Mistake in ITR Filling to be avoided while Filing ITR

Taxpayer should avoid all the mistake in Income tax return filling to be avoided while Filing ITR, The process for correcting errors depends on the nature of the mistake and the stage of the filing process you’re in. Here’s what you can do:

Before submitting the ITR return: If you haven’t submitted your return yet, you can simply go back and correct the mistake in the relevant section of the form. Most online platforms and tax preparation software allow you to edit your entries before final submission.

After Filling ITR but before assessment: If you’ve already submitted your return but it hasn’t been assessed yet, you may be able to revise it using the online portal or by filing a revised return. The procedure for this varies depending on the tax authority in your country. Check the guidelines provided by your tax authority for instructions on how to file a revised return.

After assessment: If your return has already been assessed and you’ve discovered an error, you may need to file an amendment or correction. Again, the process for this varies by jurisdiction. You might need to file an amended return or submit a correction form, depending on the specific requirements of your Income tax authority.

Remember that it’s important to rectify any errors in your tax return as soon as possible to avoid potential penalties or complications down the line.

Table of Contents

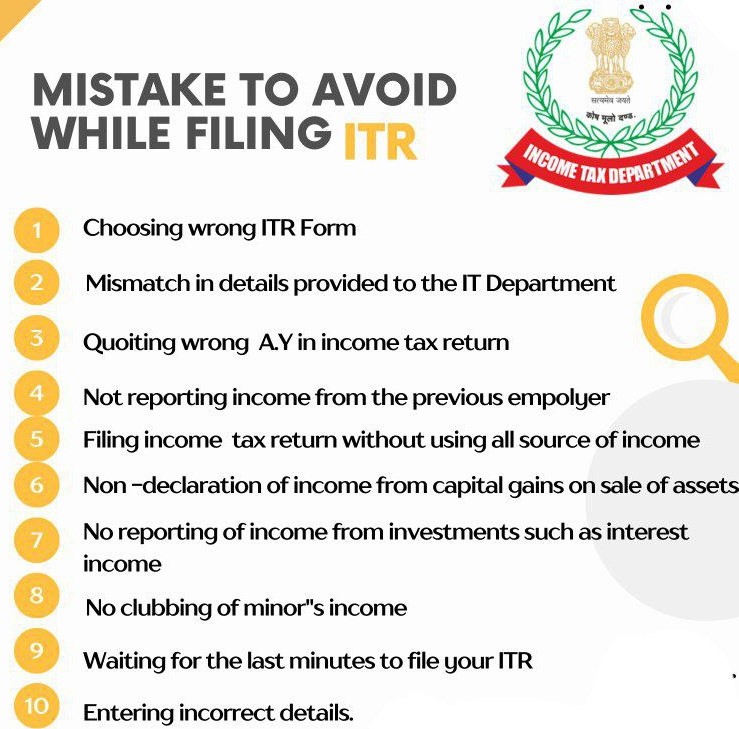

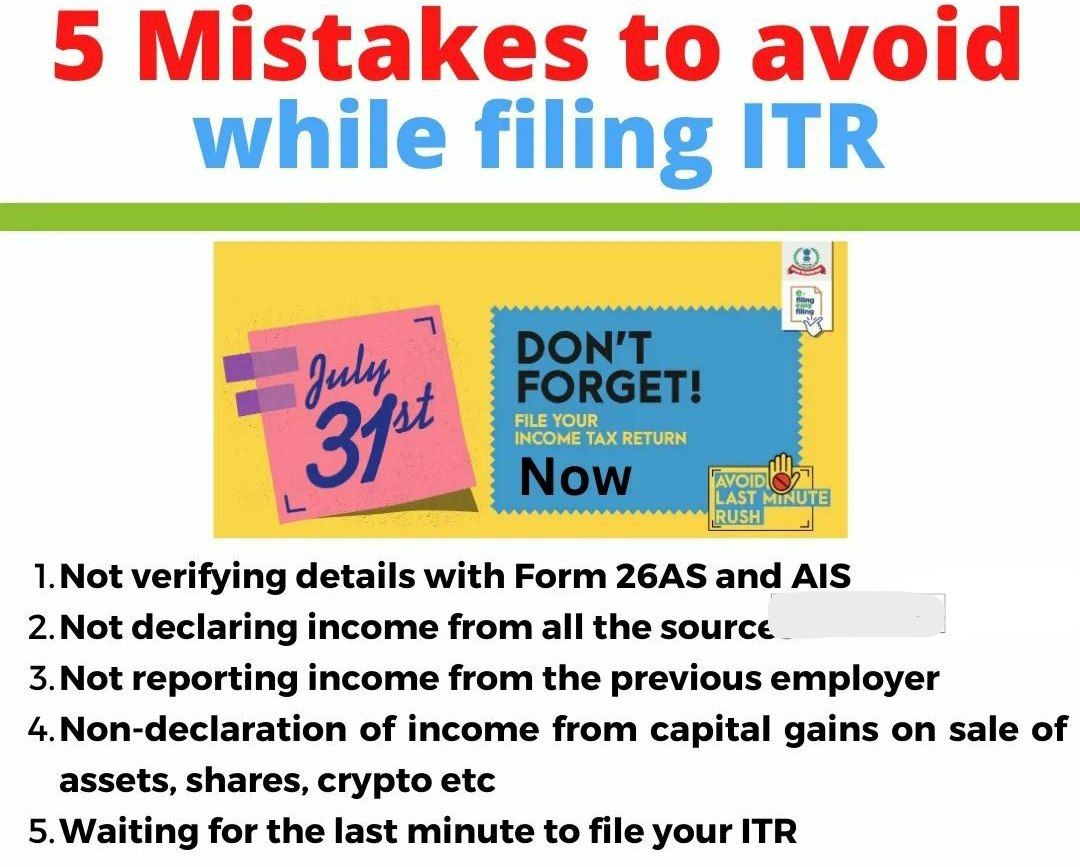

What are the Common ITR mistakes to avoid ?

When filing your ITR, it’s crucial to avoid mistakes to ensure accuracy & compliance with Income Tax Act 1961. Here are some mistakes to avoid:

Omitting income: Avoid omitting any income, no matter how small or insignificant it may seem. All income, including interest income, dividends, rental income, & any other earnings, should be reported in the Income tax return.

Claiming incorrect deductions or exemptions:

Make sure to correctly claim deductions and exemptions that you’re eligible for under the tax laws. Common deductions include those for investments such as PF, PPF, LIC Premiums, & contributions to Pension Funds, among others.

Not reconciling Tax Deducted at Source details:

We needed to Cross-verify the Tax Deducted at Source details from Form 26AS with details provided by Taxpayers employer, banks, or any other diductors. Ensure that all Tax Deducted at Source amounts are correctly reported in Taxpayer ITR Return to avoid any discrepancies.

Incorrect personal information:

Mistakes in personal information can lead to processing delays or complications, So Taxpayer must Ensure that all personal information such as name, PAN, address, & contact information are accurately provided..

Failing to report foreign income & assets:

Failure to disclose foreign assets and income can lead to penalties and legal consequences. If Taxpayer have foreign assets or income, Taxpayer must Ensure that Taxpayer must comply with the reporting regulations needs prescribed by Income tax Act 1961.

Ignoring filing deadlines: Be aware of the due dates for filing your tax return and ensure timely submission. Late filing can attract penalties and interest charges.

Incorrect computation of income: Carefully calculate Taxpayer Gross total income from all Income sources & make ensure that it’s accurately reported in the appropriate sections of the ITR form. Include income from salary, capital gains, house property, business or profession & other sources as applicable.

Incomplete or illegible documentation:

Ensure that all needed Income Tax documents & relevant supporting evidence are attached to Taxpayer ITR Return where required. Moreover, Taxpayer must ensure that all income Tax Supporting documents are legible & clearly presented.

Not reviewing the return before submission: Before submitting your tax return, carefully review all entries and calculations to identify any errors or discrepancies. Double-check the accuracy of all information provided to avoid filing an incorrect return.

Not keeping records: Maintain proper records of all income, expenses, investments, deductions, and tax-related documents. These records will be helpful for future reference and in case of any tax audits or inquiries.

In case we avoiding above normal mistakes & Make ensuring accuracy & Income tax compliance with Income tax Act 1961, you can file your Income tax Return correctly & efficiently.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.