CORPORATE AND PROFESSIONAL UPDATE SEPT 20,2016

TODAY UPDATES:

DIRECT TAX:

CBDT has issued a clarification regarding u/s 119 of the Income Tax Act, 1961 dated 9th September 2016 vide F. No. 225/195/2016-ITA II dated 14th September 2016. CBDT clarified that the extended due date of filing return would also apply for the tax audit report.

ITAT Indore in the below citied case held that the failure of the assessee to comply with the notice u/s 142(1) cannot be said to be a default which may justify the levy of penalty u/s 271(1)(b) of the Act.- (M/s. M.P. State Civil Supplies Corporation Limited Versus ACIT, 2 (1) , Bhopal)

Calcutta High Court In the below citied case dismissed the petition as the assessee had questioned the territorial jurisdiction of the assessing officer and the assessing officer held that the assessee had lost the right to raise the objection by efflux of time. (M/s. ELITE PHARMACEUTICALS AND ANR. Versus INCOME TAX OFFICER, WARD 46 (1) , KOLKATA)

Bombay High court in the below citied case held that retrenchment compensation paid by subsidiary to the workers of the two units which belonged to the assessee and which were transferred to the subsidiary and which amount was reimbursed by the assessee under a contractual agreement – allowable as an admissible deduction (The Wallace Flour Mills Co. Ltd. Versus The Commissioner of Income Tax Central CircleI)

ITAT Delhi in the below citied case held that once no sum in respect of accrual of interest is credited in the books of accounts of the assesssee it is really not known how any figure reflected in Form 26AS can be treated as income of the assessee as Form 26AS neither forms part of books of accounts of the assessee.(VIKASH YADAV Versus ITO, WARD-2, REWARI)

ITAT disallows Rs 76 lakh incurred by Pharma Co. on foreign trip of doctors and their spouses Assistant Commissioner of Income-tax, Circle 6 (3), Mumbai v. Liva Healthcare Ltd. [2016] 73 taxmann.com 171 (Mumbai – Trib.)

Period of holding of shares would commence from date of its conversion from stock-in-trade to capital asset Cambay Investment Corpn. Ltd. v. Deputy Commissioner of Income-tax [2016] 73 taxmann.com 124 (Gujarat)

Cash deposited by partner in saving account couldn’t be held as unexplained when it was cash sales of firm Income-tax Officer, Ward- 30 (1), New Delhi v. Vinod Chadha [2016] 73 taxmann.com 118 (Delhi – Trib.)

Valuation loss in open derivative contract is allowable Mili Consultants & Investment (P.) Ltd. v. Deputy Commissioner of Income-tax, Circle-4(3) [2016] 72 taxmann.com 141 (Mumbai – Trib.)

Direct cash deposit in supplier’s bank a/c not attracts disallowance u/s 40A (3) [Bolkunda Pachwai & (S) C.S. Shop vs. Income-tax Officer (ITAT Kolkata)].

CBDT clarifies due date extension also applicable to Accounts audited under Sec 44AB vide notification no 225/195/2016-ITA II.

The CBDT on Monday said assessees taking advantage of direct tax dispute resolution scheme, 2016 will be required to pay taxes within the stipulated period to avail the relief under the scheme.

