Maintaining of the Statutory Registers & Records by Co.

Table of Contents

Maintaining of the Statutory Registers & Records by the Company

- Statutory Books:- The term statutory register means the specified records related to a directors, companies shareholders & details of the meeting held. These are the additional records which are maintained by the company. Mostly companies keep their records and statutory records in a bound book or loose-leaf binder but the company is liable to keep the records in any form such as computer record.

Maintaining of registers under the Companies Act,2013

- Companies Register

- Every company that who accepts deposits should keep one or more records with its registered office for the deposits which have been accepted and/or upgraded for the period of eight years. This term may be start from the FY in which the registration of the company was held. This list should contain the follow-ups with the depositors-

- Name of the depositors with Permanent Address of the depositors.

- Details of guardian is mandatory for minors.

- Details of the nominee.

- Applicable rate and amount of each deposit.

- Receipt number of each deposit.

- Rate of interest.

- Time duration of deposit.

- Date of repayable.

- Due date for the payment of interest.

- Date of payment of interest owing.

- Aspects of charge and creation of security.

- Details of insurance.

- Any other details regarding deposits.

- The company’s Secretary, directory, or other official permitted to do so shall authenticate all the entries maintained in the registrar.

Members Register

- Every Company is the responsibility to maintain and update records of its members:

- Registers of Debenture Holders

- List of other security holders.

- Members must be registered separately for equity and preference shares.

- List of debt holders.

- List of other people who own securities.

- Every members must be registered separately for equity and preference shares.

- List of debt holders.

- List of other people who own securities.

- So, If case a company don’t have the share capital, register of member should include the below details of each member:

- Name of the member along with his Address, Email, Permanent Account Number, Unique Identity Number, Corporate Identity Number, his occupation, nationality, Fathers Name /Mothers Name/ Spouse Name.

- The date on which you became a member

- Expiration date of membership

- Any further information that is required

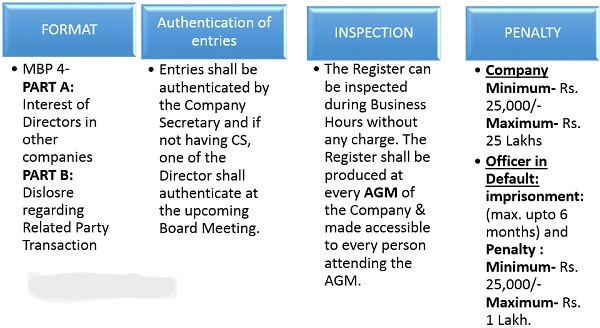

Directors Register & key managerial personnel Register

- As per the company law 2013, all the company needs to establish & maintain its record with the registered office, keeping details of the director and the Key Managerial Personnel which contains the information of the shares owned by them in the subsidiary or company of the company, its holding company, associate company or the subsidiary company.

- According to the Rule 17 of the Rules of Procedure for Companies (Entry and Qualification of Directors), 2014 the following details provide in the registry of the registered office of the company.

- DIN (Director Identification Number);

- Name and surname of the director and key management personnel

- Any prior name or surname

- Fathers’ name/ Mothers name/ Spouse name

- DOB

- Any prior name or surname

- Current and permanent residential address;

- Occupation

- Current and permanent residential address;

- Dates of office termination and grounds for termination.

Charges Register

- The fees of companies register should be record in FORM No 7 CHG. This Register will include information on charges filed with the Registrar for inventory, land, companies, or corporations, as well as property information received and subject to fees, as well as information on adjustments or fee satisfaction.

- The charges registry should be made indefinitely at the registered office, But the charging instrument should be retained for 8 years form the date that the fee is performed by the company.

Renewed and Duplicate share certificates registers

- Details of each of the share certificates issued:

- Form SH.2 should contain the registry for renewed and dual share certificates. A registry for renewed and dual share certificates should be added in the Form SH.2 in return for certificates that are aged, worn, aged bent, disfigured, daubed, worn-out, decrepit or where cages are adequately transfers instead of certificates that are destroyed or lost.

- Form No SH-2 contains the issue date & NO of certificates instead of new ones & need changes prescribe in the Register of Members by appropriate cross- references in the column of remarks against the person name to whom the certificate has been issued.

- Register maintaining shall need one person to consider the below:

- Company secretary and any other person as may be allowed by the company Board of directors should keep the register in his custody.

- All such entries should be authenticated by the CS or the person liable as per the guidelines of company Board of directors.

- The register should be kept at registered office or the place where it is strored.

Employee stock options register

- According the guidelines under the company law, the company should maintain the ESOP options register in the Form No SH.6. and the other details of an option should be entered. This register should be kept at the ROC or any other place as mentioned in the Board Discretion. The entries should be checked in respect of the CS or the person approved by the Board of the Company.

Securities and shares register should buy back

- As per company act, 2013 the registry of shares and other securities which are repurchased should be maintained in Form No SH 10.

- Details of the securities or shares which was bought back by the company.

- Number along with the price of stocks or other securities authorized for buyback

- Date of passing special resolution along with the date of buyback of securities.

- Date of approval of board

- Time of buyback of shares and other securities

- Date of opening and closing of the buyback offer

Statutory Books- Requirement of documents at registered Office of the Company.

