FAQs TDS on Purchases (Section 194Q)

Table of Contents

Frequently Asked Questions (FAQs) TDS on Purchases (Section 194Q)

Q.: Who is subject to the Section 194Q tax deduction?

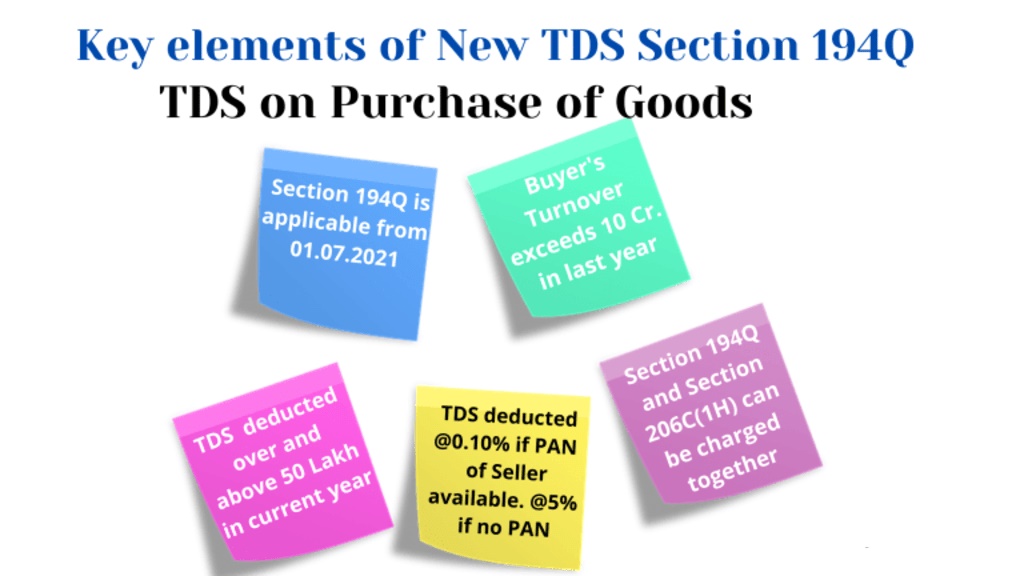

A purchaser carrying on a business whose total sales, gross revenue, or turnover from the business exceeds Rs. 10 crores for the financial year immediately preceding the financial year in which such items are purchased is entitled to deduct the tax under Section 194Q. This clause will take effect on July 1, 2021.

Thus, if the purchaser’s turnover was more than Rs. 10 crores in the financial year 2020-21, the purchaser will be liable to deduct tax under this provision in the financial year 2021-2022.

Q.: Is this true for all types of assesses, such as individuals and businesses?

The provisions apply to all types of assessees who meet the definition of buyer. There are currently no exclusions.

Q.: Is it only applicable to goods or does it include services as well?

The new provision only applies to the purchase of goods, not services.

Q.: When does this provision require tax to be deducted?

If the following conditions are met, the tax will be deducted from the buyer’s purchases.

- A resident person makes a purchase of goods.

- In any previous year, goods were purchased for a value or aggregate value in excess of Rs. 50 lakhs.

- The buyer should not be on the list of people who aren’t eligible for tax deductions.

If the tax is deductible or recoverable under any other provision save Section 206C, it cannot be deducted under this section (1H). If a transaction is subject to TCS under Section 206C(1H), the buyer is responsible for deducting the tax first. The seller will not be obligated to collect the tax under Section 206C if he does so (1H). Also, take a look at FAQ 5.

Q.: When should tax deductions be taken into account?

Tax is required to be deducted at the time of crediting such sum to the seller’s account or at the time of payment by any mode, whichever comes first. Even if the money is credited to the ‘Suspense Account,’ the tax must be deducted.

Q.: Is TDS required on the full consideration or only on the consideration that surpasses INR 50 lakhs if the consideration for the purchase of goods exceeds INR 50 lakhs?

