How can NRIs reduce TDS lability on property sales?

Table of Contents

How can NRIs reduce TDS on property sales?

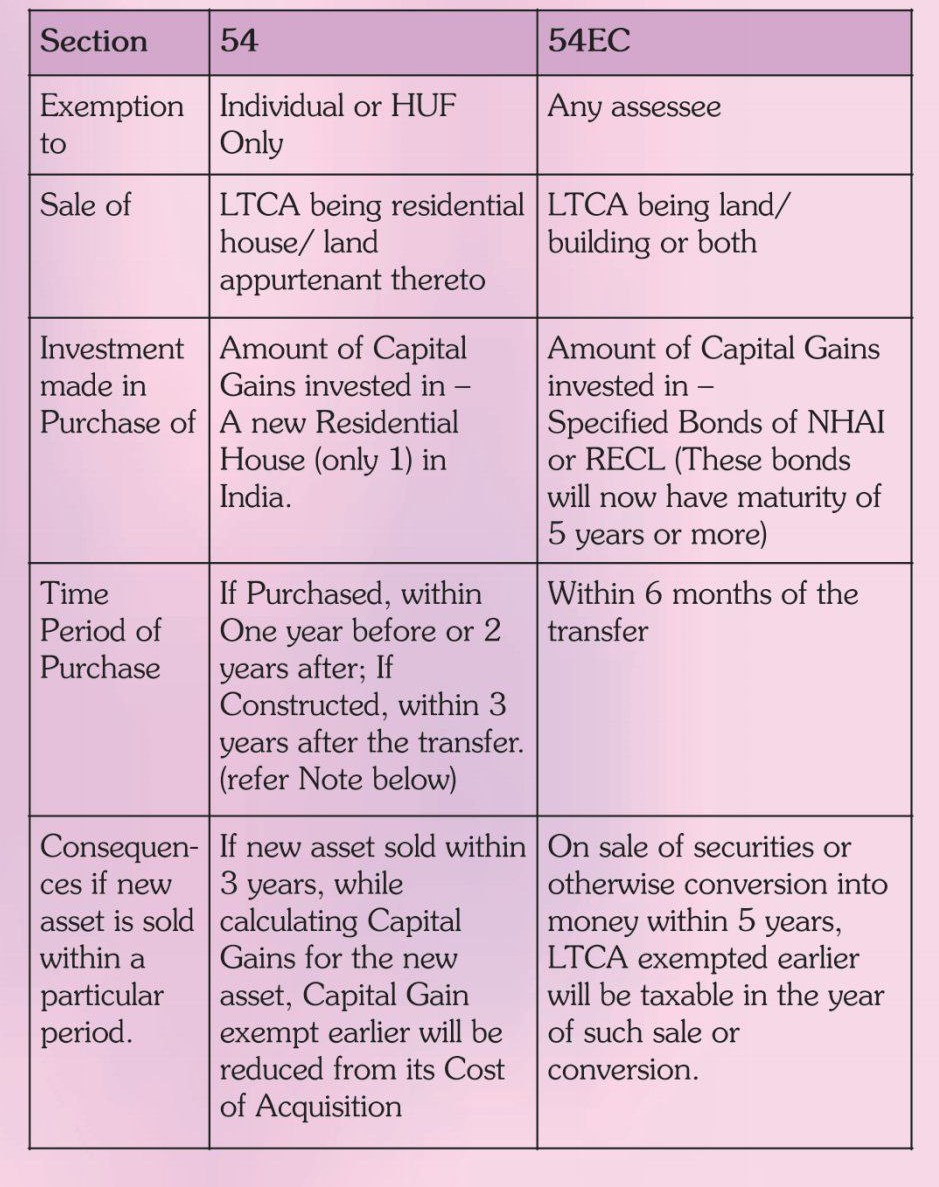

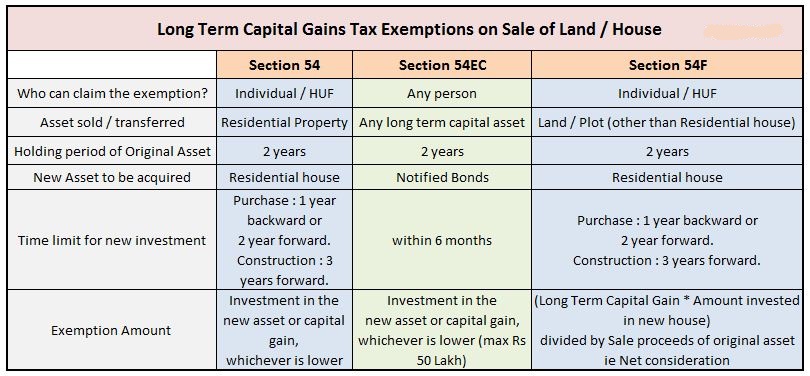

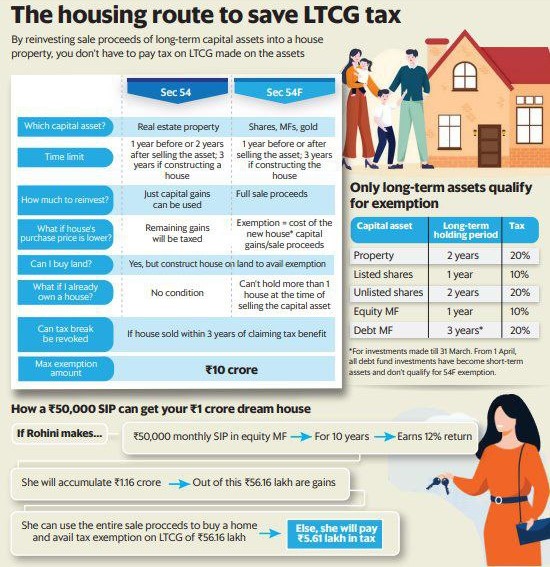

NRIs are allowed to save taxes on the sale of residential property under sections 54, 54EC, and 54F In India,

Section 54 allows NRIs to claim long-term capital gain exemption.

- If the property is a let-out or a self-occupied Residential property, NRIs might request an exemption under Section 54. You must invest the proceeds from the sale of your property either one year before or two years after it is sold to qualify for this deduction. You might also use the proceeds to construct a property that must be completed within three years of the selling date.

- Only one residential dwelling property acquired or completed in India is eligible for the exemption. If more than one house is acquired or built, only one house will be eligible for the exemption under section 54. In the case of a residence acquired outside of India, no exemption may be claimed.

- The Finance Act of 2020 modified Section 54 with effect from Assessment Year 2021-22 to prolong the advantage of exemption in respect of investments made in two residential dwelling properties.

- If the amount of long-term capital gains does not exceed Rs. 2 crores, an exemption will be provided for investments made by way of acquisition or building in two residential housing properties.

- In case the assessee chooses this option, he will not be able to choose it again for the same or any subsequent assessment year.

Section 54EC allows NRIs to claim exemption by Invest in Specified Bonds.

- You can also invest your long-term capital gains in particular bonds i.e., the Rural Electrification Corporation (REC) and the National Highway Authority of India (NHAI). These cannot be sold before 5 years have passed after the house property was sold, but they are redeemable after 5 years have passed since the house property was sold.

- Interest earned from Investing in these bonds is not tax free and the assessee is liable to pay tax on the Interest Earned.

- There are no additional deductions available for this investment. NRIs have a six-month window to invest in these bonds, but they must do so before the reporting date to be eligible for the exemption.

- In a financial year, NRIs can deposit a maximum of INR 50 lakhs in these bonds. To avoid TDS on capital gains, the NRI must make these investments and provide the Buyer with the relevant papers. An NRI can seek and reclaim any excess TDS deducted at the time of return filing.

