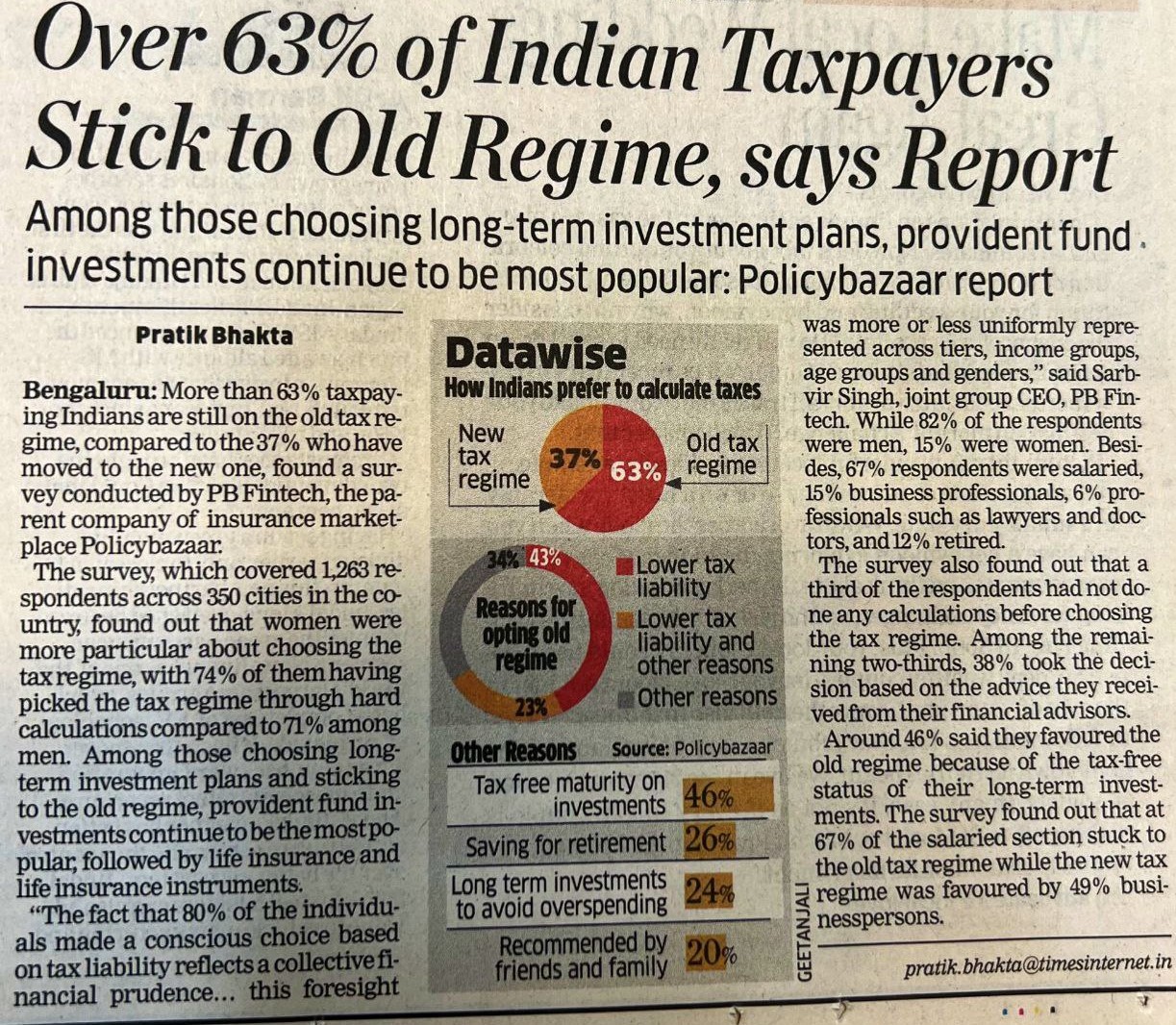

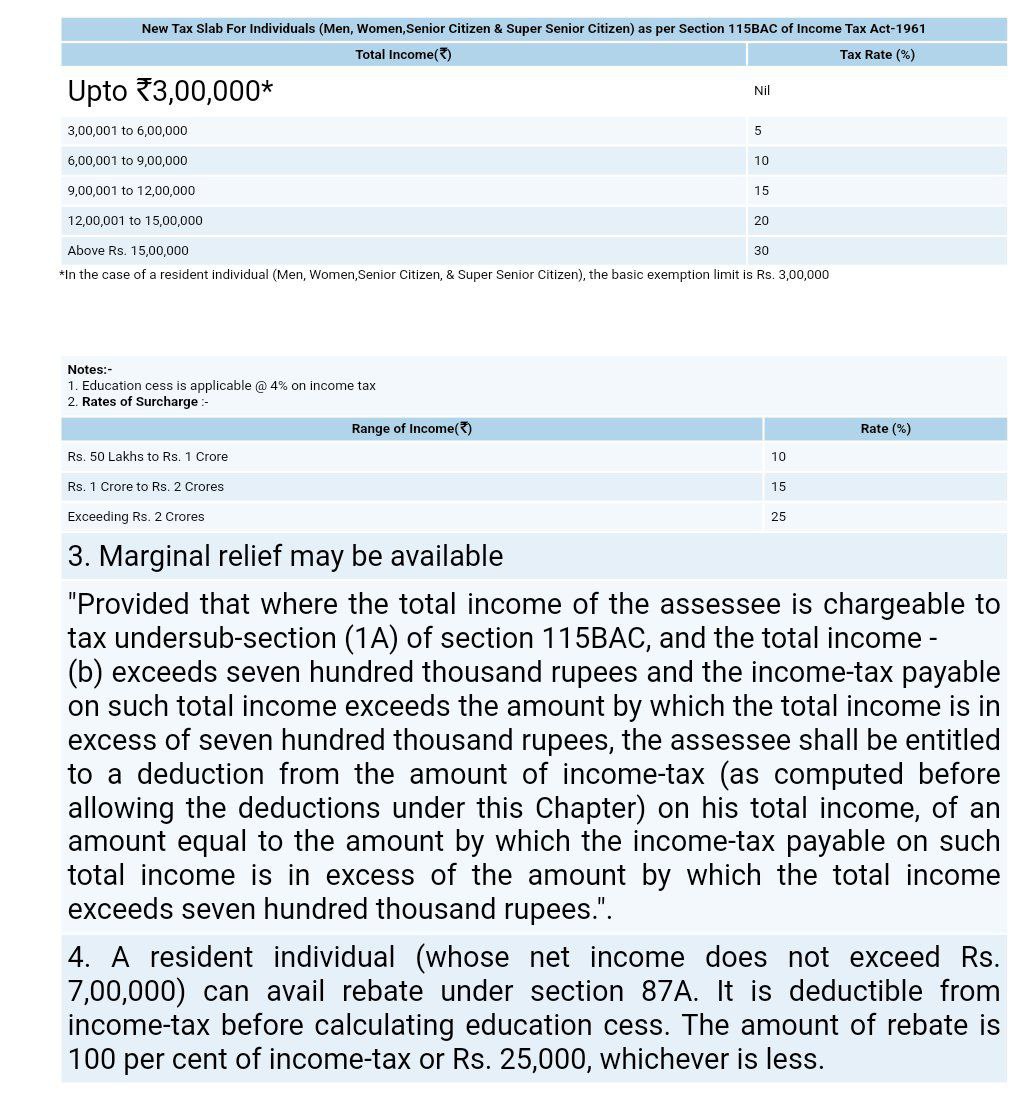

Key Changes Applicable in ITR-1 & 4 form for AY 2024-2025

