Income tax Guidance on late filing fee (u/s 234F) on Income Tax return filling

Table of Contents

Guidance on New Income Tax Section 234F (Fee for delayed filing of Income Tax Return)

Most of us have a habit of putting off tax preparation until it is absolutely necessary. For us, failing to meet the tax filing deadline simply means filing a late return. But here’s a bit of advice to all such people!!

Since last year, you must be proactive and extra cautious when it comes to filing your income tax returns.

We have covered every aspect of the applicability of section 234F under the Income Tax Act of 1961 in this guide. To avoid being subjected to the Section 234F penalty, read carefully.

Q.: What exactly does Section 234F mean?

Mr. Arun Jaitley, our honorable Finance Minister, introduced a new section 234F in Budget 2017 to ensure timely filing of income tax returns. If a person is obligated to file an Income Tax Return (ITR forms) under the rules of the Income Tax Law [section 139(1)] but does not do so within the statutory time limit, he must pay late costs when completing his ITR form, according to section 234F of the Income Tax Act. The amount of fees will be determined by the time of filing the return and the total income.

Q.: When is it necessary for a person to file an income tax return?

If you fall into one of the following categories, you must file your income tax return:

- If the gross total income (before any deductions under sections 80C to 80U) exceeds the basic exemption limit, which is Rs.2,50,000 (for individuals under 60 years) or Rs. 3,00,000 (for individuals 60 years and above but less than 80 years old) or Rs. 5,00,000 (for individuals 80 years and above), as applicable.

- If you own any asset, including a financial interest in any entity located outside of India, or if you have signing authority in any account located outside of India, whether as a beneficial owner or otherwise.

- If you are a beneficiary of an asset that is not located in India.

The basic exemption limit is the maximum amount above which your income is not taxed. To put it another way, if your income exceeds the basic exemption amount, you are obligated to file the return. It is currently Rs.2,50,000 (for individuals under 60 years old), Rs. 3,00,000 (for individuals 60 years and older but less than 80 years old), or Rs. 5,00,000 (for individuals 80 years and older).

Individuals whose total income is less than the basic exemption limit are also required to file an ITR from FY 2019-20 onwards if he has:

- Electricity payment expenses incurred during the year for Rs.1 lakh or higher.

- expense of 2 lakhs or more incurred by himself or another person for foreign journey.

- deposited Rs.1 crore or more in current accounts with a banking company or a co-operative bank

Q.: What are the time limits (due dates) for filing an ITR?

The following are the due dates for filing Income Tax Returns under Section 139(1) of the Income Tax Act for various categories of taxpayers:

| Category | Due date of filing (FY 2020-21) | Due date of filing (FY 2020-21) |

| Individuals who are not required to be audited | 31st July | 31st July 2021 |

| Company or Individual whose accounts are required to be audited | 30th Sep | 31th Oct 2020 |

| Individual who is required to furnish report referred in section 92E | 30th November | 30th November 2021 |

Q.: Who will be covered by 234F’s clauses?

Individuals, HUFs, Companies, Firms, AOPs, and other entities shall be covered by Section 234F of the Income Tax Act of 1961. When the Income Tax Return is filed after the due date, all parties are responsible for late filing fees.

Q.: What is the maximum amount of fees that the Income tax Dept. can levy under section 234F?