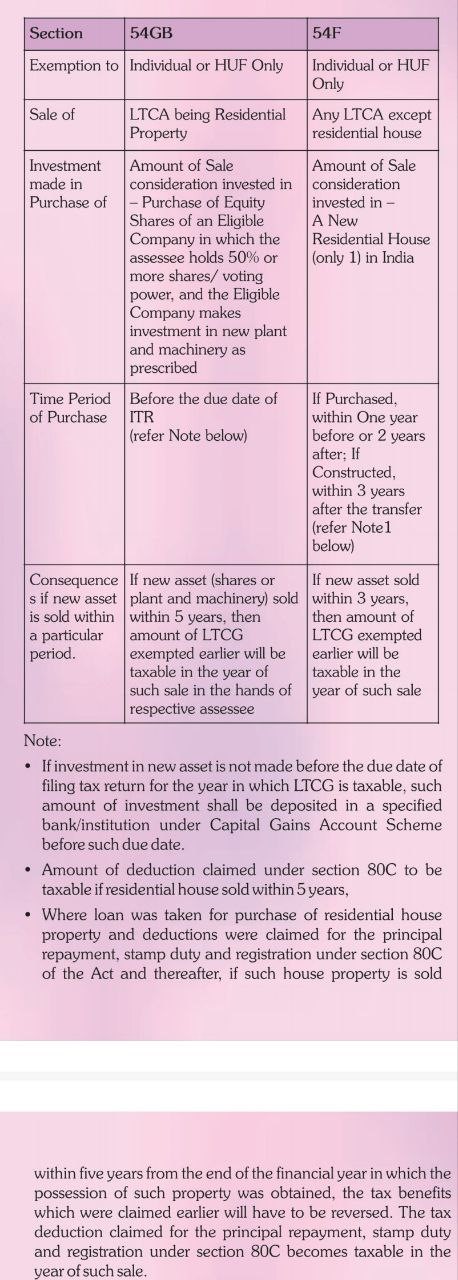

Section 54F allows NRIs to claim long-term capital gain exemption.

If the whole net sales consideration from sale of Long-Term Asset other than Residential Property shall invest in

- Purchase of one residential house within one year before or 2 years after the date of transfer of such asset or

- Construction of one residential house within 3 years of the date of such transfer

In case the whole amount is not invested then exemption shall be allowed proportionately as follow: –

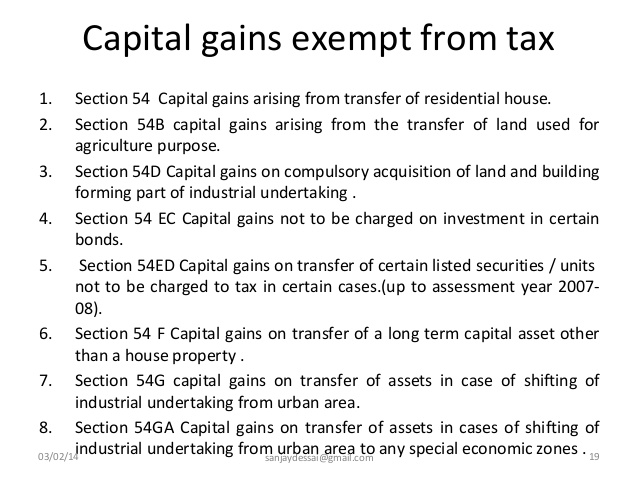

Kind of Capital Gain exempted from tax

Housing route to save LTCG Tax :

Conclusion

- NRIs might avoid paying taxes by carefully structuring their investments. With the aid of sections 54, 54EC, and 54F, NRIs would be allowed to reinvest their property gains and avoid paying taxes on them.

- A seller who is a non-resident alien (NRI) can also request a lower tax deduction. This may be done just by deducting TDS on capital gains.

- As per Section 195 of the Income Tax Act, TDS (Tax Deducted at Source) would be calculated solely on capital gains, not the whole selling amount. These sections can help you avoid TDS on NRI property sales and TDS on NRI property purchases.

Popular Article :

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.