Tax Dept tightens Grip its control over advance tax payments

Tax Department tightens Grip its control over company advance tax payments

- In order to make sure that companies do not put off the payment of taxes for the duration of the fiscal year,

- The Income Tax Department is actively keeping an eye on advance tax payments by carefully examining companies’ annual and quarterly balance statements as well as sectoral growth trends.

- Most recent annual reports and quarterly reports from the top 100 listed companies will be examined, according to the tax department’s core action plan for the financial year 2023–24.

- According to study, senior authorities would supervise the collection of advance taxes, paying specific attention to “notes” and any observations on bank accounts.

Which Sectors or industry are under Scanner?

- Citing unnamed sources, tax investigators will mention institutions, patterns in specific industries, pharmaceuticals, steel, real estate, mining, financial institutions, gems & jewellery, and trends in other areas.

- On condition of anonymity, a tax official said, “It’s important to look at the balance sheets of companies in each sector to see if payments they’re making are in line with their earnings forecast.”

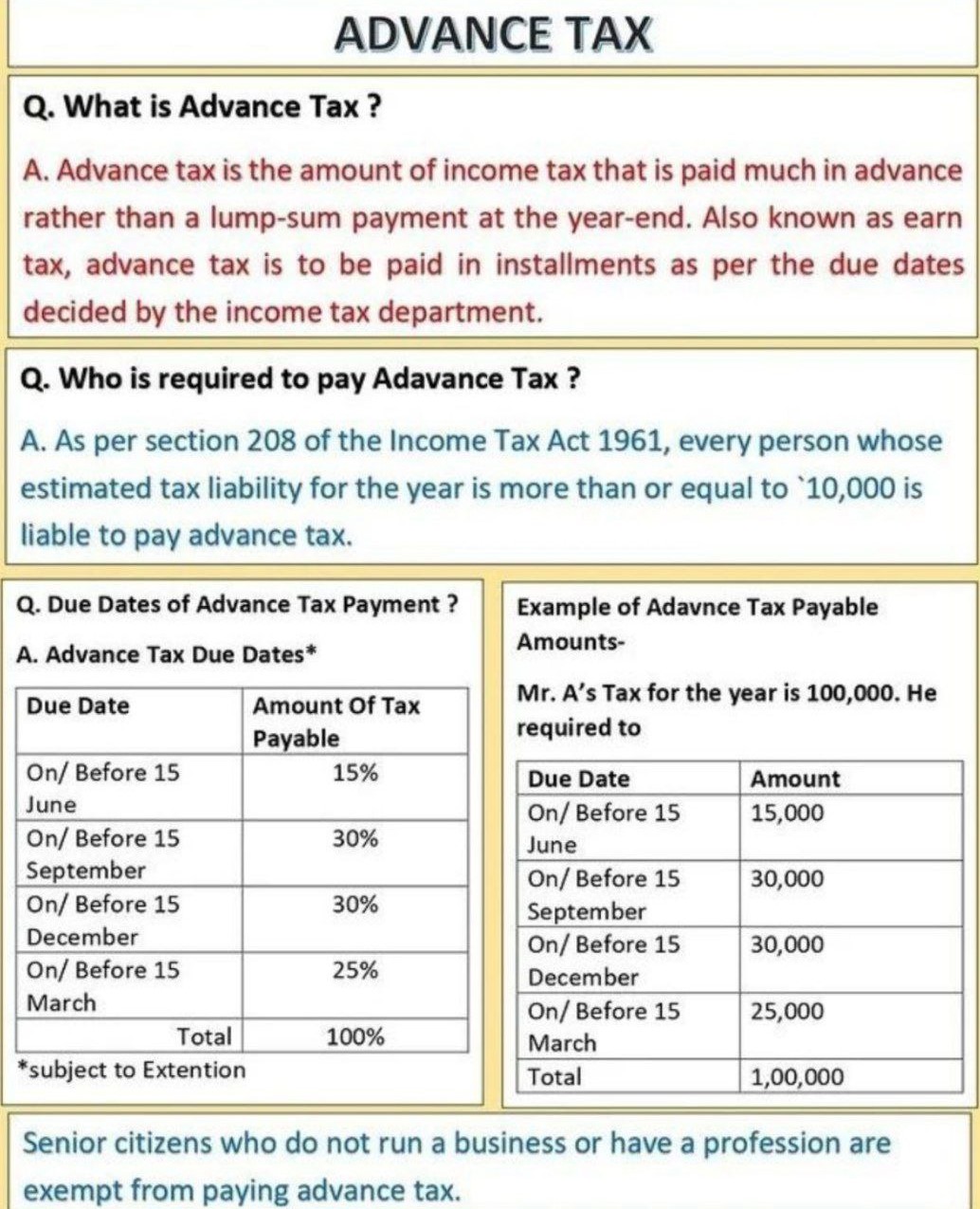

- The practise of paying tax on income earned within the same FY before the FY ends is known as advance tax payment. Corporations and partnership enterprises must pay taxes in four installments on June 15, September 15, December 15, and March 15.

- By June 15, businesses would pay the first advance tax installment. Prior to increasing tax demands, a technique for doing quality checks with a focus on dues recovery has been developed.

How to calculate advance tax?

- Calculate your overall income by adding up all of your receipts.

- Subtract only the expenses that are directly relevant to your job.

- Include earnings from other sources, such as a rental property or a savings account.

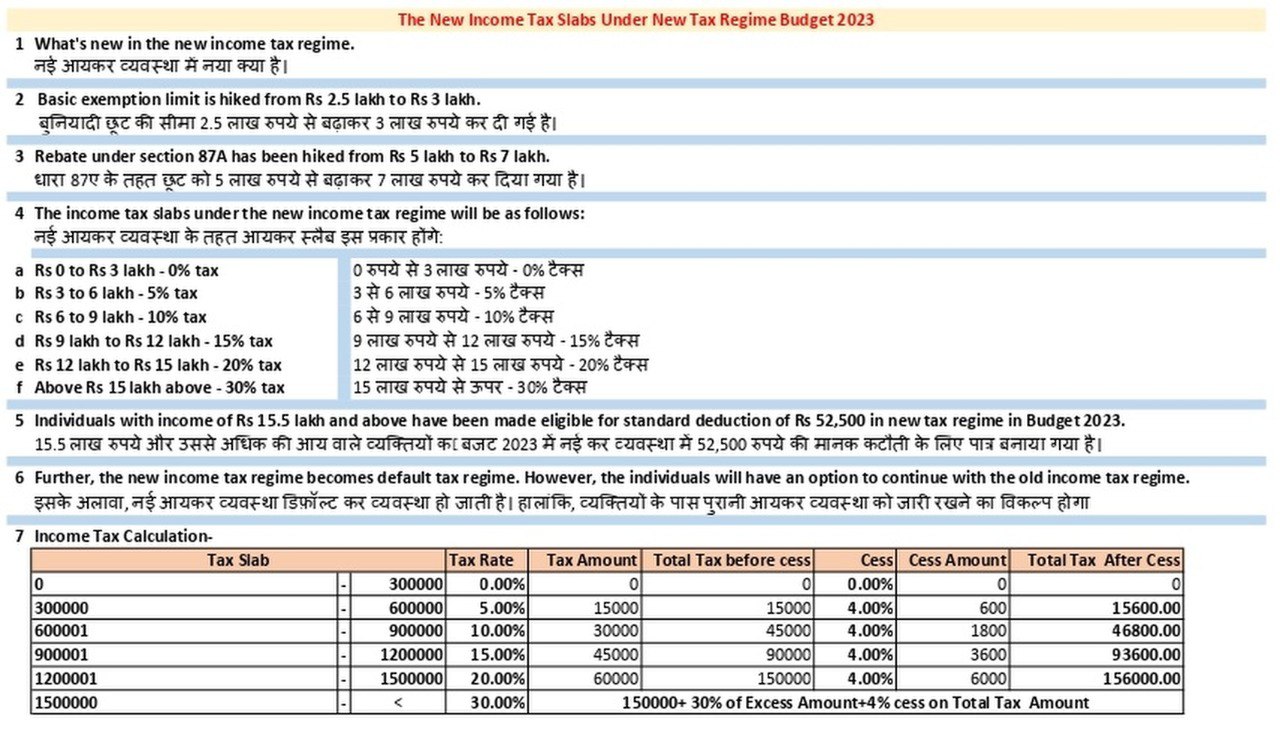

- Determine your tax slab and compute your tax liability.

Remember to deduct TDS

- If your tax payment exceeds Rs.10,000, you must pay advance tax by the deadlines listed below.

