Taxation on Employee’s Stock Option Plan in India

Table of Contents

Taxation on Employee’s Stock Option Plan (ESOP) in India

According to section 17(2)(vi), shares are vested to employees (vesting) because they have an absolute right to collect them after a certain amount of time has passed from the date of grant. When an employee is given those choices, he subsequently begins to exercise them (exercise). When an executive exercises his or her stock options, the company allots shares to the employee (allotment). In India, Employee’s Stock Option Plan’s are granted in accordance with the Securities Exchange Board of India Guidelines, 1999. Companies provide Employee’s Stock Option Plan’s to employees as well as group executives, who are rewarded based on their outcomes.

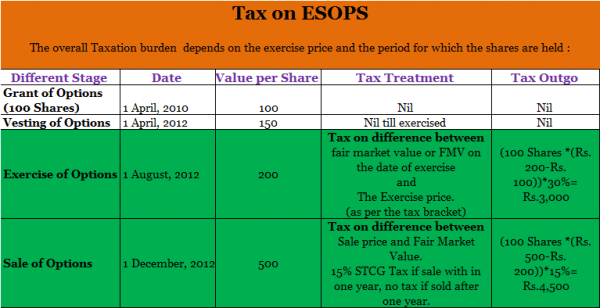

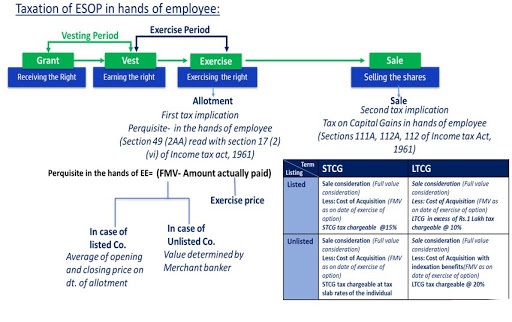

Taxation on Employee’s stock option plan are calculated at two different phases-

- The initial taxation arises when shares are allocated to the employee after he has pursued his option after the vesting period has ended, and

- The subsequent taxation occurs when the employee chooses to transfer the allotted shares under the Employee’s Stock Option Plan.

The difference between the fair market value of the shares on the exercise date and the price paid by the employee for the exercise or subscription of the shares is determined and taxable at the time of allotment of shares on the exercise date. Perquisite value is the name given to this taxable value. When an employee sells the shares that were allocated to him in an Employee’s Stock Option Plan, he must pay tax on the dividends or losses that result from the sale. Such gain is subject to taxation under the heading of “Capital Gains.” Capital gains are further divided into two categories: ‘Short Term Capital Gains’ and ‘Long Term Capital Gains,’ based on how long the stock have been retained.

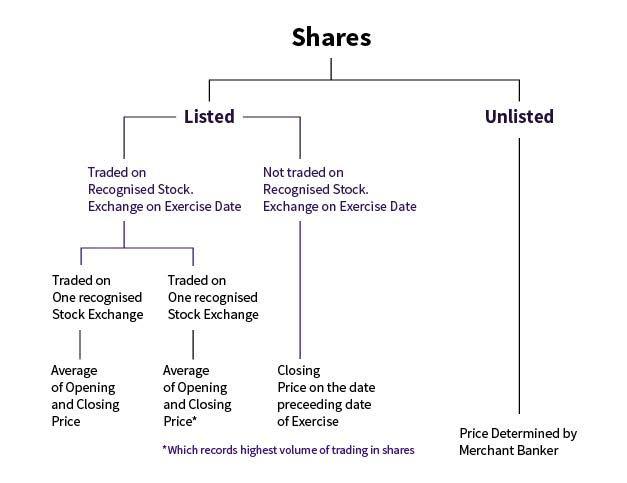

How to calculate the Fair Market Value of ESOP

The initial stage of taxation is, when the option is exercised:

- Employee’s stock option plan will be treated as a perquisite, with a value equal to (Fair Market Value per share – Exercise price per share) x number of shares allocated (on the date of allotment).

- Perquisite = (FMV per share – Exercise price per share) x number of shares allotted.

