What Are The Compliances By Private Limited Companies In India?

Compulsory Compliances by Private Limited Companies in India:

Four Pillars Of The Insolvency & Bankruptcy Code

Four Pillars of the Insolvency & Bankruptcy Code, What are the Important Aspects of IBC,

Gst Needed To Pay On Interest Component Of Emi Of Credit Card Loan

GST Needed to payable on EMI (interest component) of Credit Card loan “Ramesh Kumar Patodia v. Citi Bank (HIGH COURT OF CALCUTTA)”

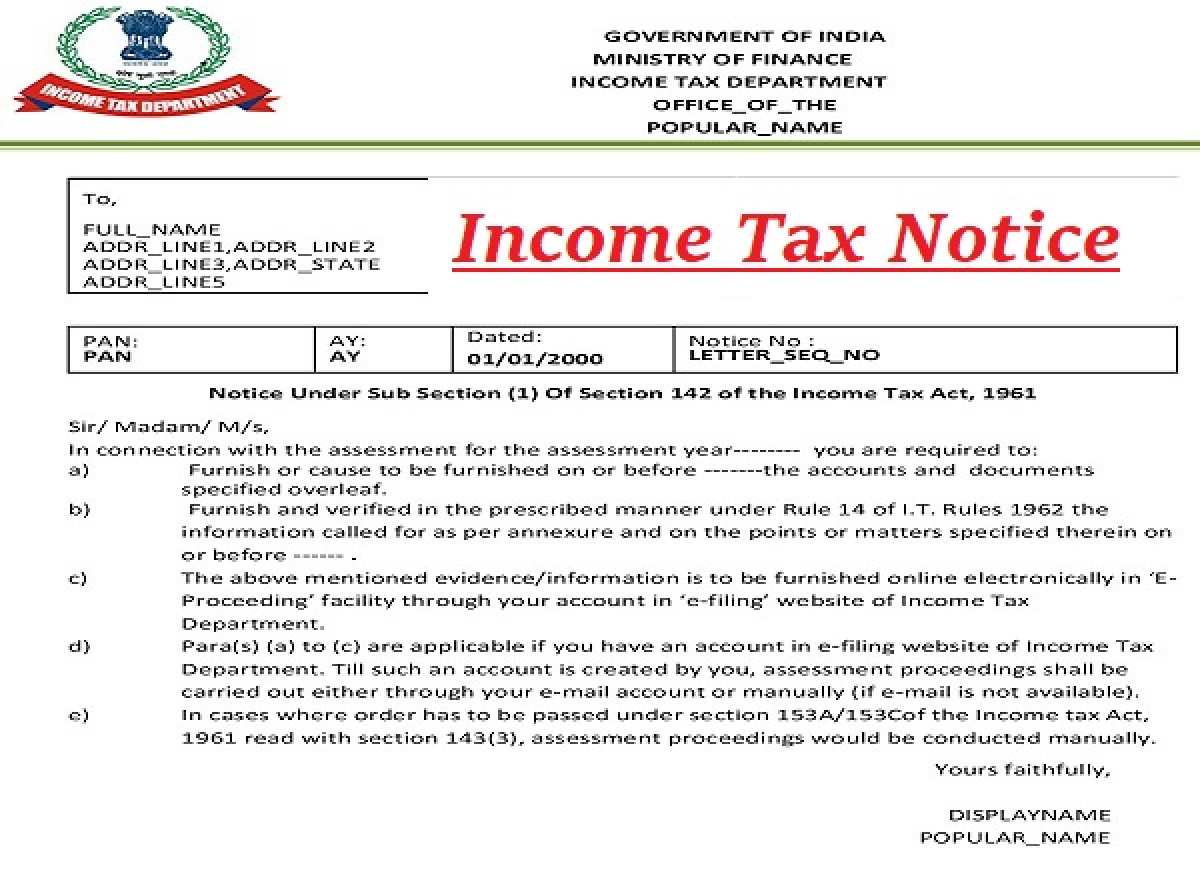

Tax Dept Updated Forms: 58c, 27c, 3cef, 3bb, 3bc, 58d, 28a, & 10bc Are Available For E-filing On Portal

Income Tax Department updated Forms i.e 58C, 27C, 3CEF, 3BB, 3BC, 58D, 28A, & 10BC are available for e-filing on portal