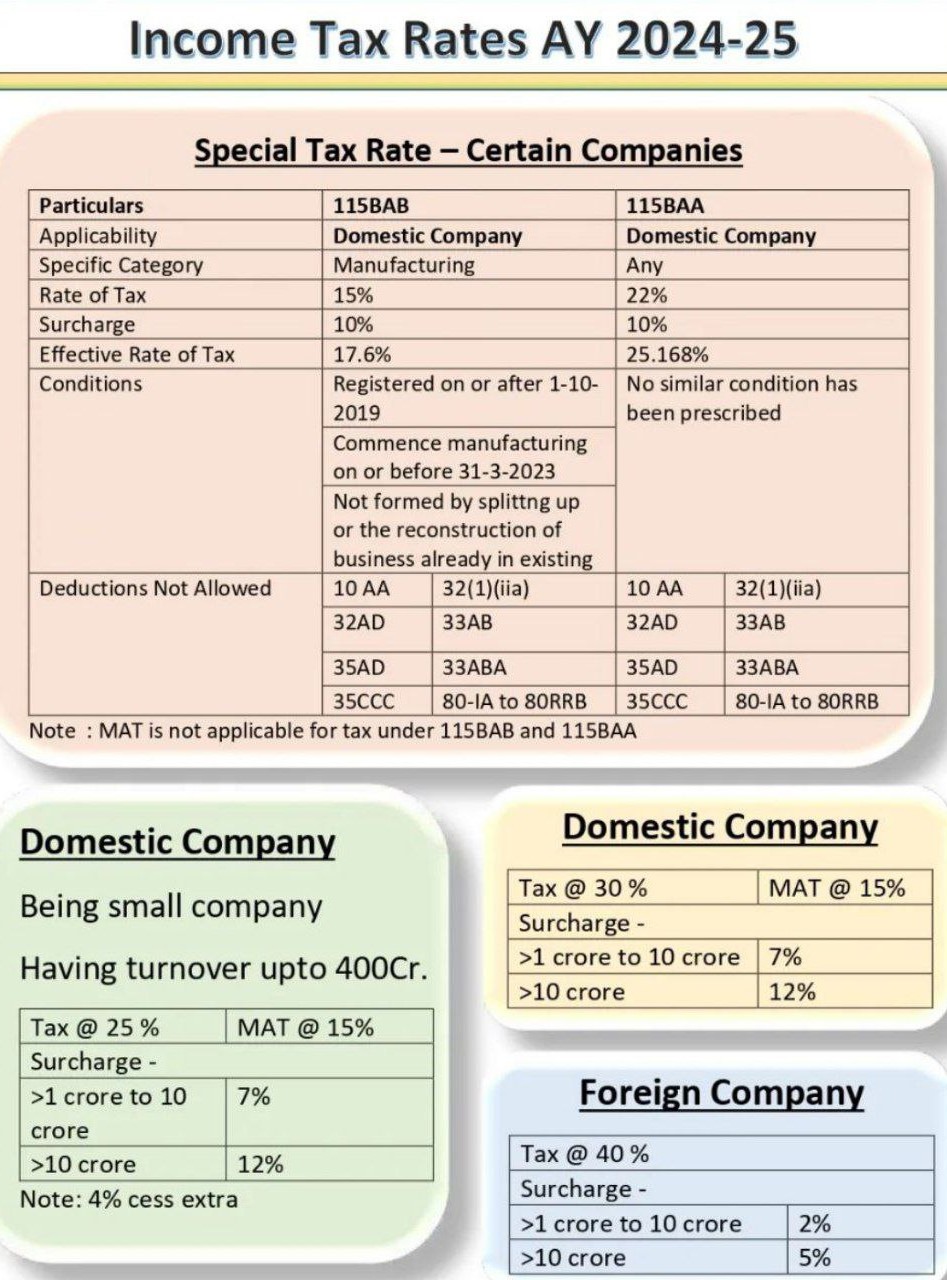

Corporate Income tax Rate

INDIRECT TAX:

Cenvat credit in respect of service tax paid on Rent-a-cab service for picking up and dropping down of its employees to the factory and back rightly denied – Tri – Service Tax (Wipro Ltd. Versus Commissioner of Central Excise, Puducherry)- 2016 (9) TMI 537 – CESTAT CHENNAI – Service Tax

The only irregularity committed by the appellant is that the Headquarters of the appellant was not registered as ISD Distributor. This being a procedural irregularity therefore cannot be made the basis of denying CENVAT Credit on services received by the appellant – Tri – Service Tax (Cement Manufacturing Company Versus Commr. of Central Excise & Service Tax, Shillong – 2016 (9) TMI 536 – CESTAT KOLKATA – Service Tax

Supreme Court in the below citied case held that the value of the work entrusted to the sub-contractors or payments made to them shall not be taken into consideration while computing total turnover – (Larsen & Toubro Limited Versus Additional Deputy Commissioner of Commercial Taxes & Another

CESTAT Chandigarh in the below citied case held that where amounts collected by the appellants as Sales Tax from the customers but not paid to the State Sales Tax authorities.50% of the amount not payable to state is liable to be included in the value.( M/s Honda Motorcycles & Scooters India Pvt. Ltd. Versus CCE, Delhi-III)

