All about Limits & penalties related to Cash Transactions

Table of Contents

All about the Limits & penalties related to Cash Transactions

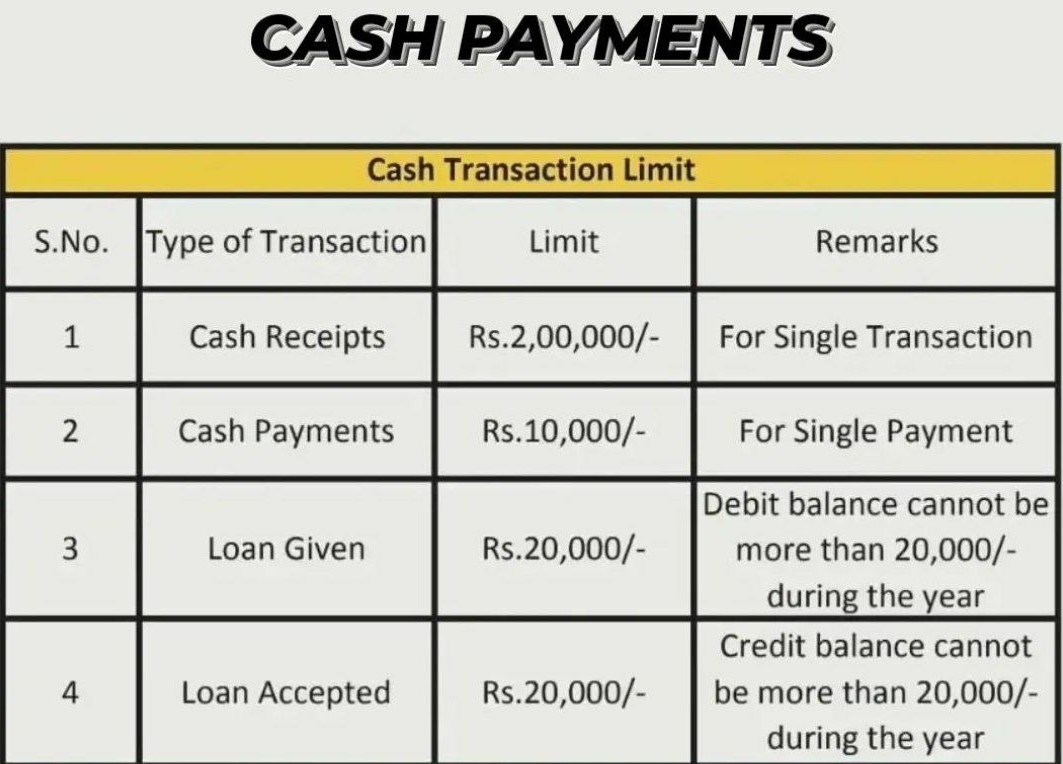

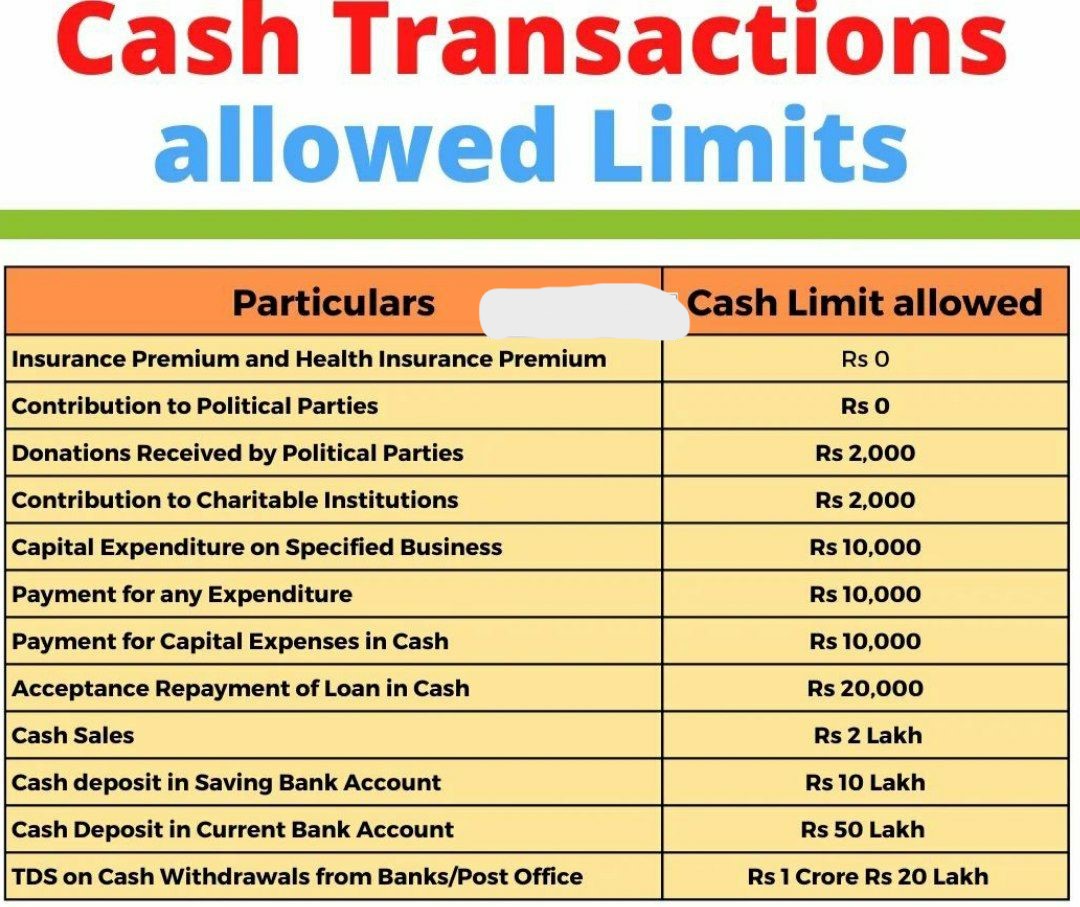

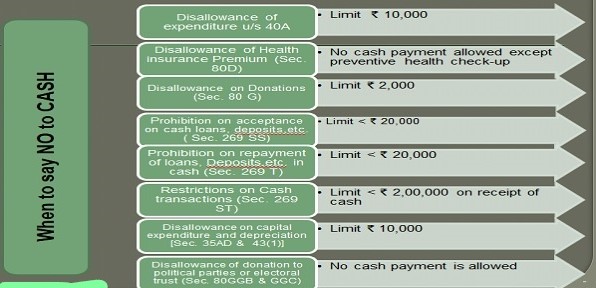

Specified Cash Transactions Limits:

In recent times, the Income Tax Dept. released an E-Flyer detailing the cash transaction limitations and emphasizing the severe consequences connected to specific kinds of cash transactions. The Tax Department strongly advises taxpayers and business professionals to stay away from cash transactions completely because there could be serious consequences if they don’t.

New Cash payment Transactions Limits along with characteristics which may have negative consequences:

Cash Payment of Health Insurance Premiums facilities: -Disallowance

- According to Section 80D of Income Tax law. Any Cash Payment of Health Insurance Premiums facilities made is not permissible allowable as deduction.

Acceptance of Certain Loans and Deposits

- No one is permissible to take payments of INR 20,000 or more. In the case of any deposit or loan, any amount related to transfer of any immovable property, If any cash received from a person for any such purpose is still outstanding to be repaid, then the total limit of INR 20,000/- will apply to the balance outstanding plus any receipt in cash subsequently.

Below mention are exempt from above Rule:

This kind of cash money is accepted from –

-

- Govt;

- Any post office savings bank or banking company, co-operative bank;

- Any corporation established by a state, central or provincial Act;

- such other association or institution or body or class of associations, institutions or bodies which the Central Govt may, by notification in the Official Gazette, specify.

- Any Govt company as defined in section 2(45) of the Co. Act, 2013;

- from a person having agriculture income, & recipient is also having agriculture income and neither of them is chargeable to income tax.

Violation Consequences: A penalty equals to cash seized will be imposed.

Fixed Assets or Capital Expenditures cash payment – -Disallowance

- According to Income Tax law, any kind of capital expenditure for purchase of Capital Asset for which a part or full payment or total payments made in cash in a day exceeds INR 10,000/- made is not permissible and this expenditure will not be consider for purposes of determination of actual cost of such asset. Its means that no depreciation allowable on the assets for which capital expenditure incurred in cash.

Loans/Deposits must Be Repaid

Any banking company or Cooperative society, firm/other person is not permissible to repay any loan/deposit in cash if:

- The amount of the loan or deposit together with interest, if any, is INR 20,000 or more, or

- Total amount of deposits/ loans held by such person, either in his own name or jointly with other person on the date of such repayment together with the interest, if any, is Rs.20,000 or more.