Key Changes Applicable in ITR-1 & 4 form for AY 2024-2025

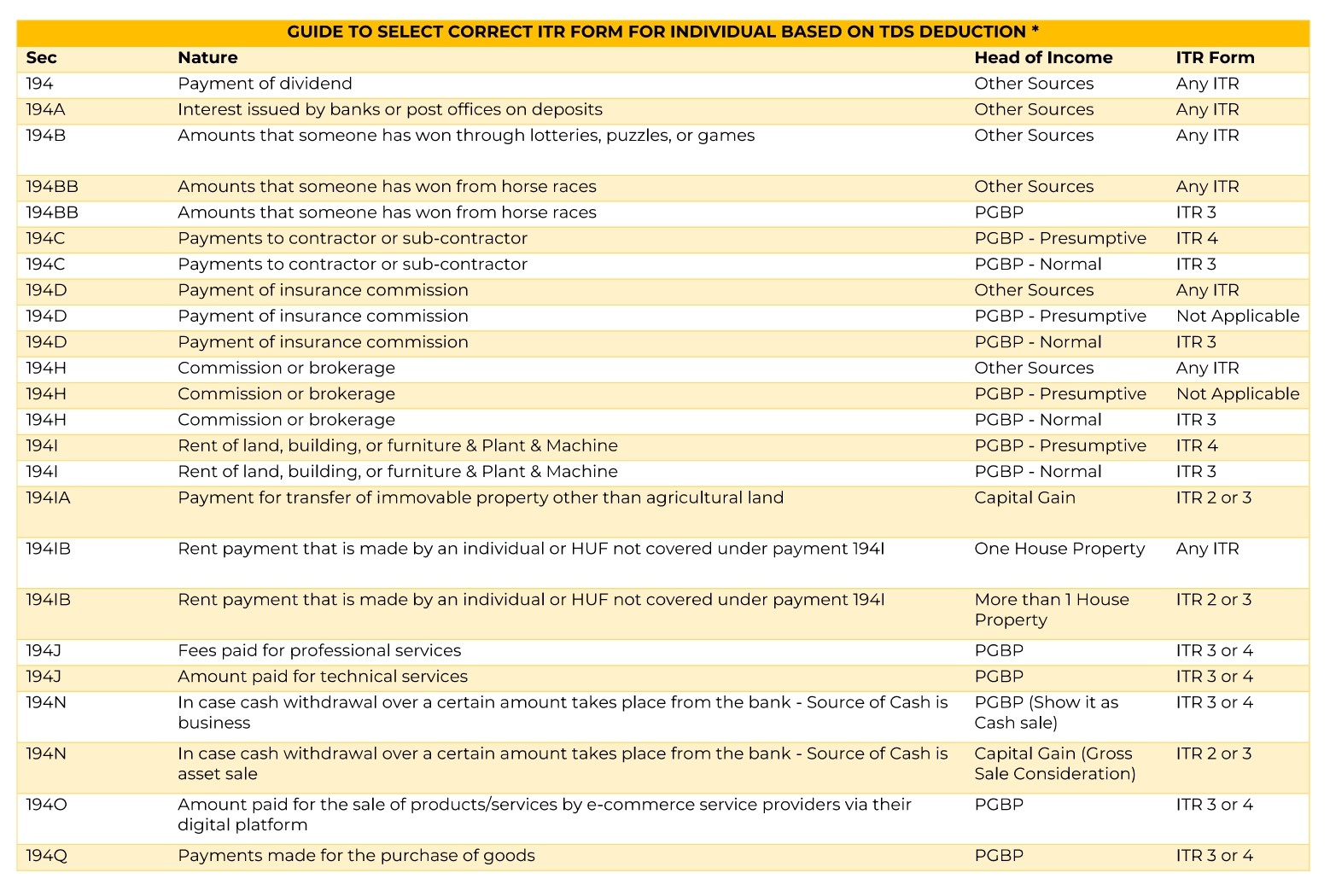

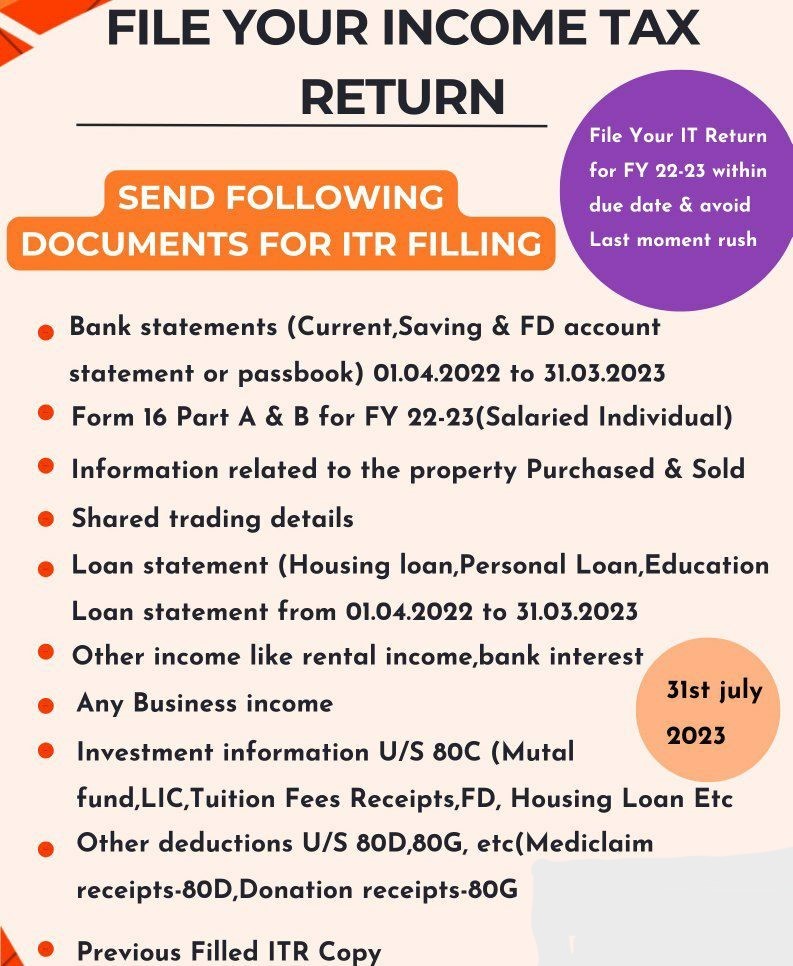

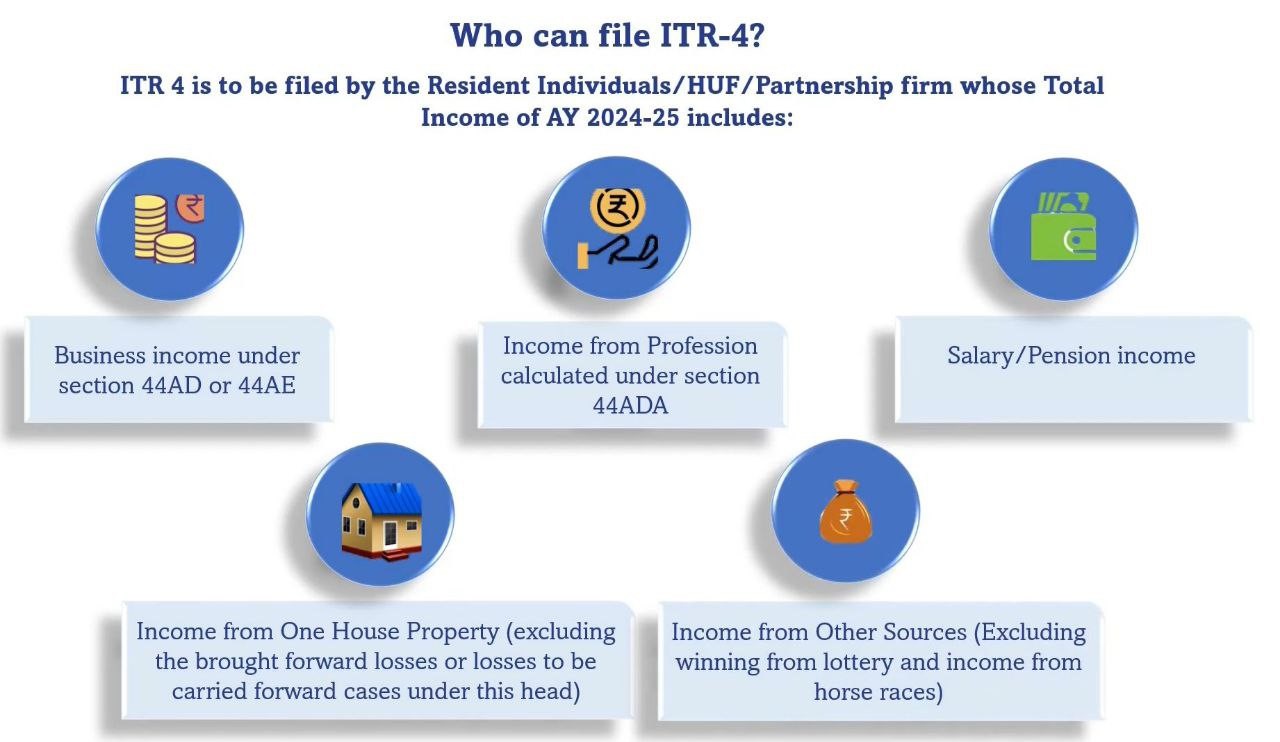