Section 194Q, sub-section (1), requires the buyer to deduct tax at the time of purchase of goods. It provides for a tax deduction of 0.1 percent of the amount exceeding INR 50 lakh in a fiscal year.

As a result, if the consideration exceeds INR 50 lakh, the tax will be deducted at source. For example, if the first purchase was for INR 35 lakh and the second purchase was for INR 40 lakh, TDS should only be applied to the second purchase and only to the sum of INR 25 lakh (35 lakh + 40 lakh – 50 lakh). The INR 50 lakh limit will be applied year after year.

Q.: What is the tax rate that will be deducted?

If the seller has provided his PAN, the tax will be deducted at the rate of 0.1 percent of the purchase value exceeding Rs. 50 lakhs by the buyer of goods; otherwise, the tax will be deducted at the rate of 5%.

The 0.1 percent rate is subject to the fulfilment of the terms set forth in the newly introduced section 206AB of the Finance Act of 2021.

Q.: What are the 206AB terms and conditions?

In the Income Tax Act of 1961, a specific provision of TDS was established by the Finance Act of 2021. Section 206AB has been added, which will take effect on July 1, 2021.

This new rule mandates that when paying a ‘Specified person,’ TDS be deducted at the higher rate. The following would have increased TDS rates.

- At twice the rate set forth in the applicable Act provision.

- At twice the current rate or rates.

- At a rate of 5% per year.

Specified person: A specified person is one who has

- failed to file income tax returns for both of the immediately preceding two years relevant to the year in which tax is due to be deducted or collected, as the case may be, and whose due date for filing such return has passed under Section 139(1).

- In each of the immediately preceding two years, his total tax deducted at source and tax collected at source was INR 50,000 or more.

A non-resident who does not have a permanent establishment in India is not considered a designated person.

This law does not apply to tax deductions at the source.

- Section 192 – TDS on salary

- TDS on payment towards an accumulated sum payable to an employee who participates in a recognised provident fund (‘PF’).

- TDS on lottery or crossword puzzle winnings (Section 194B).

- TDS on horse race winnings (Section 194BB).

- TDS on income from a securitization trust investment under Section 194LBC.

- TDS on cash withdrawals in excess of INR 20 lakhs (Section 194N).

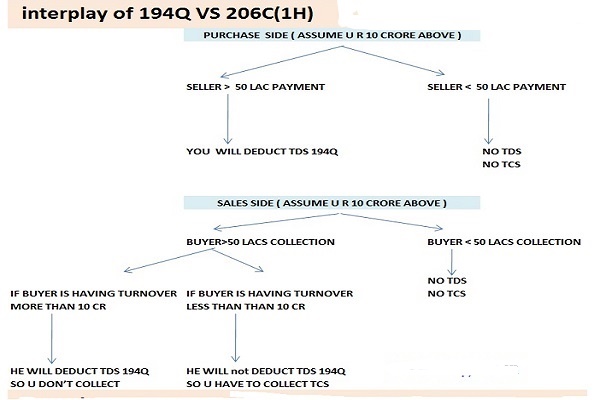

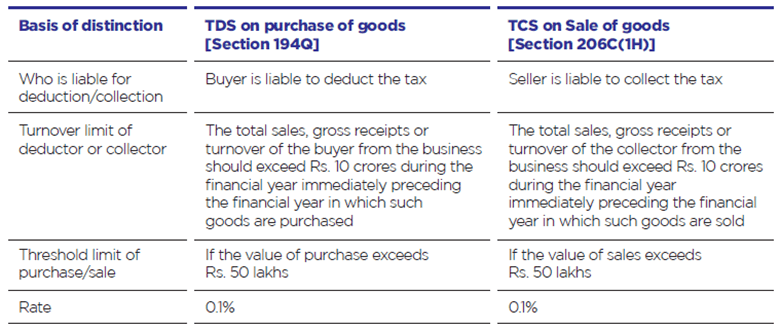

Q.: Who is responsible for tax deduction/collection when a transaction is covered by both TDS under Section 194Q and TCS under Section 206C(1H)?

