What does Peer Lending mean?

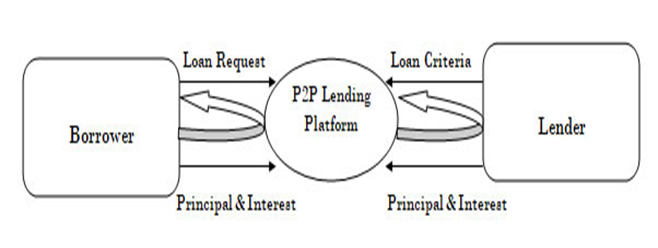

Peer to Peer (P2P) lending platform is basically an online platform for collecting loans that are to be repaid with interest. The borrower may be either a legal entity or an individual. The online platform may determine the interest rate on the loans to be paid, or the parties may agree on each other. Even if we're thinking about lending from the lender, it pays higher interest rates. Employers will conveniently borrow money from individuals on this website.

Simply put, we may conclude that borrowing from Peer to Peer (P2P) is a form of social lending which allows individuals to lend or borrow money. No financial institution is involved, and borrowers are able to choose debtor. With higher interest rates, this concept of lending is gaining popularity among lenders.

What does Peer license mean?

Peer to Peer borrowing is a debt financing structure that allows individuals to invest or borrow money without any financial institution being involved as an intermediary. The Indian Reserve Bank regulates peer-to-peer lending companies. They are running digitally with low overhead costs. This appears to be beneficial for both lenders and borrowers so that investors can gain higher interest rates and borrowers can repay at lower interest rates.

P2P lending sites are technology-driven companies listed under the Companies Act. Among lenders and creditors, they act as an aggregator. Lenders and lenders are registered on the portal at the P2P lending platform. P2P lending network then conducts due diligence and accepts requests for inclusion in lending / borrowing operations.

The Reserve Bank of India must receive a license to operate a P2P lending sector. To obtain a license for P2P borrowing, the specialist practitioners must file a proper application with the authority along with the necessary documents.

What are the peer-to-peer lending platform features?

P2P Loan system is revolutionizing the global financial sector and reshaping the financial industry in recent years through the introduction of new creative platforms and financing products.

Custom-designed P2P lending system is the best second method to old-style bank borrowing as banks take a long time to accept loans. Instead of visiting banks and applying for loans, it is easy to use P2P funding services where we only need to provide the necessary information while sitting at home / office and our loan will be reviewed and accepted within hours.

Here are the following peer-to-peer lending features

- P2P Lending system includes online transactions;

- There is no need for a prior relationship between lenders and borrowers;

- Lenders may easily pick borrowers on the P2P platform to invest in;

- No specific bargaining interest rates or sums.

What are the advantages and disadvantages of Peer to Peer Lending Platform?

Peer to Peer Lending has its own array of advantages and disadvantages.

1. From the Borrower's Points of view:

Advantages:

- Low-Interest Rates: In contrast to banks and credit cards, lenders may benefit from low interest rates.

- Fixed Rate of Interest: Â In contrast to banks and credit cards, lenders may benefit from low interest rates. In some cases, there has been a reduction of about 35 percent.

- Simple and Fast Processing of Application: Consumers have exclusive online interaction to enable fast payment movement.

- Lower Fees: the service pays lower fees than other financial types. In contrast, there is no charge for pre-payment.

Disadvantages:

- It involves a low amount of loan compared to banks.

- Less security

- In some situations, lenders are more than creditors.

2. for Lenders

Advantages:

- Higher Returns:Â Returns given to shareholders are generally higher, depending on the type of risk you are taking.

- Diversification: There are a broad range of options open to investors to invest in.

- Direct Communication with the Buyer:Â the website offers creditors with the possibility of communicating directly to borrowers and finalizing their borrowers contract.

Disadvantages:

- Whether or not the platform's credit rating evaluation is accurate is an issue. The related hazard is therefore not clear.

- It would be too early to reach a definitive conclusion with the P2P industry still in its infancy.

- Returns are smaller than publicly traded index funds

Peer-to-peer loan system legal framework

While most of the crowd-funding, whether it is focused on equity, bond or investment, comes within the purview of the capital market regulator-SEBI, the P2P loan is controlled by Reserve Bank of India. P2P borrowing is handled differently in different jurisdictions around the world. They are identified as banks in some countries while they are treated as intermediaries in other countries. This drags us to consider the international situation that circumvents the worldwide borrowing of P2P.