- Mostly, the following details and documents requires for a Pvt limited Co. or LTD company/ Non-banking financial company.

Financial statement & Books of Accounts of the company: –

- All companies are needed to maintain the books of accounts & financial statement of the company with the detailed transaction by the companies act,2013. Further, the financial transaction information in detail should be audited and verified against the financial statements prepared by the company.

- Statement of Bank Account

- Certificate of Tax Registration

- MOA

- AOA

- Certificate of Incorporation

- Pattern of shareholding

- Financial statements

- Register of Statutory

- Electricity and other utility Bill

- Record of Employee

- Records of operation

- Document of property

- Registration of intellectual property or Document of application

- Return of income tax

- Receipt of tax payment

- Details of Director

- Companies Director

- Directors date of appointment

- Charges of Registration

- Details of Secured Lenders of the Company

- Secured Loan Quantum

Our Bookkeepers and Accounting Services in India

IFCCL would like to connect with you about Bookkeepers and Accountants; we have 20+ finance professionals to provide the high-quality accounting services to small, medium, and large enterprises.

The following services are available at low cost.

- Bookkeeping & Accounting Services

- Professional Tax Preparation

- Financial Statements

- End to End Payroll Solution

- Data Entry & Administration Solutions

- Maintains of Statutory registered as per ROC Records.

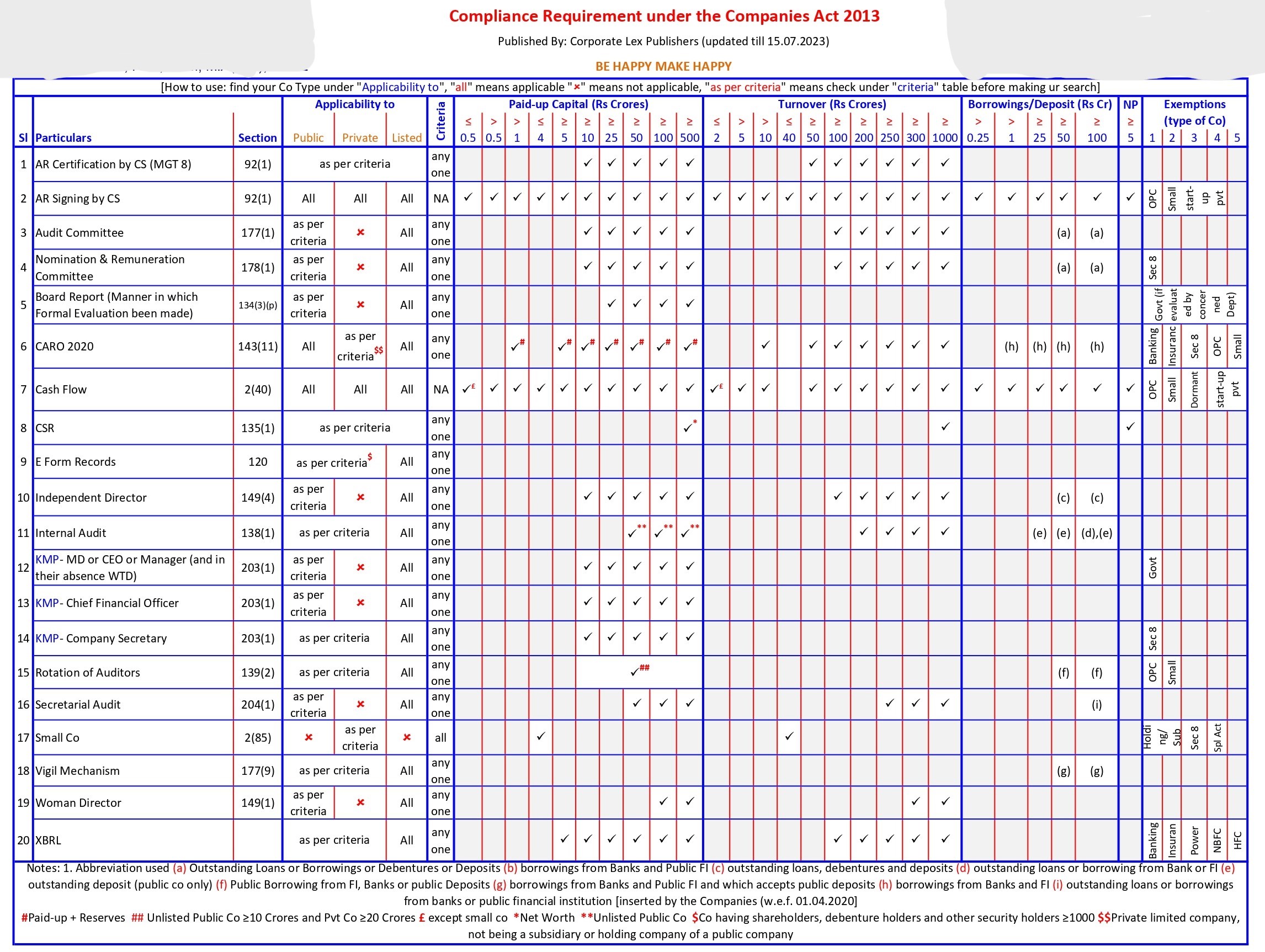

Company Law Compliance Under the Company Act 2013

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.