Some of the most typical mistakes made by Chartered Accountants while filing tax audits are as follows:

1. GST Interest, Late Fees, and Penalties:

There are two schools of thought on whether or not interest, late fees, and penalties should be allowed under GST:

• Section 37 of the Income Tax Act of 1961 prohibits the deduction of penalties, fees, and fines from turnover for calculating profit. Section 37 forbids the use of funds for any purpose that is a crime or is forbidden by law. One point of view is that interest, late fees, and penalties should be prohibited under GST.

• Another point of view is to enable interest and late fees as a penalty for late GST payment. The same is permissible under income tax. Penalty under GST, on the other hand, is prohibited under Section 37.

CAs, in their opinion, should account for these expenditures while preparing tax audit reports.

2. Observing Section 145A of the Income Tax Act of 1961

Section 145A. In calculating the income taxable under the heading "Profits and profits of business or profession,"—

I (ii) the valuation of purchases and sales of goods or services, as well as inventory, shall be adjusted to include the amount of any tax, duty, cess, or fee (by whatever name called) actually paid or incurred by the assessee to bring the goods or services to the location and condition as of the valuation date;

• According to Section 145A, the amount of any tax, duty, cess, or charge shall be included in the value of sale when determining the valuation of inventory for sale of goods.

• The CA should verify that when valuing inventory, the value of inventory includes the amount of any tax, duty, cess, or fees. The cost of the products must include the amount of taxes levied on them. Goods and Services Tax were among the taxes levied.

3. TDS credit in books should correspond to which TDS according to 26 AS

The receipts and TDS shown in 26AS should be compared to the receipts and TDS reported in the books of accounts. The same thing should be shown in the ITR. If there is a discrepancy between the information provided in the ITR and the information provided in the 26AS, a notification may be issued.

4. CA should remember Section 14A of the Income Tax Act of 1961,

Which allows for the disallowance of costs incurred in obtaining tax-exempt income, as read with Rule 6D.

5. The turnover in the books should match the turnover in the GST return.

6. Failure to comply with or notify ICDS constitutes professional negligence and is a suitable cause for the imposition of a penalty under Section 271J.

7. Interest paid to NBFCs is subject to TDS and is not exempt like interest paid to banks. Needless to say, simply including it into the TAR will have negative repercussions.

8. Acceptance and repayment of NBFC loans will also be included in section 269SS and 269T reporting.

This is not a complete list. These are some of the main precautions you should take to avoid a Tax Audit Penalty being imposed on CA.

Tax Audit Penalty of Rs 10,000 imposed on chartered accountants for report inaccuracy

This article outlines the criminal laws under which a Chartered Accountant can be fined for providing incorrect reports.

• Pursuant to Section 271J of the Income Tax Act, 1961, an Assessing Officer may assess a penalty of Rs. 10,000 on a Chartered Accountant if the Assessing Officer considers the CA provided inaccurate information in his report.

Situations in which a CA is unable to perform a tax audit include:

The following are the instances in which CA cannot undertake a tax audit: - 1) A CA cannot sign the Tax Audit Report of an assesse in whom he has a significant stake. An auditor will commit professional misconduct if he assesses an assesse in a situation where –

• Where the member, his firm, his partner, or a family has a significant stake in the business or enterprise.

• Where the member, his partner, or a relative is a director or works for the Company as an officer or employee.

In regard to a member, the term "related" refers to the member's husband, wife, brother or sister, or any lineal ascendant or descendant; and

A member shall be deemed to have a “substantial interest” in a concern –

o in a case where the concern is a Company, if its shares carrying not less than 20% of voting power at any time, during the relevant years are owned beneficially by such member or by any one or more of the following persons or partly by such member and partly by one or more of the following persons:

o One or more relatives of the member

o Any concerns in which any of the persons referred to above has a substantial interest

o in the case of any other concern, if such member is entitled or the other persons referred to above or such member and one or more of the other persons referred to above are entitled in the aggregate, at any time during the relevant years to not less than 20% of the profits of such concern.

2) The CA does not have a Certificate of Practice (COP)

• Any member who wishes to engage in public practice must first apply for and get a Certificate of Practice from the ICAI Council. Only members with a Certificate of Practice are permitted to serve as auditors or certify papers required by India's different tax and financial regulatory bodies. In India, Chartered Accountancy can be practiced by an individual Chartered Accountant, a business, or a Limited Liability Partnership of Chartered Accountants.

2) The CA does not have a Certificate of Practice (COP)

• Any member who wishes to engage in public practice must first apply for and get a Certificate of Practice from the ICAI Council. Only members with a Certificate of Practice are permitted to serve as auditors or certify papers required by India's different tax and financial regulatory bodies. In India, Chartered Accountancy can be practiced by an individual Chartered Accountant, a business, or a Limited Liability Partnership of Chartered Accountants.

• A practicing member who does not have a full-time Certificate of Practice (COP) or who is employed full-time elsewhere cannot sign the Tax Audit Report. As a result, a valid COP is required to sign any Tax Audit Report.

3) The assessee's employee is not permitted to sign the tax audit report.

• Section 2(59) of the Companies Act defines officer as "any director, manager, or key managerial staff, or any person under whose direction or instructions the board of directors or any one or more of the directors is or is used to act." The term "employee" is not defined in the legislation. As a result, a person engaged for compensation or salary (temporary or permanent) might be called a ‘employee' in the layman language. As a result, anyone who provides any kind of service to the firm is unable to be an auditor.

• A practicing member who does not have a full-time Certificate of Practice (COP) or who is employed full-time elsewhere cannot sign the Tax Audit Report. As a result, a valid COP is required to sign any Tax Audit Report.

4) A person who is a partner or an officer or employee of the assessee is not permitted to sign a tax audit report.

• This disqualification prohibits any individual linked to the assessee's officer or employee as a partner or employee from conducting a tax audit of the said assessee.

• For example, if Mr. A is an employee of Company B, he cannot be an auditor, and if Mr. C is either a partner or an employee of Mr. A, he is also banned from acting as the company's auditor due to an indirect relationship.

5) A person whose family is a director or is employed by the firm as a director or any other key managerial position of the assessee is not permitted to sign the tax audit report.

Section 2(77) of the Companies Act defines the term "related" as "members of a HUF" and "husband and wife." Furthermore, the Companies (Specification of Definition Details) Rules 2014 have provided additional list to include relatives who are connected to each other as father, stepfather, mother, stepmother, son, stepson, son's wife, daughter, daughter's husband, brother, stepbrother, sister, or stepsister.

If such relative is employed by the firm as a director or any other important managerial position of the assessee, he or she is ineligible to be the assessee's tax auditor.

6) A CA, his relative, or a partner with a security or interest in the firm is not permitted to sign the tax audit report.

A person who, or his relative or partner, cannot sign a tax audit report if he or she has a security or interest in the firm , holding, subsidiary or associate company (holding of such security or interest is exempted up to Rs. 1 Lakh)

7) A CA, his relative, or a partner who is indebted to the firm is not permitted to sign the tax audit report.

A person who, or his relative or partner, is unable to sign a tax audit report as he or she owes more than Rs. 5 lakh to the company, its subsidiary, or its holding or associate company, or a subsidiary of such holding company.

8) A CA, his relative, or a partner who has provided a guarantee to the firm is not permitted to sign the tax audit report.

A person, or his relative or partner, who has provided a guarantee or any security in connection with the indebtedness of any third person to the company or its subsidiary, or its holding or associate company, or subsidiary of such holding company, in excess of Rs. 1 lakh, is not permitted to sign a tax audit report.

9) A CA who has a commercial relationship with the Assessee is not permitted to sign the tax audit report.

• A person or firm that has a direct or indirect commercial relationship with the company, its subsidiary, or its holding or associate company, or a subsidiary of such holding or associate company, is not permitted to undertake a tax audit of such company. The phrase "business connection" is broad in scope and encompasses a wide range of situations. The Companies (Audit and Auditors) Rules, 2014 define the phrase "business connection." According to the definition, a business connection comprises any transaction engaged into for a commercial reason, with the exception of:

o Transactions at arm's length in the regular course of business

o Transactions in the type of professional services that an auditor is capable of delivering

10) A CA who provides a service as defined in Section 144 of the Companies Act is not permitted to conduct a tax audit.

