Nidhi Company Incorporation Procedure in India

Nidhi Corporation refers to a company formed to instil the habit of saving among its members or owners. The dictionary definition of Nidhi is "treasure." In the Indian financial industry, however, it is a mutual benefit society that is approved by the Central Government. Nidhi businesses can only accept deposits from their members and lend to them.

The Reserve Bank of India regulates a Nidhi Company's deposit acceptance operations. A Nidhi firm, while being an NBFC, is excluded from the basic requirements of the RBI Act, 2013, because it operates for the benefit of its members. The establishment of a Nidhi Company is a time-consuming process that requires meeting certain qualifying requirements. So, let's take a look at the overall notion of the Nidhi Company Registration Process.

Prerequisites for the Nidhi Company Registration Process

To establish a Nidhi company, the following conditions must be met:

- Before establishing as a Nidhi Firm, a company must first be a "public company."

- A minimum paid-up equity share capital of INR 5 lakhs is required to start a Nidhi Company.

- A business shall not issue any preference shares at the time of establishment. In the event that a firm issued preference shares prior to incorporation. The shares must thereafter be redeemed in accordance with the terms of the issue.

- A Nidhi company’s goal should be very clear. The primary goal must be to instil in its members’ the habit of thrift and saving. Second, for mutual advantage, the firm must accept and lend deposits to its members.

- Every firm that participates in Nidhi operations must have the words ‘Nidhi Limited [1]' at the end of its name.

- At the time of Nidhi Company's establishment, the minimum number of members and directors should be 7 or more and 3 or more, respectively.

Documents Required for the Registration of a Nidhi Company

The Nidhi Company Registration is an online process that requires the applicant to have the following self-certified documents:

Documents Required for Nidhi Company Formation: The following documents are required:

• Identity evidence for shareholders and directors: A copy of the PAN card is required for Indian nationals, and an attested copy of the passport is required for overseas nationals.

• Proof of residence for shareholders and directors: a copy of an Aadhaar card, a bank statement, a driver's license, an electricity bill, or a passport. At least two of the papers must be genuine and no more than two months old.

• Proof of registered office: To use the premises as a registered office, you must submit a copy of the Rental Agreement or Sales Deed, a property tax receipt, an electricity bill, or even a No Objection Certificate (NOC) from the landlord.

• Signed Incorporation Paperwork: A hard copy of the Signed Digital Signature Application documents and a soft copy of the other incorporation documents signed.

• Passport-Size Pictures: Include two to three passport-size photographs of directors and shareholders.

A NIDHI COMPANY IS FORMED IN THE SAME MANNER AS A PUBLIC LIMITED COMPANY, SO THE FOLLOWING CRITERIA MUST BE MET BEFORE IN-CORPORATION: -

• A minimum of seven prospective members must be present at the moment of incorporation.

• At the time of incorporation, the minimum number of proposed directors should be three or more.

• It must have a minimum paid-up equity share capital of Rs. 5, 00,000/-;

• The company's name must conclude with "Nidhi Limited." Reserve the name of the company using the "RUN" service, with the name ending in "Nidhi Limited."

• Once the name has been approved, complete the SPICe form for the incorporation of the Nidhi Company.

Nidhi Company Registration Procedure

Before creating a Nidhi Company in India, it is necessary to organize a limited company under the Companies Act, 2013. To begin the registration procedure, the applicant must have a minimum of 7 members and 3 directors present. Typically, this process takes around 45 days to complete. To register, simply follow these simple steps:

• The first and most important step for a candidate is to apply for a (DIN) Director Identification Number and a (DSC) Digital Signature Certificate. DSC procurement typically takes two days.

• It also requires directors and shareholders to prepare the MOA and AOA.

• Keep in mind that the Ministry of Corporate Affairs will issue DIN to your company's directors.

• Because the whole Nidhi Company registration procedure is online, you must submit all papers online. Also, don't forget to double-check the legitimacy of your papers.

• As soon as you have your DIN and DSC, file an INC-1 application with the Ministry of Corporate Affairs to reserve the name of your Nidhi Company.

