Cryptocurrency Treatment as Goods or Services in India

Table of Contents

The Treatment of Cryptocurrency as Goods or Services in India:

Brief Introduction

- If you’re uninterested in the government’s debate over the topic, whether cryptocurrency be considered or termed as an asset or currency, then herein we would be discussing about a new debate which awaits.

- During & after GST raid on crypto exchanges that virtual currencies trade like bitcoin, ETH etc there has been a tug of war between the GST dept & also crypto industry on whether cryptocurrency is services or goods.

- A virtual currency that can’t be seen, touched or confiscated by anyone. Neither its owner is identifiable nor its purchase and sale i.e. supply chain may be traced. In such a situation, until there’s a ban or regulation on cryptocurrency, an enormous challenge for the departments is to impose and collect tax from it.

- Recently, the Directorate General of GST Intelligence (DGGI) raided several crypto exchanges in India. At present, the liability has been fixed by taking their fees and margins because the basis of earnings and has been asked to deposit the tax.

- If experts are to be believed, levying tax on fees and margins on the lines of common commodity exchanges implies that the govt. is treating the work of crypto agencies as ‘services’, which attracts 18% GST. However, some of the crypto agencies tends to seek legal clarification on this topic.

- Since cryptocurrency isn’t mentioned anywhere in any law, nor does its trade match with any sought of existing trade, now this issue seems to be attaining high levels of the GST Council or the govt..

Taxation on Crypto

- The beauty of cryptocurrency is its private wealth. nobody else can see or confiscate it. At present, it’s difficult for the govt to even know from which hands it’s passed. Assessment, seizure or recovery isn’t possible under the income tax Act unless the currency owner himself declares the proportion which he has invested or the department proves it from the available evidence. In such a situation, short term or long-term capital gain also becomes difficult to be determined.

- As far as indirect taxes like GST are concerned, if we consider cryptocurrencies as goods, then its valuation isn’t possible. At the foremost, only operators i.e. exchanges can be reached. Their fees and margins as services are levied 18% GST, but here too there are many problems.

- Seller i.e. the supplier of the currency is required to make the payment of the transaction fee. But the determination of supply of services can’t be correct because of the non-identification of the recipient. The utmost important problem is that if a recipient or any crypto exchange is outside the country, taxation here will become even tougher under present laws.

Experts Viewpoint

- “A digital currency is basically a sought of currency which is powered by blockchain technology. Where it’s not decided whether to contemplate it as Goods or Services. However, the basic information in respect of trade value and place of supply cannot be determined in such transactions.

- That is, who is buying, how much, from whom and whom, where is selling, nothing is identifiable. Hence, the taxability of such transactions can be compares to shooting an arrow in the dark. In case of share trading.

- Securities might not be taxable, but processing or transaction fees and taxes are levied through exchange and brokerage data. All this happens because the exchange is regulated. Until there’s no regulation of cryptocurrency. It’s out of the question to recover proper tax from him.”

- We can compare trading of cryptocurrency with fake chit funds and pyramid schemes. Where one person keeps on collecting money from another and another from the third, with the idea that there’ll be lots of returns ahead. But at some point, in the future, its head or company runs away.

- He told that if the govt. doesn’t ban or regulate it, then the largest danger is of getting trapped within the younger generation. The new generation tends to invest in crypto more oftenly, in order to earn returns overnight. There’s no guarantee that the long run will still meet its financial liabilities.

Question on Business Model

- Cryptocurrency trading relies on an electronic network where each terminal acts as a server in itself. it’s also called peer to peer platform. DGGI recovered Rs. 50 crores in respect of tax and penalty from WazirX. But exchanges like Unocoin, which have come under the scanner, are yet to serve the ultimate notice of tax and penalty.

- These exchanges complain that the govt has not been able to decide under which business model they must be treated. Some are being charged under the principles of the e-commerce market place and a few are being charged under the brokerage regulation. But reports quoting GST officials said that the business model of those exchanges themselves isn’t the same. for instance, exchanges like WazirX conduct peer to peer deals and charge commission for their exchange services.

- He has told this as his income. However, exchanges like Unocoin and Coinswitch Kuber act as brokers or aggregators of cryptocurrency. They charge a set amount from the users on their profits.