The second clause to Section 206C(1H) states that if the buyer is required to deduct tax on goods purchased from the seller under any provision and has done so, no tax shall be obtained on the same transaction.

Section 194Q(5) states that if a person can deduct tax under another provision or if tax is collectable under section 206C [other than a transaction on which tax is collectible under Section 206C(1H)], no tax is required to be deducted under this provision.

Though Section 206C(1H) precludes a transaction from which tax is deducted under any other law (including Section 194Q), Section 194Q(5) does not offer a similar exclusion for a transaction from which tax is recoverable under Section 206C. (1H).

As a result, the buyer’s primary responsibility is to deduct the tax, and no tax will be collected on such a transaction under Section 206C. (1H). If the buyer defaults, however, the seller assumes responsibility for collecting the tax.

Both of these provisions are differentiated in the table below:

| Particulars | Scenario 1 | Scenario 2 | Scenario 3 |

| Turnover of Seller (In cr.) | 12 | 6 | 12 |

| Turnover of Buyer (In cr.) | 6 | 12 | 12 |

| Sale of goods (In cr.) (A) | 2 | 2 | |

| Sales consideration paid during the year (In cr.) (B) | 1 | 1 | 1 |

| Who is liable to deduct or collect tax? | Seller | Buyer | Buyer |

| Rate of Tax (Seller/Buyer has provided PAN and has satisfied section 206AB) | 0.1% | 0.1% | 0.1% |

| Amount on which tax to be deducted or collected (In Cr.)

[Amount in excess of Rs. 50,00,000 is the taxable amount] |

0.5

[(B) – 0.5] |

1.5

[(A) – 0.5] |

1.5

[(A) – 0.5] |

| Tax to be deducted or collected | 5,000 | 15,000 | 15,000 |

Both the buyer and the seller may be unsure about who should deduct the tax. The purchaser retains the primary responsibility for deducting the tax. To avoid ambiguity, the buyer may provide the seller with a declaration stating that he will deduct the taxes at the time of booking the invoice or making the advance payment, as applicable.

The seller must provide a declaration stating how he has filed the ITR for the two preceding years as specified in section 206AB.

Q.: Is a buyer importing goods from outside India required by this section to deduct tax at the source?

According to Section 194Q, every person who is a buyer and is responsible for paying any payment to any resident who is a seller is required to deduct tax at source. As a result, under this provision, the obligation to deduct tax arises only when the payment is made to a resident seller.

Because the supplier is a non-resident, the buyer is not required to deduct tax under this provision, as it is in the case of import. The buyer may obtain a declaration regarding the seller’s residential status. However, TDS under Section 195 or payment of the Equalisation Levy may be required in relation to such a transaction.

This exception may not apply in the case of a purchase of goods via a High Seas sales transaction because the High Seas seller may be a resident.

Q.: Is it necessary to deduct tax from goods exported abroad under Section 194Q?

Under this provision, liability to deduct tax arises only when the payment is made to a resident seller. The residential status of the buyer making the payment is irrelevant under this provision.

As in a goods export transaction, the seller is a resident but the buyer is a non-resident. As a result, the non-resident buyer may be obligated to deduct tax under this provision.

However, determining whether all of the prerequisites of section 194Q, section 206AB, and the availability of PAN have been met is a time-consuming process. I hope that the CBDT and the government provide the necessary clarifications to improve the ease of doing business in India.

Q.: What shall be construed as a purchase of goods in the lack of any definition of the term?

The Income-tax Act does not define the term “goods.” The phrase ‘goods’ has a broad definition. Anything that enters the market might be classified as a good. However, the Sale of Goods Act of 1930 and the Central Goods and Services Tax Act of 2017 define the term “goods.”