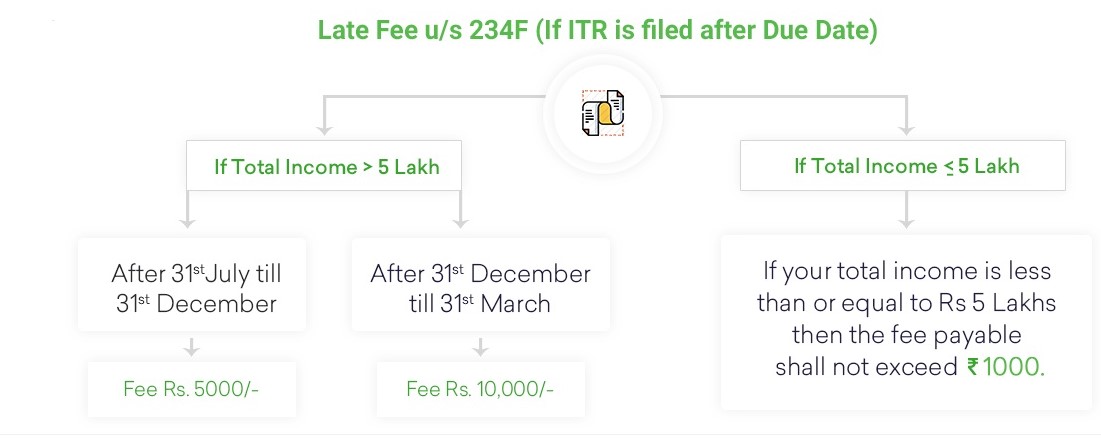

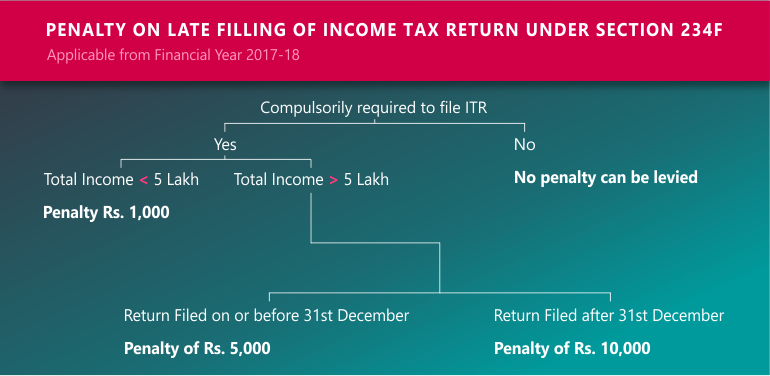

The follows is the amount of fees that can be charged under section 234F of the Income Tax Act 1961 for FY 2020-21 filing.

- If the return is filed after August 31st but on or before December 31st of the assessment year – Rs. 5000

- If the return is filed after the 31st December of the assessment year (1 January – 31 March)- Rs. 10,000.

Important points are as follows:

- The amount of the fee shall not exceed Rs 1000 if the total income after deduction is less than or equal to the five lakh ropes.

- The maximum non-taxable income, i.e. Rs. 2,50 000 for normal citizen (age < 60),Rs. 3,00,000/- for senior citizens (age 60 or over), and Rs. 5,00,000/- for superior citizens (age 60 and higher) shall not be imposed on a penalty ( age 80 or above).

For instance, A is a senior citizen superior. For F.Y. 2020-21 his Gross Total revenue is Rs. 4,95,000/-. A late return is being filed. Is it possible to charge late filing fees? Because A is a super senior person and his GTI does not exceed the basic exemption limit, no late filing fees u/s 234F will be charged.

Calculation of 234 F Late Fees as an example:

Let’s look as an example of the amount of fee that would be payable under section 234 F on the next income and return filing date.

| Total Income | Income Tax Return Filing Date | Fees 234F |

| 3,00,000 | 05/07/2021 | NA |

| 6,00,000 | 31/07/2021 | NA |

| 10,00,000 | 25/07/2021 | NA |

| 25,00,000 | 10/09/2021 | 5,000/- |

| 4,00,000 | 10/01/2021 | 1,000 |

| 9,00,000 | 15/10/2021 | 5,000 |

| 4,50,000 | 13/11/2021 | 1,000 |

| 18,00,000 | 15/02/2022 | 10,000 |

Q.: When do the provisions of section 234F’s penalty provisions take effect?

The penalty provisions of section 234F will take effect on April 1, 2018, and also apply to income tax returns due for the FY 2020-21. (Or AY 2021-22). As a result, section 234F of the Income Tax Act has been added. Furthermore, the proposed shorter time restrictions for making assessments under various provisions are predicated on the requirement that returns be filed on time.

Q.: What was the reason behind introducing Section 234F’s penalty?

It is important that the income tax returns are filed within the due dates indicated in section 139 in order to improve tax compliance (1). Accordingly, Article 234F of the Revenue Tax Act was inserted. In addition, the proposed reduced time limits for assessment under several sections are also based on the precondition of filing returns on time.

Q.: What is the best way to pay 234F fees?

According to the Finance Act of 2017, late fees under section 234F can be paid through “Self-Assessment”—-> “Others,” and this penalty can be paid starting in FY 17-18.

- Challan No. 280.

- Payment method – self-assessment (300).

- Fill in the 234 F amount in the “Others” section.

If you miss the deadline for reporting your ITR, under which part will the fees under section 234F be paid?

Section 140A requires the payment of fees under section 234F. (Self-Assessment Tax). Section 140A has been amended as a result, so that in the event of a delay in furnishing a return of income, in addition to the tax and interest payable, a fee for delay in furnishing a return of income is also payable.

The latest details on the late fee under section 234F:

In Budget 2020, no change was made in the late fee provisions u/s 234F. It will apply to the existing taxation slabs as well as the new tax system.

From 31 July 2020 to 30 November 2020, the date for filing income tax return for FY 19-20 was extended.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.