- The sum determined above as perquisite value of Employee’s stock option plan will be included in XYZ’s salary and will be taxable in the year in which the shares are allotted. Tax Deducted and Collected at Sources must be deducted by the employer on such a sum.

The Subsequent Stage of Taxation, when Employee’s stock option plan are sold:

- Capital profits are calculated as the difference between the sale proceeds and the fair market value of the shares at the time of allotment. i.e. Capital gains = Sale proceeds – FMV of shares at the time of allotment of shares

Are you listed or unlisted?

- Capital income taxes should be incurred if shares are sold. The tax rates vary depending on whether or not the corporation is Listed or Not.

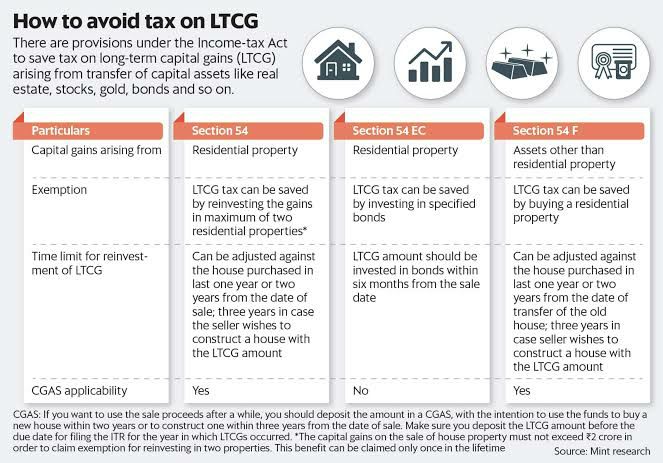

- When the company is Listed, Long-Term Capital Gains applies if the stock is exchanged after a year of acquisition.

- Although the LTCG rate is 10%, earnings of up to Rs 1,00,000 in a financial year are excluded.

- Short-term capital gains (those sold in less than a year) are taxed at a higher rate of 15%.

- If the corporation is unlisted, however, short-term tax rates apply if it is owned for no longer than two years. Short-term capital gains (STCG) are levied at the income tax slab rates, while long-term capital gains (LTCG) are taxed at 20% without cost indexation.

In case of an unlisted firm : The process for issuing an Employee’s stock option plan is as follows,:

- Create a Draft Employee’s stock option plan.

- Convene/Call a meeting of the Board of Directors & approve the plan.

- Call a general meeting of shareholders to approve the plan.

- Pass a special resolution to authorize the Employee’s stock option Scheme (ordinary resolution in case of Private limited Company).

- Within 30 days after passing the special resolution, fill out form MGT-14 and apply it.

- Grant options to qualifying employees after the shareholders approve the Employee’s stock option plan.

- Vesting of Options is a term that refers to the process of a Between the issuance of options and the vesting of options, a minimum of one year must pass.

- Employees’ exercise of options.

- Shares are issued. File form PAS-3 (Return of Allotment) with ROC as options are performed.

- The corporation must keep a Register of Employee Stock Options in form SH-6 and promptly enter the details of each option awarded therein.

Some Limitations of Employee’s Stock Option Plan

- Diversification lacking: Although Employee’s Stock Option plans are typically financed entirely with company shares, employees’ investment portfolios can become heavily weighted in this protection.

- Payout is lower: Employees in a privately owned Employee’s Stock Option Plan may not get the same share price as they would if the shares were publicly traded.

- Difficulties of Cash Flow:If many employees are taking dividends at the same time, employers may have trouble paying the cost of repurchasing significant amounts of shares.

- Expenses are large: Companies who incorporate Employee’s Stock Option Plans will face significant upfront and ongoing costs.

- Dilution of the stock price: The creation and issuance of additional shares for new participants will dilute the equity of all current shares, which is a particularly serious issue for tightly owned companies.