The following is a list of goods as defined by different legislation:

| Particulars | CGST Act, 2017 | Customs Act, 1962 | Sale of goods Act, 1930 |

| Definition of Goods | Every kind of movable property other than services | Inclusive definition to cover all goods | Every kind of movable property |

| Inclusions | Actionable claims, crops, grass and things attached to land | Vessels, stores, baggage, currency, negotiable instrument & other kind of movable property | Stocks & shares, Crops, Grass and things attached to Land |

| Exclusions | Money & Securities | – | Actionable claims & money |

Q.: Is a transaction in securities conducted through stock exchanges subject to TDS under this provision?

Concerns were raised about the applicability of Section 206C(1H) of the Finance Act of 2020, which provides for the collection of tax on the sale of goods, in transactions involving stock exchanges (or commodities exchanges), because there is no one-to-one contract between buyers and sellers.

In case of the case, the CBDT clarified in Circular No. 17 of 2020 that the provisions of Section 206C(1H) shall not apply to transactions in securities (and commodities) traded through recognized stock exchanges or cleared and settled by recognised clearing corporations, including recognised stock exchanges or recognised clearing corporations located in Internaional (IFSC).

Using the logic behind the clarification, it’s possible that the CBDT may provide a similar exemption from TDS under Section 194Q.

Q.: Should TDS be deducted on capital goods purchases?

‘Goods,’ as defined in Question 10, refers to all types of movable property, subject to specified restrictions and inclusions, regardless of whether they are capital goods or not. As a result, TDS will be deducted on capital goods purchases as well.

Q.: Is TDS deducted if the buyer is in the service industry and buys items from a seller?

The concept of buyer is described in section 194Q’s explanation. Buyer means a person whose total sales, gross receipts, or turnover from the business he runs exceed ten crore rupees in the financial year immediately preceding the fiscal year in which the goods are purchased.

The term “business” is defined broadly in Section 2(13) of the Income Tax Act of 1961. “Any trade, commerce, or manufacture, or any adventure or concern in the nature of trade, commerce, or manufacture, is considered a business.” As a result, we can conclude that business includes services, and if the buyer is a service provider, he must deduct TDS on the purchase of goods if all other conditions are met.

Q.: Is TDS to be deducted on a developer’s purchase of immovable property?

According to Question 12, “goods” refers to any type of movable property subject to certain exceptions and inclusions.

As a result, immovable property is not treated as ‘goods.’ As a result, the TDS under section 194Q shall not be deducted from a developer’s purchase of immovable property.

Q.: Is it required to deduct TDS from an electrical transaction?

A transaction in electricity can be completed by purchasing directly from a company that generates electricity or by using power exchanges. The CBDT has stated that electricity, renewable energy certificates, and energy-saving certificates exchanged through power exchanges authorised under Regulation 21 of the CERC are not subject to TCS under Section 206C (1H).

Applying the reason for this, it is concluded that, under Section 194Q, the CBDT may permit a similar exemption from TDS.

Q.: Should TDS be deducted when purchasing software?

The taxation of software has long been a source of contention under the Income-tax Laws. In the absence of any guidelines in the Income-tax Act, such classification has always been a source of contention. The Finance Act of 2012 included clarification amendments in Section 9 to broaden the scope of royalty taxation. The amendment clarifies that the consideration for the use or right to use computer software is a royalty.

Immaterial factors have been explained about medium, ownership, usage or right to use and location. The amendments have so given tax administration in the area of royalty taxation a new dimension. TDS applies to royalty payments made under Section 194J or Section 195. Where tax is deductible under another law, the Section 194Q clause would not apply.

The Supreme Court in another landmarch judge rendering payment for software not subject to Article 12 of the double tax evasion agreements and Indian payers were not liable to withhold tax u/s 195 as no taxable income was generated in India. This decision was not based on the Engineering Analysis Center of Excellence Private Limited [TS-5014-SC-2021-O]. This is only true for non-resident payments and we may need to see whether Section 194Q applies in this respect. As has been explained elsewhere, for payments to non-residents, TDS u/s 194Q is not applicable.

Section 194J is still applicable to resident payments and Section 194J is not applicable once Section 194J is applicable.

Accordingly, it is concluded that the above review does not apply to software payments in Section 194Q where Sections 194J and 195 apply.