Here are the five ways in which P2P lending has been regularized globally mentioned in consultation paper released by RBI

| Regulatory Regime | Description | Countries Currently Using the Regime |

| Exempt market/ Unregulated through lack of definition | Either the law has listed P2P lending as an excluded sector or there is a shortage of meaning in the regulations in these jurisdictions. Nevertheless, in some situations, there are laws designed to protect lenders, but mostly include legislation already in place to protect the applicant against excessive interest rates, unfair credit arrangement and false advertising. | China, Ecuador, Egypt, South Korea, Tunisia |

| Intermediary Regulation | As an agent, this controls P2P lending services. Registration as an agent and other regulatory requirements, based on the jurisdiction, are usually required. Usually, there are laws defining the standards for the registration of platforms in order to have access to the business. In what manner, the platform should conduct the activities are determined by the Other rules and requirements defined. (for example, the licensing needed to provide credit and/or financial services). | Australia, Argentina, Canada (Ontario), New Zealand, United Kingdom |

| Banking Regulation | It governs P2P lending sites as banks because of their payment intermediation roles and is therefore governed as banks. As such, the sites must acquire a banking license; they must meet with the disclosure requirements and other such legislation. | France, Germany, Italy |

| US Model | Two levels of regulation are defined which includes the Federal Regulation through the Securities and Exchange Commission (SEC) and the State level, where the systems have to be implemented on a state-by-state basis. The state regulation is one point below the federal requirements. Many jurisdictions fully ban the practice of P2P lending (e.g. Texas). Some jurisdictions place limits on the sort of borrowers that use the sites to lend (e.g. California). In fact, if a network wants to work through multiple national boundaries, it must report to each State separately. | United States of America |

| Prohibited | P2P lending is banned under legislation. | Israel, Japan |

System of Peer to peer lending in India

There is massive growth in the online market for loans and funds, so it is necessary to find a way to satisfy a wide range of stakeholders and fund-seekers on a unified platform to satisfy their financial motives. Although Peer to Peer Borrowing (P2P) is in its infancy in India, the risk associated with financial market P2P borrowing is too popular to be overlooked.

There is one variable that has boosted the increase in India's peer-to-peer borrowing sector, i.e. the decline in bank lending during 2016-2017. According to the reports, this market is expected to grow to $5 billion by the year 2023. More than 30 companies are currently on the market, such as Faircent, Lentbox, Capital Float, Indifi, India Money Mart, Monexo, Rupaiya Exchange, Capzest LoanBaba, i2iFunding, etc.

RBI publishes guidance to govern P2P lending platforms so that they can expand in an organized, equal and controlled way. RBI also told last year that it will recognize Peer to Peer borrowing sites as Non Banking Financial Companies (NBFC). In order to protect the interest of all funding sites and investors as well as borrowers, RBI issues guidance from time to time. The analysts have expected that P2P borrowing sites would be able to access credit information in the near future.

Peer to Peer International Scenario Loans

- P2P borrowing is absolutely banned in places like Israel and Japan. Several nations including Australia, Canada, the United Kingdom view them as financial intermediaries.

- In China, Egypt, South Korea, P2P loans are not limited and are deemed excluded because of the lack of definition.

- In China, Egypt, South Korea, P2P loans are not controlled and are deemed excluded because of the lack of definition

- In the United States, the person concerned is treated at the central level in the dual phase-one and at the state level in the other.

Scope of Activities undertaken by the Peer to Peer Lending

Fintech firms listed under the Companies Act are the P2P borrowing sites. Upon reporting the applicant on its own, the sites conduct their credit appraisal activities. Only those applicants who agree with the platform's due diligence requirement are allowed to participate in the borrowing and lending process. Many additional services such as credit evaluation, risk analysis, restorations etc. are also offered by the sites.

Following are the scope of activities:

- Work as an agent

- P2P lending platform is not allowed to lend on its own

- Unauthorized to negotiate credit enhancement / guarantee

- P2P lending platform does not have the power to allow safe borrowing

- Any other financial commodity cannot be offered

- External transfer of funds can not be permitted

- Compliance with all relevant legal standards is essential.

What is the peer-to-peer lending process?

- Financing P2P by auction

At the p2p market place, the borrower may bargain with each other to finance the debt obligation of the claimant at the lowest interest rates.

- Using a set auction cost

In this situation, only borrowers are expected to fund the mortgage amount.

- The P2P lending platform on the industry

In this arrangement, the loan conditions of the Borrower must be fulfilled and sustained either by a P2P lending network alone or by a financial associate or program linked entity

What are the peer-to-peer loan models?

Let's now tackle the definition of peer-to-peer lending in the following types of loans:

- Mortgage loans

Small personal loans, such as car / family loans or self-holiday / home repair / credit card fees. Small Business (SME) Lending

- SME loans are issued to small businesses for the above purposes:

1. Assets of function

2. Expansion of sector, and

3. Financing of investments

The promoters generally offer a personal guarantee against the loan.

Loans for land

P2P mortgages are protected against the first payment on commercial or residential properties. The fund is borrowed for personal loans, buy-to-lets, residential refurbishment, and the development of industrial credit. This style is not popular in India.

How does Peer to Peer Lending work?

Funds are collected from individual investors on peer-to-peer finance platforms who are willing to lend their cash to lenders at the interest rate agreed.

Profiles of borrowers are shown on the P2P lending platform, from which lenders may openly pick the profile of borrowers and decide to lend money. There is no need for a creditor-purchaser relationship.

It is not required for the borrower to receive the full loan amount; he may receive some part of what he has received from a lender.

How peer-to-peer loans differ from banks?

