The Role of the Chartered Accountant in Tax Planning

Table of Contents

The Role of the Chartered Accountant in Tax Planning

Tax planning is the process of putting the provisions of the Income Tax Act of 1961 into practise. To put it another way, tax planning is the process of examining a person’s situation in the most significant way possible. As a result, someone might steal such provisions. Tax reduction and nonpayment are not considered in tax planning. As a result, tax planning is a cost-effective and strong instrument for implementing rules included in the Income Tax Act of 1961 and the Income Tax Law. The CHAPTER-VI of the Taxation Act of 1961 contains all of the provisions for granting a person a deduction.

There are Various Type of Tax Planning in India, which are Listed Below:-

- Long Term taxation Planning

- Short Term taxation Planning

- Permissive taxation Planning

- Purposive taxation Planning

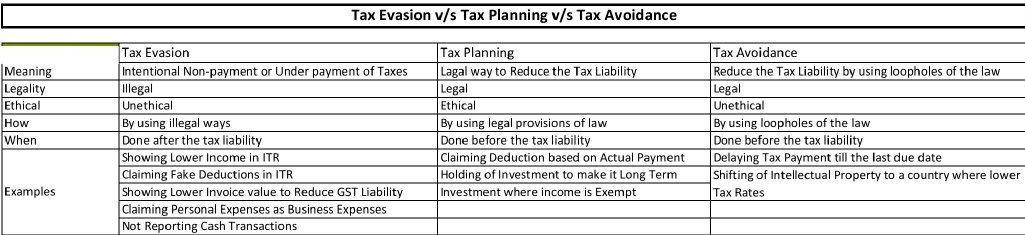

Tax Planning, Tax Avoidance, and Tax Evasion

A Chartered Accountants isn’t simply a title for a degree; those who have it are experts in a variety of fields, including finance, taxation, legal, and management. When it comes to tax planning, no one in our nation is more efficient than a chartered accountant. When it comes to the previously mentioned tax planning, Chartered Accountants is the most intelligent person who can provide guidance to both individuals and businesses. The accountant assists them in a variety of ways, including assisting them in obtaining LIC, medical insurance, investment trusts, and stock in profitable companies.

India Financial Consultancy provides tax consulting services.

The India Financial Consultancy is one of India’s top 25 tax planners and chartered accountants firm, At India Financial Consultancy, we guarantee that you will receive the best income tax consulting services in India.

Some of the areas of expertise are:

-

Auditing and Accounting

Even though their functions differ in terms of their focus, accounting and audit play a critical part in each business’s financial record-keeping process. While accounting refers to a much broader topic that encompasses everything from organisational structure to cash flow management, auditing is a more specialised service.

The independent inspection of accounting and financial records is referred to as auditing. The purpose of an audit is to determine if a corporation or a commercial undertaking has confirmed that its activities are legal and in accordance with Generally Accepted Accounting Principles.

-

Management Advisory Services

We live in a dynamic environment. It includes a variety of issues such as legal, economic, political, social, structural, and so on. To keep up with the changing environment, businesses must constantly update their business processes. To enhance a business process, skilled, clever, and intellectual individuals are required, as well as the ability to predict what could happen in the near future in relation to a certain business process. A Chartered Accountants may be viewed as a valuable asset because they possess all of the necessary skills for improving corporate processes. As a result, Chartered Accountants will precisely fit between the current situation and the business’s future prospects.

-

Fair valuation assets and liabilities

Every person followed all of the Accounting Standards and Indian Accounting Standards put out by the ICAI while studying for India’s most difficult course. Chartered Accountants are prepared with the ability to practically apply their information gained during test preparation during both their training and post-qualification. As we all know, Ind AS – 113 is concerned with the fair appraisal of an entity’s assets and liabilities. As a result, a chartered accountant is well-versed in the Ind AS -113 compliances, and so a Chartered Accountants might assist in the Appropriate appraisal of assets and liabilities.

-

Companies, LLPs, and businesses registration.

A Chartered Accountants studied the concepts of the Companies Act 2013, the LLP Act 2008, and the Partnership Act 1932 in depth before putting them into practice. Chartered accountants help those who need to register under the above-mentioned Acts in complying with all of the acts’ provisions. As a result, a Chartered Accountants is the ideal choice for anybody seeking expert guidance on how to comply with the Act’s requirements.

-

Fraud investigation and due diligence

Due diligence is word that can be applied to business restructuring. Internal restructuring involves things like mergers, acquisitions, and joint ventures. Corporate restructuring involving more than one party, on the other hand, should be carefully prepared. Due diligence is carried out in such circumstances. The purpose of the due diligence evaluation is to see if acquiring / merging the unit is possible and desirable. In terms of fraud investigation, we have a standard on auditing -240 (Auditor’s responsibilities linked with fraud in a monetary statement audit). As a result, if they need to build a successful plan, they should seek help from a professional accountant. During this time, a Chartered Accountants may be identified as a significant business tool.

-

Help in assisting start-ups with their progress.

Since the notion of start-ups was introduced in India, our finance ministry has drafted a new regulation to provide them a bird’s eye perspective of what’s happening in the startup world. The Finance Ministry is constantly revising the law to ensure that start-ups run smoothly. Now comes the job of the accountant: by keeping up to date on the regulations governing start-ups, the accountant can assist them in generating financial projections so that they may be financed by banks and investors. As a result, a CA may assist start-ups in the areas of market research and development, legal compliance, and strategic thinking.

-

Society and Trust Registrations in India

A chartered accountant plays an important role in society, and the registration of a trust as a memorandum of society requires the signatures of a chartered accountant and other officials. CA also assists in adhering to essential norms and regulations in order to encourage the registration of a society or trust.

-

Compliance to all new GST rules & regulations

With GST being the talk of the City, Chartered Accountants will play a big role in the coming days. To register their business, issue invoices, submit returns, correct mismatched returns, claim input credit (ITC), and grasp the day-to-day complexity of this new GST programme, businesses of all sizes will require the help of their Chartered Accountants.

-

Trademark registration

A trademark is one of a company’s most valuable assets. A buyer may distinguish one’s goods from others with the use of a trademark. It aids the entity in generating an intangible known as goodwill. CA assists with trademark registration in eight ways (i.e. assets, Visual Representation, Protection against infringement and other legal protection, voluntary, not Compulsory Registration, Trademark search, class selection, Validity, & Trademark Symbols).

-

Income tax filings

They have extensive expertise and understanding of both individual and corporate tax legislation. As a result, they assist you in filing tax returns in accordance with applicable tax rules. They provide a variety of services, including:

- Income Tax return preparation and filing.

- Assisting taxpayers with tax-related issues.

- Evaluating taxpayers’ financial & legal conditions in order to reduce obligations.

- Acting as a representative for taxpayers during the tax payment procedure.

Conclusion –

Finally, you’ll file your tax returns if you have got knowledge of taxation law and compliance understanding procedure. It’s possible that you’ll find it satisfactory in this reference. However, employing a tax adviser is recommended if you lack the necessary knowledge or time to submit your returns. It will save you time and reduce your risks. Hopefully, the preceding considerations have persuaded you that engaging a tax expert is typically a wise investment for your company. If you’re looking for a dependable tax consultant or have any more questions, please contact us at www.carajput.com, and we’ll be pleased to assist you in any way we can.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.