Foreign Account Tax Compliance Act Reporting for investors

Foreign Account Tax Compliance Act (FATCA) Reporting for investors:

- Internal Revenue Service must receive information about American citizens’ or NRI financial accounts located outside of the country under the terms of the FATCA. In 2010, the legislation was released. The law intends to create a transparent, traceable tax system and prevent American taxpayers from avoiding US-based taxation on the income of actual or legal persons.

- As per Bank operating transactions with FI & Other banks internationally, this collaboration objective to prevent facing a TDS or a transaction reject from other FU which may affect customers’ transactions. In this reference Bank needs clients cooperation to respond on their questions & file more documents and information. Normally Bank reserves the rights to consider closing customers’ accounts in case that specific clients deny responding the questionnaire or submitting the Bank more documents related to Foreign Account Tax Compliance Act.

- The USA Tax Dept came up with Foreign Account Tax Compliance Act guidelines in 2010 to enforce tax compliance and step towards the avoid tax evasion.

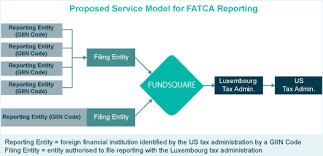

- Inter-Govt Agreement (IGA) signed agreement with Indian Govt with the USA in the year 2015 for the implementation of Foreign Account Tax Compliance Act (FATCA) Reporting for investors.

- With effective January 2016, it is mandatory for all Indian & Non-Resident Indians investors (existing and new) to file a Foreign Account Tax Compliance Act (FATCA) self-declaration. While the details might be slightly different with each financial institution, the Normal details needed is as given below:

-

- Name

- PAN (Permanent Account No)

- Address

- Country of birth

- Place (city/state) of birth

- Country/Nationality

- Business or profession or Occupation

- Gross Annual Income

- In case resident of other country? If yes, then the Nationality of residence, Income tax ID No & type

- The declaration asks explicitly to include the United States of America as a country of residence if you are a a green cardholder or United States of America citizen. This United States of America citizen or green card holder even if you have moved to India & are now an Indian resident of India.

- Internal Revenue Service of United States of America requires an annual report from Indian and foreign banks located in India against bank accounts as maintained in India by person of United States of America about maximum outstanding balance in account in calendar year in India.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.