• Any person who directly or indirectly provides any of the services mentioned in section 144 to the firm, its holding company, or its subsidiary company is not permitted to conduct a tax audit of the said business. Section 144 addresses the services that auditors are specifically prohibited from providing, such as accounting and bookkeeping services, actuarial services, management services, and others.

• The potential auditor must not be involved in rendering services to any related companies of the concerned company.

• For example, Mr. A provides investment banking services to a business called "XYZ Ltd." “XYZ Ltd” is a subsidiary of “ABC Ltd.” As a result, Mr. A cannot be hired as an auditor for "ABC Ltd."

11. ICAI increased the “specified number of tax audit assignments” for practising Chartered Accountants, as an individual or as a partner in a business, from 45 to 60 beginning with the fiscal year 2014-15 and continuing. A person appointed as a tax auditor for 60 audits cannot accept additional audits at the same time. This excludes audits performed under sections 44AD, 44ADA, and 44AE of the Income Tax Act of 1961.

12) A CA who has been involved in fraud for more than 10 years cannot conduct a tax audit.

• A person who has been found guilty by a court of an offence involving fraud and a period of ten years has not passed from the date of such conviction cannot be designated as a tax auditor.

• A person who has been found guilty by a court of an offence involving fraud and a period of ten years has not passed from the date of such conviction cannot be designated as a tax auditor.

Conclusion

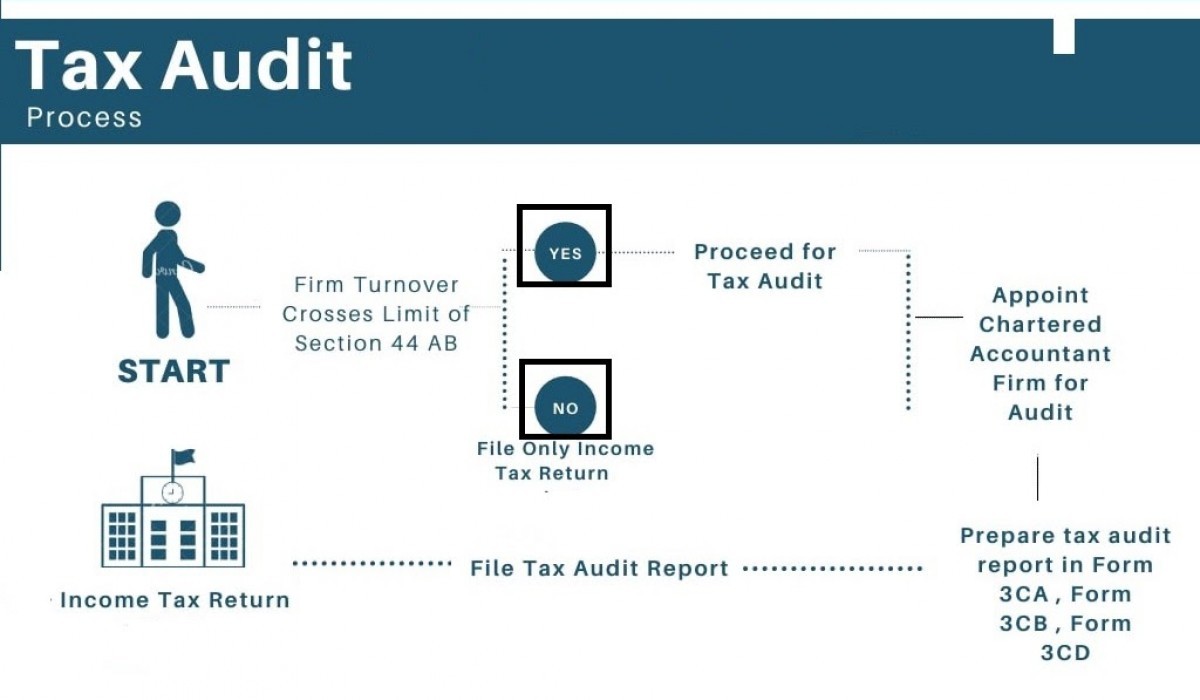

If you are a taxpayer, you must abide by the terms of Section 44AB of the Income Tax Act of 1961. This provision says that all taxpayers must get an audit report following an audit of their books of accounts. This is done to accurately depict the taxpayers' income-related activities, deductions, and taxes.

Leave a Reply

Your email address will not be published. Required fields are marked *