Who is ineligible according to Section 29A of IBC law ?

Table of Contents

Who is ineligible according to Section 29A of IBC law ?

- When the promoter (or someone in the management or control) of a corporate debtor engages in preferential transactions, undervalued transactions, extortionate credit transactions, or fraudulent transactions, this ineligibility comes into effect.

- This simply means that an insolvent entity whose accounts are classified as Non-Performing Assets is ineligible to be a resolution applicant if it has not been able to pay past due amounts, including interest and charges related to the account before the submission of the resolution plan for one or more years.

- RA must declare that he is qualified under Section 29A of the IBC ( Section 30(1) of the IBC),. The RP is required by Section 30(2) to review each Resolution Plan that he receives in order to verify that it, among other things, “does not contravene any of the provisions of the law for the time being in force” (which would also include Section 29A).

- If the RP approves the Resolution Plan & sends Resolution Plan to the CoC, the Committee of Creditors will decide whether Section 29A applies and, if so, will have the authority to take the appropriate action u/s 30(4).

Resolution Applicant not eligible to be as resolution applicant under IBC Code [Section 29A]

- un-discharged insolvent;

- wilful defaulter;

- classified as non performing asset as per guidelines of the Reserve Bank of India;

- convicted for any offence punishable with imprisonment for Two years or more;

- is disqualified to act as a director under Company Act;

- is prohibited by Securities and Exchange Board of India from trading in securities or accessing the securities markets;

- has been a promoter or in the management or control of a corporate debtor in which a preferential transaction, undervalued transaction, extortionate credit transaction or fraudulent transaction has taken place and in respect of which an order has been made by National Company Law Tribunal;

- has executed an enforceable guarantee in favour of a creditor in respect of a corporate debtor under Corporate Insolvency Resolution Process

Arun Kumar Jagatramka vs. Jindal Steel and Power Ltd (Hon’ble Supreme Court) :

Hon’ble Supreme Court in the matter of Arun Kumar Jagatramka vs. Jindal Steel and Power Ltd, and SC Court given below comments on Section 29A of the Insolvency and Bankruptcy Code: –

- Law maker objective behind enactment of a strict regime in relation to Insolvency and Bankruptcy Code was to provide an tool for timely resolution of company actual creditors’ & their grievances to be resolve.

- The accurate meaning of the Insolvency and Bankruptcy Code would be one which facilitates its salutary objects & clears cobwebs of previous legal regime which was basically a debtor’s paradise.

- A person who is the cause of problem cannot be part of the process of solution.

- IBC Section 29A has come with a specific objective which is to protect the interest of the creditors & Insolvency and Bankruptcy Code Section 29A disallow the indirect entry of Mgt which is responsible for actual default in the company. (ArcelorMittal India Pvt Ltd vs. Satish Kumar Gupta [(2019) & Chitra Sharma vs. UOI [(2018))

Insolvency and Bankruptcy Code under Section 35(f), Which deals with the power of Liquidator also restrict the Liquidator from selling immovable & movable properties of the CD to the RA who is not eligible to file resolution plan.

SC also said that Promoter of the CD cannot plan a compromise or arrangement u/s 230 of Co. Act, 2013 since Promoter of the CD is ineligible u/s 29A of the Insolvency and Bankruptcy Code.

Pursuant to section 240A of the Insolvency and Bankruptcy Code, promoters of Ministry of Micro, Small and Medium Enterprises can be the RA for Ministry of Micro, Small and Medium Enterprises undergoing the Corporate Insolvency Resolution Process,

Even if these promoters are otherwise disqualified under section 29A(c) or section 29A(h) of the Insolvency and Bankruptcy Code, provided they are not disqualified under any other provision of section 29A.

Such Promoters of the Ministry of Micro, Small and Medium Enterprises can also propose compromise or arrangement u/s 230 of the Co. Act, 2013.

More about 29A certificate

- 29A Cerificate under the IBC law

- Related party under section 29a of ibc Code

- Section 29A of IBC act

- Who is ineligible according to section 29A of IBC law

- Time to time change in the IBC Section 29A

- What is ineligibility criteria U/s 29A of IBC Code

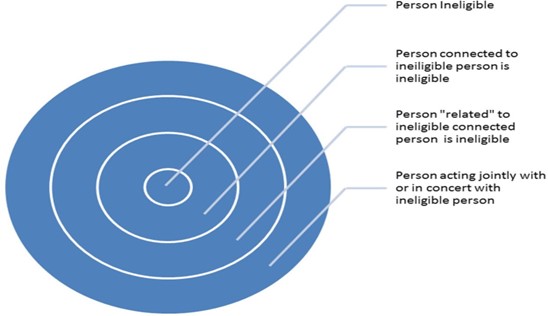

India Financial Consultancy Services Pvt Ltd 3 levels of checks on “connected parties” will assist you in making an informed decision on selecting the right & compliant Prospective Resolution Applicant for your corporate insolvency resolution process or liquidation matter.

Salient features of India Financial Consultancy Services Pvt Ltd Section 29A report:

- Duly signed 29A reports.

- Reports prepared by experienced lawyers & professionals.

- Exhaustive research was conducted on connected parties.

- Reports were prepared in record time.

- Other Popular blog:-

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.