Who can file ITR-4- Who cannot file ITR-4

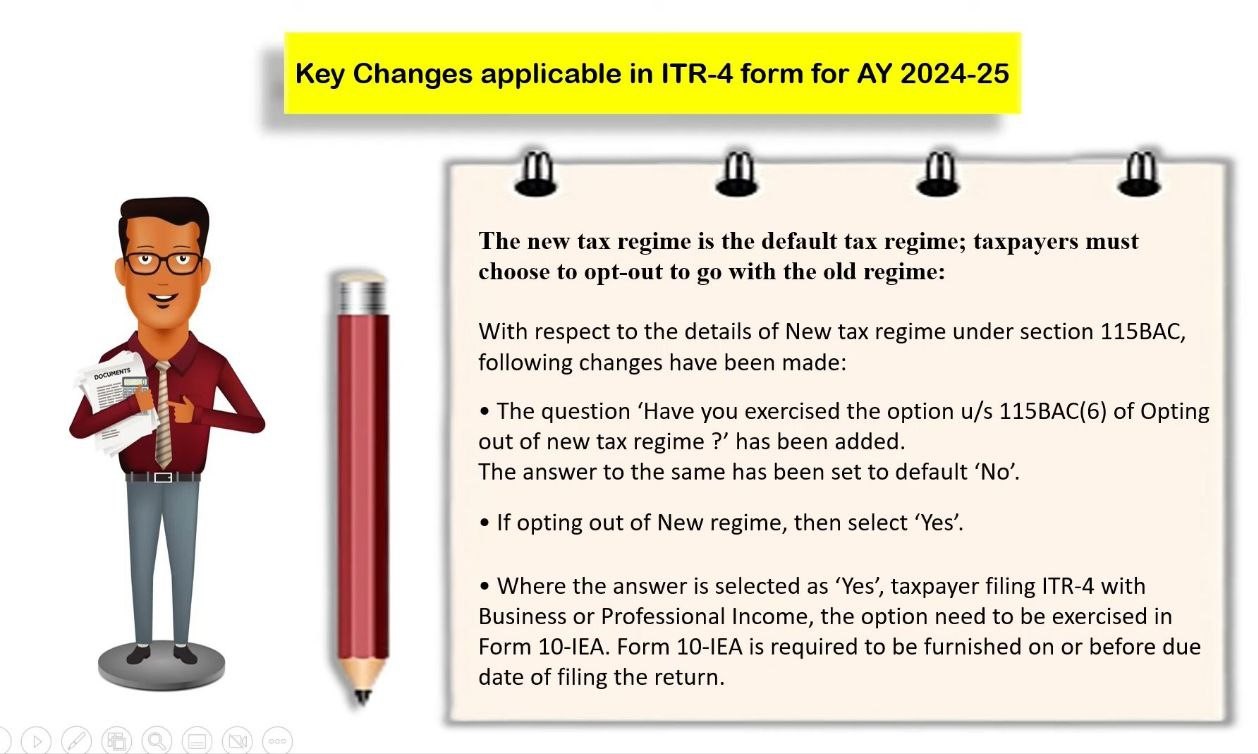

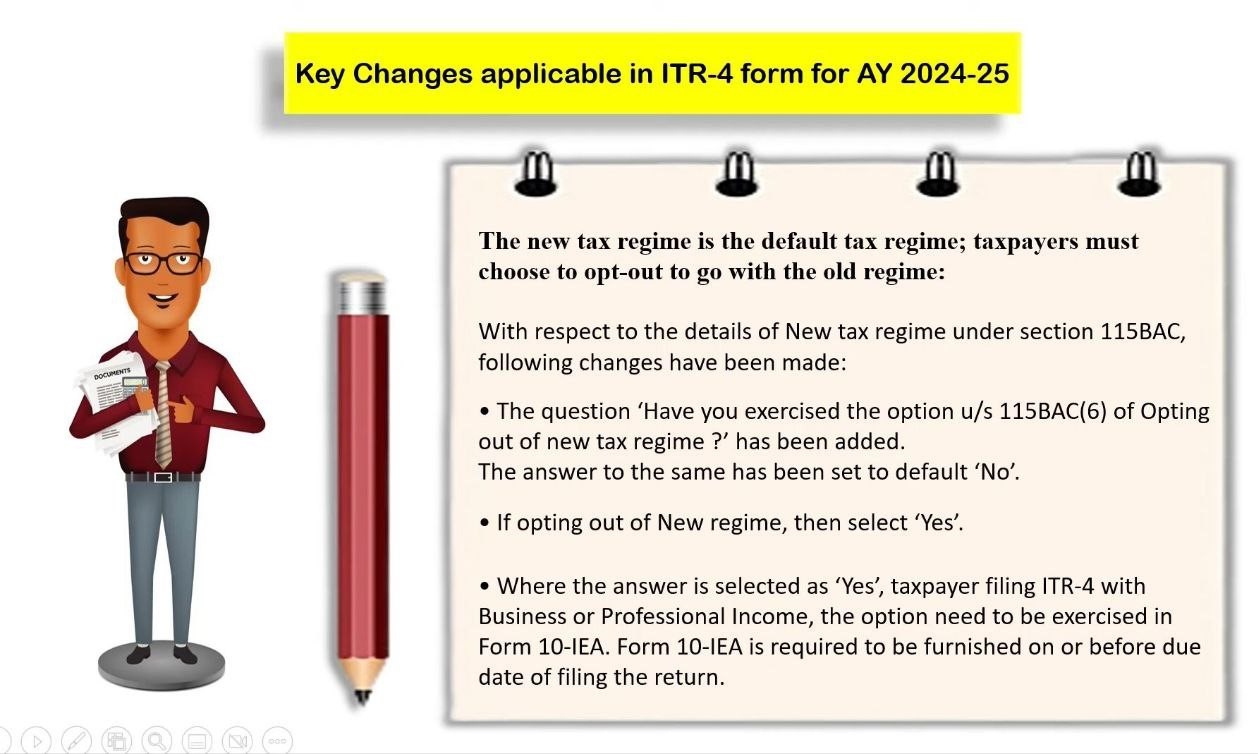

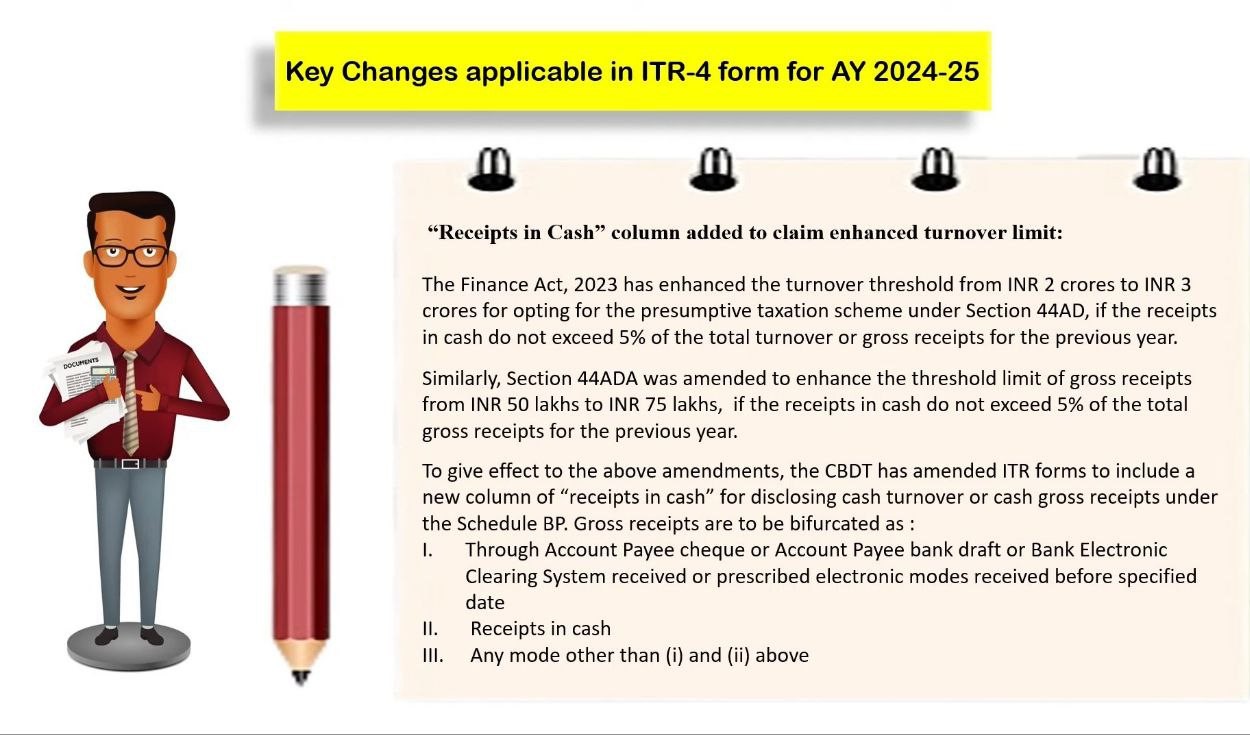