Q.: Is Section 194Q or 194-O applicable if goods are bought by the customer of an e-commerce participant?

Initially, Section 194-O required e-commerce operator to deduct tax while paying for e-commerce members. For the following reasons, the e-commerce operator should deduct tax under Section 194-O of the Act if the requirement for activation of section 194-O is met.

- Section 194Q specifically exempts transactions which under any other provisions of the Act are subject to a tax withholding.

- Section 194-O begins with the non-abstant clause, thus overriding section 194Q.

Q.: Is TDS required to be deducted on the purchase of jewellery that is not related to a business?

In the financial year immediately prior to the financial year in which the goods are purchased, the tax is to be deducted from a buyer carrying on the business whose total sales, gross proceeds or turnover of the business exceeds 10 crores. There is no requirement that purchases only relate to the company. Thus, if a person is covered by the buyer’s definition, tax must be deducted, even if that purchase is not related to his undertaking.

The term goods includes jewellery, which is a movable property. Section 194Q does not specifically exclude TDS from the purchase of jewellery. As a result, if additional conditions are met, the tax on jewellery purchases will be deducted.

However, deducting the TDS by the purchaser may be challenging because the purchaser may argue that the jewellery is being acquired for personal rather than business purposes. CBDT explanation is sought to minimise trouble and misunderstandings.

Q.: Should TDS be deducted or TCS be collected if the buyer purchased items from the seller worth Rs. 45 lakhs in one financial year and Rs. 40 lakhs the previous financial year, and the seller got Rs. 60 lakhs in respect of the two purchases made by the buyer?

If all of the elements of section 206C(1H) are met, the seller must collect the tax since the buyer has not exceeded the threshold limit of Rs. 50 lakhs and the seller has received an amount surpassing the threshold limit of Rs. 50 lakhs.

Q.: Does the purchase price of items include additional, allied and out-of-pocket expenses?

It is imperative to determine accurately the purchase value, since it is important to determine how applicable and what tax would be deducted from the provision. Where the purchase invoice itself reflects these expenses, it must be part of the value for the purchase. More clarity in this connection is, however, expected from CBDT.

Q.: When will the threshold limit of Rs. 50 lakhs be calculated?

With effect from July 1, 2021, Section 194Q of the Finance Act of 2021 has been inserted to provide for the deduction of tax on specified purchases. If the amount or aggregate purchase value exceeds Rs. 50 lakhs in the preceding year, TDS must be deducted. Is the TDS deduction limit of Rs. 50 lakh to be calculated from 01-04-2021 or 01-07-2021?

When Section 206C(1H) of the Finance Act, 2020, went into effect on October 1, 2020, there was a lot of uncertainty. In this regard, the CBDT has clarified in Circular No. 17 dated 29-09-2020 that, because the Rs. 50 lakhs barrier is for the previous year, the sale consideration for triggering TCS under this section must be computed from 01-04-2020. As a result, if a seller has already received Rs. 50 lakhs or more from a buyer before September 30, 2020, TCS will apply to any receipts of sale consideration on or from October 1, 2020.

Using the same logic, it can be concluded that the Rs. 50 lakhs threshold will be calculated beginning on April 1, 2021. If a buyer has already purchased items worth Rs. 50 lakhs or more from a supplier before June 30, 2021, TDS under this section will apply to any purchases made on or after July 1, 2021.

Q.: What is the base year for the Rs.50 lakhs threshold limit?

Each financial year, a limit of 50 lakhs is considered. For a single seller, the exemption of 50 lakhs is valid for one financial year.

Q.: Will TDS be deducted from the total invoice amount, including GST?

A similar issue has been raised in relation to Section 194J, to which the CBDT has clarified in Circular No. 23/2017, dated 19-7-2017, that where the component of ‘GST on services’ comprised in the amount payable to a resident is indicated separately in terms of the agreement or contract between the payer and the payee, tax shall be deducted at source on the amount paid or payable without inc. However, this clarification was only given in relation to the GST on services. There has been no such clarification for GST on goods.