Generally speaking, borrowers are asking people or business entities to take out loans for it. Therefore, a bank takes a long time to review the detailed financial history. The banks do this to determine the credit score of the lenders and the mortgage history. The banks decide if the prospective borrower is eligible for a mortgage, based on the certification .Compared to banks, Peer to Peer's financing system requires faster loan storage as no intermediary remains.

| Basis | Bank | Peer to Peer Lending Platform |

| Duration | Banks take longer to authorize a loan because of a detailed review of the financial background of the borrower | Faster Loan management as less stringent rules occur |

| Product | The clients are given structured loan options | Based on their profile, a personalized approach is offered to customers |

| Approach | Looking closer to the credit score | For loans, a data-driven method is used |

| Rules & Regulations | Strict rules and regulations because there is a fair review of credit ratings | Therefore, robust rules and regulations are not certain about the risk associated with P2P |

| Loan Amount | The lending can be higher | Loan cap (Maximum Rs. 10 lakhs/-) |

What are the basic requirements for peer-to-peer loans?

The P2P lending networks are under the authority of Reserve Bank of India under section 45I(f)(iii) of the RBI Act to establish NBFCs.

The main foundations of the regulatory framework are:

- Permitted Activity:Â Banks assess whether the prospective borrower is eligible for a mortgage, based on the certification. Unlike banks, Peer to Peer's financing system requires quicker loan handling, as no broker occurs. To avoid the risk of money laundering, the funds are transferred directly from the Lender's account to the Borrower's account. The FEMA guidelines will also be followed in the case of any cross-border transactions.

- Prudential Requirements: A minimum capital cost of INR 2 crore.

- Governance Requirements:Â It provides adequate partners, administrators and CEO criteria. A large number of highly trained leaders would also be included in the board. It is also necessary to establish a specific business location in India, with mainly country-based management.

- Business Continuity Plan: The body that serves as the keeper of controls and agreements shall develop an effective risk management strategy.

- Customer Interface:Â Since the platform requires consumer data to determine their credibility, safeguarding their information is the primary duty of the system. The details will be kept confidential, our operations will be available. With outstanding performance, there will be no false promises.

- Reporting Requirements: These electronic organizations shall, on the basis of their financial position, send regular reports to the Reserve Bank of India, standardized loans in each section, complaints obtained in each group, etc. Loan sum-: loan amount cannot surpass INR 1 million for one borrower.

If we're confident about the P2P loan regulatory framework, let's look at the Peer to Peer loan criteria.

Who is eligible to apply for a Peer to Peer loan?

The following are eligible to apply for a peer-to-peer loan permit in India:

- A company approved in India

- Applicants must have political, technological and strategic resources;

- Applicants must have an adequate equity framework to integrate the P2P lending platform;

- Proposed managers must fulfill the required and suitable criteria

- A robust IT plan

- A sound business strategy Claims for serving the public interest

What steps are defined for acquiring Peer to Peer lending?

Any person who wishes to start lending P2P and register as a Private Limited Company or Public Limited Company can apply for a RBI P2P license. The requirements must be addressed in order to do this:

As a private limited company or public limited company with the primary funding purpose, business should be allowed in India;

- Net assets of INR 2 crores.

- Work Stream Desktop / Mobile App

- Offline RBI desktop (COSMOS) connections.

- The RBI Office shall provide the attached papers with a hard copy of the submission.

- Only after careful inspection of the paperwork and associated documents will the permit be given it.

What is Peer-to-peer financing and flow?

Borrowing from peer to peer in India is a crowd-funding system under which loans are obtained and returned with interest. The P2P lending site allowing lenders and investors to sign up for unsecured loans is an online platform. The creditor may be an individual or legal entity within this system.

Minimize instability and optimize peer-to-peer lending returns

Borrowers in an unorganized sector are compensated with the low interest rate on P2P loans relative to those issued by other money lenders. Interest rates charged on mortgages range from one scheme to another, ranging from the uniform interest rate of the market to the dynamic interest rates agreed by borrowers and investors.

- Ways to benefit from returns:

- Â Diversify holdings to take advantage of higher returns.

- Regularly recycle purchases to profit from compounding electricity.

- Â Break the total investment and lend to different borrowers in the same class to mitigate the default.

What online platform defined under Peer to Peer lending?

The automated network of P2P lending provides services such as debt collection, redemption of loans, creditworthiness ranking, etc. The network fees are usually charged in order to promote the above items or to fund general business expenditures.. The online platform does not take advantage of the gap in loan and deposit rates in the case of general financial intermediation. Alternatively, they benefit from the contract fees and credit scoring of the borrowers.

Fees described under online platform for P2P lending

Both the borrower and the lender are paying the lending site pre-determined rates. Borrowers are either charged origination fees at a flat rate or as a percentage based on how much loan they have received. As described above, the origination charges are often dependent on the risk category of the raised funds. In fact, borrowers are charging administrative fees. If they want to use any other resources provided by the organization, such as consulting services, risk analysis, etc., they must also pay an additional charge.