Compulsory Compliances by Private Limited Companies in India:

- Board Meeting.

- Annual General Meeting (AGM)

- Appointment of the Auditor (Form ADT-1)

- Director Disclosure.

- Accounts to be Audited by a Statutory Auditor.

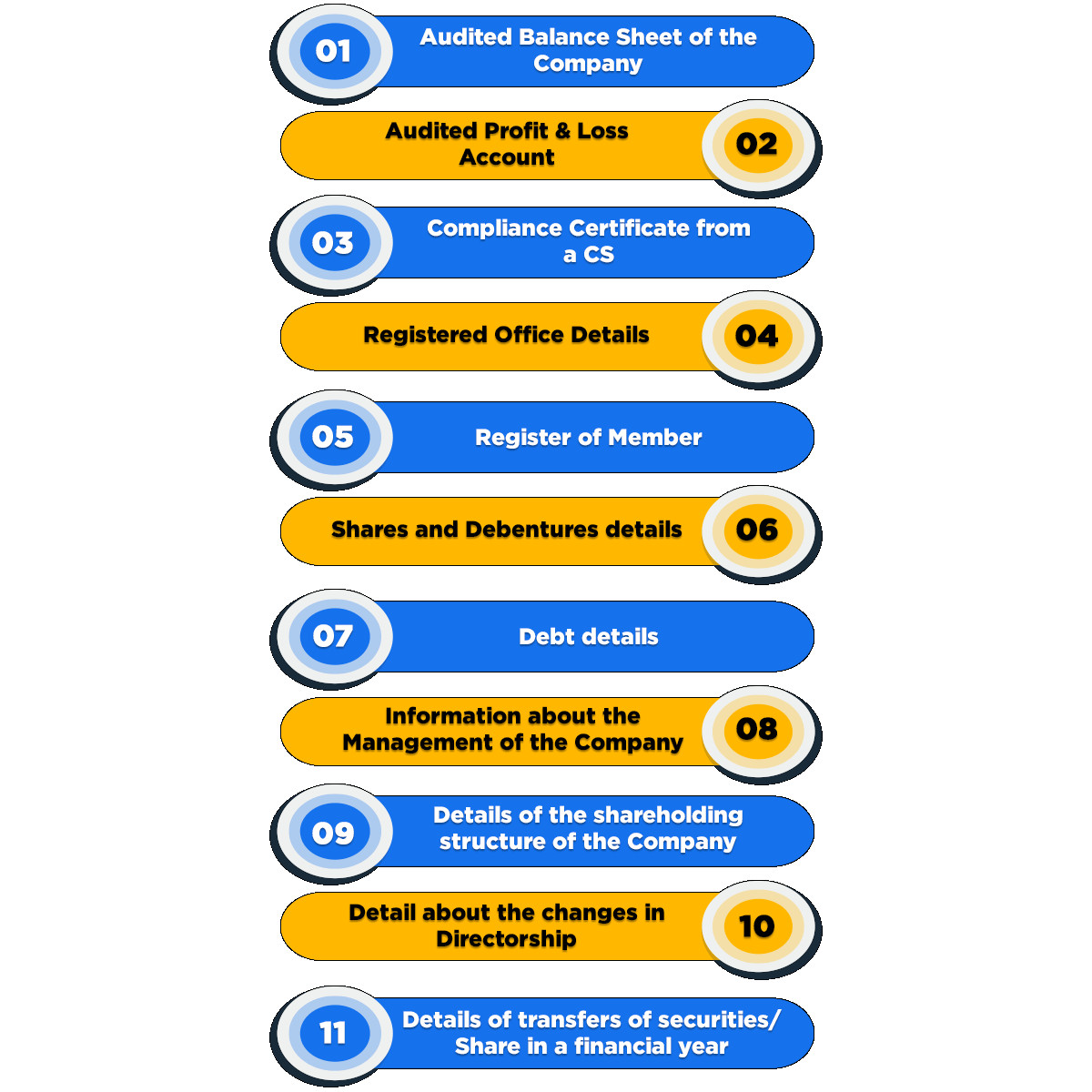

- Filing of Form MGT-7.

- Filing of Financial Statement (Form AOC-4 )

- Statutory Audit of Accounts.

|

S.No |

Section

|

Form

|

Compliances Particular

|

Non- Compliance Penalty

|

|

1. |

Section 139 (6)

|

Form ADT-1

|

First auditor shall be appointed within 30 days from Registration of the company & hold the office till the conclusion of First AGM.

|

|

|

2. |

Section 184(1) |

Form MBP-1 |

Every director of the Company in First Meeting of the Board of Directors in each FY shall disclose his interest in other entities |

Director who fails to give disclosure of interest shall be punishable with imprisonment which may extend to one year or with fine which may extend to INR. 1,00,000 or both

|

|

3. |

Section 10(A)(a)

|

INC- 20 A

|

All the companies must have to file Form INC-20A within 180 days from the date of registration for commencement of business. |

Company liable to pay INR. 50,000 & every officer in Default liable to pay Rs. 1000 per day till the default continues but maximum of INR. 1 Lakh.

|

|

4. |

Section 173(1)

|

|

Company shall hold First Meeting of the Board of Directors within 30 Days of the date of its incorporation. Directors can participate in Board Meeting either in person or through video conferencing or other audio visual means. |

Every officer of the company whose duty is to give notice of BM and fails to do so shall be liable to a penalty of INR. 25,000.

|

|

5. |

Rule 12A of Companies (Appointment and Qualification of Directors) Rules 2014

|

Form DIR 3 KYC

|

All the Directors of company shall file this form on or before 30th September every year for all the directors of the Company |

DIN shall be marked as 'Deactivated due to non- filing of DIR-3 KYC' and shall remain in such Deactivated status until KYC is done with a fee of INR. 5000.

|

|

6.

|

Section 164(2) & Section 143(3)(g)

|

Form DIR-8

|

Every Director of the Company in each FY will file with the company disclosure of non- disqualification.

|

|

|

7.. |

Section 88 & other Sections

|

Maintenance of Statutory Registers

|

Company will maintain the following compulsory Registers: Register of Director, Registers of Director Shareholding, Register of Member, Register of transfer, Register of related party etc.

|

Company and Every Officer of the company who is in default shall be punishable with fine not less that Rs. 50,000 but which may extend up to INR. 3 Lakh and in case of continuing failure further fine of INR. 1000/ day |