Startup Loan for Business without any Collateral

Table of Contents

How to get a startup Loan for business without any Kind of collateral ?

Lack of funds is one of the reason number of good business blows. However there exists sources in India that grant loans. In general, a 3 year of business vintage period is required for loan from financial institution. For ease of doing business , government offers loan without collateral.

Some schemes of government to provide ease of doing business for startups in India (2022)

Following is a list of schemes offered by indian government for startups in India :

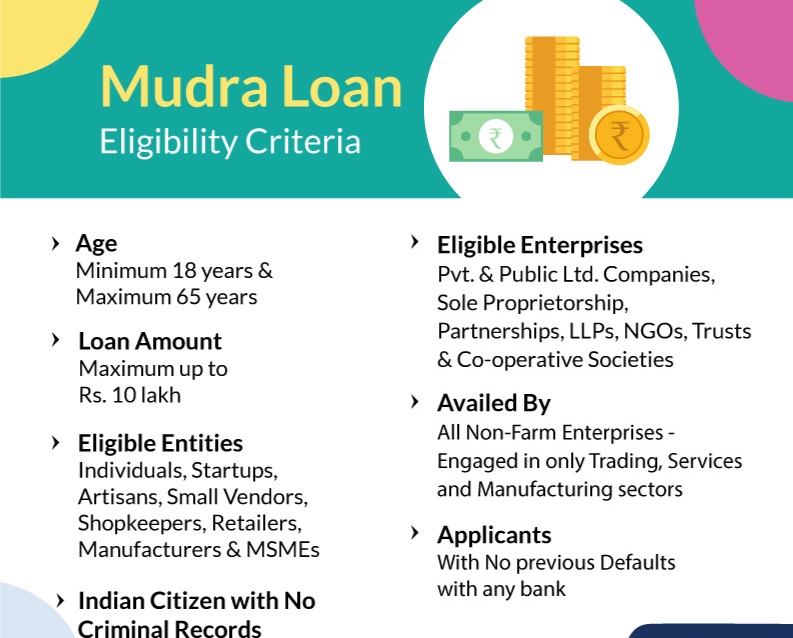

Mudra loan under PMMY :

The Prime Minister’s Pradhan Mantri Mudra Yojana (PMMY) is a lending scheme that provides loans up to Rs. 10 lakh to non-corporate, non-farm small and micro enterprises. Under PMMY, these loans are categorised as Mudra loans. Commercial banks, RRBs, Small Finance Banks, MFIs, and NBFCs provide these loans.

The motive of this scheme is to fund the unfunded. Micro Units Development and Refinancing Agency (MUDRA) offers loan to micro units and non cooperative small businesses. It is a collateral free loan. Further it is divided into 3 units/

- Shishu Loan- entrepreneurs can get loans up to Rs.50,000 for a maximum of 5 years repayment period, under this scheme.

- Kishor Loan-Loan offered from the loan amount of Rs.50,000 to Rs.5 lakhs.

- Tarun Loan- Loan amount ranges from Rs. 5 lakhs to Rs.10 lakh.

Stand up India scheme:

This scheme provide financial assistance to SC/ST and women entrepreneurs to start business . loan of sum 10 lakh to 1 crore can be availed, to a single borrower, under this scheme to set up business entereprise in manufacturing sector or service sector etc.

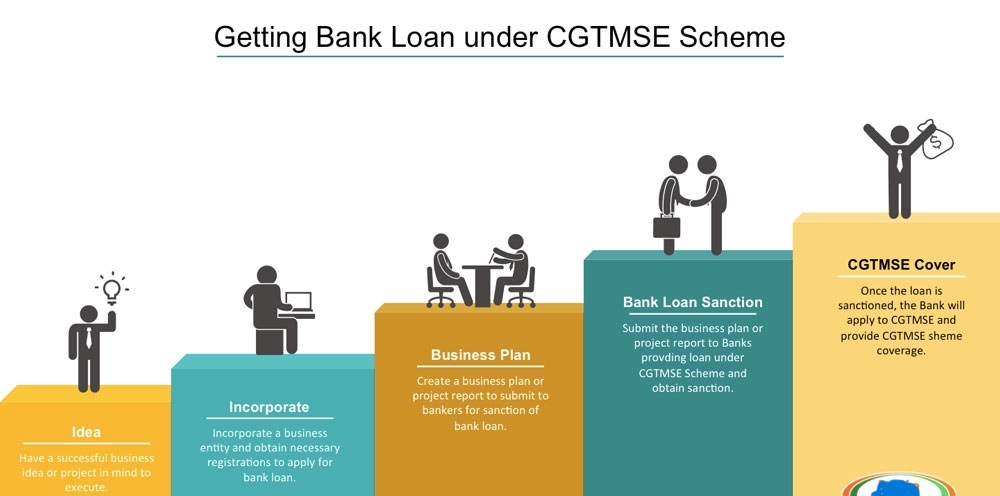

CGTMSE scheme:

stands for Credit guarantee trust fund for micro and small businesses. This loan covers almost all new and existing enterprise. Maximum of 1 crore can be availed under this scheme, without collateral. It is easy to get loan under this scheme for manufacturing enterprises.

Bank credit facilitation scheme:

NSIC which stands for National small industry facilitation give loan to MSMEs in India with collaborating public and private sector. Repayment tenure depends on income of the borrower. Generally, the repayment tenure is from 5 to 7 years, it can go upto 11 years.

Coir Udyami Yojana :

Coir Udyami Yojana (CUY) is a credit-linked subsidy scheme, Coir board initiated this scheme, the task is to coir unit all over India. It grants loan specifically to project-based enterprises with a project cost up to 10 lakh. The limit that of not exceed 25% of project cost set up by Coir board. In the form of term loan , capital expenditure is given , in form cash credit working capital is given.

ELIGIBILITY & CONDITIONS TO GET A STARTUP LOAN COLLATERAL FREE

- Age of borrower shall be minimum can go upto 60 years.

- There shall be no default in repayment from any financial institution.

- There shall be atleast 3 years of business existence.

- The borrower shall present a good business plan with innovative product/service in market.

- Firm shall carry a patron from a patent or trademark office.

DOCUMENTS NECESSARY FOR LOAN

- Application is to filed with a passport sized photograph.

- PAN card, aadhar card , voter Id , Utility bills etc for KYC

- Certificate of business registration

- Patent’ registration certificate

- Any other document as required by the lender.

Procedure to apply for a loan without collateral for startup :

Various lender offers various loans at different rates , borrower is advised to compare all of them by visiting IFCCL , to get the best deal among all. Collateral is not required only on unsecured business loans.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.