MCA notifies Companies on Dematerialisation Compliance

Table of Contents

Dematerialisation of shares mandatory:

- Every unlisted public company must issue all of its securities in dematerialized form in accordance with the provisions of the Depositories Act of 1996 and the rules promulgated thereunder, as stated in the aforementioned new Rule 9A, and must also take all other necessary steps to facilitate the dematerialization of all of its existing securities.

- Compulsory dematerialization should only apply to large Company, such as those with more than 10,000 shareholders and more than 300 share transfers each month. In other cases, dematerialization should be at the company’s discretion.

- All unlisted public companies must only issue securities in dematerialized form, and they must assist the dematerialization of all of their existing securities, according to a notification from the Ministry of Corporate Affairs (MCA) dated September 10, 2018. The notification will go into effect on October 2, 2018.

- All unlisted public companies are required to get an International Security Identification Number (ISIN) through a Registrar and Transfer Agent (RTA) and to notify all of their current security holders of this facility.

- After that, security holders must apply to the depository participant in order to dematerialize their existing securities.

- Every public unlisted company will need to comply with the aforementioned announcement of September 10, 2018 & designate a Registrar & Share Transfer Agent (RTA).

- MCA (Ministry of Corporate Affairs) has notified (Notification dated 10th Sept 2018 Govt of India) Amendment to the Companies (Prospectus and Allotment of Securities) Rules, 2014 making it mandatory for every Unlisted Publicly held Company to facilitate dematerialization of all its existing securities. Every unlisted public company making any offer for issue of any securities or buyback of securities or issue of bonus shares or rights offer shall ensure that before making such offer, entire holding of securities of its promoters, key managerial persons & directors has been dematerialized. Transfer of securities on or after 2nd October 2018 shall be effected only if such securities are dematerialized before the transfer.

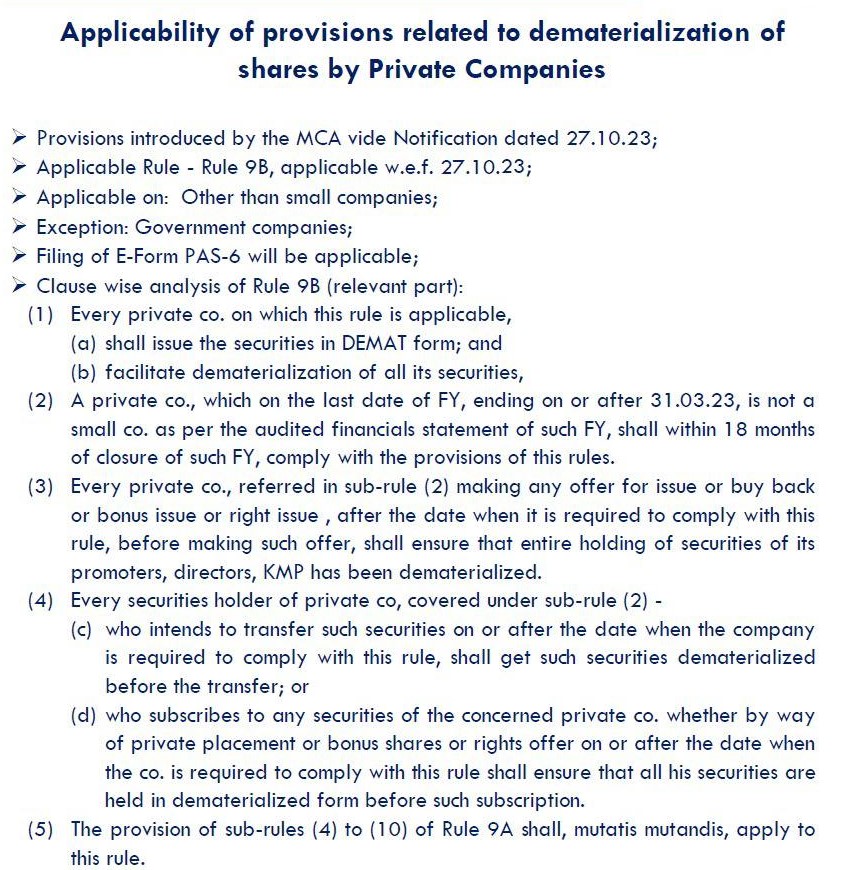

Important MCA Update !!

A big change, now in case of private limited companies (other than small ), dematerialization of securities is mandatory.

Can a private company transfer shares in physical form?

- A share certificate serves as an a prima facie evidence of the title of the ownership of the company shares. The shares are transferrable and movable property. Physical or Demat shares of a company are both allowed.

- Shareholders must first dematerialize their shares if they want to transfer them. Previously, the notification was applicable to all Unlisted Public Companies without any class of such companies receiving an exception. But, in response to stakeholder requests, the Ministry of Corporate Affairs issued a notification on January 22nd, 2019 that following classes of unlisted public companies from dematerializing their shares are exempted.

- Notification Link :

Benefit of Dematerialisation

- Ease in Mergers and Consolidation of Companies

- Preventing malpractices

- Nomination Facility

- Loan against securities which are held in a DEMAT by offering it as a collateral to the lender

- Improving the corporate governance system

- Ease in Transfer, Pledge, etc.

- Elimination of risks associated with physical certificate

- Reduce the risk of duplication, fraud, loss or theft, delays in respect of securities held in physical share certificates.

- Exemption from payment of stamp duty on transfer

The Ministry of Corporate Affairs vide its notification dated May 22, 2019 compulsory all the unlisted public companies to file a half yearly return in form PAS-6 to the concerned ROC within sixty days from the conclusion of each half year. This notification was applicable with effect from Sept. 30, 2019. But Ministry of Corporate Affairs has recently deployed the aforesaid form PAS-6 for filing on its portal in the month of July 2020. The details such as ISIN, number of shares held in physical form and demat form, number of shares held by its directors, promoters, KMP, reason for not keeping the securities in demat form, if applicable etc. are required to be provided in the said form.

This notification state that no invitation or offer of any share or securities under below mention rule will be made to a Company incorporated in, or The nine neighbouring countries of India are – Afghanistan, Bangladesh, Bhutan, China, Maldives, Myanmar, Nepal, Pakistan, and Sri Lanka. which shares a land border with India, unless such Company or the Country, as the case may be, have obtained Govt approval under the Foreign Exchange Management (Non-debt Instruments) Rules, 2019 & attached the same with the private placement offer cum application letter.

Moreover, as per Ministry of Corporate Affairs Notification Dated 23 May 2019 companies have to file ROC – Form PAS-6 Half Yearly audit report on share capital reconciliation. It is also required for Unlisted Public Companies to submit audit report half yearly as per regulation 55A of the SEBI (Depositories and Participants) Regulations, 1996 to the registrar under whose jurisdiction the registered office of the company is situated.

Every company whether public limited or private limited excluding one person company and small company file MGT-7 may insert the details of the ISIN of the equity shares of the company.

ROC Form PAS-6 required to be file -Reconciliation of Share Capital Audit Report a half-yearly basis:

- The ROC Form PAS-6 is used for reconciliation of the share capital audit report on the half –year basis.

ROC Form PAS-6 Applicability in the below mention situations :

- Applicable with effect from July 15, 2020.

- Unlisted Public Companies.

- Form PAS-6 is a half yearly audit report on reconciliation of share capital which is to be signed by a PCA/ PCS(Practicing CS/ CA).

- All information shall be furnished within 60 days from the end of each half year (30th September/31st March) for each ISIN separately.

- Company must bring to notice of depositories any difference finding in its the capital held in dematerialised form & issued capital.

Main information & Details required in filling of the ROC Form PAS-6:

- ISIN(International Securities Identification Number)

- Period for which return is filling.

- Details of capital of the Company.

a Issued Capital

b Held in Demarialised Form in CSDL

c Held in Demarialised Form in NSDL

d Held in Physical Form e

e Total No. of Share (b)+(c)+(d)

- Reasons for difference if any in (a) and (e) Details of changes in Share Capital during the half –year under due to any:

- Amalgamation

- Private Placement

- ESOPs

- Right Issue

- Bonus Issue Advertisement

- Conversion

- Buy Back

- Capital Reduction

Just wanted to apprise you of the recent MCA notification for Private Limited Companies and it is very important for companies to comply with the notification of MCA to avoid penalties and other compliances issues.

MCA notification in brief Dematerialized of Security :

· Every Private Company other than a small company as on 31st March 2023 shall issue the securities only in Dematerialized Form

· All such companies to comply with the MCA notification by 30th September 2024

· Companies intending for Bonus, Buyback, ESOP, Rights shall ensure that before making such offer, the entire holding of securities of its promoters, directors, key managerial personnel has been dematerialized in accordance with provisions of the Depositories Act 1996 and regulations made there under

· Transfer, Purchase and Sell of shares can only happen in dematerialize form

Definition of non-small private limited companies?

· Companies whose paid-up capital is Rs. 4 Crores & above

· Turnover for immediate preceding financial year is Rs. 40 Crores & above

The above notification is not applicable to

· Nidhi Companies

· Small private limited companies

· Govt Companies

· Wholly owned subsidiaries of Public companies

We at India Financial Consultancy Corporation Pvt Ltd are assisting all such non-small private limited companies to comply with the MCA notifications by handholding the companies in:

· Acquiring the ISIN number from Depositories of India

· Guidance for demat of your securities

· Maintaining your shareholder database in electronic mode

· Managing transfer, purchase, sell of securities in electronic mode

· Offers of your company – Rigts, Bonus, ESOP all in electronic mode

· Capital restructuring

· Providing weekly Benpos

· Handling your IPO as and when you are IPO ready

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.