IMPORTER –EXPORTER CODE REGISTRATION & DOCUMENTATION

Table of Contents

IMPORTER – EXPORTER CODE REGISTRATION AND DOCUMENTATION

BRIEF INTRODUCTION

In India, we have registration compliance that an importer or exporter company has to comply with. Such registration is known as Import Export Code Number. Importer Exporter Code (IEC) is mandatory for a person indulging in any export or import activities. IEC number is a basic 10-digit number that is issued by the DGFT and allows Indian companies to export & import goods to and from India. Importer Exporter Code (IEC) number comes with indefinite validity and easy registration procedure. Also, the process of modification in case of any change is quite simple. There are certain benefits of getting such registration namely-

CATEGORY OF PERSONS REQUIRING IEC NUMBER

- Any persons requiring to send shipments via customs.

- Any person getting foreign currency directly deposited into their bank account in the form of consideration received for exported goods.

- Any person requiring the approval of customs authority in order to approve their shipments.

- Any person required to send money abroad through financial institutions or banks in the form of payment made for imported goods.

BENEFITS OF IEC NUMBER

- INDEFINITE VALIDITY: One of the greatest features of the IEC code is that there is no specific period of validation i.e. it is valid for the whole existence of the organization. As a result, there does not exist the need to renew it.

- NO FILING OF RETURNS: Unlike other compliances, IEC registration is a straightforward procedure that does not necessitate the filing of any returns for companies. As a result, once the allotment of the IEC certificate is done, the company is not required to provide any return to the government while undertaking any activity of export or import of goods.

- EXPANSION OF BUSINESS ACTIVITY: With an IEC registration, One can easily expand their business activity by exploring the global markets and also helping in increasing the country’s GDP.

- EASE IN SUPERVISION/MONITORING OF FOREIGN TRADE ACTIVITIES: The IEC code helps the Indian Government to keep a regular check on the company and also provides the company to take advantage of the opportunities provided by Customs, the DGFT, and the Export Promotion Council.

- EASE IN REGISTRATION: The government has now simplified and streamlined the registration process for IECs by opening an online portal wherein the company can apply for IEC in a paperless and hassle-free manner.

- NO SEPARATE REGISTRATION FOR UNITS ESTABLISHED UNDER SAME PAN: Since, PAN card is mandatory for registration, any business already having an IEC number is not required to obtain any further registration for any other unit or entity registered under the same PAN as of the above company.

EXEMPTED CATEGORIES OF IMPORTER AND EXPORTER

Generally, no export or import shall be made by any person without obtaining the IEC number unless they come under the following category, namely –

- Person importing and exporting goods or technology specifically under the authority of Central Government.

- Any Ministry or department of Central and State Government.

- Any Person importing or exporting goods for personal consumption and the same is not subject to any commercial activity.

- Any person who is specifically importing or exporting goods, to and from Nepal and Myanmar through the Indo-Myanmar border areas and China through Gunji and Namgaya Shipkila port wherein the number of such goods or single consignment shall not exceed Rs. 25,000. In case through Nathula port the above limit is increased from Rs. 25,000 to Rs. 1,00,000.

PERMANENT IEC NUMBER OF NON – COMMERCIAL PSU

The Government of India has specifically allotted some permanent IEC numbers which shall be used by the non – commercial public sector units. The list of IEC number is as follows –

| SERIAL NO. | PERMANENT IEC NO. | CATEGORY OF IMPORTER/EXPORTER |

| 1. | 0100000011 | Ministries and departments of Central Government and agencies that are wholly or partially owned by them. |

| 2. | 0100000029 | Ministries and departments of State Government and agencies that are wholly or partially owned by them. |

| 3. | 0100000037 | Counsellor officers and diplomatic personnel in India, along with officials and agencies of UNO. |

| 4. | 0100000045 | Indian citizens going/returning from abroad and also claiming benefit under Baggage rules. |

| 5. | 0100000053 | Hospitals, individuals or institutions importing/exporting goods specifically for personal consumption and not for any commercial activity. |

| 6. | 0100000061 | Persons indulging in trade with Nepal. |

| 7. | 0100000070 | Persons indulging in trade with Myanmar through Indo-Myanmar border areas. |

| 8. | 0100000088 | Ford Foundation and its Branches |

| 9. | 0100000096 | Importers of goods exclusively used for display in fairs and exhibitions |

| 10. | 0100000100 | Directors and authorized representatives of National Blood Group |

| 11. | 0100000126 | Importing of goods, by individuals/ institutions and charitable NGOs, which are exempted from any custom duty and is used for victims of natural calamity. |

| 12. | 0100000134 | Import/export of goods from/to China through Gunji, Namgaya shipkala and Nathula ports, subject to the ceiling limit specified by the government. |

| 13. | 0100000169 | Import/export of goods by the entities authorized by the Reserve Bank of India and is of non-commercial nature. |

