All About the Public Provident Fund Account

All About the Public Provident Fund Account

When it comes to financial planning, the Public Provident Fund (PPF) is one investment that is often recommended by financial experts. A government-backed investment scheme, the PPF offers a safe and reliable way to build wealth over the long term. By investing in a PPF account, you can make your way towards becoming a crorepati.

What is a PPF Account?

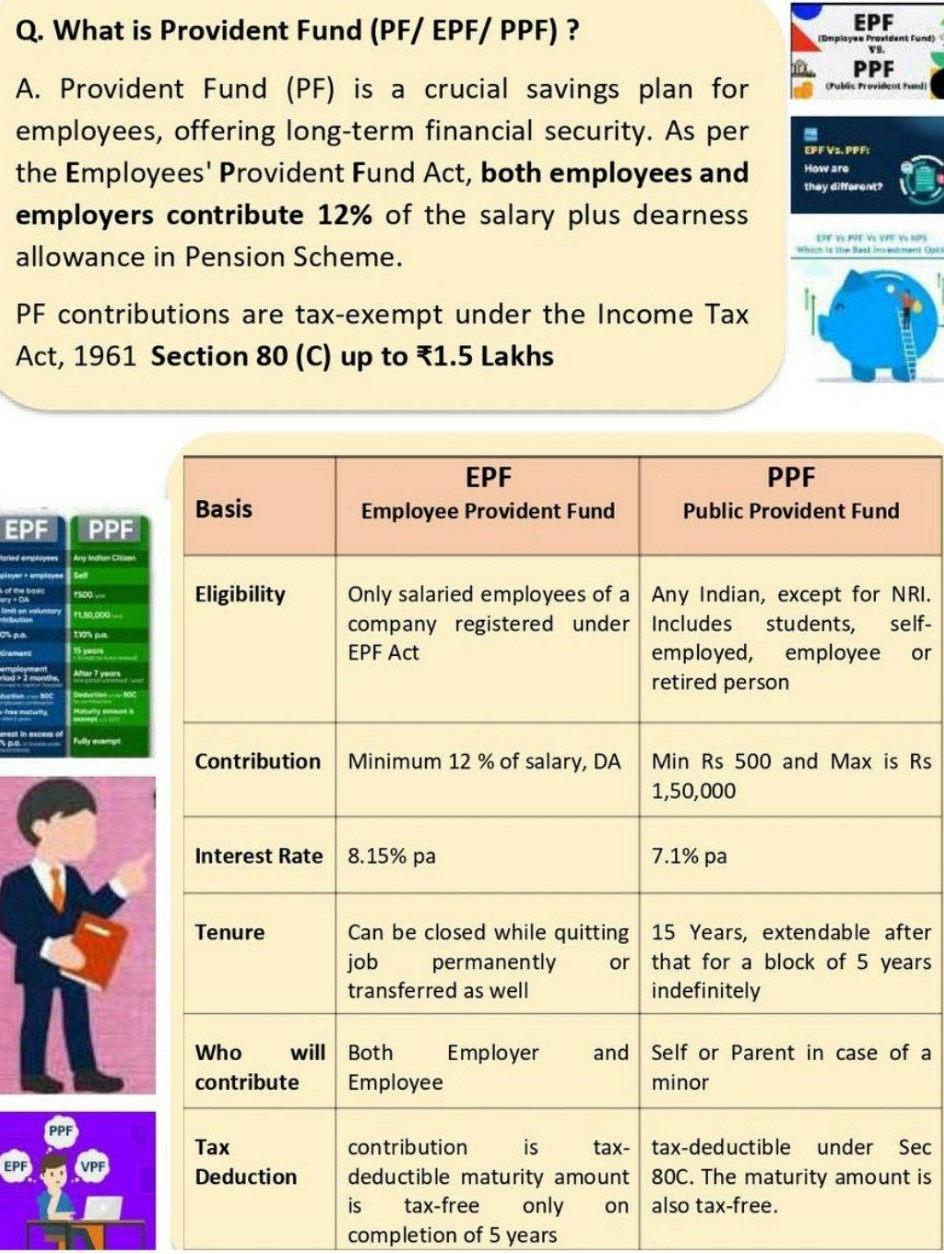

The Public Provident Fund (PPF) is a long-term investment option offered by the Government of India. The investment scheme aims to encourage saving amongst citizens of India and provides attractive returns. The current interest rate offered on a PPF account is 7.1% per annum. The interest earned is tax-free, making it an attractive investment option for anyone looking to build wealth in a tax-efficient manner.

How can a PPF Calculator Help You Become a Crorepati?

A PPF calculator is a tool designed to help individuals calculate the amount of interest they can earn on their PPF account over a specified period. By using a PPF calculator, you can get an estimate of the amount you can earn on your investment and make an informed decision about how much to invest to achieve your financial goals.

To use the PPF calculator, you need to provide information such as the amount you plan to invest, the tenure of your investment, and the frequency of your investments. Once you enter this information, the PPF calculator will provide you with an estimate of the amount you can earn on your investment.

