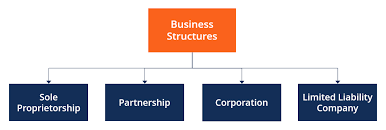

How to choose a business structure in India?

How to choose a business structure in India?

- When starting a business the first step to incorporating a company is to satisfy all legal regulations and ensure compliance with the legal requirements to make the Firm function safely.

- A Business model is a conceptual structure. It involves purpose goals to achieve long-term goals and planning for smooth functioning of the organization. The business model describes an entity how achieves its goals.

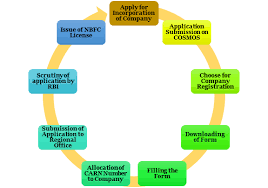

- A Registration is the first step that gives an organization the legal power to conduct business. There is a requirement to fill the compliance with a set of regulations under company’s Act 2013.

- The primary method to conduct a company is Company incorporation which is to be done by the owner of the company. Various types of companies can be established in India under the Companies Act 2013.

1. What is sole proprietorship?

A sole proprietorship is a business that is incorporated by a single person. A sole proprietor is who is responsible for paying its debts. A sole proprietor can operate the business under its own name or has the power to do the business under any fictitious name like Ram Enterprises.

What are the advantages of a sole proprietorship?

- The establishment of a sole proprietorship is instant, easy, and inexpensive for the owner of the entity.

- There are a few if any, ongoing formalities for a sole proprietorship.

- Sole proprietorship is a popular business because it is very simple, easy to set up and has a nominal cost.

- It is very easy for the owner after registration of his/her name to get GST, and local licenses for business.

- There is no need to pay unemployment tax on the behalf of the owner’s name. He/she can pay the tax on behalf of employees.

- Business of a sole proprietor runs into financial trouble. The creditors have the right to file suit against the business owner. If these suits succeed then the owner is personally liable to pay the debts.

- Because the entity has its own legal entity the owner of the sole proprietorship can sign the contract in his/her name .

- Owner of the sole proprietorship has its own bank account .

Following are the disadvantages of a sole proprietorship business:

- Owner of a sole proprietorship is subject to unlimited personal liability for the debts, losses, and liabilities of the business.

- The owner of the sole proprietorship is personally liable for all the business debts.

- Owner of the business is not liable to sell the interest for the purpose of raising capital.

- A Sole proprietorship cannot survive if the owner of the business died or become incapable of doing work.

- sole proprietor can file a suit against another party if wronged by them. Similary, if a Company can file a suit against under the name of the company if wronged

The formation of a sole proprietorship is simple and easy for the sole proprietor. It includes buying and selling of goods or services. It is not required to do formal filing in the formation of a sole proprietorship.

Because a sole proprietorship is indistinguishable from its owner, its taxation is straightforward. A sole proprietorship’s income is the income earned by its owner. According to the nature of the firm, a sole proprietor’s income reports the sole proprietorship income, losses, and expenses by filling out and completing an appropriate ITR in India.

2. Define One Person Company

A one-person company is a company that has only one member. One Person Corporation (OPC) is a firm with only one shareholder as its member since members are recognized as the company’s shareholders or subscribers to its MOA. When a company has only one founder or promoter, an OPC is founded. Because of the various benefits that OPCs provide, entrepreneurs who are just starting their enterprises prefer to form OPCs over sole proprietorships.

OPC was introduced in India on 31 March 2005 and was implemented under the companies Act 2013 for the benefit of the entrepreneurs. Before this many countries like China, Singapore, France, and the USA had already prevailed and ruined the concept of OPC. A person who is an Indian citizen and resident in India can incorporate an OPC or be the nominee for the sole member of an OPC. The minor person is not eligible to become a nominee of the OPC and cannot share the beneficial interest. The minimum paid up capital of OPC shall be INR 1 lakh.

Any person who is not a minor irrespective of the fact that he is an Indian citizen or not an Indian citizen i.e., the NRI can enter the One Person Company and appoint a nominee on his behalf. The timeline for India’s non residents has been shortened to 120 days.

What are the features of a one person company?

The general features of a One-Person Company are as follows.

- Private Company :- As per section 3(1)© of the Companies Act,2013 a single person can form a company for any purpose recognized by the law. OPCs are also known as private company.

- No Minimum Paid-up Share Capital : The Companies Act of 2013 does not mandate any minimum paid-up share capital for OPCs.

- Single- Member:- One-Person Company’s are liable to have only one shareholder or one member.

- Nominee:- During the company’s registration, the company’s only member nominates a nominee. This is a property that distinguishes OPCs from all other forms of businesses.

- Special Privileges : OPCs are subject to certain benefits and exemptions under the Companies Act that other forms of businesses are not. The following are some of them:

- No Perpetual Succession:- After the death of the only member of the company a nominee can become the sole member of the company or he may reject to become the member of the company. other companies followed perpetual succession.

- Minimum One Director : The director of One-Person Company’s must be at least one person, which in this case is the member. A maximum of 15 directors are allowed.

Advantage or Exemptions Provided to an OPC

Certain benefits and exemptions are available to One-Person Company’s that are not available to other forms of businesses. Such exemptions are as follows

- An OPC is not required to prepare a Cash Flow Statement as part of its financial statement.

- An Annual General Meeting is not required of an OPC.

- They do not have to include cash flow statements in their financial statements.

- OPCs are exempt from provisions relating to independent directors.

- When compared to other companies, directors can earn greater money.

- In the event of an OPC, the Annual Returns must be signed by the Company Secretary or, if there is no company secretary, by the company’s director. The yearly returns could be signed by the directors as well; a company secretary is not required.

Restriction and terms imposed of OPC

An One-Person Company is provided with certain restrictions and conditions. One-Person Company has imposed the following restrictions and terms:

- No one natural person can have more than one OPC.

- Any natural person under the age of majority is ineligible to become a member or nominee of an OPC.

- OPC cannot be turned into a non-profit corporation, and it cannot engage in non-banking financial investment activities.

- NRIs are not permitted to form a one-person company.

Criticisms of OPC:

The success of One-Person Company’s concept is in doubt for the following reasons:

- Currently, sole proprietors can raise cash and reserves from their relatives/friends or others, whereas an OPC, as a private limited company, is not permitted to do so.

- There are a few existing proprietors in India who do not want to follow the OPC concept because they desire to do business in their own traditional manner and because they are concerned about legal compliance.

There are a few existing proprietors in India who do not want to follow the OPC concept because they prefer to do business in their own traditional manner and because they are concerned about legal compliance.

It is absurd to expect financial firms to provide funds to OPC. Currently, financial institutions require guarantees and various security before extending credit to small business owners. The risk factor for financial institutions has increased since the One-Person Company now allows the same individual proprietors to claim limited liability.