Job-worker to be treated as manufacture for medicines made for brand owners

Commissioner of Central Excise & Service Tax, Ahmedabad-II v. Intas Pharmaceuticals Ltd. [2016] 73 taxmann.com 144 (SC)

Physician’s samples packed in “special packs” are to be valued on basis of price of “regular packs” Commissioner of Central Excise, Mumbai v. Johnson & Johnson Ltd. [2016] 73 taxmann.com 143 (SC)

Depreciation already allowed before initial AY couldn’t be artificially carry forward to deny sec. 80-IA relief Eagle Press (P.) Ltd. v. Assistant Commissioner of Income-tax, Company Circle II(1), Chennai [2016] 73 taxmann.com 141 (Madras)

MCA UPDATE :

MCA notified that the Remuneration Limits for the Companies having no or inadequate profits can be enhanced without the Central Government approval, that is, Section II of Part II has been substituted.

MCA doubles limit of managerial remuneration payable by Cos. having no profit or inadequate profit REGD. NO. D. L.-33004/99 Dated SEPTEMBER 12, 2016

Vijay Mallya’ rightly summoned when cheque issued by ‘Kingfisher Airlines’ was dishonoured: HC, Vijay Mallya v. Delhi International Airport (P.) Ltd. [2016] 3 taxmann.com 95 (Delhi)

FAQ ON COMPANY LAW:

Query: If during the lean period, there is some activity being carried out by the company, which is not in its normal course of business, and there is a receivable or outstanding from such activity, whether it shall be considered as “Trade Receivable” in Financial Statements of Company?

Answer: If the receivables arise out of sale of materials or rendering of services in the normal course of business, it should be treated as trade receivables. Otherwise, it is treated as other assets in Financial Statements of Company.

Query: A company has a single class of equity shares. Is the company still required to disclose rights, restrictions and preferences with respect to the same in the Financial Statements?

Answer: Schedule III of Companies Act 2013 requires disclosures of rights, preferences and restrictions attached to each class of shares. If a company has only one class of equity shares, it is still required to make this disclosure in the Financial Statements of Company.

Query: Should investment in LLP should be disclosed in Financial statements of company?

Answer: LLP is a body corporate and not a partnership firm as envisaged under the Partnership Act, 1932. Hence, disclosures pertaining to investment in partnership firms will not include the investment in LLP. The investment in LLP should therefore be disclosed separately under ‘Other Investments’. Other disclosures prescribed for investment in a partnership firm need not be made for investment in an LLP.

Query: How will a company classify its investment in preference shares, which are convertible into equity shares within one year from the balance sheet date? Will it classify the investment as a current asset or a non-current asset?

Answer: In accordance with the Schedule III, an investment realisable within 12 months from the reporting date is classified as a current asset. Such realisation should be in the form of cash or cash equivalents, rather than through conversion of one asset into another non-current asset. Hence, the company must classify such an investment as a non-current asset, unless it expects to sell the preference shares or the equity shares on conversion and realise cash within 12 months.

GST UPDATE:

GST: MoF notifies Constitution of Goods & Services Tax Council – Notification – Goods and Services Tax –F.No.31011/09/2015-SO (ST) – S.O.2957(E), dt.15-9-2016.

GST: PM Narendra Modi wants all steps for GST rollout to be completed before April 1, 2017.

Under GST late returns would attract fee @ 100 per day subject to maximum of Rs 5,000/- maximum fee in case of annual return is 0.25% of aggregate turnover.

DGFT UPDATES:-

DGFT has issued a clarification in regard of issuance of Free Sale & Commerce Certificate to Merchant Exporters vide circular No. 02/2015-20 dated 15/09/2016.

ICAI UPDATE :

Kindly pay ICAI membership/COP fee for the year 2016-17 by 30th September, 2016.

CA held as guilty of professional misconduct as he had disclosed info gathered during audit Council of The Institute of Chartered Accountants of India v. Devinder Kumar Jain [2016] 73 taxmann.com 103 (Delhi)

KEY DATES:

Peace cannot be kept by force; it can only be achieved by understanding. -Albert Einstein

The mind is not a vessel to be filled but a fire to be kindled. -Plutarch

We look forward for your valuable comments. www.caindelhiindia.com

FOR FURTHER QUERIES CONTACT US:

W: www.caindelhiindia.com E: info@caindelhiindia.com T: 9-555-555-480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.