- According to officials, there’s a necessity for more investigation and regulation of this model. As we all know that GST is levied on value addition, the same should be applicable at every step wherein profit is earned. This is often possible when the currency is treated as a taxable good or commodity. That too when the govt. recognizes or regulates it.

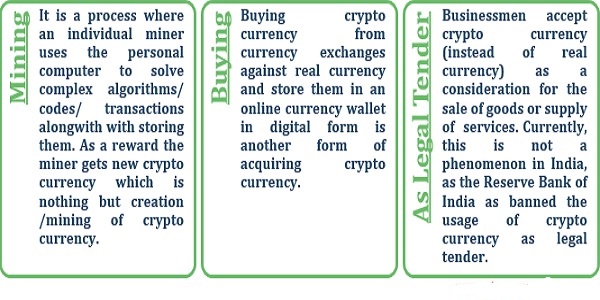

Crypto Trading Process

- You can roughly think about cryptocurrency as a token of a small-shop shop or a hundi between traders and brokers within the wholesale markets.

- That is, a slip of paper, which has no value in itself, but within the eyes of the giver and the giver, it may be of hundreds, thousands or lakhs. the most important strength of the hundi is that neither a thief can rob it, nor the police can catch it, nor can any authority impose tax. the value of the hundi was considered between two people. But the creditors and debtors of cryptocurrency are numerous. What sets it apart the foremost is its technology of use.

- In technical terms, it’s a digital document transmitted over a blockchain-based network, on which each and every transaction is signed. Every transaction may be a block in itself. Basically blockchain is basically a software protocol.

- Similarly, there’s SMTP (Simple Mail Transfer Protocol) for our email. Such a chain helps in identifying when the currency exchanged hands and what all parties were involved. Blockchain files reside across the network instead of on a particular computer. Adding a brand-new block to a specific chain is termed crypto mining.

- You have to affix this network to buy and sell cryptocurrency. That’s where we facilitate your, crypto exchanges. Here you open an account rather like a demat or trading account for shares.

- The sole difference is that these exchanges are self-regulated. That is, beyond the govt. rules and regulations. As we’ve mentioned above, how these exchanges have different business models. In such a situation, their fees also are broadly of three types – exchange fee, network fee and wallet fee. At present, tax agencies are deciding their liabilities by considering this fee as income.

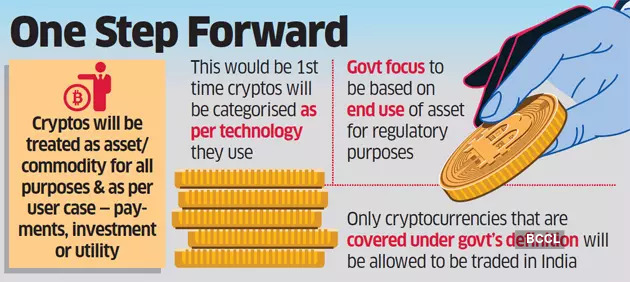

Recent Proposals on Crypto Taxation

The reports presented by Media, suggests that the Central Economic Intelligence Bureau raised a proposal to the Central Board for Indirect Taxes and Customs (CBIC) for bringing the cryptocurrency exchanges as well as the platforms under the purview of GST.

After the completion of investigation by the GST department the cryptocurrency exchange WazirX was fined, and their management firm confirmed that the company voluntarily paid additional GST in order to cooperate and be compliant with the rules and regulations.

- Days after the GST authority fined WazirX, their management clarified that they have voluntarily paid the amount of additional GST in order to be cooperative and compliant with the rules and regulations.

- As per GST authority, the exchange tends to provide its clients, an option to trade and to transact in Rupee or WRX.

- In return of such service, the company was charging commission on each transaction in cryptocurrency from buyer and seller both. However, the rate of commission differ in respect of buyers and sellers and also in respect of the transactions undertaken.

- The department has alleged that in the investigation, it came to the notice of officials that the taxpayer wants to collect revenue from commission as trading fees, deposit fees and withdrawal fees.

- “The taxpayer was paying GST only on commission earned in rupee but wasn’t paying GST on commission earned in WRX.