•Make certain that your company's name is distinct and does not sound similar to the names of other businesses. It should also not be undesirable in the opinion of the Central Government.

• A Nidhi Company's name must include the words "Nidhi Limited."

• Once MOCA has approved the company's name, it's time to draught the Memorandum of Association (MOA) and Articles of Association (AOA).

•While preparing your MOA and AOA, keep your company's goal in mind.

• Submit an application for the incorporation of Nidhi Company.

• Once you have received the Incorporation Certificate, you may apply for the company's PAN and TAN.

• Finally, open a checking account.

It should be noted that a Nidhi applicant must obtain GST registration. All business entities in India that reach the threshold level of sales or earnings are required to comply with GST laws. If one fails to do so for tax evasion, it is regarded a criminal offence and is punishable by prosecution, jail time, and fines.

Nidhi Company Post-Registration Requirements

Following the registration of a Nidhi Company, the following conditions must be met:

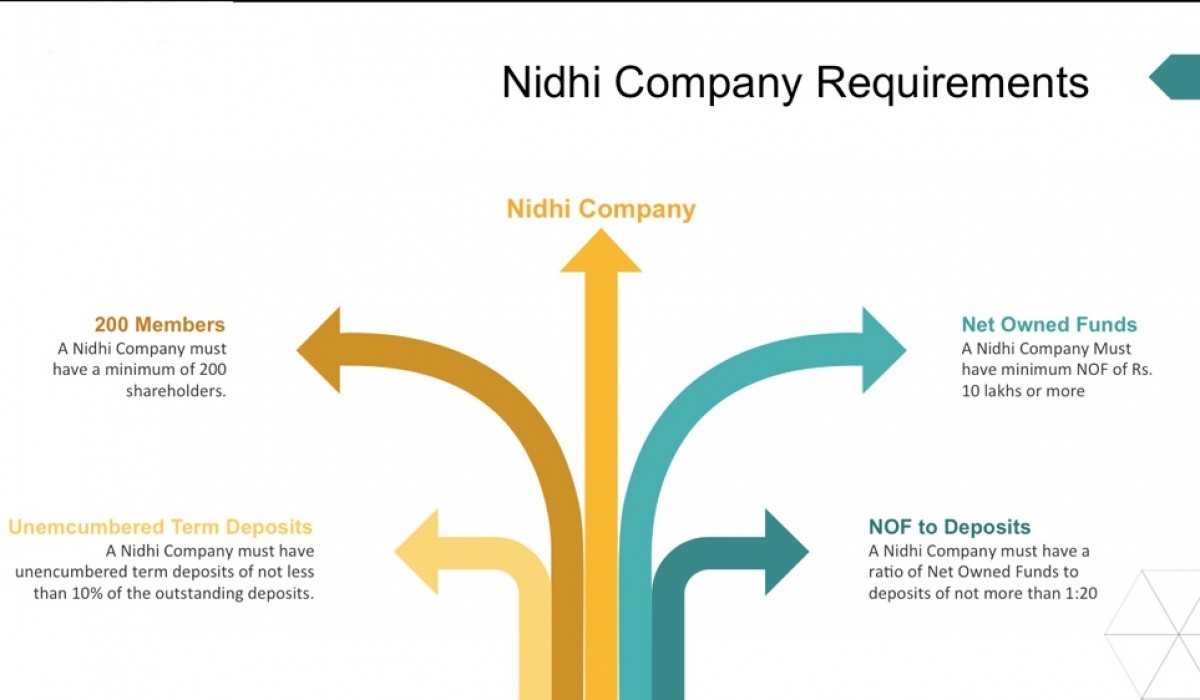

• A Nidhi Company must have at least 200 members within a year of its establishment. Along with that, the firm must have Net Owned Funds of Rupees 10 Lakhs or more.

• It must have Unencumbered Term Deposits equal to or greater than 10% of its Outstanding Deposits.

• The Net Owned Fund to Deposits Ratio must be greater than 2:1.

• If the company does not satisfy the aforementioned conditions within one year of incorporation, it must request an extension from RD in Form NDH-2 within 30 days of the end of the first fiscal year.