However, with regard to Section 206C(1H), the CBDT has clarified in Circular No. 17, dated 29-09-2020, that because the collection is made with reference to receipt of the amount of sale consideration, no adjustment for indirect taxes, including GST, is required for the collection of tax under this provision.

Because the deduction under Section 194Q is based on the purchase price, adopting the same logic, it may be determined that GST is included in the purchase price, and so the TDS is deductible on the total purchase price, including GST. A clarification from the CBDT in this regard would be greatly appreciated.

Q.: Is it necessary to deduct TDS from a seller’s advance payment?

Section 194Q states that tax must be deducted in any transaction involving the purchase of goods. It does not specify whether such a purchase must be made immediately or at a later date. Because the tax must be deducted at the time of payment or credit, whichever comes first, it is reasonable to conclude that the provision may be attracted even if the purchase occurs in the future.

If the goal is to apply the advance payment to a future purchase of goods, the tax should be deducted at the time of payment or credit, whichever comes first. If the advance payment is not made with the aim of applying it to a future purchase (deposit or loan), but is finally applied to a future purchase, no tax is required to be deducted at the time of payment. When such an advance is offset against the purchase price of goods, the obligation to deduct tax arises.

If the goal is to apply the advance payment to a future purchase of goods, the tax should be deducted at the time of payment or credit, whichever comes first. If an advance payment is made without the intention of adjusting it against a future purchase (deposit or loan), but is eventually adjusted against a future purchase, no tax is needed to be deducted at the time of payment. When such an advance is offset against the purchase price of goods, the obligation to deduct tax arises. Because most advance payments are made solely for the purpose of purchasing goods, it would be reasonable to deduct TDS under section 194Q at the time of advance payment.

Q.: Will TDS be applied to advance payments for items purchased before July 1, 2021?

With effect from July 1, 2021, the Finance Act of 2021 has inserted Section 194Q. As a result, the terms of this Section will not apply to any payment or credit made in the books before to July 1, 2021. As a result, it would be applicable to any purchases made on or after July 1, 2021.

In other words, when a payment is made or an amount is credited on or after July 1, 2021, the tax should be deducted. As a result, if any of the trigger events (i.e., payment or credit) occurs before the effective date of the provision, there will be no obligation to deduct tax.

However, if the threshold limit has been exceeded and all other conditions have been met, the buyer must deduct the tax on the amount above the threshold limit as of the date of booking the real invoice.

Q.: Does the amount advanced as a loan to the seller fall under the purview of this provision?

Under this provision, the requirement to deduct TDS arises if the purchase value exceeds the threshold limit in the previous years. The deduction is to be made as soon as payment or credit for the purchase of goods is received. Because the loan advanced by buyers is not a payment towards the purchase of goods, it is exempt from the provisions of this section.

As a result, there is no requirement to deduct TDS on the buyer’s loan.

However, if the loan amount is settled against the purchase price at a later date, the obligation to deduct TDS will emerge. On the date that the parties agreed to modify the loan amount against the outstanding responsibility, the tax will be subtracted.

Q.: Is TCS applicable to amounts collected on invoices issued prior to July 1, 2021, if all of the prerequisites of section 206C (1H) are met?

TCS is applicable for amounts collected prior to July 1, 2021, because TDS is only applicable after July 1, 2021.

Q.: Should tax be deducted when one branch purchases goods from another?

Any person who is a buyer and is responsible for making payment to the seller for the purchase of goods is required to deduct TDS under this provision. As a result, the presence of two distinct parties as’seller’ and ‘buyer’ is required to interpret a transaction as a purchase. The purchase condition is not met in the context of branch transfer. As a result, the provisions of this section do not apply to branch transfers.

Q.: How should a debit note be treated for computing TDS?

Because the tax must be calculated on the purchase price, the adjustment made to the seller’s ledger by issuing the debit note has no effect on the tax to be deducted. The situation would be the same if the seller returned portion of the consideration to the buyer after deducting the tax. The amount of the purchase value shall not be lowered by the money thus reimbursed or the debit note so modified for TDS computation in such a circumstance.