A GST @ 18% shall be applicable on transaction fees. As a result, GST of Rs 40.5 crore wasn’t paid by the firm, and the same was recovered by the authority along with applicable interest and penalty on December 30, 21.

- After the amount was determined, the Directorate General of Goods and Services Tax Intelligence undertake scrutinization of the multiple crypto firms involving Buyucoin and Unocoin.

- Cryptocurrency platforms that face increased scrutiny from tax authorities for GST evasion are unclear about “applicable provisions” under the country’s taxation regime amid regulatory uncertainty, industry executives told ET.

- The industry members commented that the crypto platforms didn’t pay the amount of GST due to the confusion over the tax applicability on different business models operating in India.

- The cryptocurrencies are not considered legal tender in india. They are considered commodities as they are tradable in the exchanges. In case it is treated as commodities, any kind of profits or gains on this trading of cryptocurrencies are liable for taxation under capital gain head as per under Income Tax law.

Features of CEIB’s proposals during this regard, as available publicly domain is excerpted below:

- The act of cryptocurrency mining can be treated as a supply of service because it generates cryptocurrency and charges transaction fees, and per se, should classify as an intangible asset and the same shall be attract GST @ 18%. Thus, persons operating as cryptocurrency miners would be required to register under GST, where their annual revenue exceeds ₹20 lakh in a particular financial year.

- GST be levied on the transaction fee as well as the currency which is mined by the business miners. Also, there is consideration to bring the wallet service providers under the purview of GST Act 2017. Also, the trading in the cryptocurrency and other related transactions involving transfer, storage, accounting etc. shall be considered as supply and the same be taxed accordingly.

- The transaction value in INR or a similar freely convertible foreign currency are used to determine the worth of cryptocurrency and thereby the transaction and subsequent tax liabilities. In cases where the customer and seller are registered as Indian residents and operators, the transaction should be treated as a supply of software.

- Cryptocurrency transactions undertaken internationally, by companies registered in India, shall be treated as import or export of services, and the same shall be subject to IGST. Apart from this, bringing cryptocurrencies under the GST purview is very important, in order to curb concealing and undermining of legitimate currencies. Some of these proposals don’t seem to be in sync with the worldwide best practices and would hopefully be reconsidered.

- Thus, it is believed, that just like Australia and UK, having clear and progressive guidelines, India would be soon proposing a policy on cryptocurrency.

Precedent for Crypto Taxation

- After the investigation by the income tax department against various crypto exchanges, the same has somewhere set a precedent round for the categorization of crypto assets for taxation purpose.

- Long debates have been undertaken by various experts on the categorization as well the tax treatment of cryptocurrencies in India. However, they’re yet to clarify as to whether a cryptocurrency be treated as currency, a commodity, a service, or something else.

- Various searches were conducted by DGGI on crypto exchanges and hence demanded certain amount GST on their transaction fees or margins.

- According to these investigations, the authorities tends to impose an 18% GST on the margins and transactions undertaken by the exchanges in India.

- However, still there is no clarification as to the rate of GST that shall be levied on cryptocurrency under Income Tax Act or GST regulations. This can be mainly because of the paradoxity around categorizing cryptocurrencies like Bitcoin and other assets.

- As to whether they’ll be treated similarly to currency, equity, gold, technology, services, or some of lottery, taxation rates on returns from different assets are separate and range from 10% to 35%. The GST rates could vary from nil to twenty-eight as per the category.

- Even in 2017, tax investigations were administrated where the department asked top management of some cryptocurrency exchanges to elucidate their business model and the way much indirect tax was being levied.

- The govt is undertaking discussions with various stakeholders of cryptocurrency, about the complete ban on cryptocurrencies or allowing it in a very limited way with the Reserve Bank of India as a regulator.

For any clarifications/feedback on the subject, don’t hesitate to get connected with the writer at singh@caindelhiindia.com.

Also Read Articles :

- Bitcoin Taxability under GST Act,2017

- India’s Latest Development on Crypto-Currencies

- Cryptocurrencies Taxation Scenario in India

- Pm modi chairs meet on cryptocurrency

- Guidance on major concern in Cryptocurrency

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.