Within 30 days of receiving the Application for Extension, RD may issue such directions as it deems necessary.

The Benefits and Procedure for Creating a Nidhi Company

Section 406 of the Businesses Act of 2013 governs Nidhi companies. Nidhi businesses are essentially a subset of the on-banking financial industry, with the primary goal of encouraging members of the company to save. This firm is permitted to take deposits from its members and to lend money to its members for future mutual profit gains. This post will go over the process of registering a Nidhi company.

There is no need to attend a government agency to register a Nidhi Company because these do not demand RBI clearance, making the registration procedure considerably simpler. As compared to NBFCs, Nidhi Company adheres to less stringent standards. The method for registering a Nidhi business is fairly simple; for the establishment of the Nidhi Company, there must be at least 7 shareholders and 3 directors. If you want to create a Nidhi firm, you should know that you will require a capital investment of Rs. 5 lakhs, which will be increased to Rs. 10 lakhs in the coming year.

Nidhi firms are essentially a subset of NBFCs, and the RBI has the authority to give directives regulating deposit acceptance activities. If you want to create your own Nidhi Company, simply call RJA; we have a team of specialists that have already assisted a lot of clients. Our staff members will assist, educate, and guide you through the whole Nidhi business registration process.

Furthermore, we will go through the benefits and procedure of Nidhi business registration, the papers needed for the Nidhi Company, the features of the Nidhi Company, the benefits of Nidhi company registration, and so on.

List of Benefits of Nidhi Company Registration

When considering establishing a Nidhi business, there is a number of perks that you may take advantage of after completing the registration process.

• Individual Legal Identification

According to the Companies Act of 2013, a Nidhi business registration provides a separate legal identity from its promoters and stockholders. It allows the Nidhi Company to hold property and incur obligations in its name. And the company's directors cannot be held responsible for these obligations or make claims on the Nidhi Company's possessions.

• The Nidhi Company's continuous existence

Because Nidhi businesses are regarded as having their own legal personality, the unexpected withdrawal or untimely death of its stockholders has no effect on their operations. Nidhi businesses continue to exist and function until they are officially dissolved in accordance with the rules of the law.

• Quick management

In comparison to other types of corporate organizations in India, changing the purpose of Nidhi corporations is considerably easier. If you wish to make any changes to the management of the Nidhi Company, you only need to fill out and submit a few documents to the MCA.

• Market reputation for dependability

In terms of market credibility, Nidhi businesses are more trusted than other types of business organizations accessible in the market. The Ministry of Corporate Affairs is in charge of the Nidhi Company's registration and also monitors the kind of operations that take place within the Nidhi Company.

What are the fundamental features of Nidhi Company Registration?

When you set up a Nidhi business, you should be aware that Nidhi company registration has its unique set of characteristics. Let's have a look at the following Nidhi business registration features:

• As previously said, Nidhi Company registration is handled under Section 406 of the Companies Act, 2013 and is governed by the Nidhi Rules, 2014.

• Nidhi company registrations are completed in the same manner as public limited company registration.

The Reserve Bank of India has the authority to provide instructions to Nidhi businesses while they are in operation. Nonetheless, there is no necessity for the RBI's permission for the registration of Nidhi businesses.

• The Nidhi Company's primary goal is to borrow or lend money between its shareholders and members.

• It is important to remember that if you establish a Nidhi business, the firm must have at least 200 members within a year of incorporation.

• Following the registration of the Nidhi Business, the suffix "Nidhi limited" must be appended to the company name.

• It has been discovered that Tamil Nadu accounts for 80 percent of all Nidhi business registrations in India.

Steps Involved in the Nidhi Company Registration Process

There is a set of procedures that must be taken in order to register a Nidhi Company-

• Step 1: Obtaining Digital Signatures

All prospective directors of the corporation must have digital signatures (DSC), which are issued by certain authorities.

• Step 2: Nidhi Company name approval

There is an RUN service available that may be utilized to apply the Nidhi Company's name. You will be able to submit two name suggestions to the Ministry of Corporate Affairs (MCA). The suggested names must not be similar to any of the company's previously registered names.

• Step 3: Complete the Spice Form

Once the name has been approved, the next step is to complete the Spice form. You will be filling out paperwork such as the e-Memorandum of Association (MOA) and the e-Articles of Association (AOA) (AOA). In this stage, you must supply all information on the company's stockholders.

• Step 4: Company incorporation

After receiving a certificate of registration and the Business identity number, the entire procedure of Nidhi company registration takes about a month. The registration certificate serves as documentation of registration with the Ministry of Corporate Affairs (MCA).

If the company's directors do not yet have a Director Identification Number, they can obtain one at this time.

Nidhi Company Restriction

The Nidhi Rules, 2014 impose various constraints on Nidhi companies. According to Rule 6 of the Nidhi Rules, 2014, a Nidhi Company shall not:

- Engage in the business of-

• Chit Fund,

• Hire Purchase Finance,

• Leasing Finance

• Insurance, or

• Acquisition of Securities issued by any corporation.

2. Issue Preference Shares, Debentures, or any other type of debt instrument under any name or in any form.

3. Open a current account with any of its members.

4. Acquire another company through the purchase of securities, or control the composition of the Board of Directors of any company in any way, or enter into any arrangement for the change of its management unless approved by a Special Resolution in its general meeting and with the prior approval of the Regional Director.

5. Conduct any other business than borrowing/lending in its own name.

(A Nidhi that has followed all of the conditions of the Nidhi Rules may provide locker facilities on a rental basis to its members, but the rental income from such facilities may not exceed 20% of the nidhi's gross income at any time.)

6. Accept or lend to anybody other than its members for deposits or loans.

7. Pledge whatever assets that its members have deposited as security,

8. Accept deposits from or lend money to any legal entity,

9. Enter into any Partnership Agreement in connection with its borrowing or lending activities,

10. Issue or cause to be issued any advertisement in any manner for the purpose of soliciting deposits (Private distribution of the information of the Fixed Deposit Scheme among Nidhi members with the wording “For Private Circulation to Members Only” shall not be deemed an advertisement.)

11. Pay any brokerage or incentive for mobilizing member deposits, deploying money, or providing loans.

IN A NIDHI COMPANY, THESE ACTIVITIES ARE PROHIBITED

No Nidhi shall:

(a) Issue preference shares, debentures, or any other debt instrument under any name or in any form whatsoever;

(b) Engage in the business of chit fund, hire purchase finance, leasing finance, insurance, or the acquisition of securities issued by anybody corporate;

(c) Open any current account with its members;

(d) Accept deposits from or lend to any person other than its members; or

(e) Accept deposits from or lend to any person other than its members.

(f) Take deposits from or lend money to anybody corporate;

(g) Pay any brokerage or incentive for mobilizing deposits from members or for deployment of funds or for granting loans.

MEMBERSHIP

(1) A Nidhi must not admit as a member a body corporate or a trust.

(2) Except as otherwise provided in these regulations, each Nidhi should guarantee that its membership does not fall below 200 members at any time.

(3) A minor must not be allowed as a member of Nidhi: Provided, however, that deposits in the name of a minor may be accepted if made by the natural or legal guardian who is a member of Nidhi.

NUMBER OF MEMBERS

A minimum of seven members are necessary to establish a Nidhi Company, with three of those members serving as directors.

SHARE CAPITAL

A minimum of 5 lakh rupees in equity share capital is required to establish a Nidhi Company. Nidhi Company is not permitted to issue preference shares.

A NIDHI SHALL COMPLY WITH THE FOLLOWING REQUIREMENTS AFTER ITS INCORPORATION: –

• Within one year of its incorporation, Nidhi Company shall have not less than 200 Members, Net Owned Funds of not less than Rupees 10 Lakhs, and an Unencumbered Term Deposit of not less than 10% of its Outstanding Deposits.

• Nidhi Company shall file Form NDH-1 (Return of Statutory Compliances), certified by CA/CS/CMA within 90 days of closure of First Financial Year.

• If the aforementioned conditions are not met within one year of formation, the Nidhi Company must seek an extension from the RD in Form NDH-2 within 30 days of the end of the first fiscal year. Within 30 days after receiving the Application for Extension, the RD shall issue such orders as it deems appropriate.

• If non-compliance with Point No. 1 continues into the second fiscal year, Nidhi will not take any additional deposits from the start of the second fiscal year until it complies with the rules.

• The Nidhi Company must file Form NDH-3 (Half Yearly Return), approved by CA/CS/CMA, within 30 days of the end of each half year.

• Every Nidhi Director must also be a member of the Nidhi.

Nidhi Company Frequently Asked Questions

Q.: How does the Nidhi Company use the funds it receives?

• The Nidhi Company lends the cash to shareholders in accordance with Nidhi Rules. It lends such funds in the form of small business and financial loans.

Q.: Are Nidhi Company deposits safe and secure?

• Deposits with such firms are safe and secure since the Ministry of Corporate Affairs and the Reserve Bank of India have established laws and regulations to ensure deposit safety and security. And the Nidhi Company is required to follow the guidelines of the Central Government.

Q.: Who is eligible to become a shareholder/member of Nidhi Company?

• Any individual who is over the age of 18 according to the standard age proof can become a member of the Nidhi Companies. A valid ID and address proof are required for anybody interested in becoming a member.

Q.: Can a Minor Be a Member of a Nidhi Company?

• A minor shall not be allowed as a member in a Nidhi company, although deposits in the name of a minor may be accepted if made by a natural or legal guardian who is a member of the particular Nidhi.

Q.: Is it possible to provide loans to non-members?

• The mutual benefit concept has been to pool the funds of members and lend solely to members, never dealing with non-members.

Q.: What are the Nidhi Company's Restrictions?

Nidhi Companies are not permitted to engage in the following activities:

- They are not permitted to establish chit funds, insurance, or other similar businesses.

- Nidhi Company is not permitted to issue securities such as preference shares, debentures, and so forth.

- They are not permitted to open any current accounts with its members.

- it cannot form a partnership to undertake lending and borrowing activity.

- it is not permitted to purchase another firm.

Q.: Can Nidhi operate in business other than those listed above, such as (Chit Fund, Hire Purchase, Insurance, Investing, and so on)?

• Nidhi are not to operate in the business of Chit Fund, hire purchase, insurance, or any other business, including investments in shares or debentures.

Q.: What is the minimum number of members required in Nidhi Company?

• Within one year of the beginning of these regulations, each Nidhi should guarantee that it has at least two hundred members.

Q.: Can Nidhi Company issue Preference Shares?

• Nidhi will not issue preferred stock.

Q.: Can a person serve as a director of the NIDHI Company without owning any stock?

• The Director must be a Nidhi member. As a result, it is essential for Nidhi Company's directors to own shares.

Q.: What is the maximum term for a director in Nidhi Company?

The Director of a Nidhi shall serve on the Board of Nidhi for a term of up to 10 years. The Director will be eligible for re-appointment only after two years of not serving as a Director.

Q.: What is the minimum nominal value of Nidhi Company's shares?

• Each Nidhi must issue equity shares with a nominal value of at least 10 rupees.

Q.: What is the minimum ownership requirement for deposit holders?

• Each Nidhi should award at least 10 equity shares or shares worth one hundred rupees to each deposit holder.

Q.: What is the highest amount that Nidhi may accept as a deposit?

- A Nidhi shall not accept deposits exceeding twenty times of its Net Owned Funds (NOF) as per its last audited financial statements.

Q.: What is the maximum amount that a Nidhi can declare as a dividend?

• A Nidhi may not declare a dividend in excess of 25%, or such greater sum as may be explicitly allowed by the Regional Director for reasons to be stated in writing.

Q.: Is it legal for Nidhi Company to take over another company?

• Nidhi businesses are not permitted to acquire any other company by purchasing its securities. It does not even have the authority to take over another company's management or change the composition of its management.

Please contact IFCCL for further details.