The Issues with respect to ESOPs

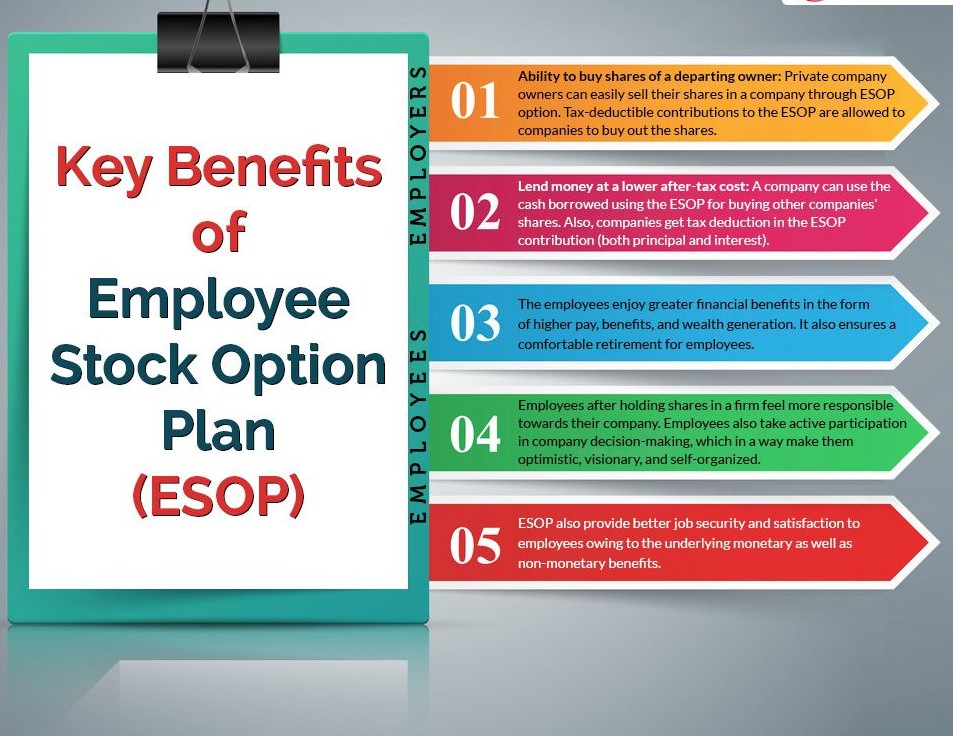

Employee Stock Option Plans (ESOPs) are often promoted as financial mechanisms that promote corporate democracy. Since Employee Stock Option Plans (ESOPs) were adopted, several businesses registered fast growth driven by engaged employees and a democratic decision-making process.

ESOPs also facilitate better financial management. Employees will save up for larger potential payoffs by deferring smaller current payoffs. Additionally, using Employee Stock Option Plans (ESOPs) has significant tax benefits.

Frequently Ask Question on Employee Stock Option Plan (ESOP)

Q: What Is an Employee Stock Option Plan (ESOP)?

An employee stock option plan (ESOP) is a type of employee benefit plan that gives employees a share of the company’s equity. Employee’s Stock Option Plan’s provide different tax incentives to the sponsorship organization, selling shareholder, and members, making them eligible plans.

Q: Why does the company have ESOPs to its employees?

Employee equity investment programs are often used by companies to recruit and retain high-quality employees.

Stocks are normally distributed in stages by organizations. For example, a company might give its employees stock at the end of the fiscal year as an opportunity to stay with the company and get the incentive.

Companies that sell ESOPs have long-term goals in mind. Companies want to keep their employees for a long time, so they they want to turn them into shareholders.

Most IT firms have unprecedented attrition rates, and ESOPs may help them reduce these high attrition rates. Startups sell stocks as a way to recruit talent. Frequently, such companies are cash-strapped and reluctant to pay competitive wages. However, by including an interest in their company in their pay plan, they make them more competitive.

Conclusion

An Employee’s Stock Option Plan may provide major benefits to selling owners, managers, and employees. However, the federal rules covering Employee’s Stock Option Plan’s are complicated, and the expense of setting up and managing one could be higher than with other forms of retirement benefits.

As a result, it’s important to work with consultants who are familiar with the regulatory, accounting, and managerial problems that Employee’s Stock Option Plan’s face. It may be difficult to set up and prescribe an ESOP.

However, with a constant emphasis on education and advice from experienced practitioners, the advantages of an Employee’s Stock Option Plan typically overshadow the difficulties.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.