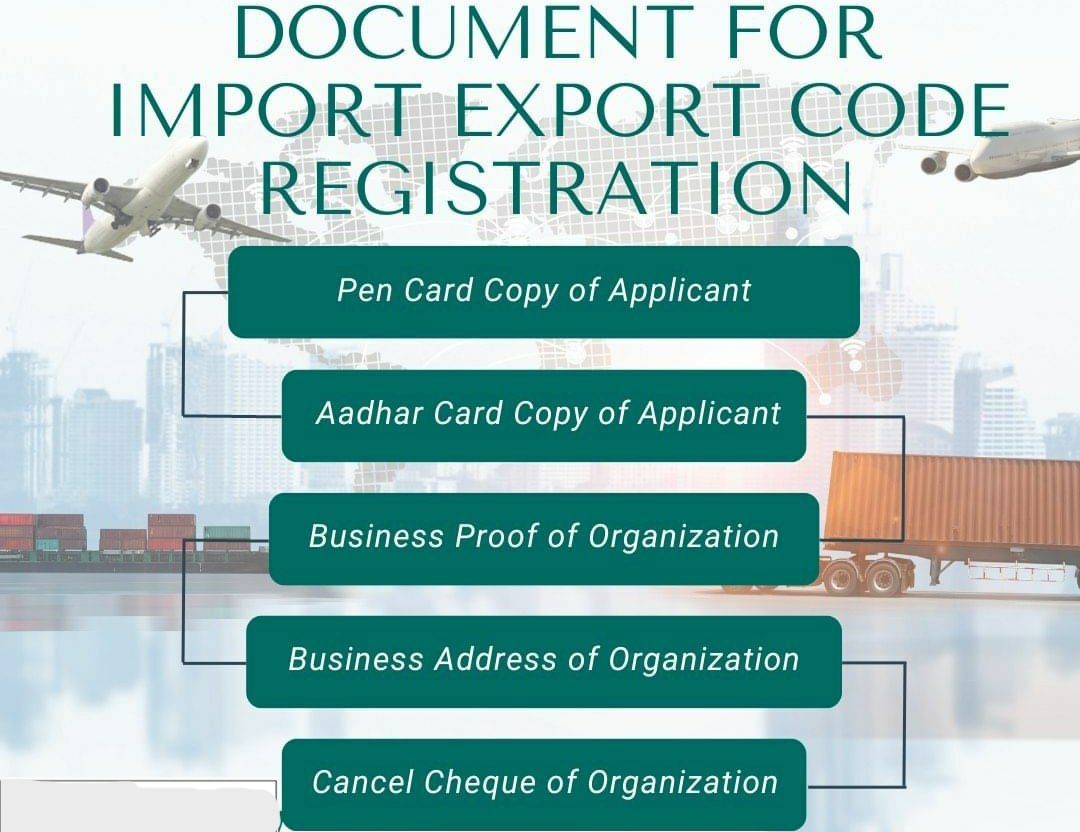

DOCUMENTS REQUIRED FOR IEC CODE

There are certain documents that are required to be scanned or copy be sent to the DGFT office as per the online or offline registration process. These documents include –

- DETAILS OF THE ENTITY SEEKING IEC NUMBER –

- PAN card of the business unit that would be undertaking the import/export activity.

- Address proof of the applicant entity which could be the sale deed or the lease deed in case of purchased or leased property respectively.

- Registration Certificate Number of the entity obtained from the concerned authorities at the time of the establishment of the entity.

- A canceled Cheque bearing the entity’s preprinted name as a proof for bank account detail.

- DETAILS OF THE MANAGING INDIVIDUAL – The managing individual could be a proprietor, partner, director, secretary, managing trustee as the case may be

- PAN card of the individual

- DIN/DPIN in case of company or LLP

- DETAILS OF THE SIGNATORY –

- Identity proof of the individual i.e. Aadhaar card or driving license etc.

- PAN card of the signatory.

- Digital photo

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.