Company Registration in Gurugram: A Step-by-Step Guide

Company Registration in Gurugram: A Step-by-Step Guide

Company Registration in Gurugram is a simple and straightforward process; registering as a Private Limited (Pvt Ltd Registration) in Gurugram is the first step in the corporate route; it is a structure one where your liability in the event of a failure is limited to the capital invested; this benefit is not available in a proprietary business, where your liability is unlimited. You’ve decided to incorporate your business in Gurugram?

Please contact us at 9555555480 if you have any questions. There is a big variation between having a great idea and turning it into a successful start-up company.

Please contact us at 9555555480 if you need help registering a company in Gurugram.

Complete guide to Company Registration – How to Register a Company in India:

As an entrepreneur, you have managed to establish and run a business. The first step is to decide on the structure of the business and to begin the process of Company Registration in India.

Start a company quickly and easily:

Due to various benefits such as fundraising, equity dilution, and easy FDI, private limited companies are the most popular in India (Foreign Direct Investment). IFCCL provides company registration starting at Rs.0/-; call us at 9555555480 for more information. The decision to establish a company is also known as pvt Ltd company registration.

Company Registration:

Because its investors preferred the option of company registration, the Private Limited Company is the best choice for start-up and large businesses. The process of registering a company is governed by the Companies Act 2013 and the Company Incorporation Rules 2014, both of which are issued by the Ministry of Corporate Affairs of the Government of India and fall under the jurisdiction of a regional Registrar of Companies. The cost of company registration in India is determined by the number of directors, the company’s share capital, and the state of registration. IFCCL specialists in the establishment of a private limited company, a one-person company, a Nidhi company, a section 8 company, a producer company, or an Indian subsidiary. The typical time it takes to incorporate a company is 10 to 15 working days, depending on how quickly the government processes the documents and how quickly the client submits them.

With a notification issued on March 30, 2019, the government of India established a combined streamlined form for acquiring GST registration, ESI PF registration, and company registration in the name of ease of doing business.

Benefits of Company Registration

- Separate legal identity:

One of the most significant advantages of company registration is that the company becomes an independent and distinct legal entity.

- Limited Liability:

A private limited company is a legal entity distinct from its shareholders.

- Perpetual succession:

One of the major advantages of forming a private limited company is that the company’s life does not end even if all members die, and the shares are transferred to the legal heirs.

- Ease of formation:

Unlike other forms of registration, company registration is completed entirely online, via the Ministry of Corporate Affairs website www.mca.gov.in.

Company Registration Portal of Government of India

- Transferability of shares is easy and free:

The shares of a private limited company can be easily transferred; there is no need to redo the entire partnership deed in case of partnership or reconstitution of LLP dead if it is an LLP.

- Property can be owned in the name of the company (Company as Owner):

A company is a separate legal entity with the authority to purchase, own, enjoy, and alienate property in its own name.

- Raising Foreign Direct Investment:

During the formation of a private limited company, any non-resident or foreign national can make an investment using the automatic route, which does not require government approval.

A guide to business registration in Gurugram: Types of Legal Entities with Directors and Shareholders.

You could be a tech or non-technical partner or a single founder when forming a firm in Gurugram. Gurugram is India’s startup capital and investment capital.

- Private limited company and

- LLP (limited liability Partnership) and

- One Person Company.

Apart from the founders, depending on the legal entity, you can refer to investors as shareholders. In most cases, the founders and shareholders are the same in the beginning because they are investing money in the business and running it on their own.

A brief guide to selecting the best legal entity to start a business, Company Formation in Gurugram:

a) Formation of a Private Limited Company.

When you have two co-founders or want to raise money from angel investors or venture capitalists in the future, always register a private limited company in Gurugram.

b) Formation of a Limited Liability Partnership | LLP:

When you have two partners or co-founders, but not enough money to invest in the venture for the long term, and you need limited liability in the firm, LLP company registration in Gurugram is the best option.

c) One Person Company Registration – OPC is similar to a private limited:

company, so if you are the sole founder of the company and only need a limited liability in the business with company legal status and 100% control over the business, go with the One Person company registration in Gurugram.

Apart from the above three legal entities, if you have any untested business ideas, you should always choose simple sole proprietorship company registration in Gurugram to test the ideas before proceeding with proper pvt. ltd company registration.

Table of Contents

Formation of a Private Limited Company in Gurugram:

The registration fee for a private limited company is Rs 8,999. Because of the company formation approval process and time involved Limited Liability Partnership, you can register a private limited company in Gurugram within 5–10 working days.

Limited Liability Partnership:

Limited Liability Partnership registration costs Rs 10,000 (includes taxes) and can be completed in 10-15 working days in Gurugram.

One-person company:

One person company registration starts at Rs 10,000 (inclusive of taxes) and an OPC can be registered in Gurugram in 10 – 15 working days.

Partnership Firm:

Registration of a partnership firm in Gurugram begins at Rs 10,000 (inclusive of taxes) and takes 5 – 10 working days.

