GST Registration is getting suspended due to non-compliance

Table of Contents

GST Registration is getting suspended due to non-compliance – GST Important Provision

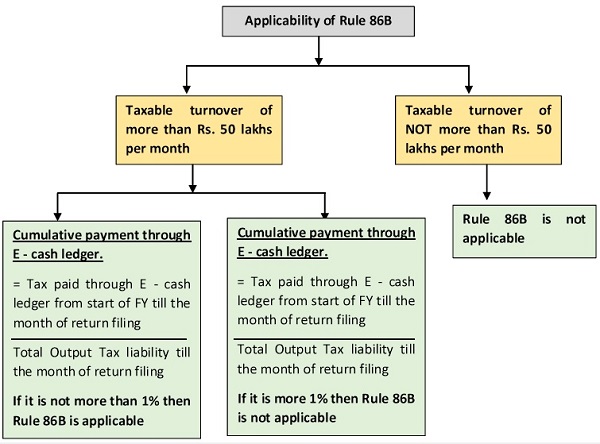

- As per the notification, GST registered individuals would be unable to pay more than 99% of their production tax obligations from the funds in their electronic credit ledger as of Jan 1st, 2021. In other words, as per the rule 86b example above, GST taxpayers cannot claim input tax credit for more than 99% of the output tax liability.

- What is an electronic credit ledger: The amount of funds that is available for the payment of tax debt is shown in the electronic cash ledger. While Electronic Liability Ledger displays the taxpayer’s GST Tax liability. The balance that remains of the registered taxpayer’s applicable input tax credit is shown on the electronic credit ledger.

- Rule 86B imposes restrictions regarding how an input tax credit (ITC) from the electronic credit ledger can be used to reduce the output tax liability. This regulation overrides all previous CGST regulations. This GST Restriction does not apply in different cases: you may refer First Proviso to the GST Rule 86B

GST Restrictions on use of amount available in electronic credit ledger (GST Rule 86B)

- Notwithstanding anything contained in these rules,

- GST registered person shall not use the amount available in electronic credit ledger to discharge his liability

- Towards output tax

- In excess of 99% of such GST tax liability,

- In cases where the value of taxable supply

- Other than exempt supply & zero-rated supply,

- In a month

- more than INR. 50,00,000/-

Exceptions of Rule 86B

Rule 86B of the GST has few Exceptions which is mention here under :

- Following people have paid more than INR 1,00,000 as income tax in each of the last 2 Fy, for which time limit to file the ITR u/s 139(1) has expired:

- Goods and Services Tax registered person or

- Any of Partners, Members of Managing Committee of Associations or Board of Trustees, whole-time Directors of GST registered person. or

- Karta or Proprietor, or Managing Director of the Goods and Services Tax registered person

- Goods and Services Tax registered person has received a Goods and Services Tax refund of more than Rs. 1 Lakhs in preceding fy on a/c of unutilised ITC or export under letter of undertaking or due to the inverted tax structure.

- Goods and Services Tax registered person has discharged his/her liability towards output tax through the electronic cash ledger for an amount which is more than 1% of the total output tax liability.

- Goods and Services Tax registered person is a:

- Local authority; or

- Government Department; or

- Statutory body. or

- Public Sector Undertaking

Note: The officer authorized by the commissioner or Commissioner can remove the Goods and Services Tax restrictions mentioned above after undertaking need verifications & safeguards

Penalties on violation of rule 86B

- GST Registration taxpayer shall be liable to pay a penalty of minimum penalty ₹ 10,000/- and maximum penalty equal to the tax evaded, whichever is higher. It is one time penalty for one offence.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.