What are the Different kind of ITNS Challan?

When we talk about tax paying in past years this is used to be manually done by individuals. The department was used to collect taxes from banks when individual or business paid their tax at their respective banks. There was a lot of manipulation and fraud was on practice during that procedure and it was so challenging because people frequently pay wrong taxes. As a result, government was always operating at loss.

Online Tax accounting System, commonly known as OLTAS 2004 launched by the government to address this kind of problem. This technology is reducing people’s manipulation, errors and offer online information on taxes collected or deposited.

It was simple for layperson to file their taxes these are all possible due to OLTAS 2004, the system also offers a copy of challan which will help you to report your progress while filing online tax.

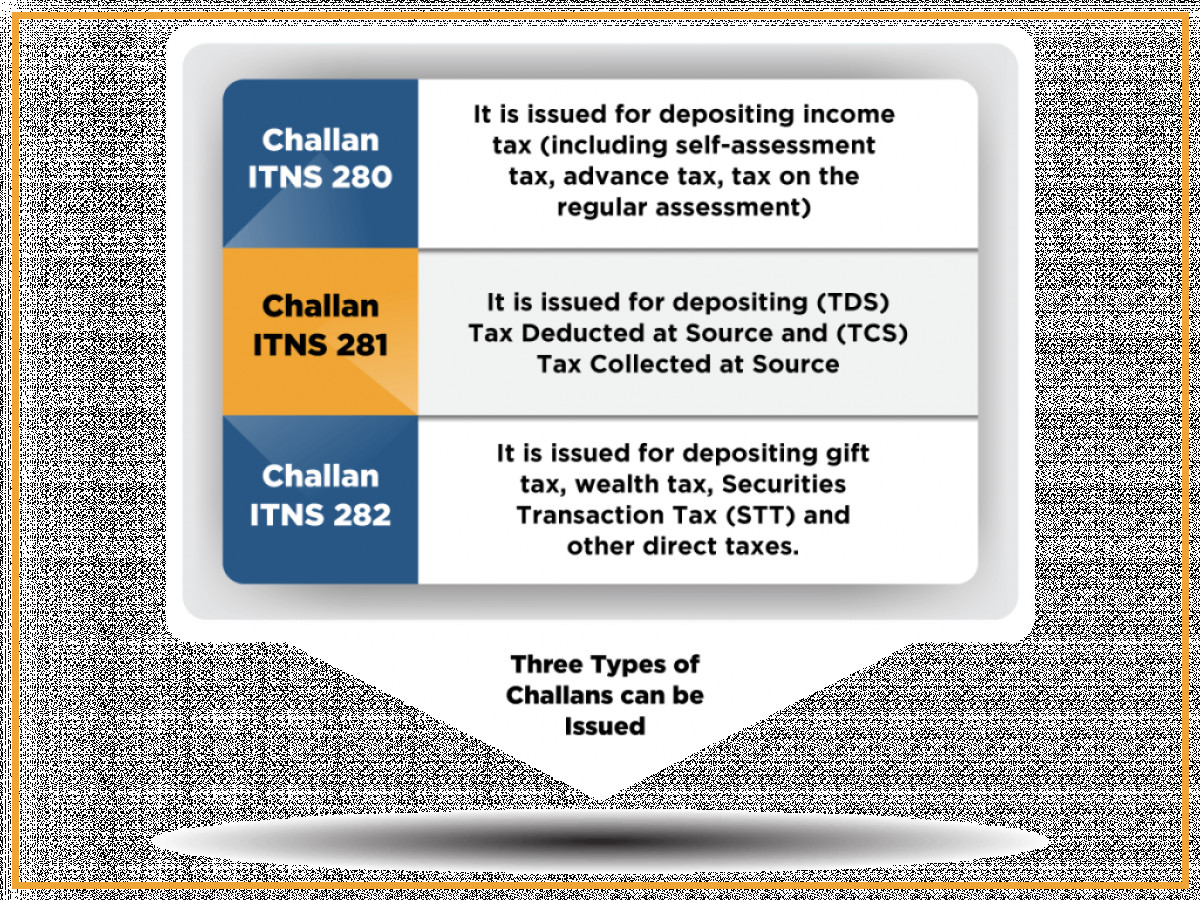

Three Kind of ITNS challans:

There are three different types of ITNS Challans.

- Challan ITNS 280: When income Advance tax, Income tax, including self-assessment tax, and regular assessment taxes are paid, ITNS 280 is issue/generated.\

- Challan ITNS 281: When Tax collected at source(TCS) and tax deducted at source(TDS) are submitted then ITNS 281 is issued.

- Challan ITNS 282: When we give tax on the payment of wealth tax, gift tax, expenditure tax and estate duty then ITNS 282 challan is generated.