Q.: Should purchase returns be adjusted when calculating the INR 50 lakh threshold in a fiscal year?

In view of the consideration paid for the ‘purchase’ of goods, the INR 50 lakh limit should be calculated and the value of those goods reduced for arrival at an INR 50 lakh threshold, if they are returned. The goods are therefore returned. However, such purchase returns must have been made on or before the point of tax deduction, as the INR 50 lakh threshold must be checked when the liability to deduct at source arises. Any subsequent returns will be rejected.

Q.: Is TDS applicable to a work contract if a single invoice is issued?

Under the GST Regulations, a construction contract comprising the delivery of products, labour, and other services is now classed as a service. However, if a single invoice is issued with no distinction between the value of goods and services, the question of whether TDS and TCS provisions apply to the single invoice arises.

Section 194Q (5)(a) states that if tax has been deducted under any other provision of the Act, the provisions of 194Q would not apply.

As a result, if TDS is deducted on the whole invoice amount under any other provision (e.g. 194C), TDS under 194Q is not applicable.

Q.: Whether purchases from various units must be aggregated if the vendor has several units?

If tax is to be deducted from the deduction source, the deductee must provide his PAN to the deductor, if it does not, at higher rates. Where there is a PAN available, each PAN must be measured by a threshold limit of Rs. 50 lakhs. In other words, if various selling units are under the same PAN, they are aggregated to calculate the limit of Rs 50Lakhs, the amount paid or payable for all such units.

Q.: Goods are being transferred for testing purposes.

Section 194Q requires the buyer to deduct TDS when purchasing goods. This provision will not apply because the goods were transferred for testing purposes only and no purchase was made.

Q.: Can a seller apply for a certificate allowing for a lower TDS deduction?

Where TDS is applicable under other provisions such as 194C, 194J, 194I, etc., an assessee can apply to the Assessing Officer for a certificate allowing tax to be deducted at lower rates. Such a certificate shall be issued if the assessee’s existing and estimated tax liability justifies the deduction of tax at a lower rate. Furthermore, certain assessees have the option of filing a declaration for no tax deduction.

The Finance Act of 2021 however did not extend the benefit of applying for a lower rate tax deduction certificate or filing a no deduction declaration for transactions covered by the provisions of Section 194Q. Therefore, the assessee is not able to approach the assessing official in respect of the transactions covered by Section 194Q to issue a certificate for a lower tax deduction or to file a no-deduction statement.

Q.: How can the TDS be deposited?

A corporate assessee and other business assessees are required to pay taxes (including TDS) via internet or debit cards electronically. The deductor must fill in the Challan No. ITNS 281 to deposit the tax.

Other deductors may deposit the tax so deducted in any branch of the Reserve Bank of India, the State Bank of India, or any authorised bank.

Q.: When is the deadline for submitting TDS?

Taxes deducted during the month must be deposited on or before the due date the following dates.

| Type of Deductor | Mode of payment of TDS | Due Date for deposit of TDS | ||

|

Office of Government |

Without Income-tax Challan |

On the same day on which tax is deducted |

||

| With Income-tax Challan ITNS 281 | Within 7 days from the end of the month in which tax is deducted | |||

| Other Deductor | With Income-tax Challan ITNS 281 |

|

Q.: What are the ramifications of failing to deduct or pay TDS?

If any person who is responsible for deducting tax at source fails to deduct the whole or any part of the tax or fails to deposit the same to the credit of the Central government after deduction, he is considered to be an assessee-in-default.

If the deductor does not deduct tax at source, the deductor is liable for paying an amount of tax he failed to deduct at an interest rate of 1% for each month or part thereof. In the event that the tax deducted is not deposited at the origin, however, the applicant will be liable to pay interest of 1,5% on or part of the tax that he did not deposit with the central government loan for each month.

Apart from this in accordance with Article 40(a)(ia) of the law, the taxable income of the buyer will not be paid for at least 30 percent of the purchasing value that was responsible for TDS.

Q.: If the buyer pays tax due on the income reported in the return of income, is the seller considered as the assessee in default?

According to Section 201 of the Income-tax Act, a deductor who fails to deduct tax at source is not considered in default if the payee has taken such amount into account when computing income in the return and has paid the tax due on such disclosed income. A certificate is to be obtained in Form No. 26A and submitted electronically by the deductor from the chartered accountable.

Thus, the buyer is not considered an assessee-in-default if the seller has taken the purchase amount into account when calculating his income and has paid the tax due on the income declared in the return.

Q.: What is the deadline for submitting a TDS return?

The tax deducted at source statement required by this provision must be filed with the Income-tax Department on or before the following due date:

| Quarter | Due Date |

| April- June | 31st July of the Financial Year |

| July- September | 31st October of the Financial Year |

| October- December | 31st January of the Financial Year |

| January- March | 31st May of the financial year immediately following the financial year in which deduction is made |

If you fail to file your TDS return on time, you will be charged a late filing fee under Section 234E. The price for failing to provide the TDS/TCS Statement would be charged at the rate of Rs. 200 per day that the failure continues. The amount of the fee, however, must not exceed the total amount deductible or collectible, as applicable. The cost must be paid before the late TDS/TCS Statement may be submitted.

A person who fails to file the TDS return or fails to file it by the required date is subject to a penalty under Section 271H. If you provide inaccurate information on your TDS return, you will face a penalty under Section 271H. The minimum penalty for failing to file a TDS return or providing inaccurate information is Rs. 10,000, with a maximum penalty of Rs. 100,000.

Q.: What are the ramifications of being an assessee in default under the Income Tax Act of 1961?

The following are the consequences of being an assessee in default:

- Interest levied under Section 220.

Simple interest at the rate of one percent per month is payable on any amount not paid within the time period specified in the notice under Section 156.

Furthermore, this interest can only be levied until the Purchaser of the Goods files the ROI. However, if all three of the following requirements are met, the Principle Chief Commissioner / Chief Commissioner / Principle Commissioner/Commissioner might lower the interest:

- Payment of such sum has/would cause actual hardship to the assessee.

- The assessee’s default was caused by circumstances beyond his or her control.

- The assessee has cooperated in the assessment/recovery procedures investigation.

- Section 221 imposes a penalty.

The Assessing Officer may order the payment of a penalty, which can be any sum up to the amount owed in tax arrears. If the AO is satisfied that the default was for good and sufficient reasons, he or she may refuse to direct the penalty.

- Sections 222, 227, 229, and 232 govern recovery proceedings.

Apart from penalties, recovery proceedings must be initiated against the assessee/person responsible under the Act’s sections 222 (Certificate to Tax Recovery Officer), 227 (Recovery through State Government), 229 (Recovery of penalties, fines, interest, and other sums), or 232 (Recovery by suit or under other law not affected).

- Proceedings for Prosecution.

Depending on the nature and severity of the default, the repercussions may include prosecution under Chapter XXII of the Income Tax Act of 1961 sections 276BB and 276C. If a person fails to pay the tax collected to the credit of the Central Government, he shall be punished by rigorous imprisonment for a time of not less than three months but not more than seven years, as well as a fine (Section 276BB).

Q.: When and how does the seller’s tax collection responsibility arise?

The buyer bears the primary responsibility for deducting tax; however, if the buyer fails to deduct tax, the seller bears the primary responsibility for collecting the tax. When the seller receives the amount as sales consideration, he is required to collect the tax. As a result, upon receipt of sales consideration, the seller must ensure that the buyer has deducted the tax. If the buyer has not deducted the tax, the seller must collect it. The seller can obtain from the buyer a declaration regarding the status of tax deduction at source.

It should also be noted that, because 194Q becomes effective on July 1, 2021, the seller is required to collect tax on sales consideration received prior to July 1, 2021.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.