Key Changes Applicable in ITR-4 form for AY 2024-25

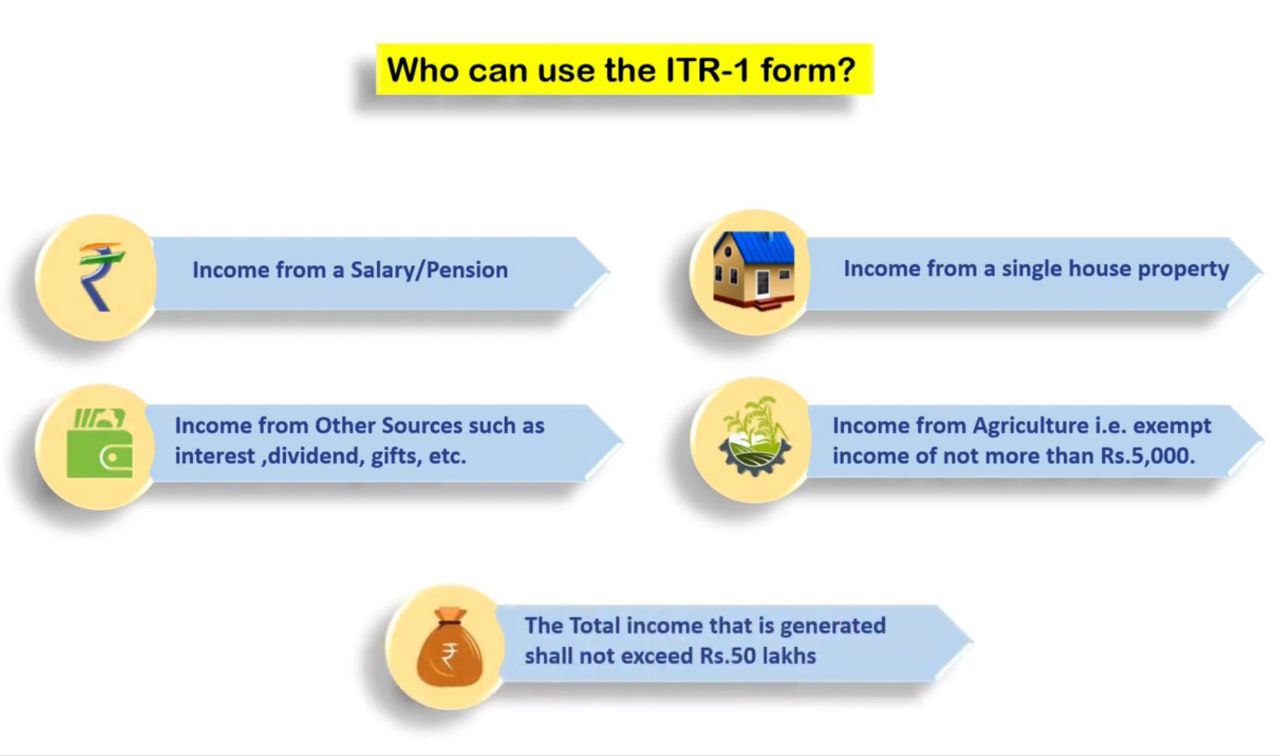

Who can file ITR-1

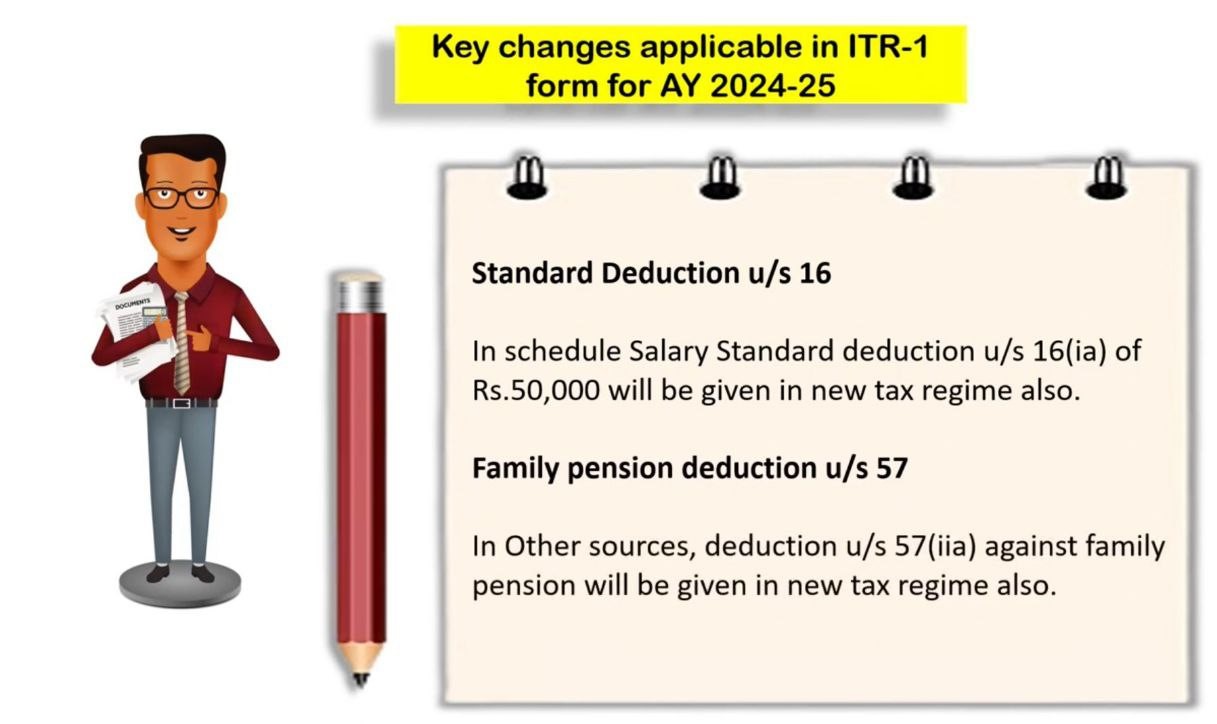