3 Income Tax Significant Changes Effective From 1 July

3 Income Tax Significant Changes effective from 1 July, TDS on cryptocurrencies, New TDS Rule for social media influencers & healthcare professionals, Penalty in case PAN Aadhaar is Non-Linking,

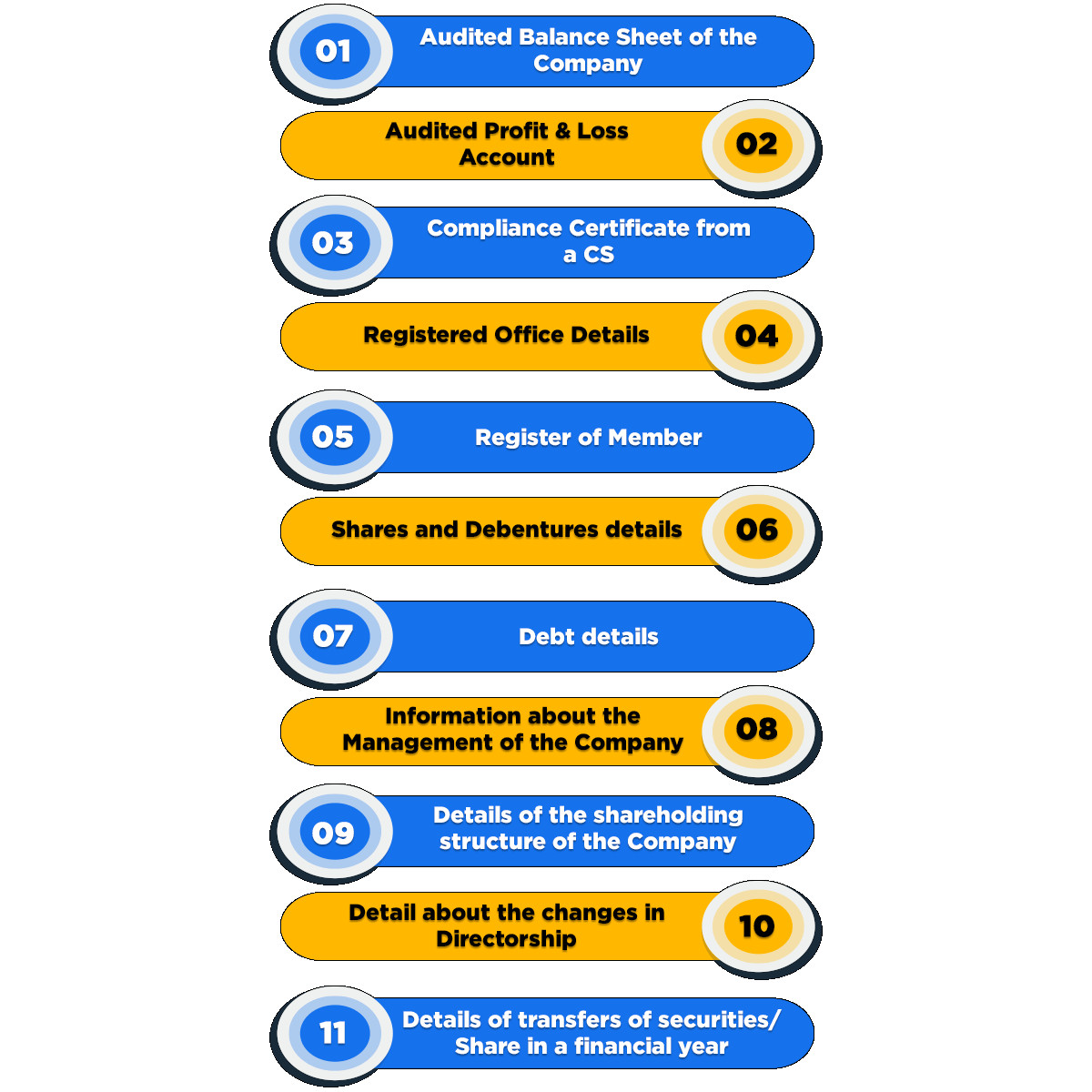

Statutory Registers For Private Limited Company Under Companies Act 2013

statutory registers for private limited company under companies act 2013

Penalty Insolvency Professional Under Ibc Regulations.