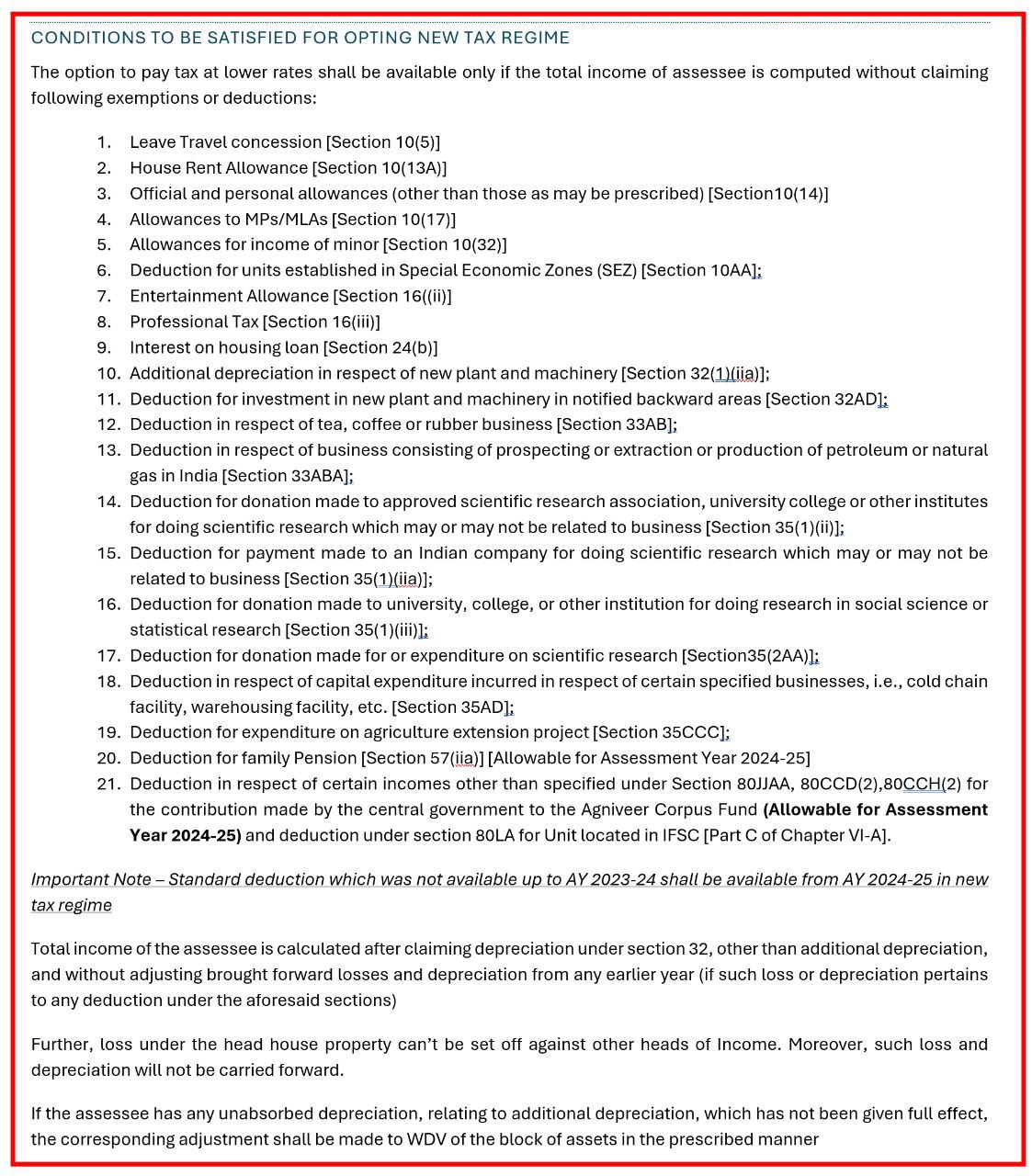

Due date for Advance Tax

| On-or before 15th June | Not less than 15% of advance tax |

| On or before 15th September | Not-less than 45% of advance tax as reduced by the tax paid in the last installment. |

| On-or before 15th December | Not less than 75% of advance tax as reduced by the tax paid till the last installments. |

| On or before 15th March | The whole amount (100%) of advance tax as reduced by the tax paid till the last installments. |

Popular blogs :