Foreign Subsidiary:

Registering a branch office or a wholly owned subsidiary in India takes 30–45 days, and the cost of registering a wholly owned company starts at Rs 40,000.

Gurugram has a new company registration process.

SPICe+ Form, As part of the government’s Ease of Doing Business (EODB) initiative in India, the Ministry of Corporate Affairs launched a new web form known as SPICe+. This web form will be used to handle a variety of Company registration services, including name reservation, company incorporation, DIN allotment, PAN, TAN, ESIC, EFPO, Bank Account Opening, and Professional Tax. Following its implementation, the new SPICe+ form will be used to process all new name reservations and incorporations.

Gurugram Corporate Registration Process: The integrated company registration form can be filed after the company name has been approved through the RUN application platform. Only SPICe+ application process can be used to reserve the name. Only one name can be submitted with the SPICe form for approval, but if the name is refused, the name can be re-submitted with another two additional times with another name.

Process to forming Private Company in Gurugram:

To register in Gurugram a private limited company, CA/CS/Lawyer requires support, as it involves legal procedures, a complicated process, but is not concerned about these issues. Our team of experts is concerned about them.

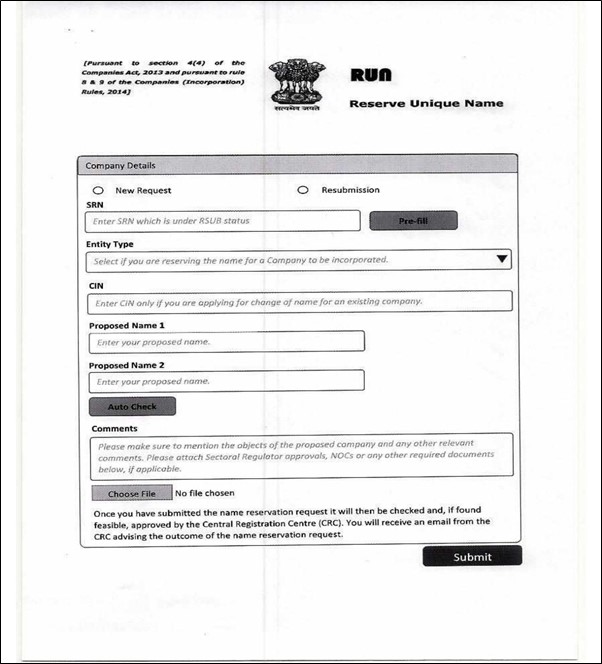

Step 1: Fill out the RUN (Reserve Unique Name Form ). (Name Availability).

Step 2: Obtain the DSC and the SPICE INC-32 form (E Form used for Company Registration).

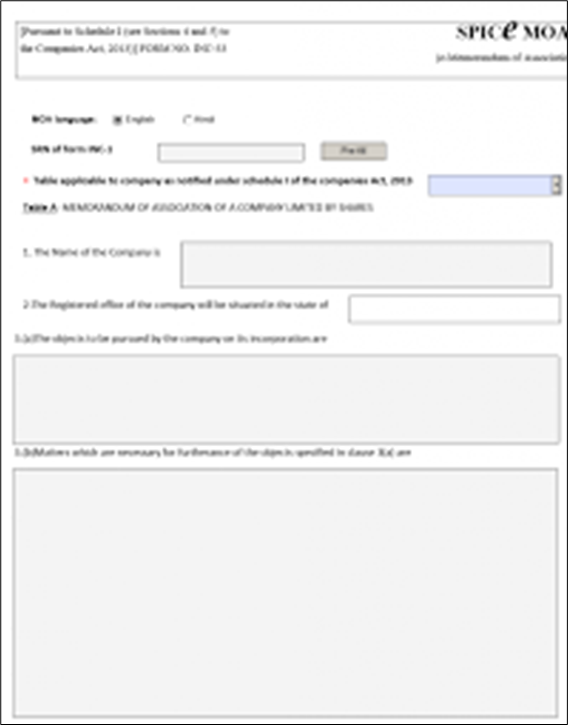

Step 3: Create a Memorandum of Agreement (MOA) in SPICE INC – 33 and AOA. Registration of a company in SPICE form.

Step 4: Submit a PAN and TAN application along with the SPICE INC -32 form (E Form used for Company Registration).

Step 5: Apply for ESI and PF registration in addition to company registration.

Step 6: After completing the above-mentioned company registration process, RoC.

Step 7: The Ministry of Corporate Affairs issues a Certificate of Incorporation.

So, the next time you’re wondering how to register a company in India, just visit our website and take advantage of our services. Now that you understand the steps involved, we will delve into the intricate details of company formation and procedures.

Complete Process of Company Formation in Gurugram:

We have the option of using any of the methods for name approval:

- Approval through RUN form route

- Direct SPICE Route

Method 1: Incorporating a Business Using the RUN (Reserve Unique Name) Form.

RUN(Reserve Unique Name) From grants only two (2) chances to apply, one for the first time and the other for the second time. You must ensure that the names are not generic and closely like those of other organisations. You must also have a thorough awareness of name availability requirements.

We can apply for two names in one application, and in the case of resubmission, we can apply for the next two names.

You can check the names using this government portal link, or you can read more about company name selection on our website.

METHOD 2:

Step 1: Apply for company registration directly in SPICE INC -32 and receive a direct certificate of incorporation. The only drawback is that we can only apply for one name, and all legal documents must be fully prepared to proceed. If the name is rejected, we must completely redo all documents, including INC- 9 (Affidavit) and DIR -2, as well as all other documents, including NOC from the owner.

Step 2: Fill out the SPICe (INC-32) form for Gurugram company registration.

Apply for the DSC ( Digital Signature) The following are the advantages of using the SPICe (INC-32) form for company registration in Gurugram.

- Application for DIN allocation (Director Identification Number).

- Reservation of the firm’s name.

- The formation of a new business.

- PAN and TAN application.

Step 3: E-MoA (INC-33) (INC-34):

AOA Articles of Association

The terms e-MoA and eAoA stand for electronic Memorandum of Association and electronic Articles of Association, respectively.

In company registration, the Memorandum of Association serves as the foundation, identifying the lines of business that the company will do as well as additional activities relevant to its main business.

The powers, rights, and obligations of the directors and shareholders are defined in the articles of association used in the business registration procedure.

Step 6: Apply for a PAN and TAN:

You must apply for PAN and TAN using forms 49A for PAN and 49B for TAN utilizing this one form SPICe.

Following the submission of the SPICe form, the system will automatically produce these forms.

Step 7: Apply for GST Registration:

Request for registration with GST and ESI and PF together with registration in the company The company application will be submitted using e-form AGILE (lNC 35), which contains a request for the following numbers, i.e.

(a) GSTIN and

(b) ITPFO and

(c) ESI

Cost of Company Registration in Gurugram:

The cost of company registration in Gurugram would depend on the legal entity because the government fees are based on the share capital it would cost ranging from Rs 11,999 to Rs 19,999 for Private Limited Company Registration in Gurugram and pvt ltd company in Gurugram is the best choice given the structure and ease of doing business LLP company registration in Gurugram cost in this range 8,999 to 10,999 rupees. The cost of forming a one-person corporation in Gurugram ranges from Rs 11,999 to Rs 19,999 rupees.

The Most Effective Way to Locate Gurugram Company Registration Consultants

Your IFCCL Experts is here to help you with your Private Limited company registration in Gurugram. Email us at info@caindelhiindia.com or call us at 9555 555 480, and we’ll walk you through the procedure.

AFTER COMPANY REGISTRATION IN GURUGRAM, WHAT OTHER REGISTRATION IS REQUIRED?

The following is a list of mandatory registrations that must be completed after a company is registered in Gurugram. Registration under the Shop Act (Shop & Establishment Act Registration) The Department of Labor issues a Karnataka Shops and Commercial Establishment licence, which is required for all firms incorporated in Karnataka Post Company Registration in Gurugram.

Registration of Import and Export Codes:

Obtaining an Import Export Code is required GST REGISTRATION when your company registration in Gurugram is done and your organisation is a software exporter/goods exporter.

If the turnover exceed the limit of Rs 20 Lakhs per year, any post-enrollment company that is engaged in any trade or professional should get GST REGISTRATION.

How is a company name registered?

The selection of business name, the name follows certain guidelines, is the most significant task in the formation process.

How do I choose a registration company name?

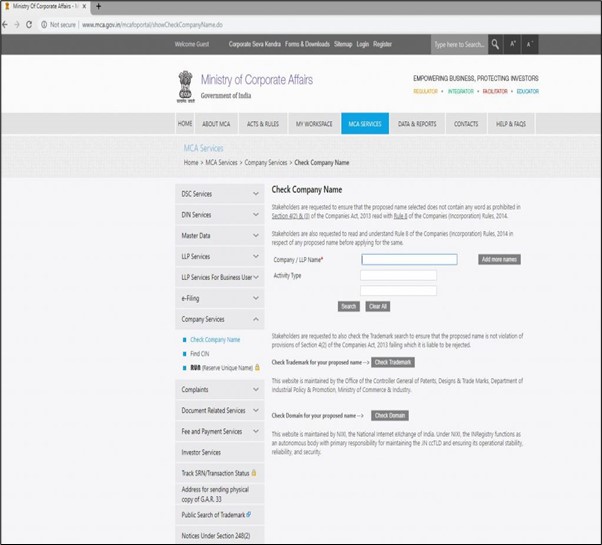

Do you know that the central registration centre of MCA rejects how many companies’ names? And why is it very important to check the availability of company names?

MCA, on the other hand, rejects more than 70% of the names applied for online. Please double-check the company name on the following link before starting the company registration procedure: http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do

What are the documents needed to register a business?

Check out our entire guide on how to choose a company name.

The documents needed to register a business are mentioned below.

Shareholders’ and directors’ identities and addresses must be verified.

In the name of the director, the most recent bank statement or telephone bill.

In case the registrar’s office is rented together with NoC from the owner together with EB CARD (Electricity Card).

The tax receipt is mandatory in case of own property.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.