- With effect from Financial Year 2019-20. Tax deducted at source @2% to be deducted on cash withdrawals of INR 1,00,00,000/- in a year from bank A/c for business purpose.

to any person who has made the loan or deposit or paid the specified advance.

This clause is not apply to: Repayment of any deposit loan or defined amount received from or made payable to: This kind of cash money is accepted from –

- Govt;

- any post office savings bank or banking company, co-operative bank;

- any corporation established by a state, central or provincial Act;

- such other association or institution or body or class of associations, institutions or bodies which the Central Govt may, by notification in the Official Gazette, specify.

- any Govt company as defined in section 2(45) of the Co. Act, 2013;

- from a person having agriculture income, & recipient is also having agriculture income and neither of them is chargeable to income tax.

Violation Consequences: A penalty equals to such deposit or loan repaid will be levied.

Consider as Deemed Income of Year Following Year of Payment:

- In case an allowance has been made in respect of any liability incurred by a person for any expenditure, and then during any subsequent year the person makes payment in respect thereof in cash, the payment is chargeable to income-tax as income of the subsequent year if the payment or aggregate of payments made to a person in a day exceeds Rs.10,000.

- In case payment is being made for plying, hiring or leasing goods carriages, then the limit is Rs.35000, instead of Rs. 1,00,000/-.

- If goods carriages are being plyed, hired, or leased, the payment maximum is Rs. 35,000 instead of Rs. 1,00,000/-.

Cash Donations – Disallowance

- According to section 80G of Income Tax law, Rs 2000/- cash Donation to a political party or an NGO is not permissible allowable as deduction.

Additional Cash Transaction- Permissible

- No person is permissible to take / receive in any cash an amount of INR 2 lakhs or more- in Total receipt from a any person in a day; or in respect of a single transaction; or in respect of transactions relating to one time or occasion from a person,

- Above income tax provision will not applicable in the following cases –

(i) any receipt by-

-

- Govt;

- any post office savings bank or banking company, co-operative bank;

(ii) in case the cash transactions of Nature classified in section 2695S or Section 2695T

(iii) with effect from Financial Year 2019-20, all the electronic payments or digital payments are allowed in addition to a/c payee cheque, electronic clearing system or A/c Payee bank draft via a bank A/c. any Persons having earing income from business & gross receipt or turnover more than Rs. 50 Cr in a FY are compulsory needed to accept payment via specified electronic payments or digital payments or other electronic mode only. In case of failure to do so, it would attract a penalty of INR 5000/- per day till such failure continues.

- Consequences of violation of above provision: Assessee have to face the penalty under section 271DA is levied for a amount equal to the receipt amount.

Cash Payment expenses -Disallowance

- According to section 40A(3) of income tax Act, any cash expenditure incurred for the purpose profession or business in cash a day exceeds INR 10,000, 100% of such kind of cash payment will be disallowed while computing taxable income from profession/ business. But few exceptions are also given in Income tax Rule 60D.

