What is NBFC's collaboration?

Collaboration involves uniting for a common goal, India has more than 9000 + operating NBFC licence, but the book size of NBFC is hardly more than 40 crores. The remaining 8046 + NBFC can only meet the INR's 20 million loan book regulatory cap. NBFC Collaboration is a new business model in which NBFC license holders collaborate with banks / fintech firms to acquire and finance. All parties may or may not accept any chance of NPA and share the income of each other. Following strong RBI regulation in 2019, the conventional large-scale NBFC was confronted with a liquidity crisis, but mid-size and small-scale NBFC performed well and received a good amount of FDI for retail borrowing. NBFCs partner with banks and fintech companies to find affordable ways to raise funds and retain customers. In NBFC Collaborations, the bank or Fintech Company shall finance NBFC at the negotiated interest rate, covering at least 20% of the loan books and the remaining loan book balance. NBFC Collaboration is very successful if new loan technologies and timely disbursement of loans are available using the latest technology

NBFC Relationship process with Fintech

- Fintech Company and NBFC Group will have to sign Co-Originating System Agreements

- Fintech Company will have to register with Fund Manager (Intercorporate Deposit Agreements) NBFC will have to sign a Fintech Business Network Service Agreement

- Appointment of a Chartered Auditor for the management of the Escrow Account Fund and Facilities

- Free Escrow Account (Separate Escrow Account for Disbursement and Re-Payment)

- Effective tracking of compliance (GST, TDS, CKYC, Credit Reporting, etc.)

- NBFC 45/90 Days NPA Terms of service

- Quarterly assessment and CIC monitoring.

Should NBFC still look properly at These Fintech or FLDG's balance sheet?

NBFC should look for the past of Fintech firms and their financial strength and promoter profile, in particular for Foreign Fintech, before joining the NBFC Collaborative Agreements, Due diligence should be mandatory. The tax paid must be the basis of the fund invested on ICD routes and the fin-tech company must comply with the compliance criteria.

Progress of the device lead

The core of Model Fintech drives the business and provides resources for advanced technology underwriting and risk assessment. Generally speaking, NBFC pays Fintech commissions varying from 1% to 3% of Loan Amount.

Program co-financing

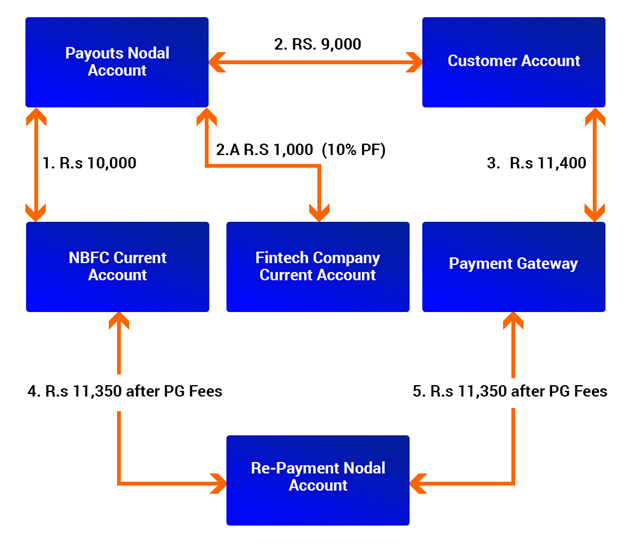

In this model, the Fintech business offers the expertise and decision-making methods needed to rapidly deliver NBFC loans. Under the FLDG scheme, Fintech companies used a dedicated Escrow account. FLDG Perhaps up to 70% of the NBFC's loan book and the remaining 30% of its portfolio. Fintech contrasts ROI from 24% to 36% with NBFC. Therefore, Fintech covers 100% NPA & Expense.