How Much to Invest to Become a Crorepati?

The amount you need to invest to become a crorepati through a PPF account depends on various factors such as the tenure of your investment, the frequency of your investments, the interest rate offered on your investment, and the age at which you start investing.

Here are some scenarios which will give you an idea of how much you need to invest to become a crorepati through a PPF account:

Scenario 1:

You are 25 years old and plan to invest Rs. 50,000 every year in a PPF account for the next 35 s

Scenario 2:

You are 30 years old and plan to invest Rs. 1,00,000 every year in a PPF account for the next 25 years. Assuming an interest rate of 7.1% per annum, you will accumulate a corpus of Rs. 1,16,57,298 by the time you turn 55 years old.

Scenario 3:

You are 35 years old and plan to invest Rs. 2,00,000 every year in a PPF account for the next 20 years. Assuming an interest rate of 7.1% per annum, you will accumulate a corpus of Rs. 1,61,60,887 by the time you turn 55 years old.

As you can see from the above scenarios, the amount you need to invest to become a crorepati through a PPF account depends on various factors. However, investing regularly and starting early can help you maximize your returns and achieve your financial goals.

Other Benefits of a PPF Account

Apart from offering attractive returns, a PPF account offers several other benefits. Here are some of them:

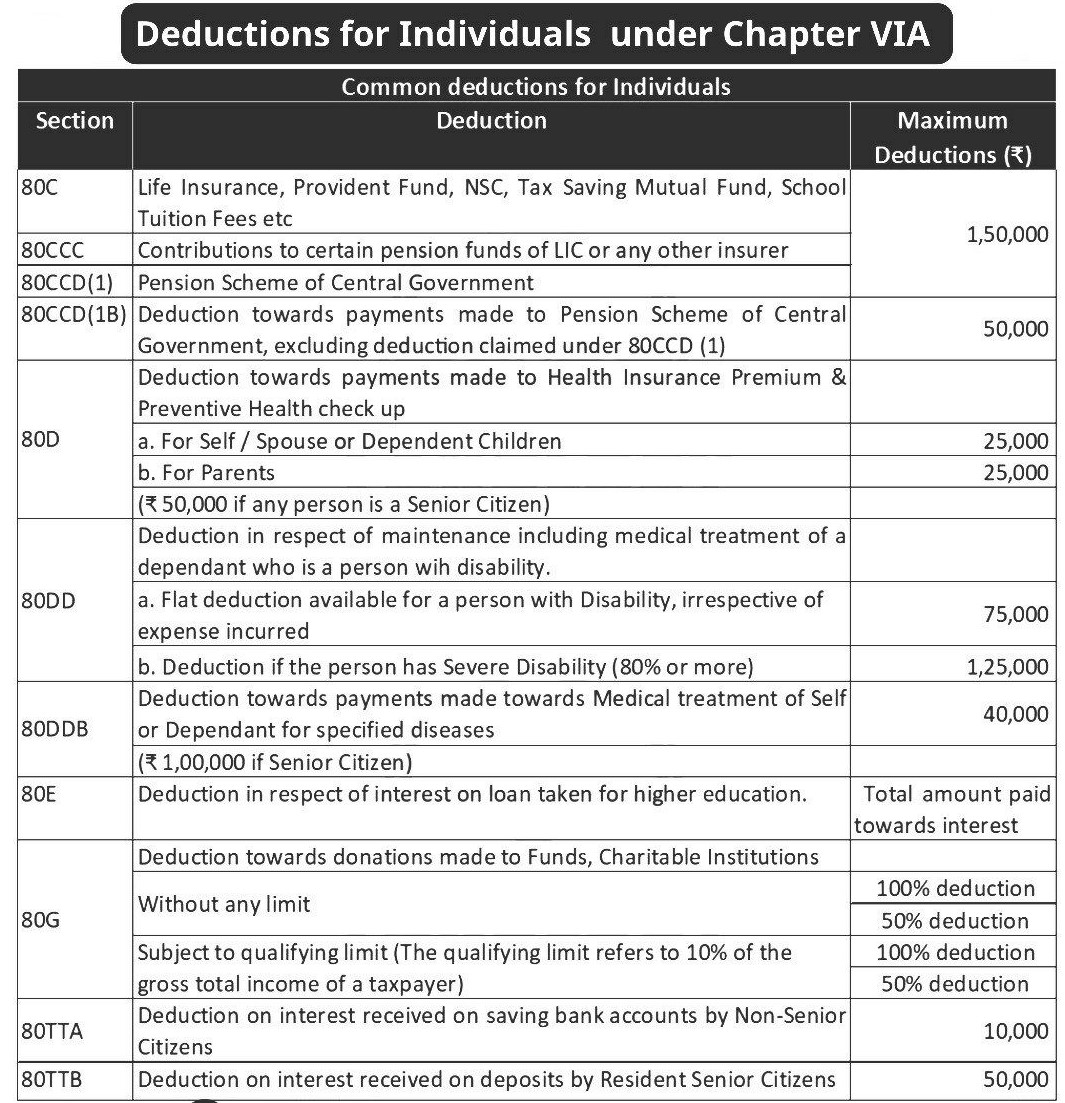

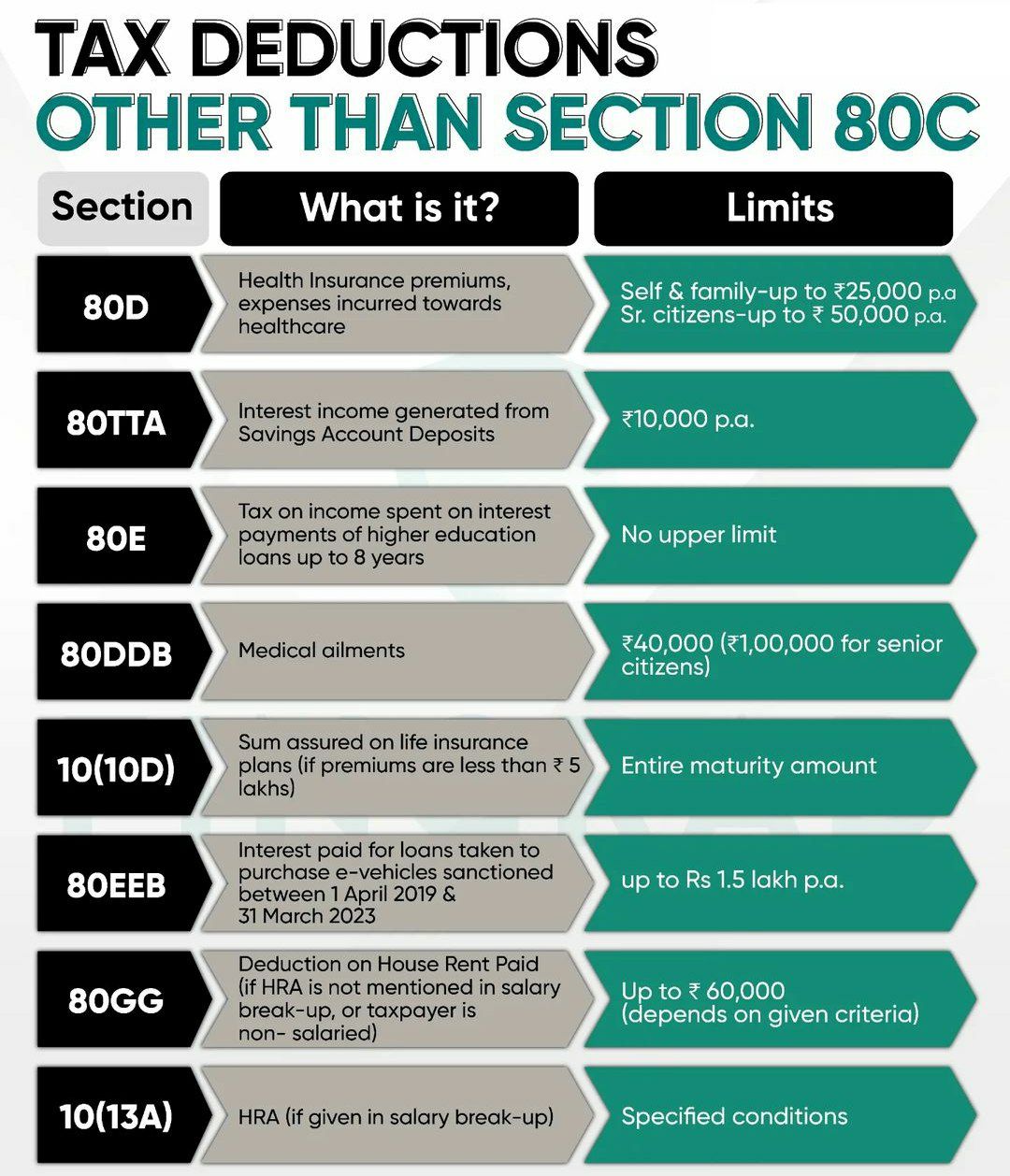

- Tax Savings: The amount invested in a public provident fund account qualifies for tax deductions under Section 80C of the Income Tax Act, 1961. The maximum deduction allowed is Rs. 1.5 lakh per annum.

- Loan against PPF: You can take a loan against your PPF account after the completion of the third financial year from the date of opening the account.

- Partial Withdrawal: You can make partial withdrawals from your PPF account after the completion of the sixth financial year from the date of opening the account.

Conclusion

Investing in a PPF account can help you become a crorepati over the long term. By using a PPF calculator, you can get an estimate of the returns you can earn on your investment and plan your investments accordingly. Investing regularly and starting early can help you maximize your returns and achieve your financial goals. Remember to review your investment periodically and make changes as per your financial needs and goals.

What are the differences and similarities between the National Savings Certificate (NSC) and PPF?

What are the differences and similarities between the National Savings Certificate (NSC) and PPF?