Summary can be presented in the below Table

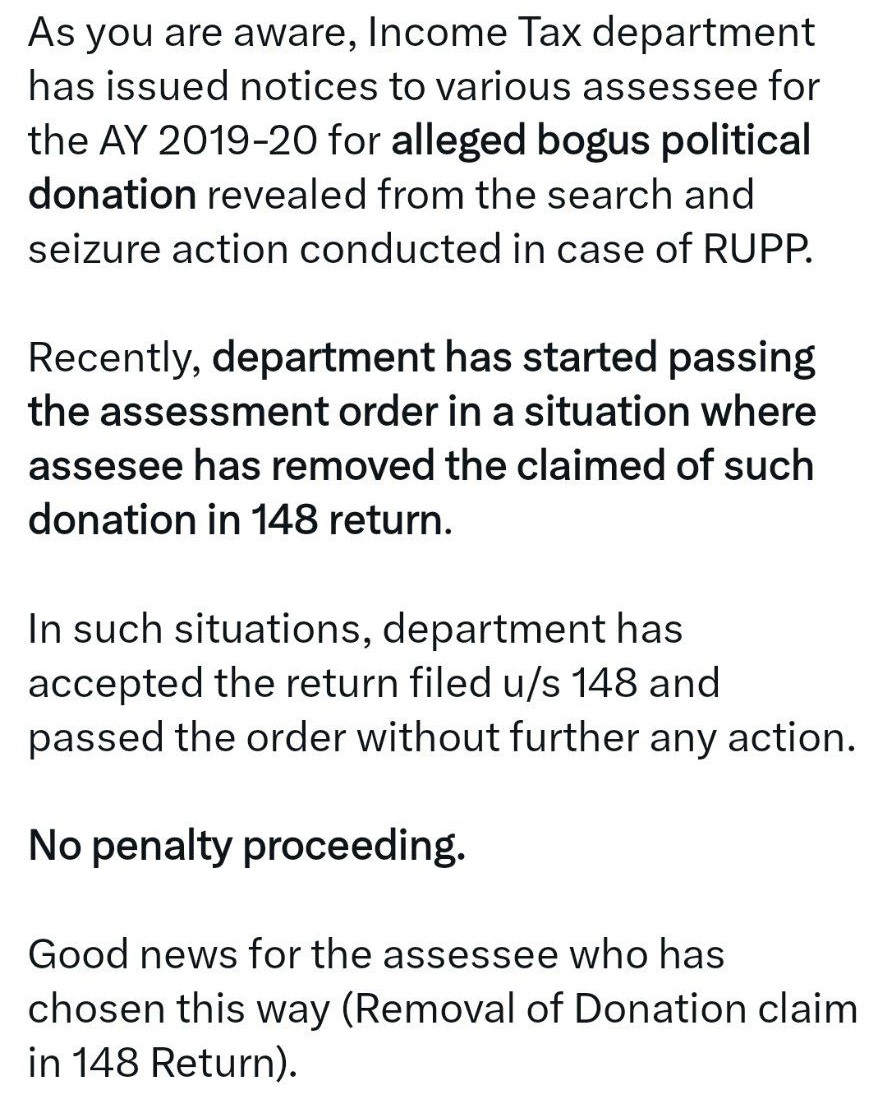

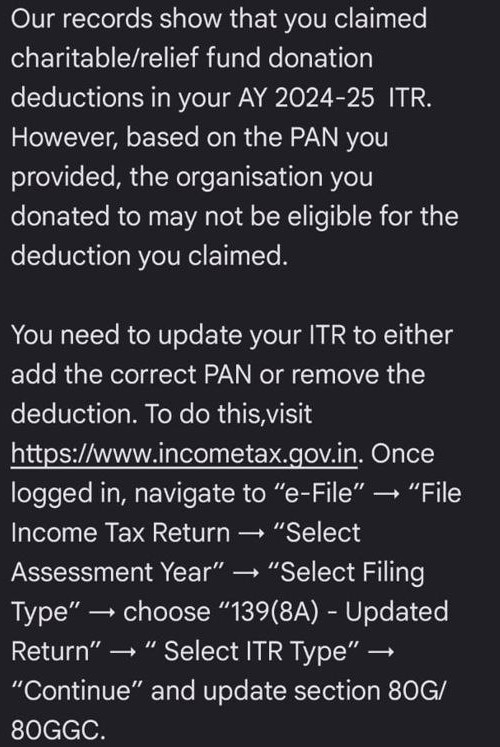

Received Income Tax Notice for 80G & 80GGC Deductions?

Here is the Solution :

What is the notice about?

You claimed a deduction u/s 80G or 80GGC, but As per ITD records, the PAN of the donee is either incorrect or not eligible. Hence, Dept is asking you to file Updated Return u/s 139(8A).

Why is this happening suddenly?

Because now All eligible trusts & political parties must file Form 10BD, Donations are auto-matched with PAN, & Any mismatch triggers system-generated alert

Common Reasons for Notice

- Wrong PAN of trust / political party

- Donation made to non-registered entity

- Trust registration expired/cancelled

- Claimed 80GGC instead of 80G (or vice-versa)

- Cash donation where only online allowed

This is NOT a penalty notice : This is a correction opportunity before scrutiny. Ignoring it may lead to a demand notice, interest u/s 234B/234C, Possible scrutiny later

Popular Article :

- All about the Income taxation on capital gain

- Provision-of-capital-gains-charts

- All about the Income taxation on capital gain

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Aware of the penalty of Section-234f for late filing of ITR

- Which is Better- Old vs New Tax Regime Comparison 2024 ?

Our Services:

- Tax Returns: Individual Tax Returns, Company Tax Returns

- Consultancy: Comprehensive Compliance Consultancy

Contact Us: For query or help, contact: singh@caindelhiindia.com or call at 9555-555-480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.