchase within a period of 3 years after the date of transfer. | Purchase within a

period of 6 months after the date of transfer |

Purchase before 1 year or 2 year after the date of transfer or construct within 3 years |

| 5. | Amount of Exemption | Cost of New

Residential house or 2 houses, as the case may be or CG whichever is lower is exempt |

Cost of new agricultural land or CG, whichever is lower is exempt | Cost of new asset or CG whichever is lower is exempt | CG or amt. invested in specified bonds, whichever is lower | Cost of New residential house >= Net sales consideration of original asset, entire Capital gain is exempt. |

Capital Gains Account Scheme

- The government, in order to encourage reinvestment of the capital gains made on the sale of capital assets by the seller, has provided with relief from capital gains tax if such capital gain is re-invested in certain specified assets within a specified time limit under section 54 to 54GB.

- Capital Gains Account Scheme was introduced in 1988 by the Central Government.

- As mentioned above, the time limit available to the depositor for re-investment and avail the exemption, in many cases is longer than the due date to file the return of income. In such cases, the taxpayer is given an option of depositing such under-utilised capital gains in ‘Capital Gains Account’ introduced under Capital Gains Account Scheme.

- Any capital gain invested in Capital Gains Account Scheme will be eligible for capital gain exemption as it would in case of re-investment.

Tax Rates on Capital Gains on Transfer of Securities (For Individuals and HUFs)

Amendments in Section 86 of the Income-Tax Bill, 2025

Extended Reinvestment Window for Capital Gains Exemption for Taxpayer who sale the Capital Assets :

- Previous Rule (Section 54F, IT Act 1961): Taxpayers had one year before or one year after the sale to reinvest in a new residential property.

- New Rule (Section 86, Proposed IT Bill 2025): The reinvestment period is now one year before or two years after the sale.If constructing a house, the period remains three years from the date of transfer.

- Applicability This applies to capital gains from long-term assets (excluding residential houses). Taxpayers can claim exemption from capital gains tax by reinvesting the proceeds into a new residential property.

- Impact of the Amendment : Extending the reinvestment window to two years provides greater flexibility to taxpayers. Aligns the capital gains exemption provisions with real estate market dynamics, allowing more time for reinvestment decisions.

Income tax rate in case of capital Gain regulation in India

Ready Recknor for calculating capital gains tax for all class of Assets.

Written by the IFCCL -Team

IFCCL provides our clients adequate guidance and assistance as they deal with internal audits as well as government audits of various corporate problems (business incorporation, statutory audits, ROC compliance, and company winding-up) in India. Please get in contact with us if you have any questions or would need more information concerning with Capital gain.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.