Key Changes Applicable in ITR-1 form for AY 2024-2025

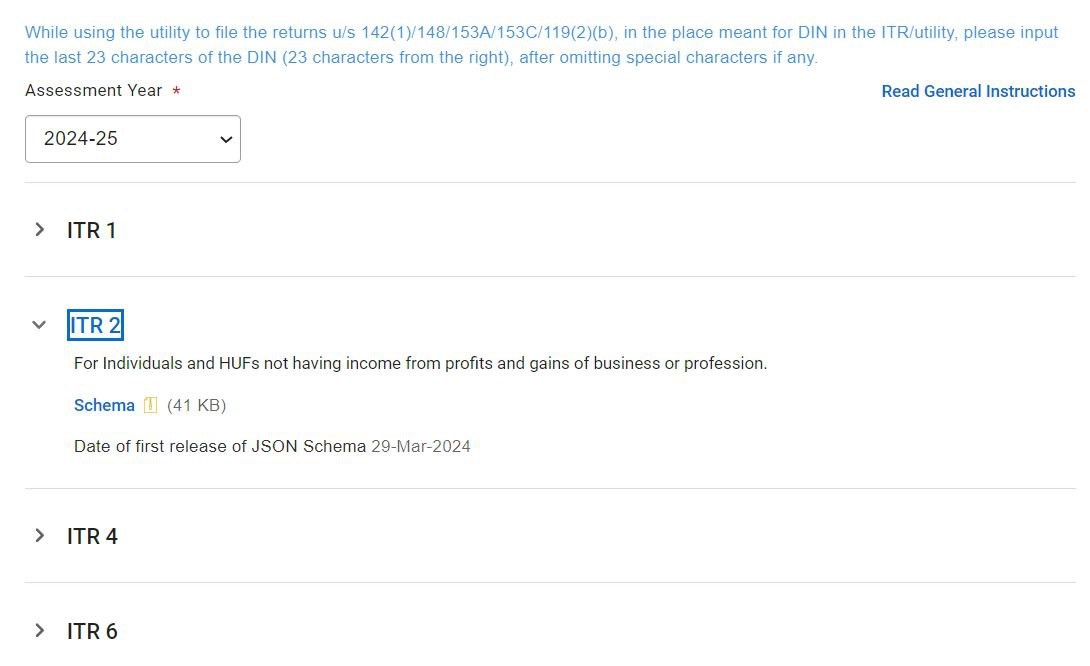

Income Tax Return Form Offline and Excel Utilities

- Tax Dept. issue Offline Utilities for ITR-1, ITR-2, ITR-4 and ITR 6 for AY 2024-25 are available for filing. Click here to download. (https://www.incometax.gov.in/iec/foportal/downloads/income-tax-returns)

- Income tax Dept issue Excel Utilities of ITR-1, ITR-2 and ITR-4 for AY 2024-25 are available for filing. Click here to download. (https://www.incometax.gov.in/iec/foportal/downloads/income-tax-returns)

- Income Tax Return Form of ITR-1, 2 and 4 are enabled to file via Online mode with prefilled data at the income tax portal.