100% Fintech Led ICD Road

100% Loan book funded in this phase by the Fintech firm via ICD / OCD Road. Over the past few months, a growing number of Fintech companies have opted to work along this route. In this scheme, NBFC collects 1% to 2% of Loan Amount disbursed in one month. Fintech manages 100% NPA and All Expenses Related mortgage assets. Either ICD or Mortgage disbursement or re-payment of loans, through the escrow account, the entire transfer of funds is rendered.

The NBFC Market Flow System

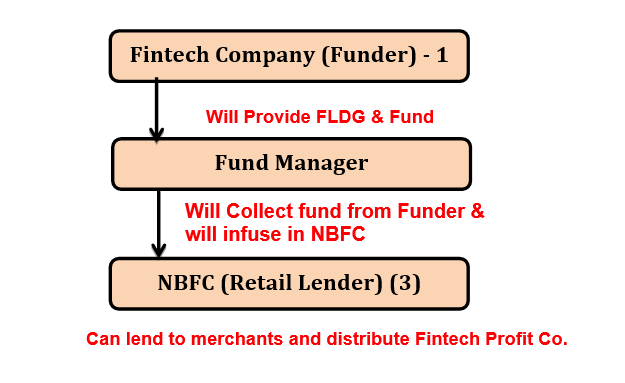

Company (1)

A With Fintech Business may or may not have an overseas division accessible from Software and Underwriting and Threat Model. Fintech business will produce leads from a marketing campaign online and offline. Fintech Company will have to provide the fund manager as FLDG with a sufficient amount of deposits. Fund Manager will infuse NBFC funds as an inter-corporate investment. Fintech will provide the NBFC with collection services.

Company (2)

A law firm, CA or consultant with experience in law and finance operates the fund in compliance with the guidelines of the Fintech client and pays Fintech a service fee.

Company (3)

The NBFC, which is regulated by the RBI Act, is allowed to disburse and borrow. Fintech will exchange a list of lenders involved in different loan items, and NBFC will be disbursed after risk assessment. NBF must retain some percent of Loan and Risk Assessment Services sales, And the remainder of the income will be split up as Fintech agreed.

Profile of Fintech ICD Alliance

Definition of loan movement

Minimum technologies needed for Fintech

- Mobile App Respond to Indian demand

- Loan origination, loan processing, collection system should be ready Credit and underwriting systems should be operated by the Fintech business

- Fintech business should have ample IT security to keep the Borrowers ' personal information from being misused.

- Loan App should be capable of combining various APIs, but not restricted to Aadhar, PAN, Driver licenses

- Live Borrowers Identity Verification should be accessible

- Bank statement analysis will conform with the Income Review System

- The name of the creditor should meet with the ID Submitted online.

- For the use of social scoring tools, safety guidelines must be followed in compliance with Indian regulations.

There must be a database in India. Fintech Company will require a stock certificate in this context.

What is the prerequisite for Fintech enforcement?

- Fintech Company may offer any loan or guarantee by board resolution up to 60% of its paid-up capital and up to 100% of its free reserves and protection premium, whichever is higher.

- With the exception of Members, Approval that award up to 100 percent of their paid-up capital (see full ICD Guidelines)

- Fintech Company is required to pay GST on loan processing fees, and GST is included in regular handling fees.

- Fintech Company must meet the requirements of the ECB in the case of expanded debt / credit by foreign funds.

What is the NBFC enforcement requirement?

- Including Employees, Approval granting up to 100% of their paid-up money (see full ICD Guidelines)

- Fintech Company is required to pay GST on loan processing fees, and GST is included in daily handling fees.

- In the case of extended debt / credit through foreign funds, Fintech Company shall meet the ECB's specifications.

- Pursue GST, TDS, RBI and Company Act.

- Appoint a CA for the Fintech company's surprise check and business risk appraisal

- Based on 45 days or 90 days for NPA loan book efficiency requirements

- FinTech is the new way of improving and supplying consumers with financial services via computers and mobile phones. Things can range from money transfer, invest, manage your savings and online banking credits.