Penalty Insolvency Professional under IBC regulations, Monetary Penalties by IPA

Significant Changes In Income Tax Regulations On Cash Deposit.

Significant Changes in Income Tax regulations on Cash Deposit, Aadhaar - PAN-Non- Linking Late Fee Applicable,

How To Tax - Share & Mutual Fund Income – Taxation On India Vs Hongkong

Share and mutual fund income taxation in case income accrue and arise in Hong Kong and Person are dual residency status - India VS Hongkong DTAA Taxation clarification, Taxation on India VS Hongkong

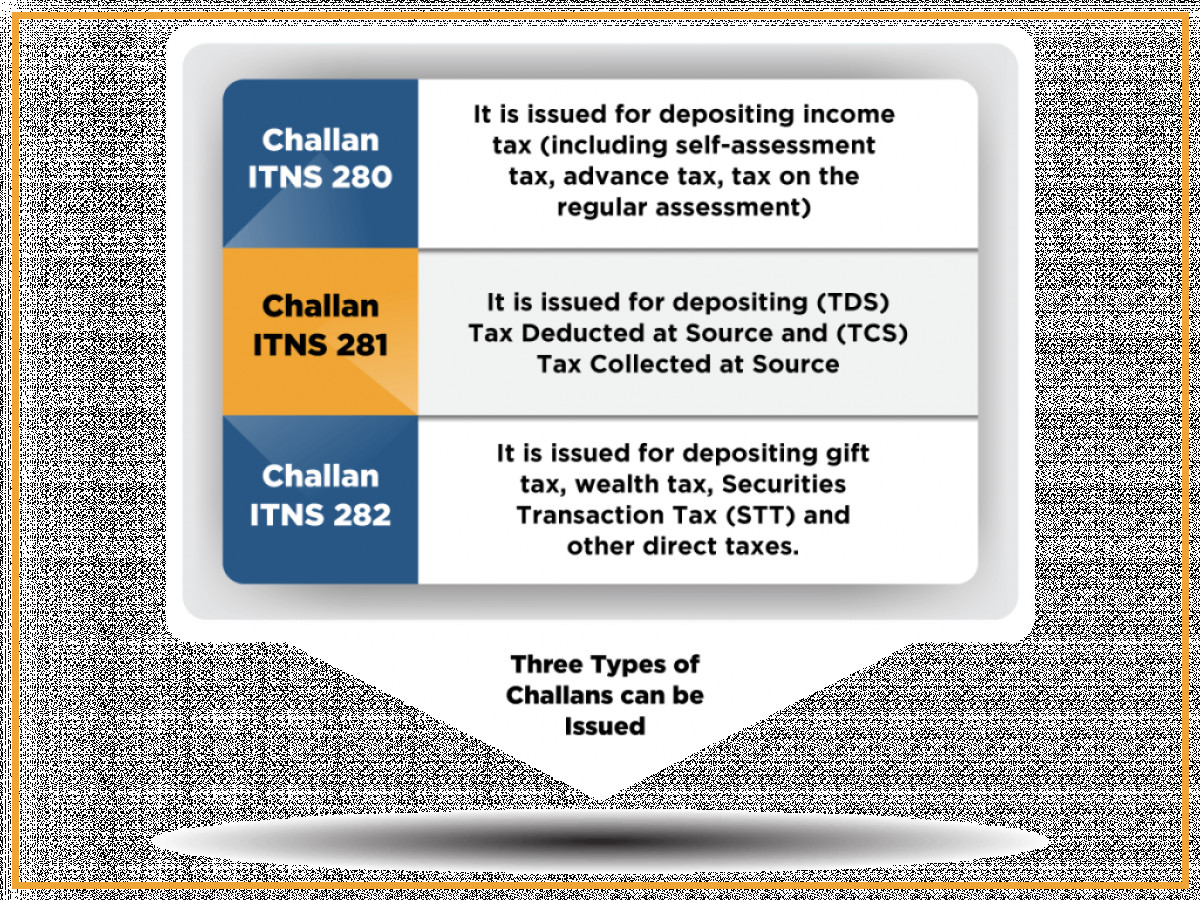

What Are The Different Kind Of Itns Challan?

What are the Different kind of ITNS Challan?, Three Kind of ITNS challans: